In the early hours of Nov. 14, bitcoin ( BTC) briefly tumbled to $95,919, marking its lowest price point since May 5. The drop followed what has been characterized as the second-largest net outflow of spot bitcoin exchange-traded funds (ETFs) on Nov. 13, totaling $870 million. Although the top cryptocurrency recovered to settle above $97,000, this sharp price action casts doubt on the prospects of another milestone-setting rally before the end of the year.

The swift decline immediately erased significant market value. BTC was down by approximately 6%, pushing its market capitalization below the $2 trillion threshold to $1.94 trillion. Due to BTC’s dominance, the overall crypto economy’s market capitalization declined by approximately 6% to $3.73 trillion in 24 hours.

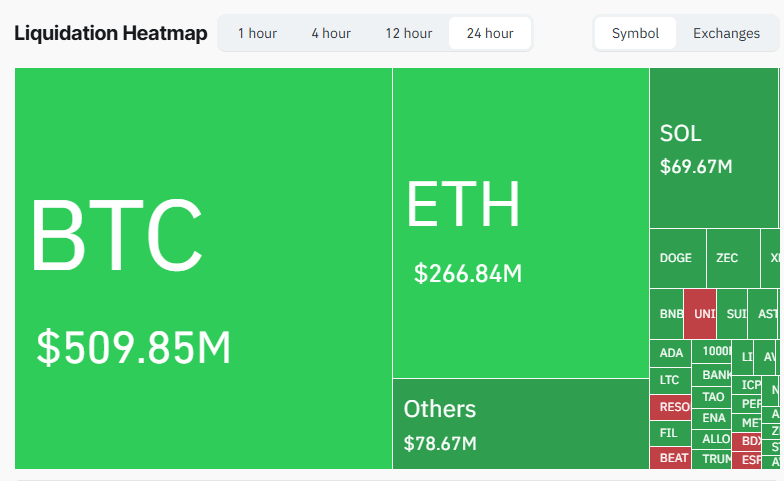

Furthermore, over $500 million in leveraged positions on BTC alone were wiped out, with long positions accounting for more than 90% of the losses. Overall, the wider crypto economy saw the liquidation of over $1.1 billion in leveraged positions across 246,000 traders.

The top cryptocurrency’s retreat occurred amid heightened concerns over the sustainability of the artificial intelligence (AI) stocks rally. Critics warn that many AI firms are overvalued, potentially existing in a dot-com-style bubble, which could foreshadow a future collapse impacting broader sentiment. For crypto critics, the drop well under $100,000 signals that bears have seized momentum and BTC could decline further.

Read more: Bitcoin Dips as Concerns of an AI Bubble Mount

However, some experts view the decline as a necessary correction before BTC reclaims the uptrend that led to its all-time high in October. Crypto analyst Casitrades commented on the bearish action, stating that data suggests the correction is close to finishing. She noted that momentum indicates BTC could briefly touch closer to $94,000 before stabilizing and reclaiming the $97,000 level.

“Remember, it is very possible that this support cluster is what ends the entire correction for Bitcoin. This lines up with what we’re seeing on the altcoin charts right now. XRP, HBAR, ALGO, XLM, and others are all approaching their macro fib supports at the same time,” Casitrades asserted in a post on X.

The analyst believes that once the market stabilizes at these critical support levels, it will likely gain the necessary momentum to pivot out of this corrective phase.

- Why did bitcoin drop on Nov. 14? BTC fell to $95,919 after $870M in ETF outflows.

- How much market value was lost? Bitcoin’s market cap slid below $2T, dragging global crypto to $3.73T.

- What happened to leveraged traders? Over $1.1B in positions were liquidated, affecting 246,000 traders worldwide.

- Is this a crash or correction? Analysts see it as a correction, with BTC likely stabilizing near $94K–$97K.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。