Ether Slips, Solana Surges, and Bitcoin Extends Inflow Streak

The crypto exchange-traded fund (ETF) market closed Tuesday, Dec. 2, with a split narrative, one where bitcoin climbed steadily, ether stumbled, and solana continued its remarkable streak with conviction. The day’s flows painted a picture of shifting investor preference, marked by decisive bids for BTC and SOL exposure.

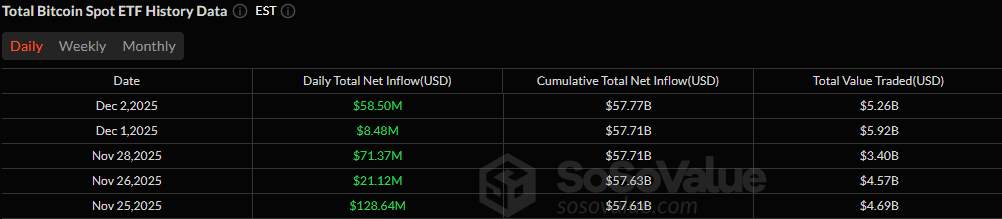

Bitcoin ETFs returned confidently to the green with a $58.5 million net inflow. Blackrock’s IBIT dominated the day, pulling in a hefty $120.14 million, reaffirming its role as the bellwether of institutional bitcoin flows. Fidelity’s FBTC added $21.85 million, and Bitwise’s BITB contributed another $7.44 million.

The gains were tempered by a sharp $90.94 million outflow from ARK & 21Shares’ ARKB, but not enough to derail the category’s upward trajectory. Trading volumes hit $5.26 billion, and total net assets rose to $119.59 billion, signaling renewed conviction in BTC exposure.

Five days of consecutive inflows for bitcoin ETFs.

Ether ETFs struggled to find their footing, closing with a $9.92 million net outflow. Two funds stood firmly in positive territory, Fidelity’s FETH with $50.65 million in inflows and Grayscale’s Ether Mini Trust with $28.11 million.

Yet the narrative shifted dramatically due to a substantial $88.68 million withdrawal from Blackrock’s ETHA. Despite the setback, trading remained active at $1.65 billion, and category net assets rose slightly to $18.66 billion, showing that investor engagement remains high even amid uneven flows.

Read more: Bitcoin ETFs Begin December With Modest Gains as Ether and Solana Slide

Solana ETFs delivered one of their strongest days yet, posting a $45.77 million total inflow. Bitwise’s BSOL led with $29.45 million, followed by Fidelity’s FSOL at $6.92 million and Grayscale’s GSOL at $6.28 million.

Additional contributions came from Vaneck’s VSOL with $2.71 million and 21Shares’ TSOL with $418.5K, locking in a uniform day of inflows across all issuers. Trading activity reached $56.71 million, and net assets climbed to $929.70 million, reinforcing solana’s status as the day’s standout performer.

FAQ📈

- Why did bitcoin ETFs see strong inflows today?

BTC funds added $58.5 million as IBIT and FBTC drove renewed institutional demand. - What pushed ether ETFs back into outflows?

A large $88.68 million exit from ETHA outweighed inflows into FETH and Grayscale’s Mini Trust. - How did solana ETFs perform compared to other assets?

Solana posted a uniform $45.77 million inflow across all issuers, making it the day’s strongest segment. - What does today’s flow pattern say about investor sentiment?

Markets showed a clear preference for BTC and SOL exposure while staying cautious toward ETH.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。