Original|Odaily Planet Daily (@OdailyChina)

Author|CryptoLeo (@LeoAndCrypto)

The prediction market has become a "killer application" in the crypto space for 2025. Data shows that in October, the total number of prediction market users reached 524,200 (with 40.4% being new users), and the number of transactions reached 30 million, making it the most active month in the history of prediction markets. Among them, Kalshi accounted for about 45%-55% of the market share in terms of trading volume and number of transactions, followed by Polymarket, while other smaller projects accounted for only about 7%-10%. If you haven't participated in the prediction market yet, you are missing out on the best way to make money in 2025-2026.

Many friends may worry that they cannot profit in the prediction market, possibly due to trading operations, professional levels, etc. To address this, Odaily has compiled a list of practical "auxiliary projects" for the prediction market, including prediction market analysis, agents, and other applications that can help you achieve the best trading direction in the prediction market. Most of the recommended protocols are based on Polymarket, as follows:

HashDive

HashDive is a prediction market trading analysis platform (based on Polymarket), which includes trading volume, wallet, and market analysis. Market analysis includes: current trading volume data for events, liquidity data, how many new YES or NO preferences were added in the last 24 hours, as well as event expiration times and potential returns for users buying YES/NO.

Additionally, HashDive allows users to check their trading performance by entering an address/username, including: trading positions, active days, balance, and profit/loss rankings for 1/7/30 days and all time. Users can also see recent/historical betting events, highest/lowest return betting events, and average trading volume over the past 30 days. (Tracking whales)

HashDive has also launched an account intelligence scoring feature, with scores ranging from -100 to 100. Higher scores typically reflect more stable and profitable trading. (Full data requires funding)

Its Screener feature can filter trading markets, results, trading volume, trader data, recent price changes, whale buy/sell data and ratios, etc. It also has a tree diagram of prediction markets grouped by category. Each box represents a market outcome, with the size of the box reflecting one metric (e.g., trading volume) and the color reflecting another metric (e.g., price change), helping users better see the direction of a particular event.

The PnL Leaderboard section displays user profit rankings in a specific market and the maximum trading volume rankings for users betting in that market.

The whale position section shows the main market positions of users on Polymarket, focusing on the largest positions a single user has in currently active and unsettled markets (entry price, current market price, profit, etc.).

zerosupercycle

zerosupercycle is a community focused on Polymarket users, providing help and analysis through Discord. Users can discuss any analysis and trading trends related to prediction market events, making it suitable for friends active in DC groups.

PredictFolio

PredictFolio is a user analysis platform for multiple prediction markets, allowing analysis, comparison, and tracking of any user.

PredictFolio is relatively simple, lacking the many sections and details of HashDive. Users can search for top users in the prediction market for analysis, including trading volume, investment scale, and markets participated in, as well as seeing trading profits and losses (realized/unrealized). Currently, this application has a fast query speed and a clean interface, but it is not particularly complete and cannot perform in-depth analysis like HashDive, serving as a simple prediction market query tool.

fireplace

fireplace is a news prediction betting platform that is currently in the waiting list stage. When hot news appears, related bets are made available. Users can follow other people's bets, including high-stakes betting transactions. Currently, besides predictions, it also has some social aspects. The author is still on the waiting list and has not yet summarized the advantages of fireplace compared to other platforms.

Liquid

Liquid is a prediction market protocol that I am optimistic about. Similar to betting insurance, ordinary prediction market users lose their bet amount, which becomes zero. Liquid introduces an insurance mechanism where users can invest a certain percentage of insurance money after placing a bet. This way, even if they lose the prediction, they can receive a return far greater than the insurance amount. For example: if a user bets $1,000 and invests $150 in insurance, after losing the prediction, they can receive $500 back. According to official information, the insurance amount can be adjusted in proportion to the bet amount and return amount. Liquid supports the return of funds through a Delta neutral aggregation vault.

The insurance mechanism allows users to confidently increase the value of their betting positions, but currently, Liquid is still in the waiting list stage, and the transaction fees and the usage of insurance amounts and Delta neutral amounts are not yet known, so it is advisable to keep an eye on it.

Betmoar

Betmoar is a prediction market trading application and also the official bot provider for Polymarket, supporting large bet searches, real-time news betting, and real-time UMA decision-making.

Betmoar's news section can filter recent hot news, and by clicking on the news, users can obtain related markets and trade based on keywords and content.

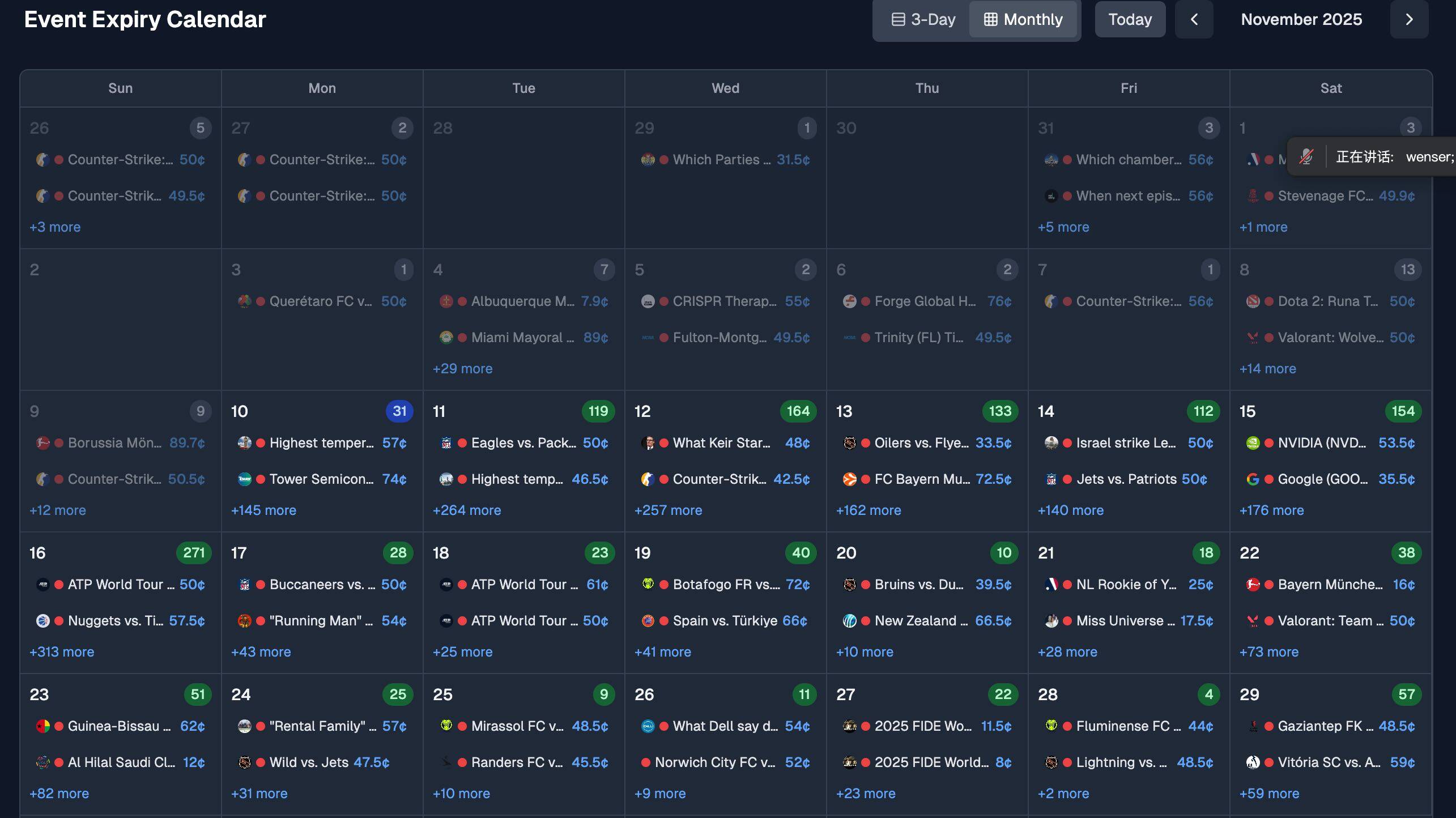

Betmoar's Clandar section displays the number of active markets in all prediction markets, total liquidity, total trading volume, and 24H trading volume. It also allows filtering by hot topics, deadlines, result prices, price range (the price range for prediction betting, e.g., YES 60%, NO 40%), trading volume, and liquidity.

The calendar section is very practical, allowing users to intuitively see the prediction markets they want after filtering.

Its UMA section allows users to vote on some controversial prediction market events.

Users can log into Betmoar using their email/wallet. Email login requires private key verification, and it is recommended to use wallet login.

Sportstensor

Sportstensor is an AI network for predicting sports events, supported by the Bittensor network. It can utilize various AI models to create and improve prediction models in a decentralized manner, reducing reliance on any single entity or algorithm, and building more suitable prediction schemes through summarization and analysis to aid accurate predictions.

Miners can receive requests from validators, which include specific information such as team names and match details;

Retrieve historical data and current statistics related to the teams involved from sports databases;

Use trained machine learning models to analyze data and predict which teams they believe will win and their winning probabilities;

Return the prediction results to the validators for confirmation and further action.

Many organizations currently have a high demand for high-performance prediction AI and are looking for more accurate sports AI prediction models. AI prediction models may become the next hot area in the prediction market. Interested friends can register on their official website to become miners.

Polyfactual

Polyfactual is an AI-based analysis platform that has launched in-depth research for prediction markets, providing real-time news push.

Its built-in AI performs deep analysis, allowing users to simply paste Polymarket links or ask any prediction market-related questions, consuming 10 PLOYFACTS tokens (a practical token, currently priced at $0.0038, with a market cap of $3.8 million) to obtain deep AI predictive analysis provided by its model.

Currently, Polyfactual has also launched a Google Chrome extension, which is quite convenient. Polyfactual has 12.6k followers on X.

Polysights

Polysights is a prediction market analysis platform that provides users with practical tools related to Polymarket. This includes:

AI insights and analysis for prediction markets, price and trading volume analysis, real-time notifications and information streams, arbitrage and trading indicator functions, TG bots, etc.

I am particularly optimistic about the arbitrage function, which detects real-time price differences on the platform and utilizes detailed market data to provide arbitrage opportunities.

Currently, Polysights is in beta and has also launched an insider tracking feature (this insider feature does not represent a true 100% insider win rate account, as such accounts are hard to find in prediction markets, including large trades and arbitrage trades, etc.), allowing real-time queries of insider accounts' positions and betting situations. In the future, AI agents will also be launched (funding required).

Robin

Robin is a DeFi platform aimed at earning returns on positions in Polymarket, passively providing liquidity for prediction markets. It allows traders to stake prediction tokens from platforms like Polymarket to earn income. Funds are invested in the DeFi space, generating returns during the prediction period without affecting exposure to the underlying events or adding extra liquidation risks for stakers.

Specifically, when users deposit prediction outcome tokens (YES/NO) into Robin's staking vault, Robin automatically provides counterparty tokens to synthesize USDC and create delta neutral positions, depositing the tokens into a yield protocol to earn returns. After Polymarket completes market settlement, Robin will automatically redeem the underlying YES/NO tokens and decompose the merged USDC. The vault will identify the winning outcome, distributing the returns to the correct token holders and unlocking earnings for all stakers. During this period, users can redeem their prediction tokens at any time.

Currently, Robin is in the testing phase and is worth long-term observation. In addition, Robin has also launched a points program for token airdrops during the TGE.

Stand

Stand is a trading terminal for trading on Polymarket, providing real-time news and notifications. In addition to basic market queries and filtering, the highlight of Stand is the Octobox feature, which supports trading across multiple prediction markets. One interface allows you to simultaneously track and trade 8 prediction markets, enabling you to view the trading direction and win rates of the prediction market events you are interested in in real-time.

Nevua Markets

Nevua Markets is a prediction market monitoring platform that provides users with real-time updates on prediction market events of interest. Users can select topics they are interested in and receive related prediction markets. Nevua Markets allows users to monitor topics, event statuses, and market price alerts (equivalent to exchange listings and price breakout notifications in the prediction market). Users can set one-time and recurring alerts, receiving notifications on TG and Discord, enabling early trading on prediction market events.

Conclusion

Currently, the applications I am optimistic about and will continue to observe or participate in include: HashDive, Liquid, Polyfactual tokens, Polysights, and Robin. The reasons are: for example, the data diversity of HashDive, the insurance mechanism of Liquid (which is also a prediction protocol on BNB, mentioned as a warning by CZ), Robin's airdrop points, and the arbitrage indicators of Polysights.

BTW, there are many prediction auxiliary applications in the market, and this article will continue to be updated. Of course, the above protocols each have their strengths, and which protocols you are optimistic about depends on your own perspective. DYOR!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。