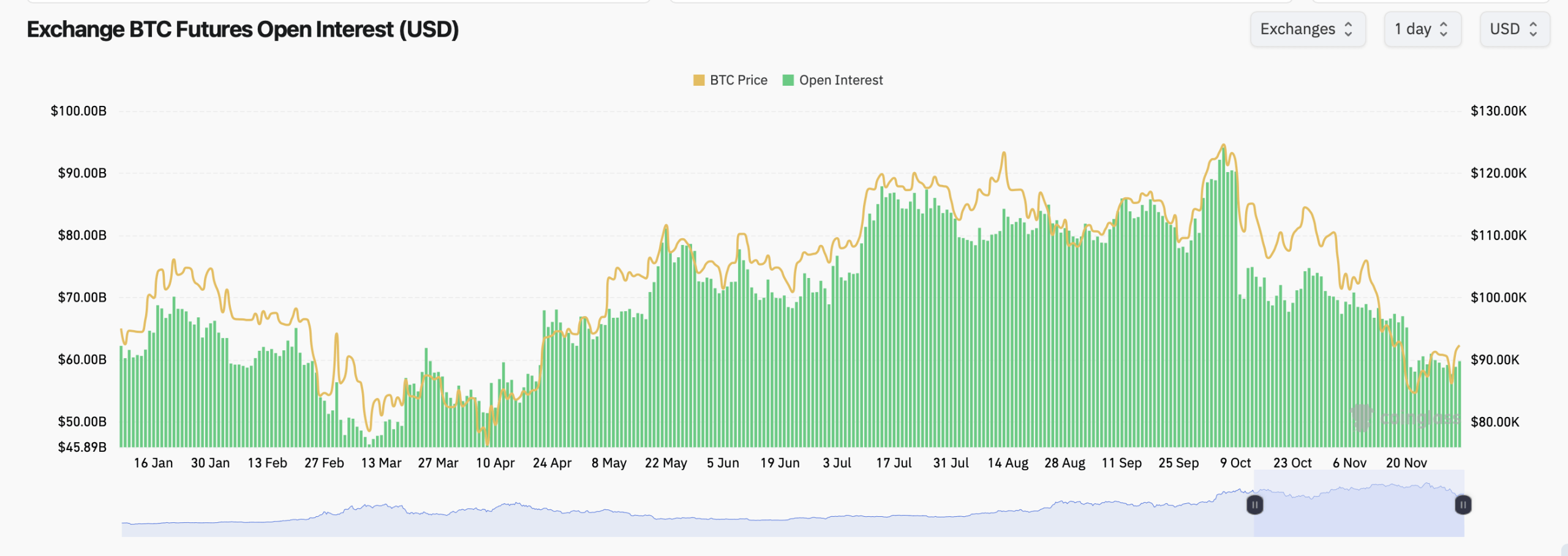

According to coinglass.com stats, bitcoin’s futures market stands at 646.84K BTC in open interest (OI), valued at $59.74 billion, with modest hourly softening but a firm +2.07% rise over the past 24 hours. It’s not a stampede of fresh leverage, but it does signal that traders are once again testing the waters instead of heading for the exits.

CME continues to lead the futures arena with 124.48K BTC in OI and a 19.24% market share, closely followed by Binance, which holds 121.46K BTC and 18.78% of the market. Bybit delivered one of the strongest daily rebounds with a 4% rise in open interest, while mid-tier exchanges such as Kucoin and Gate also saw meaningful inflows.

After weeks of consistent drains, the aggregate futures OI chart finally shows stabilization near the $60 billion level rather than another leg down — a welcome shift for anyone tired of watching cascading liquidations.

BTC futures open interest (OI) via coinglass.com stats on Dec. 3, 2025.

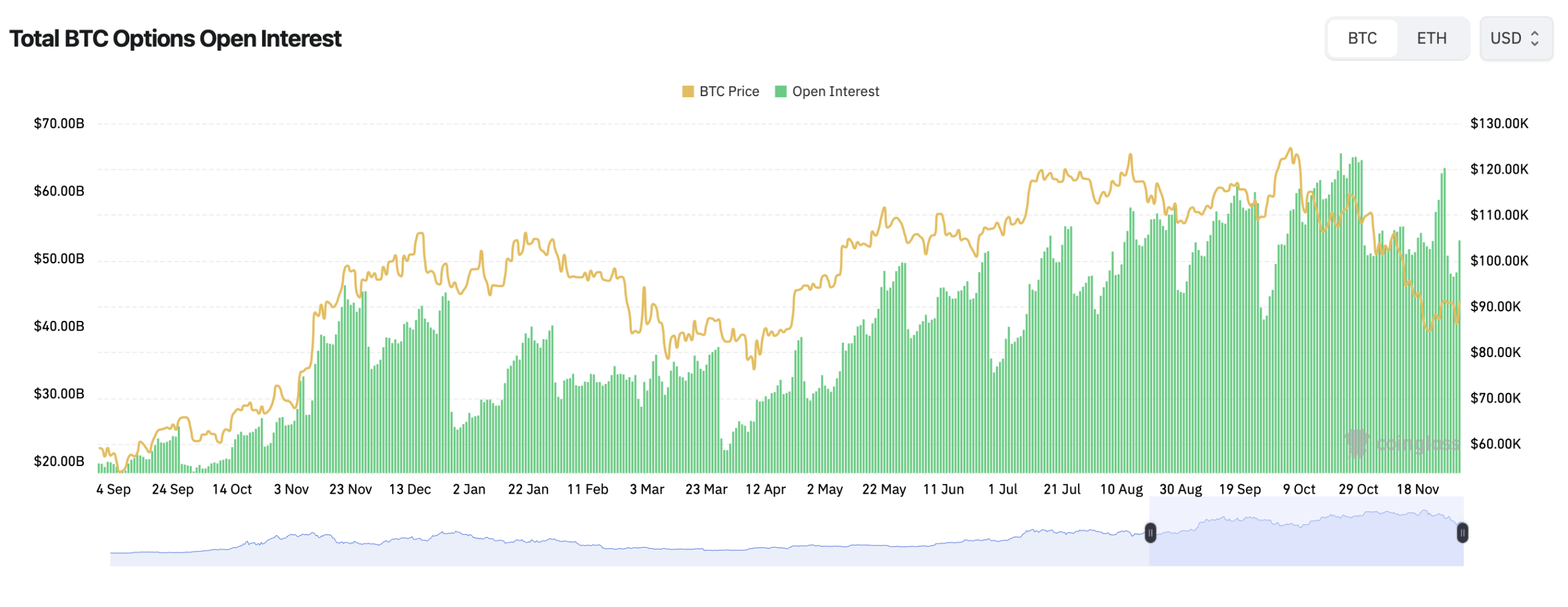

Options markets tell a slightly more optimistic story. Calls account for 345,483.7 BTC, while puts sit at 192,956.85 BTC, giving calls roughly a 64% share of open interest. In the past 24 hours, calls also saw higher trading volume than puts, continuing a trend that suggests traders are still leaning into the possibility of a late-year bounce rather than bracing for a deeper slump.

On Deribit — the dominant venue for bitcoin options — traders are concentrating on December 26 expiries, and most of the activity clusters around strike prices between $100,000 and $118,000. Even though bitcoin is nowhere near six figures right now, the willingness to bet on those levels shows that traders haven’t abandoned the upside narrative.

BTC options open interest (OI) via coinglass.com stats on Dec. 3, 2025.

There is put demand around the $85,000 region, but not enough to overshadow the far larger stacks of capital committed to upward speculation. In a nutshell: the downside hedging is present, but the bullish appetite is still bigger. The “max pain” levels across the top exchanges paint an even clearer picture of where traders’ risks converge.

Deribit, Binance and OKX all indicate max-pain zones in roughly the same band — the upper-$80,000s to the low-$90,000s. With bitcoin sitting at $92,295, it’s trading nearly dead center in that gravitational pocket. While max pain doesn’t dictate price direction, it often encourages choppy, indecisive movement as both bullish and bearish traders endure equal discomfort leading into key expiries.

Read more: Bitcoin Steadies as Markets Brace for Fed Shake-Up

Spot market action supports this read. The daily chart on Wednesday shows bitcoin climbing away from last week’s $80,537 low, printing a steady recovery candle by candle. Volume remains mixed, signaling a market still negotiating its next decisive move, but the selling pressure that dominated much of November appears to be losing momentum.

Bitcoin’s derivatives markets are shifting from pure defensive mode to cautious re-engagement. Futures open interest is no longer sliding, options traders remain tilted toward upside strikes, and max pain levels are keeping price action comfortably boxed in. If traders continue adding exposure at this pace, December may see tighter, more directional movement — but for now, bitcoin is enjoying a rare moment of balance in a usually restless market.

- What is bitcoin’s current total futures open interest?

Bitcoin futures open interest stands at 646.84K BTC, valued at $59.74 billion. - Are bitcoin options traders leaning bullish right now?

Yes, calls remain firmly ahead of puts, indicating modest bullish sentiment. - Where are max-pain levels landing this week?

Most major platforms cluster max pain in the upper-$80,000s to low-$90,000s. - Which exchanges lead bitcoin futures activity today?

CME and Binance hold the top two spots in total bitcoin futures open interest.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。