Selected News

Selected Articles

The longest government shutdown in U.S. history is finally coming to an end. The government shut down due to budget disagreements, a phenomenon almost unique to the U.S. political system. The 40-day shutdown significantly impacted global financial markets, affecting the Nasdaq, Bitcoin, tech stocks, the Nikkei index, and even safe-haven assets like U.S. Treasuries and gold.

From the retail trading wave ignited by GameStop to Robinhood's vision of a "financial super app," social trading is evolving from a fringe phenomenon to a part of financial infrastructure. They do not replace brokerages but build a new layer of discovery and discussion on top of them. This article delves into how emerging platforms like Blossom, AfterHour, and Fomo are reshaping retail investor behavior and market structure through real holding data, community interaction, and trading integration. In this process of gradually forming infrastructure, those who understand their users will define the future financial entry points.

On-chain Data

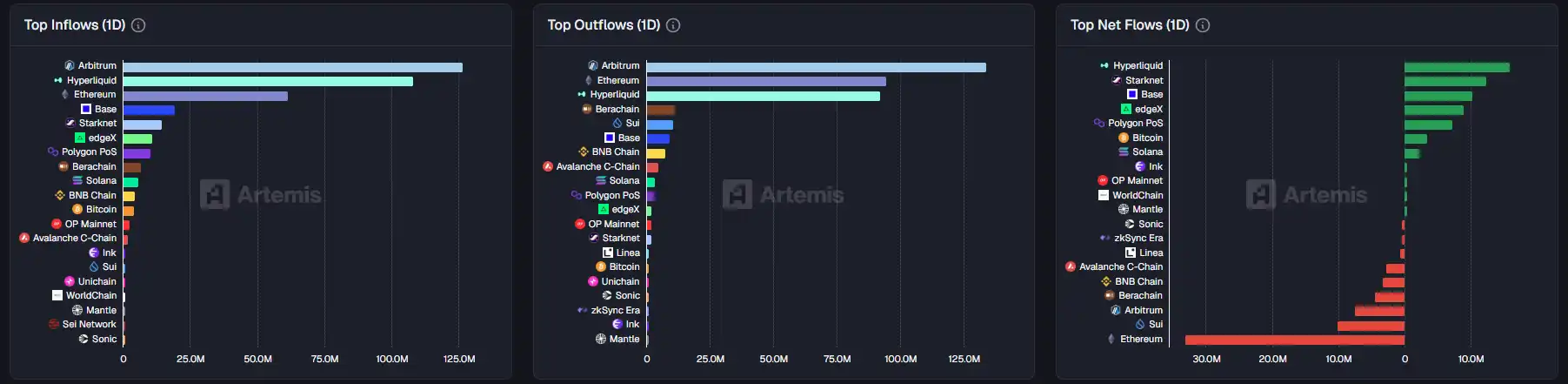

On-chain capital flow situation for the week of November 10

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。