“If you’re going to be a bitcoin investor, you need a 4-year time horizon and you need to be prepared to handle the volatility in this market,” said Strategy

Chairman Michael Saylor.

At a time when skeptics are projecting gloom and doom over bitcoin’s sinking price, Michael Saylor, Chairman of Strategy (Nasdaq: MSTR), the largest corporate holder of the cryptocurrency, casually purchased 8,178 BTC, according to a Monday filing. The firm now holds 649,870 bitcoin, or roughly 3.05% of the entire supply. Besides taking his own advice and “buying the dip,” many see Saylor’s decision as a statement of conviction.

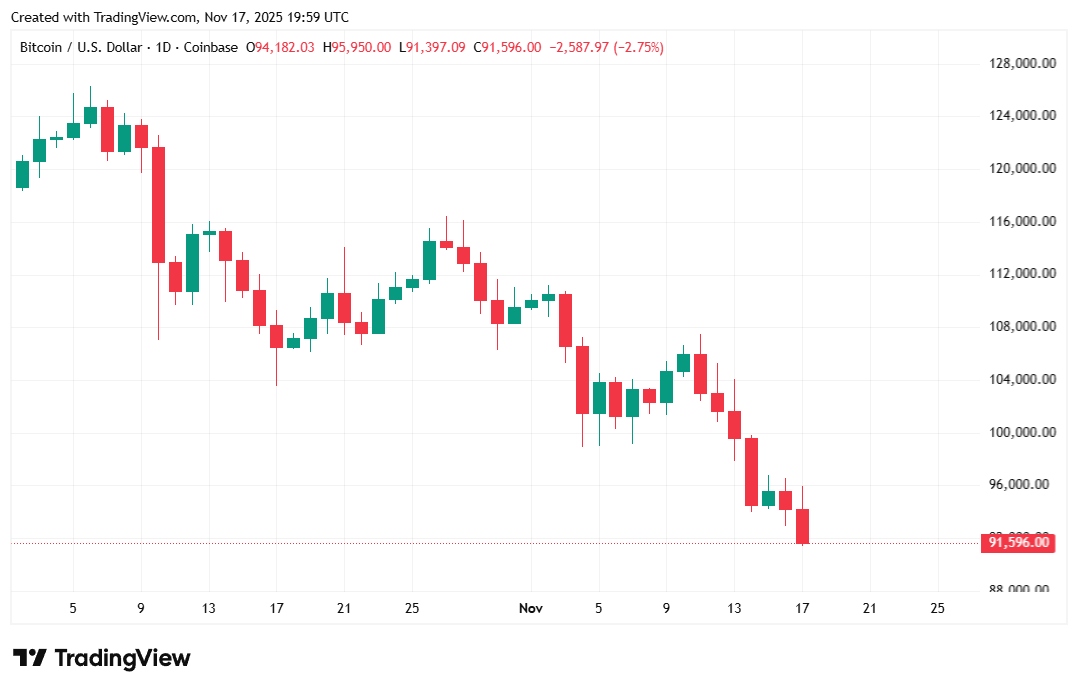

The digital asset has seen multiple precipitous drops in price over the past few weeks; first falling below the $100K threshold, then plunging under $95K, and now, over the past 24 hours, even retreating to $91K. Multiple catalysts have applied downward pressure on bitcoin, from fears of an AI bubble in tech stocks, to general economic headwinds triggered by uncertainty around trade, employment, and interest rate policy.

Read more: Bitcoin Dips as Concerns of an AI Bubble Mount

But longtime bitcoin investors remain bullish on the asset, with respected names such as billionaire venture capitalist Tim Draper announcing today that he still believes “we’re headed to $250K BTC and beyond.” And Saylor, ever the showman, going further than merely throwing out a prediction, and instead, putting his money where his mouth is with an $836 million bitcoin purchase.

“We are buying,” he said in a Friday interview with CNBC. “We’re buying quite a lot actually. And we’ll actually report our next buys on Monday morning. I think people will be pleasantly surprised.”

Indeed, Strategy’s announcement on Monday confirmed Saylor’s conviction, but the high-profile purchase failed to lift the digital asset’s price, which has continued to flounder. Some hardline critics, like goldbug Peter Schiff, are even suggesting Strategy will eventually go bankrupt if it continues down the path of bitcoin acquisition.

“MSTR’s entire business model is a fraud,” Schiff warned. “Regardless of what happens to Bitcoin, I believe $MSTR will eventually go bankrupt.”

Bitcoin was priced at $91,676.96 at the time of writing, a 2.62% decrease over 24 hours and 13.54% plunge since last week, according to Coinmarketcap. The cryptocurrency fell to $91,545.84 Friday afternoon after trading as high as $95,928.37.

( BTC price / Trading View)

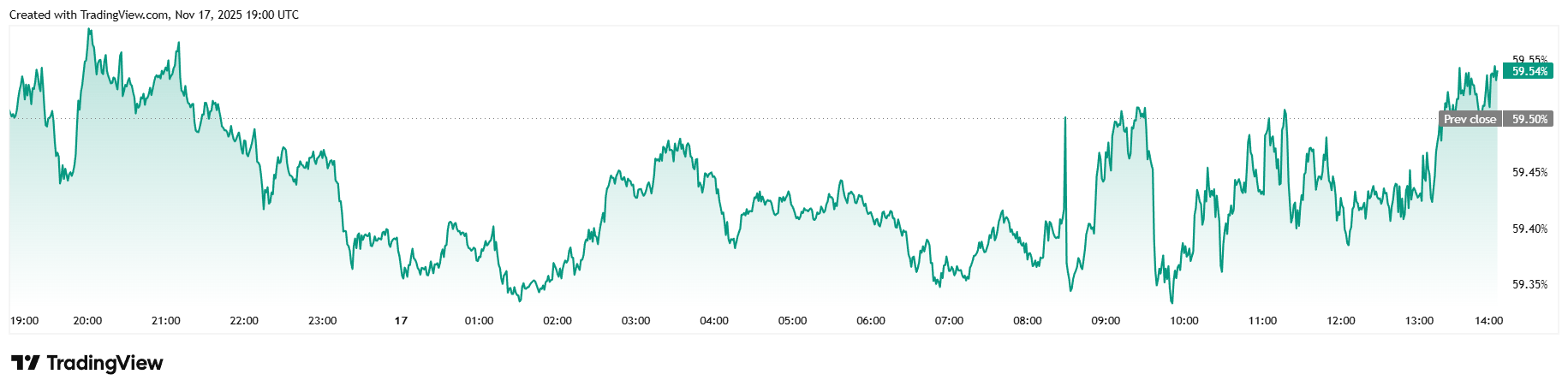

Daily trading volume climbed to $87.02 billion after the weekend, a 42.25% increase. Market capitalization dropped to $1.84 trillion, and bitcoin dominance inched down slightly by 0.05% to 59.53%.

( BTC dominance / Trading View)

The total value of open bitcoin futures contracts was lower by 1.06% at $65.17 billion since yesterday, according to Coinglass. Long liquidations were roughly two-thirds of Friday’s total at $414.89 million. Long investors garnered a lion’s share of the losses at $225.37 million, but short sellers weren’t too far behind, losing $189.51 million in liquidated margin.

- Why is bitcoin struggling right now?

A mix of AI-bubble fears, macro uncertainty, and falling risk appetite has pushed BTC as low as $91K. - What is Michael Saylor doing during the downturn?

He bought 8,178 more BTC, boosting Strategy’s holdings to nearly 650,000 coins. - Are major investors still bullish?

Yes, figures like Tim Draper continue to predict long-term targets of $250K and higher. - What are critics saying?

Skeptics such as Peter Schiff warn that Strategy’s aggressive bitcoin strategy could eventually lead to bankruptcy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。