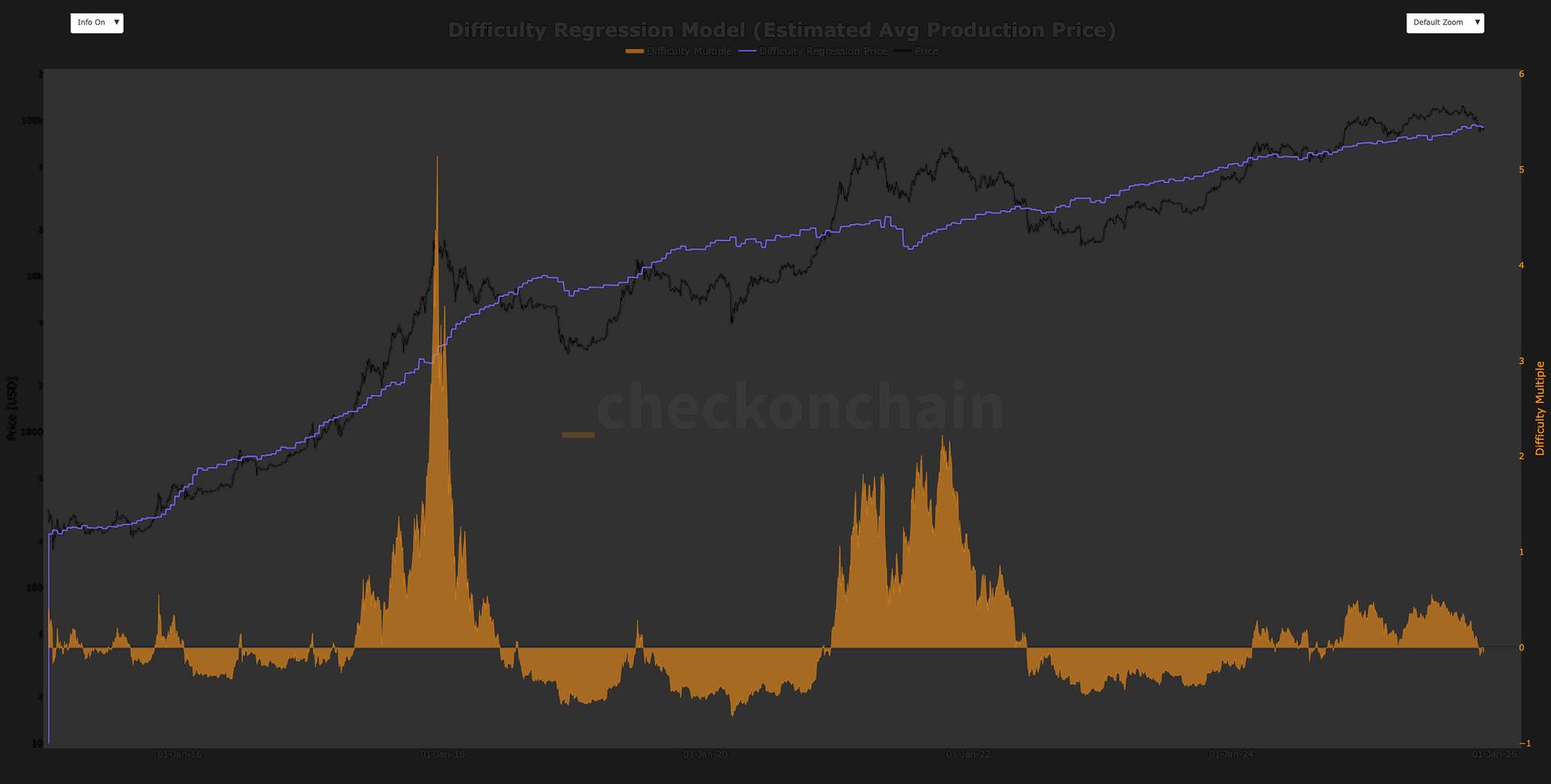

Bitcoin is closely tracking with the Difficulty Regression Model, according to checkonchain.

This model estimates the all-in sustaining production cost for the network. The model treats mining difficulty as the distilled measure of mining price because it incorporates all major operational variables into a single figure. This provides an industry wide estimate of the average cost to produce one bitcoin without needing detailed assumptions about hardware, energy expenses or logistics.

The model currently sits near $92,300, roughly matching the spot bitcoin price. It was briefly tripped on the downside when bitcoin fell to around $80,000, but has since recovered back to the model's valuation.

Price tends to remain in a bull market when trading above the model and often shifts into a bear market regime when trading below it.

In April 2025, bitcoin dropped to about $76,000 and bounced precisely at the model value at the time, acting as an important support level. Throughout much of 2025, it traded at a premium of approximately 50% of the model, while for much of 2024 price hovered close to the model.

During the 2022 bear market bitcoin traded at a discount of as much as 50% of the model. Meanwhile, in earlier bull markets the multiple expanded far more, with bitcoin's price doubling the model at the top in 2021 and quintupling it in 2017.

As bitcoin has matured as an asset, premiums anywhere close to those levels appear to be a thing of the past.

Overall, the model suggests bitcoin is currently priced near its production cost which can be interpreted as a fair value zone. Metcalfe law based valuations also place bitcoin near fair value around $90,000, reinforcing that assessment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。