Original Title: The Former God Disk ORE Makes a Comeback, This Time It Multiplied 30 Times in a Single Month

Original Author: Nicky, Foresight News

In 2024, ORE initially emerged as the champion of the Solana Renaissance hackathon, and its proof-of-work mechanism had previously caused congestion on the Solana network due to excessive transaction volume.

After nearly a year of silence, the Solana ecosystem project ORE has returned to the market spotlight. This PoW mining protocol, once humorously dubbed "the one that crashed Solana," is back with a newly upgraded protocol that not only propelled the token price from $10 to over $600 in nearly a month but also achieved over $1 million in daily protocol revenue, ranking second on the Solana network, only behind Pump.fun, with this growth almost entirely occurring within DEX.

ORE was created by the anonymous developer Hardhat Chad, whose identity model draws from the tradition of Bitcoin's Satoshi Nakamoto. In the early stages of the project, Hardhat Chad independently completed the development of ORE V1. Currently, the team includes members like Neil Shahani, who are responsible for project development and community communication.

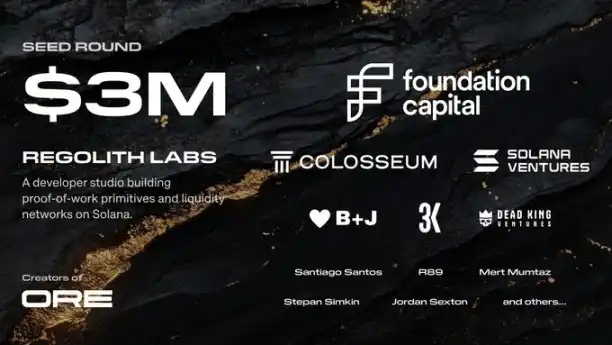

As the project developed, ORE established Regolith Labs as its formal development entity.

In September 2024, the development team behind ORE, Regolith Labs, completed a $3 million seed round of financing, led by Foundation Capital, with participation from Solana Ventures. This funding is primarily used for team expansion and technical development.

Subsequently, the project team launched the V2 version; however, the early V2 version failed to completely resolve the incentive misalignment issue, resulting in low mining rewards and a prolonged decline in ORE's price.

After a year of exploration, the team recognized the fundamental value loss issues inherent in traditional PoW and decided to undertake a comprehensive reconstruction. On October 22, 2025, ORE officially released a new announcement, stating that after redesign, it could accumulate protocol revenue, achieve sustainable token economics, and accelerate the mission of creating a native value storage for Solana.

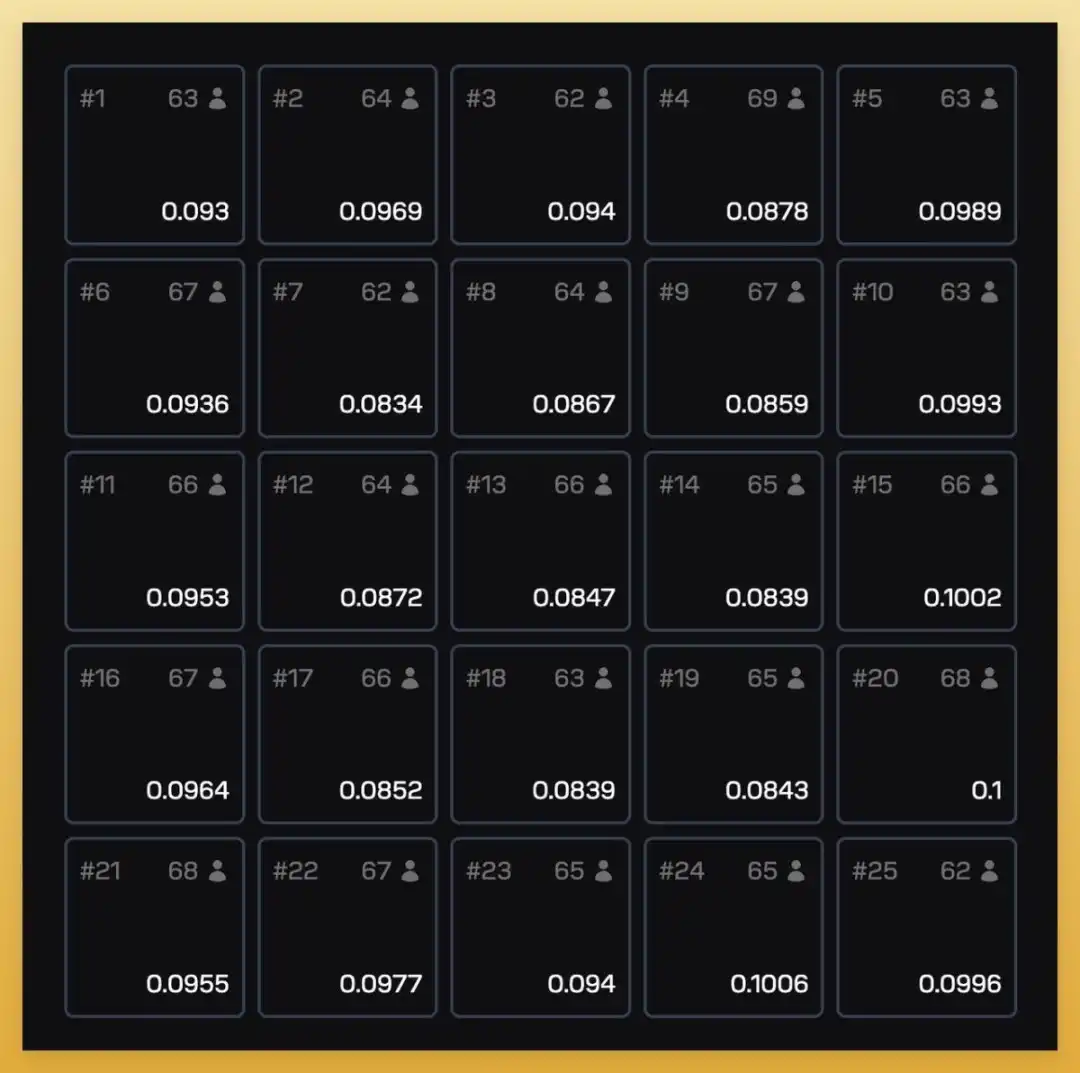

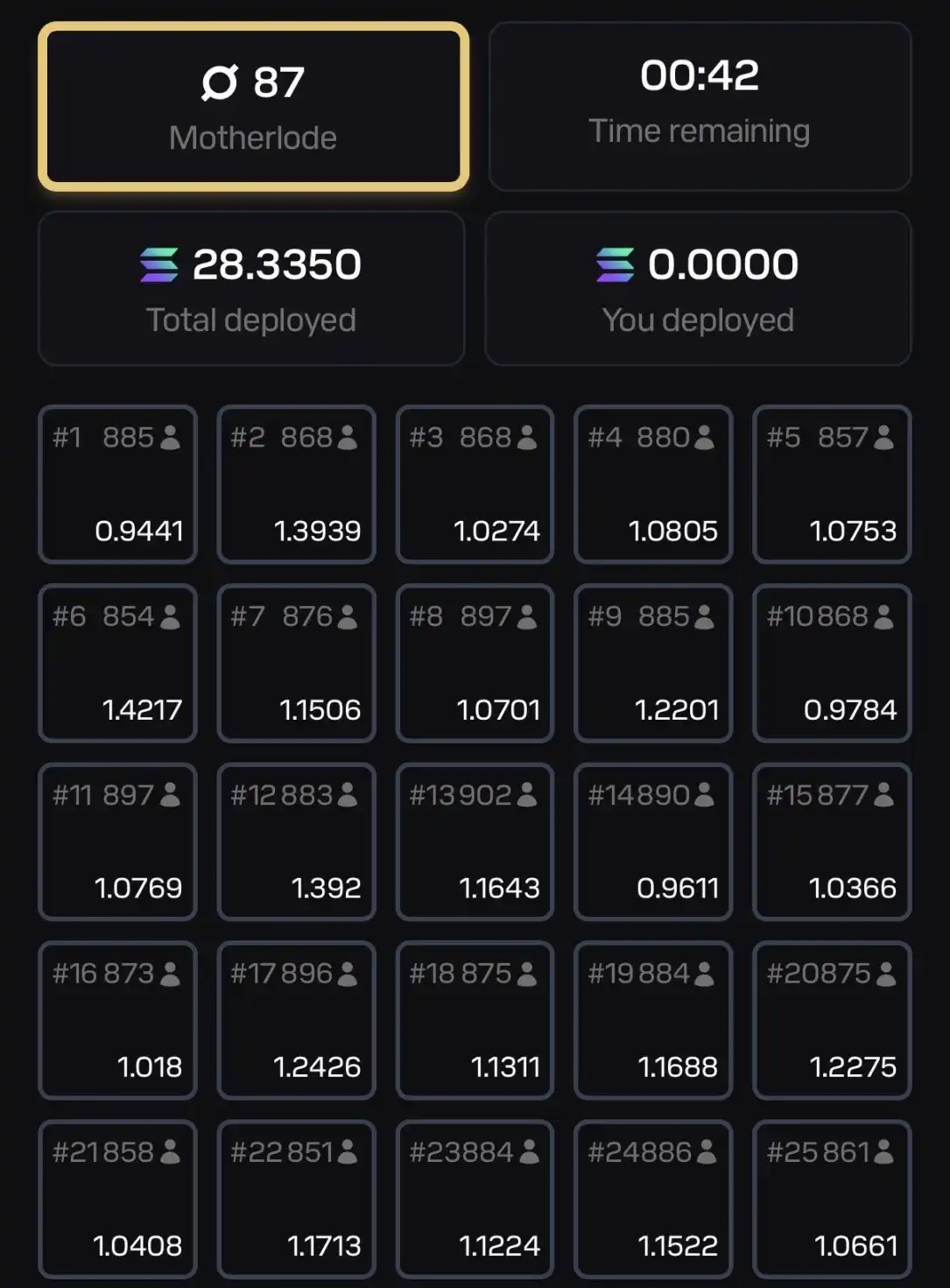

The new protocol introduces a 5×5 grid mining system. Each round lasts one minute, and miners occupy blocks in the grid by deploying SOL. At the end of each round, the system selects a winning block using a secure random number generator, and miners on that block share all SOL from the other 24 blocks proportionally. Additionally, one miner from the winning block has the chance to receive an extra 1 ORE reward (approximately once every three rounds). This design transforms "zero-sum games" into "collective value redistribution," where the SOL from losers fully flows to the winners, avoiding value outflow.

The protocol also features a "Motherlode" prize pool mechanism, which contributes 0.2 ORE to the prize pool each round, with a 1:625 chance of triggering the prize pool. If the reward is not triggered, the prize pool continues to accumulate until it is won by a lucky miner in a future round.

Economic Model: Deflationary Mechanism and Value Accumulation

The core innovation of the ORE protocol lies in its value capture mechanism. All mining rewards require a 10% "refining fee" upon withdrawal, and these tokens are automatically distributed to other miners based on the proportion of ORE they have not claimed. The longer miners hold the ORE they have mined, the more ORE they receive.

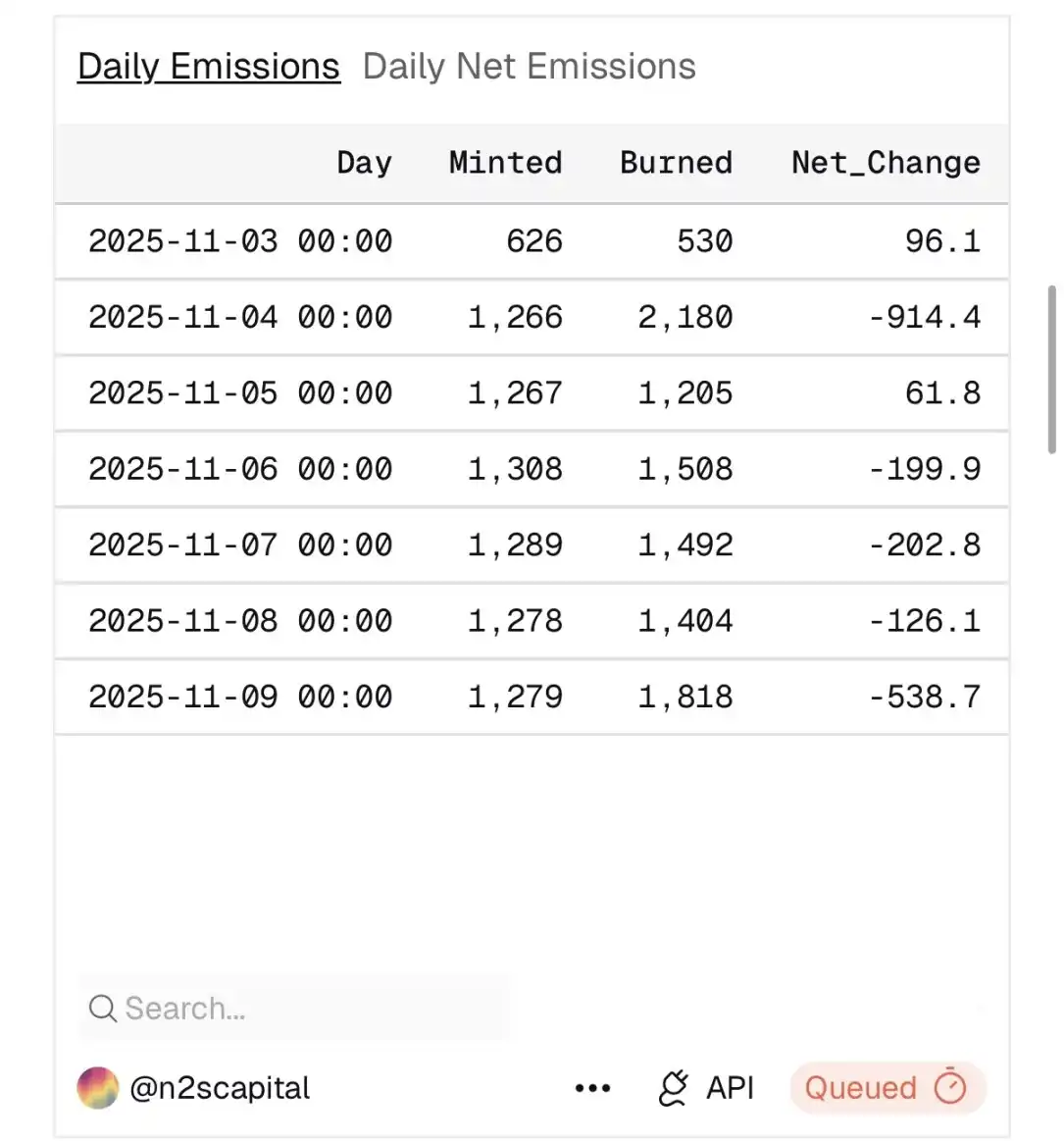

More importantly, the protocol automatically collects 10% of SOL mining rewards as protocol revenue, which is used to repurchase ORE tokens from the open market. In the past seven days, the protocol revenue reached 21,529 SOL (approximately $3.6 million), driving the repurchase of 10,381 ORE. Of these repurchased tokens, 90% are permanently "buried," while the remaining 10% are distributed to stakers.

This design allows the net emission of ORE to dynamically adjust between deflation and inflation. When the protocol revenue is sufficiently large, the entire system enters a deflationary state.

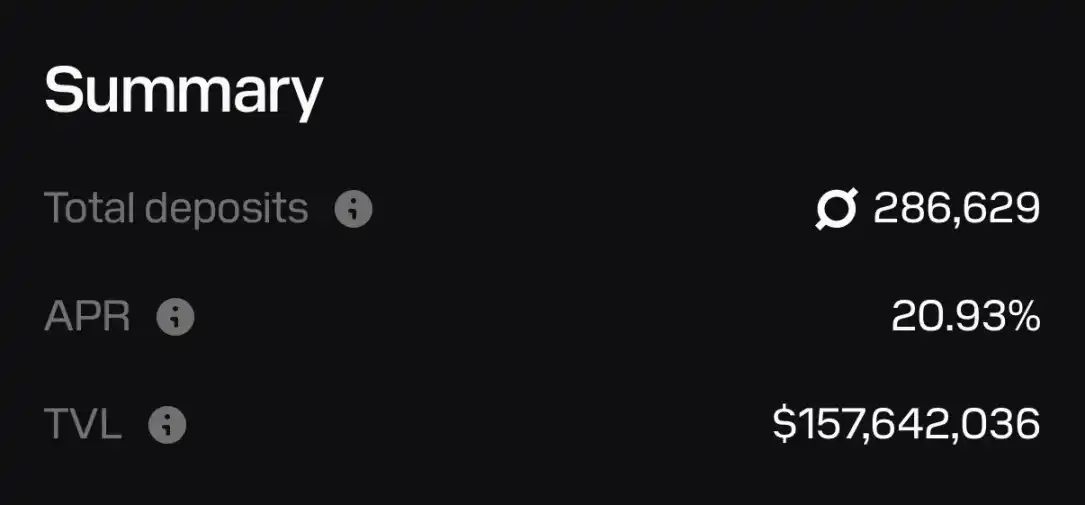

Currently, the protocol has staked 286,629 ORE, with a TVL exceeding $150 million and an APR of 20.93%.

Token Economics

ORE will maintain its existing maximum supply cap of 5 million tokens and sustain a stable average issuance rate of approximately 1 ORE per minute. However, the introduction of protocol revenue and the automatic burial mechanism means that if the protocol revenue is sufficiently large, the net issuance may fluctuate between limited inflation and unlimited deflation. According to Dune data, ORE has been in a deflationary state for five out of the past seven days.

Ecosystem Recognition: Endorsement from Solana

Solana officials are particularly focused on the profitability of this mechanism. On the morning of November 10, Solana officially quoted a tweet from ORE growth lead Neil Shahani, expressing surprise at its daily revenue surpassing $1 million.

Solana co-founder toly commented more directly: "Ore is money," and retweeted the post emphasizing its advantages such as "sustained miner incentives, staking rewards coming from protocol revenue rather than inflation, and fees benefiting the ecosystem."

The integration of ORE is also continuously expanding. The Seeker device from Solana Mobile now supports the ORE application, allowing users to participate in mining directly through their phones, achieving the experience of "mining anytime, anywhere."

Community Response

Some community users are cautiously optimistic about ORE's return. Some users pointed out that participating in the mining game itself may be a negative return behavior, with the real beneficiaries being ORE holders. The mining mechanism of ORE is essentially a "zero-sum game," where the SOL from losers fully flows to winners. As the number of participants increases, the mining costs (the SOL invested) rise significantly.

If miners choose to "mine and sell immediately," they must bear the high cost of price volatility under the "refining fee"; while long-term holders can cover costs and even achieve net gains through "refining" fees, staking rewards, and deflationary appreciation. This understanding has led more users to choose to hold tokens directly rather than participate in mining.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。