A curious trade was revealed on Peter Thiel’s Macro LLC hedge fund’s 13F filing that was submitted on Friday; all of its Nvidia stock was sold off in Q3. The fund is relatively small, and so was the stake in question; but it’s not the dollar amount that got Wall Street’s attention, it’s the signal.

The California-based chipmaker quickly rose to stardom in 2023 after artificial intelligence (AI) darling OpenAI released its ChatGPT model in late November 2022, trained using Nvidia’s graphics processing units (GPUs).

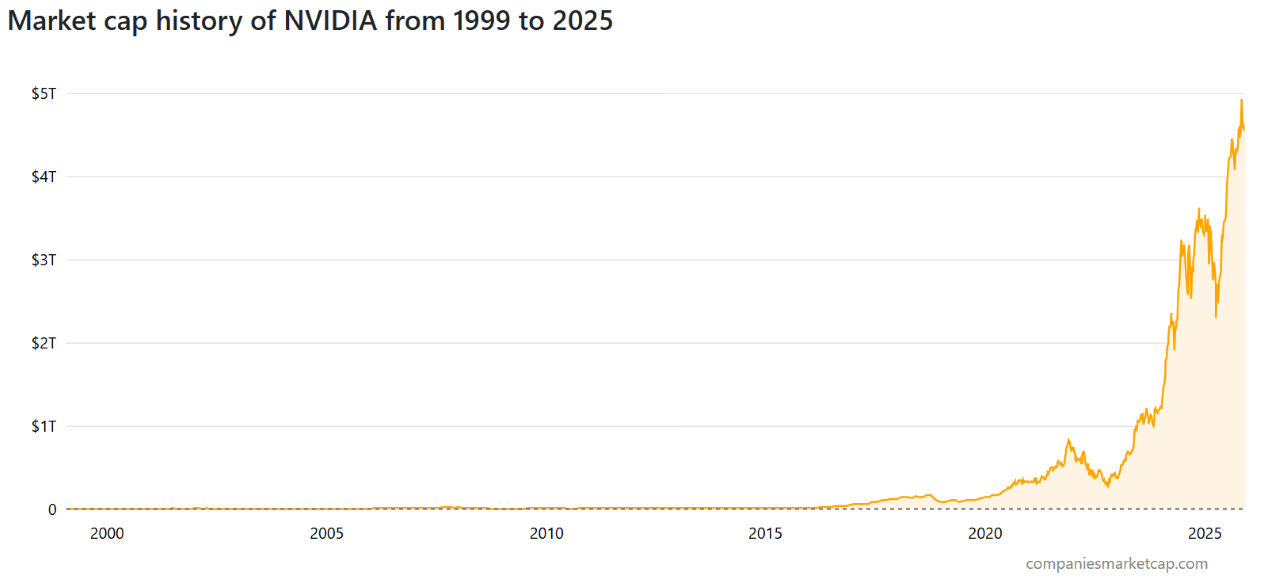

(Nvidia went from being an average public company to being the most valuable firm on earth within a couple of years, thanks to the success of its H100 chip used by top firms to train AI models / Chart: companiesmarketcap.com)

“NVIDIA and our partners are moving fast to provide the world’s most powerful AI computing platform to those building applications that will fundamentally transform how we live, work and play,” Nvidia CEO Jensen Huang said at the time.

Huang was right. Nvidia’s hyper-successful H100 chip became the computer of choice for training complex AI models. Last Wednesday, Nvidia became the first company to ever reach a $5 trillion market capitalization. But therein lies the problem, overvaluation. Other firms have also jumped onto the AI bandwagon, and Nvidia is no longer the only company basking in the technology’s success.

The world’s largest tech firms, such as Google, Meta, and Microsoft, have joined the gold rush and are now sinking billions into AI. Sam Altman, CEO of OpenAI, recently announced “commitments of about $1.4 trillion over the next 8 years.”

Read more: Bitcoin Dips as Concerns of an AI Bubble Mount

But investors are getting increasingly antsy about a potential bubble. Wall Street veterans remember all too well the dot-com crash from 25 years ago that came with a $5 trillion price tag after it was all said and done. And many of them claim we are now in an AI bubble, and that valuations have gone off the rails. Could this be why Thiel and Macro LLC are moving out of Nvidia?

Just last week, Japanese investment behemoth Softbank informed analysts that it liquidated its entire $5.83 billion stake in Nvidia. Interestingly, both firms are still bullish on the sector, with Softbank announcing a $22.5 billion investment in OpenAI, while Thiel has continued making investments in companies such as Substrate and Cognition AI. He is also the current chairman of AI-focused Palantir.

Softbank clarified that it only sold its Nvidia shares to get cash for its OpenAI investment. Macro LLC hasn’t given a reason for its transactions. Its doubtful AI is going away anytime soon, but if markets are indeed caught up in an AI bubble, the ensuing crash would likely eclipse the dot-com bust by an order of magnitude.

- Why are big investors selling Nvidia?

Softbank and Peter Thiel’s Macro LLC both exited their Nvidia positions as fears of an AI-driven market bubble grow. - Does this mean they’re bearish on AI?

Both remain heavily invested in the sector, with Softbank putting $22.5B into OpenAI and Thiel backing firms like Palantir, Substrate, and Cognition. - What’s fueling bubble concerns?

Nvidia’s $5 trillion valuation and trillion-dollar AI spending commitments have sparked comparisons to the dot-com crash. - Is AI investment slowing down?

No. Tech giants like Google, Meta, and Microsoft continue to pour billions into AI infrastructure and chips.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。