The daily chart has been on a dramatic arc, tracing a nosedive from around $111,603 to a bruising low near $80,537, only to rebound with a vengeance back toward the $94,000 mark. A string of bullish engulfing candles and a series of higher lows paint a classic accumulation pattern.

If bitcoin bulls manage to break the psychological barrier at $95,000 with volume to match, it could confirm this trend’s next act. Until then, any stalling below that line might just be the market’s way of saying, “Not so fast.”

BTC/USD 1-day chart via Bitstamp on Dec. 4, 2025.

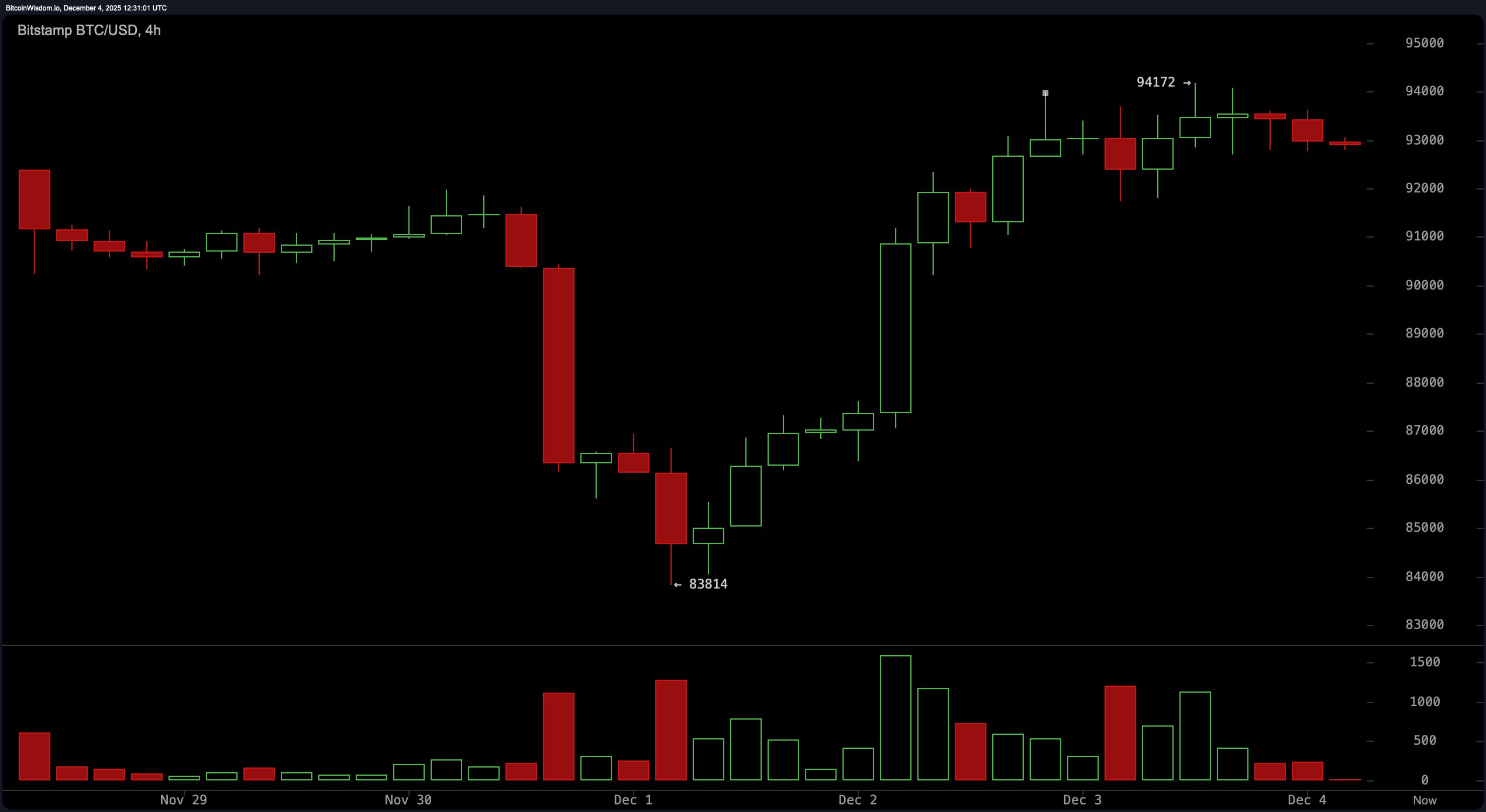

On the 4-hour chart, the price carved a V-shaped recovery from $83,814 to $94,172 before flattening into a sideways shuffle. Support around the $90,000–$91,000 region proved sturdy on recent dips, but resistance at $94,200 remains a strict gatekeeper. The recent volume drop could signal either a bullish continuation (cue bull flag) or a distribution setup—because of course, nothing in crypto comes without a cliffhanger. A push past $94,200 with strong volume could hint at another leg up; fall short, and we’re likely due for a correction curtain call.

BTC/USD 4-hour chart via Bitstamp on Dec. 4, 2025.

Over on the 1-hour chart, bitcoin seems to be catching its breath, stuck in a range between $91,500 and $94,000. There’s a whisper of a descending triangle forming, which isn’t exactly bullish poetry. Volume spikes near the upper range show some resistance muscle-flexing, making any bounce from $91,500 a tempting short-term opportunity—if confirmed by a strong bullish candle. But should bitcoin dip below that line, the short-term setup could swiftly flip from promising to pessimistic.

BTC/USD 1-hour chart via Bitstamp on Dec. 4, 2025.

Now let’s talk about our not-so-subtle indicators. Oscillators like the relative strength index (RSI), Stochastic oscillator, commodity channel index (CCI), average directional index (ADX), and the Awesome oscillator are all singing a monotonous tune of neutrality. The momentum oscillator, however, rolled its eyes and pointed downward, while the moving average convergence divergence (MACD) put on a poker face with a modestly bullish whisper. It’s like a band where every player’s out of sync—promising a show, but not quite delivering a hit.

Moving averages are just as split as a group chat on investment advice. The 10-period exponential moving average (EMA) and simple moving average (SMA), along with the 20-period variants, suggest short-term strength. But go higher—30, 50, 100, 200—and it’s a parade of pessimism, with both exponential and simple versions flashing red. This divergence screams that the bulls are in charge for now, but they’re tiptoeing across a longer-term bearish minefield. Stay alert—momentum’s fragile, and the charts never lie, even when they mumble.

Bull Verdict:

If bitcoin can stay comfortably perched above the $90,000 support zone and finally shatter the $94,200–$95,000 resistance with convincing volume, the path opens toward reclaiming lost territory. Short-term momentum is leaning bullish, and despite mixed signals from higher timeframes, the lower charts hint that buyers haven’t yet left the building.

Bear Verdict:

Should bitcoin fail to conquer the $94,000–$95,000 ceiling and instead slip below $90,000, the recent recovery risks turning into just another dead cat bounce. With longer-term moving averages dragging sentiment south and volume waning, the bears may be sharpening their claws for another round.

- Where is bitcoin trading now?

As of December 4, 2025, bitcoin is trading at $92,807. - What is bitcoin’s current support level?

Key support zones sit between $90,000 and $91,000. - What resistance levels are traders watching?

The $94,000 to $95,000 range is the major resistance area to watch. - Is bitcoin’s trend bullish or bearish today?

Short-term charts show bullish signs, but longer-term trends remain cautious.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。