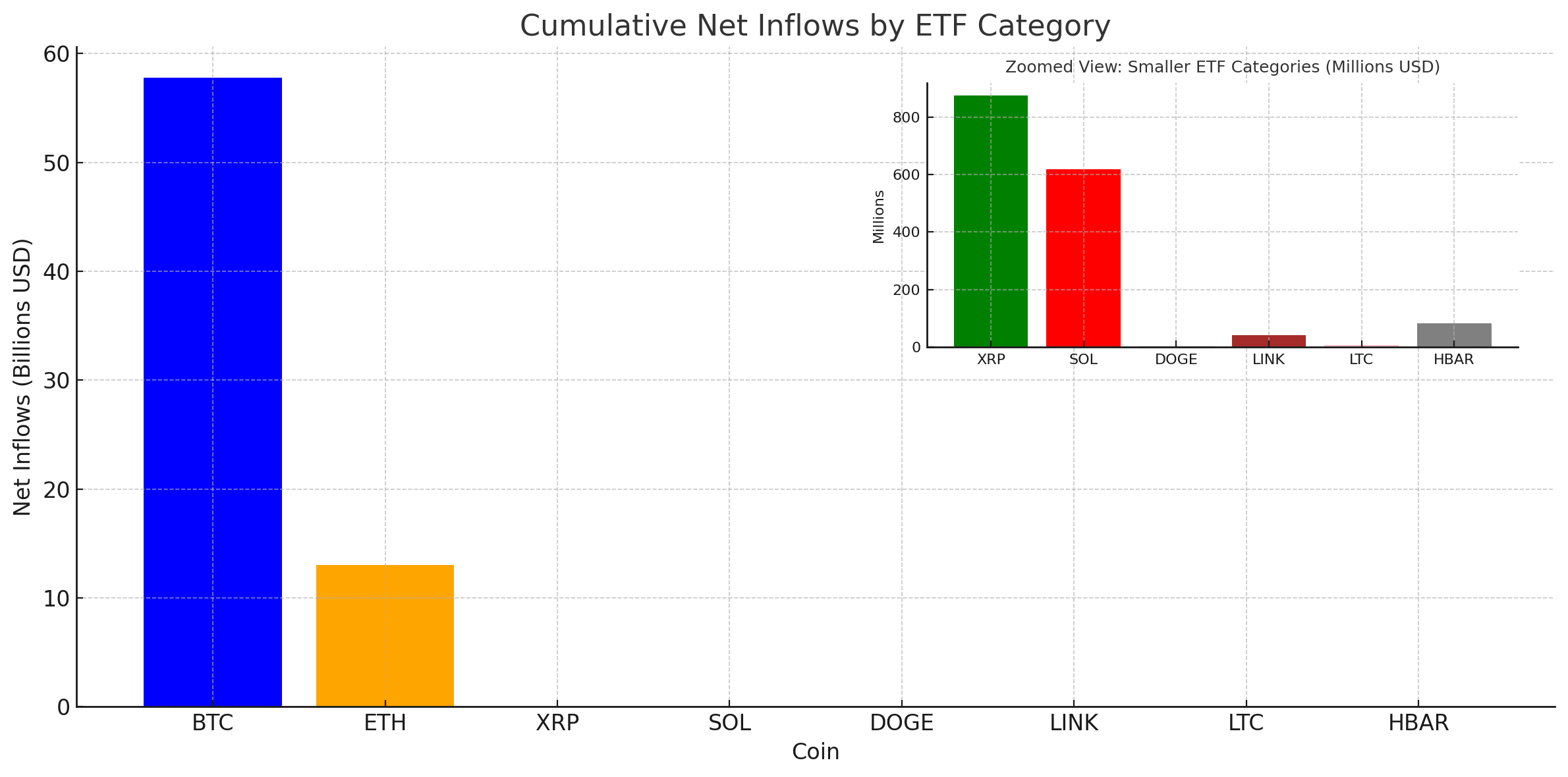

Out of seven distinct solana ( SOL) ETFs, the pack has generated $618.62 million in net inflows since launch, and with $915.08 million amassed, these funds now command roughly 1.15% of solana’s market valuation. Meanwhile, in terms of cumulative net inflows, XRP has recorded approximately $874.28 million, according to sosovalue.com figures.

There are only four listed XRP ETFs on sosovalue.com’s dashboard, featuring issuers such as Grayscale, Franklin Templeton, Canary, and Bitwise. The Canary-run XRP ETF, ticker XRPC, has snagged the lion’s share of inflows, pulling in $357 million since launch. Yesterday alone, the group collected $50.27 million, with Grayscale’s GXRP doing the heavy lifting.

Altogether, the four hold $906.46 million in net XRP, amounting to just 0.68% of XRP’s market cap. Investors looking for exposure to LINK, HBAR, LTC, and DOGE can now tap ETFs tied to these coins as well, and so far, the funds linked to this quartet have collected $133.46 million in cumulative net inflows. Two DOGE funds — Grayscale’s GDOG and Bitwise’s BWOW — have tallied $2.85 million in net inflows.

Net inflow data sourced from sosovalue.com on Dec. 4, 2025.

Grayscale’s GLNK has drawn roughly $40.90 million since hitting the market, and Canary’s Nasdaq-listed LTCC, which targets litecoin, has picked up $7.67 million. Canary’s HBAR fund, ticker HBR, has logged $82.04 million in cumulative net inflows, according to sosovalue.com’s ETF dashboard. It will be interesting to watch how the broader market behaves now that investors can hop in and out of different funds with ease.

Read more: Bitcoin Price Watch: Bulls and Bears Clash Below the $95K Line

And while XRP and SOL ETFs have essentially leveled with each other, sitting neck-and-neck, both camps still have a very long road ahead before they come anywhere close to the BTC and ETH spot ETF heavyweights. Still, those two major players have enjoyed more than a year’s head start — and BTC ETFs are now creeping up on their two-year mark.

As more altcoin ETFs hit the menu (there will be more) and capital spreads across a wider roster of assets, the real test will be whether investor enthusiasm can keep pace with this expanding lineup. All of these new entrants may be trading elbow jabs with each other for now, but their climb toward BTC and ETH territory is still a distant one. Even so, the growing mix of options signals a market settling into its next phase — one defined by choice, competition, and plenty of fresh capital looking for a home.

- Which crypto ETFs are attracting the most inflows right now? XRP and SOL ETFs are leading among altcoins, while BTC and ETH remain far ahead in total inflows.

- What new ETF options are available for investors? Funds tied to LINK, HBAR, LTC, and DOGE have recently launched, giving investors more regional and global exposure choices.

- How much capital have these altcoin ETFs gathered so far? Combined inflows across the new altcoin ETFs total more than $133 million.

- How do XRP and SOL ETFs compare to BTC and ETH products? Despite growing interest, both remain far behind the massive inflow totals of BTC and ETH spot ETFs.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。