Most analysts didn’t have an $89K bitcoin price on their bingo cards, but that’s exactly what happened at around 2 a.m. on Tuesday. Yet Standard Chartered’s head of digital assets research, Geoffrey Kendrick, isn’t fazed at all. “I see the recent sell-off as being nothing more than … the third one of the past couple of years, of nearly exactly the same magnitude,” Kendrick writes in a Tuesday note to clients.

Read more: A Perfect Storm Has Sent Bitcoin Nosediving

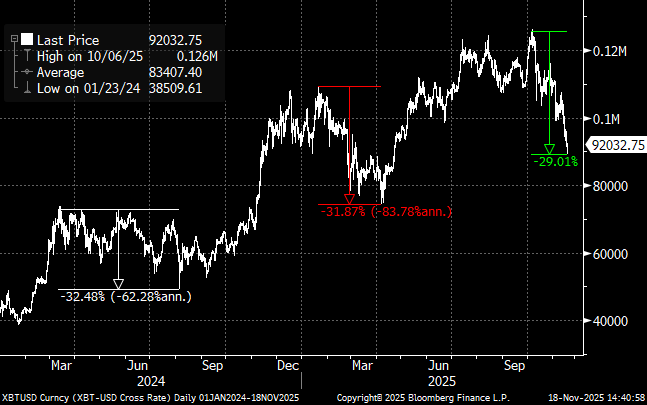

Included in his note is a chart showing three distinct periods that exhibit similar levels of price volatility, with the third period coinciding with today’s slump. Kendrick’s chart shows that shortly after bitcoin bottoms out during each of the preceding phases, it rallies.

(The volatility pattern suggests BTC may have bottomed out, and that a rally awaits. / Geoffrey Kendrick, Standard Chartered)

He also points to the declining market net asset value or mNAV for Strategy (Nasdaq: MSTR), the largest publicly traded bitcoin treasury firm. In the world of treasury companies, mNAV measures a firm’s total enterprise value relative to the value of its bitcoin holdings. For years, Strategy traded at a premium, where its market capitalization was significantly higher than the value of its bitcoin stash. That premium, as Kendrick explains, has all but disappeared. “A number of other metrics have collapsed to absolute zero levels, such as MSTR’s mNAV which is now at 1.0,” he says.

And now Kendrick, an economist by trade, who honed his forecasting chops by spending decades analyzing emerging foreign exchange markets, says the patterns he sees all point to an imminent bitcoin rally, and he expects to see that upswing around 2025’s curtain call.

“I think this is enough to signify the sell-off is over and to eventually disprove those who think the halving cycle remains valid,” Kendrick writes. “A rally into year-end is my base case.”

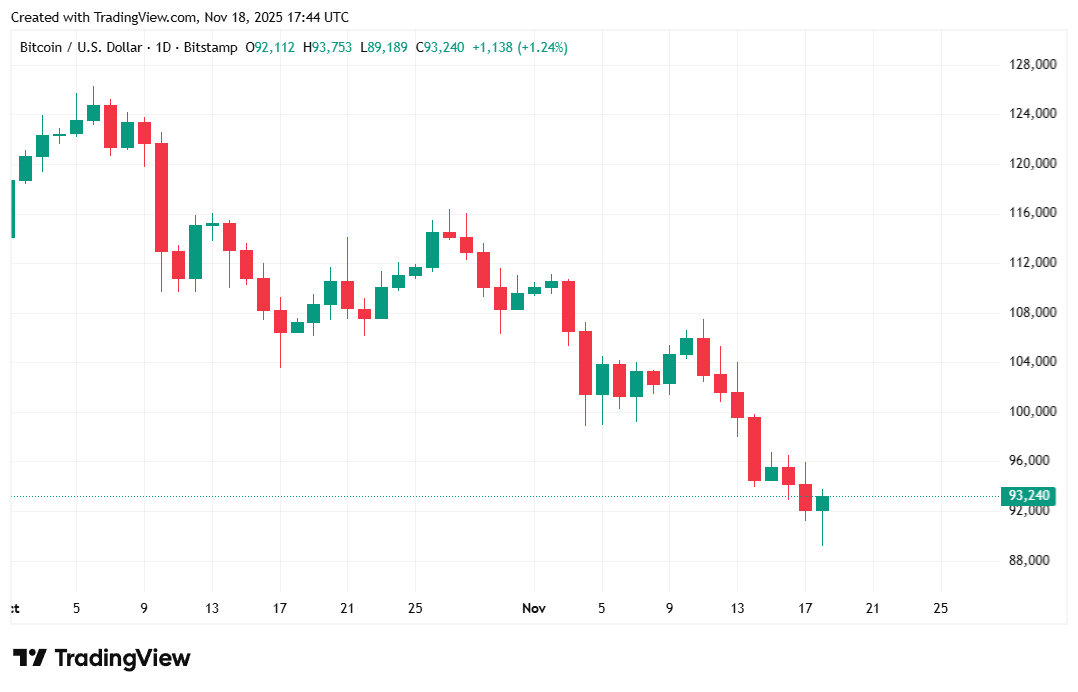

Bitcoin was trading at $93,251.65 at the time of reporting, a small 0.22% increase over 24 hours, although the cryptocurrency is still down 9.42% over seven days. Coinmarketcap data shows the digital asset has been fluctuating between $89,300.46 and $93,745.08 since yesterday.

( Bitcoin price / Trading View)

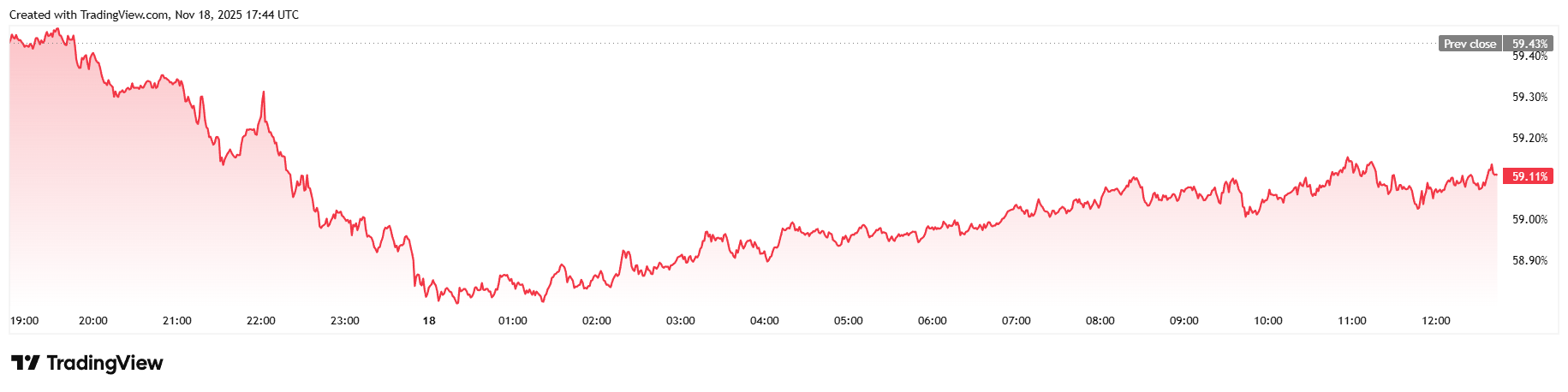

Daily trading volume climbed to $120.05 billion, a 40.42% jump since Monday. Market capitalization inched up to $1.95 trillion, but bitcoin dominance eased 0.55% to 59.11%, as the cryptocurrency fared worse than altcoins such as ether and solana.

( BTC dominance / Trading View)

Total value of open bitcoin futures contracts edged up to $66.44 billion, a slight 0.59% increase since yesterday. Coinglass data also shows that liquidations remained elevated at approximately $409.80 million at the time of writing. Long investors led the losses, with $359.12 million wiped out, while short sellers only lost $50.68 million in liquidated margin.

- Why does Standard Chartered think the sell-off is over?

Geoffrey Kendrick says bitcoin’s recent drop mirrors two past corrections that were followed by strong rallies. - What key metric is Kendrick watching?

He highlights Strategy’s mNAV falling to 1.0, showing its long-standing market premium has vanished. - When does the bank expect bitcoin to rebound?

Kendrick projects a renewed upswing before the end of 2025. - How is bitcoin trading now?

BTC is hovering near $93K after a brief crash to $89K, with high liquidations still shaking the market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。