Private employers cut 32,000 jobs in November, according to human resources firm ADP in its latest jobs report, published Wednesday. But instead of sending markets lower, both bitcoin and stocks rose on the news. Part of the reason might have to do with how weaker employment is expected to increase the odds of a rate cut by the Federal Reserve next Wednesday.

Read more: Irrational Pessimism: Have Bitcoin Investors Gone Mad?

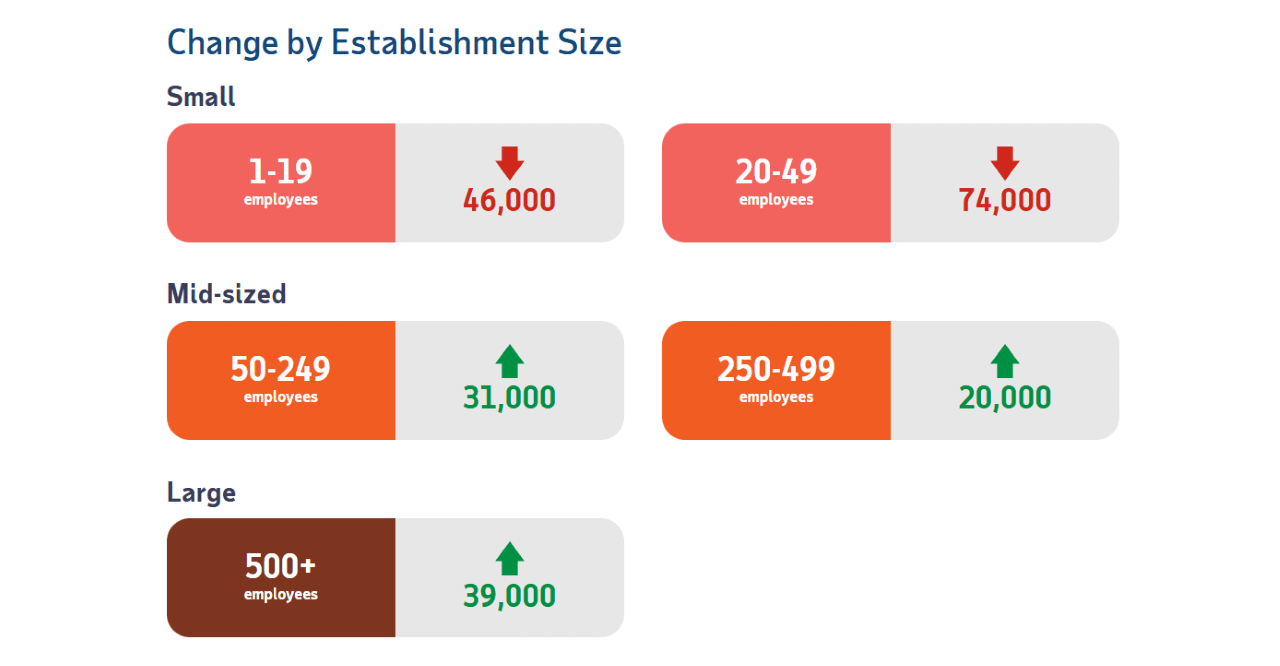

The drop in private jobs came as a shock to many. Economists had predicted an increase of 40,000 positions. But instead, ADP’s data shows small businesses bled approximately 120,000 roles. Medium and large employers added about 90,000 new employees but it wasn’t enough to compensate for the cuts by smaller firms.

(Private employment fell by 32,000 jobs in November. Small businesses led the losses, which were partly compensated for by hiring increases at larger firms. / ADP)

“Hiring has been choppy of late as employers weather cautious consumers and an uncertain macroeconomic environment,” said Dr. Nela Richardson, ADP’s chief economist. “And while November’s slowdown was broad-based, it was led by a pullback among small businesses.”

The Federal Reserve has already indicated that soft employment largely dictated its previous two rate cuts. And now, with a surprise drop in private jobs, almost all experts agree that Fed Chairman Jerome Powell and team will all be on board to lower the policy rate by another 25 basis points next week. The subsequent jump in stocks was expected, but bitcoin, which has been falling regardless of good or bad macroeconomic news, also inched upward, leading many to breathe a sigh of relief.

There are, of course, other reasons the cryptocurrency is experiencing positive price action. Investment firm Charles Schwab, which manages roughly $10 trillion in client assets, announced it would be offering bitcoin and ether spot trading at some point during the first half of 2026, according to Forbes. The firm published an educational video about investing in bitcoin on its website earlier today.

Vanguard, which boasts more than $11 trillion in assets under management (AUM) will now allow crypto exchange-traded funds (ETFs) on its platform. “Today, Vanguard allows trading of select third-party cryptocurrency ETFs and mutual funds through a Vanguard brokerage account,” the firm wrote in an official statement on Monday. “But we do not offer our own crypto products.”

With all these tailwinds, a 2% jump in bitcoin’s price shouldn’t be a surprise, but given the carnage seen over the past few weeks, some investors were expecting the unexpected.

Bitcoin was priced at $93,286.68 at the time of writing, up 1.98% for the day and 3.35% for the week, Coinmarketcap data shows. Price fluctuated in a relatively narrow range, between $91,056.39 and $93,965.10 over 24 hours.

( BTC price / Trading View)

Daily trading volume was mostly stagnant since yesterday, climbing slightly by 2.52% to reach $76.77 billion. Market capitalization stood at $1.86 trillion and bitcoin dominance edged lower, easing 0.28% to reach 59.40% at the time of reporting.

( BTC dominance / Trading View)

Total bitcoin futures open interest climbed 1.55%, to reach $60.16 billion, according to Coinglass data. Liquidations fell by approximately 30%, totaling $132.59 million. Short sellers led the losses to the tune of $92.47 million and bullish long investors lost roughly half of that amount, or about $40.13 million.

- Why did bitcoin rise after the weak jobs report?

Because weaker labor data boosted expectations of a Federal Reserve rate cut, improving risk sentiment for assets like bitcoin. - How did private employers perform in the latest ADP report?

ADP reported a surprise loss of 32,000 private-sector jobs, driven largely by steep cuts at small businesses. - Why are analysts confident the Fed will cut rates next week?

The sudden deterioration in employment aligns with conditions the Fed has previously cited when justifying rate cuts. - What other catalysts helped lift Bitcoin’s price?

Announcements from Charles Schwab and Vanguard expanding access to bitcoin products strengthened institutional support and boosted investor confidence.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。