The longest government shutdown in U.S. history is finally coming to an end.

The government shutdown, caused by a budget impasse, is a phenomenon unique to the American political system. The 40-day shutdown significantly impacted global financial markets, affecting the Nasdaq, Bitcoin, tech stocks, the Nikkei index, and even safe-haven assets like U.S. Treasuries and gold.

Even the most rigid bipartisan relations could not withstand the collective desire to enjoy a good Thanksgiving before November 27. The recently concluded Senate meeting finally achieved the 60 votes needed to advance the budget, signaling the potential end of the longest government shutdown in history, allowing the U.S. government to "open its doors."

Why the Shutdown?

This shutdown stemmed from the failure of the Republican and Democratic parties to reach an agreement on the fiscal budget after October 1.

That day marked the official expiration of the previous year's federal budget. The Republican Party currently controls both chambers of Congress but lacks the 60 votes needed in the Senate to push the budget through, giving the Democrats significant leverage in negotiations.

The core disagreement between the two parties centers on healthcare spending. The Democrats are demanding an extension of the soon-to-expire tax credits to allow millions of Americans to continue enjoying lower health insurance costs while also reversing Trump's cuts to the Medicaid program; the Republicans insist on reducing health and government healthcare-related expenditures to control the budget size.

Although the House passed a temporary funding bill to avoid a shutdown, the Senate refused to release it, leading to the government officially shutting down on October 1 for the first time in nearly seven years.

Insiders revealed that the turning point in this round of negotiations came from a preliminary agreement reached between at least eight moderate Democratic senators and Republican leaders and the White House: in exchange for a vote on extending subsidies under the Affordable Care Act (Obamacare), the government would first "open its doors."

What Are the Consequences of the Shutdown?

If one were to describe the impact of the government shutdown on the economy, "a hurricane" might be a very apt metaphor.

The first areas to be affected are financing and business approvals: loan permits and company IPO reviews are all delayed; approximately $800 million in federal contracts cannot be signed daily; contractors and suppliers are unable to receive compensation, many of whom are small businesses reliant on government orders.

This means that for every week the government is shut down, economic growth decreases by 0.1–0.2 percentage points, roughly translating to a weekly loss of $15 billion.

As the shutdown drags on, these losses will become harder to recover, especially potentially impacting the traditional consumption peak season in November and December. As White House economic advisor Kevin Hassett warned, the impact of this shutdown is "far beyond expectations," and he even believes that fourth-quarter growth could be halved from the originally expected 3% to 1.5%. Industries such as travel, leisure, and construction have already shown significant "injury."

The last serious government shutdown in U.S. history occurred from 2018 to 2019, lasting 35 days due to the controversy over the U.S.-Mexico border wall. Subsequent research by the Congressional Budget Office found that it caused approximately $11 billion in losses to the U.S. economy. However, most of those losses were later recovered, with $3 billion remaining as permanent losses.

For those in the cryptocurrency space who have experienced this shutdown firsthand, it has not been easy either. Related reading: "Wall Street Continues to Sell Off, How Low Can Bitcoin Go?."

In just the first week of November, Bitcoin has already dipped to a lower point than the "10.11" crash, failing to hold the $100,000 mark and even dropping below $99,000, marking a new low for the past six months, while Ethereum hit a low of $3,000. On the HTX trading platform, a single BTC-USDT long position was liquidated for $47.87 million, topping the liquidation leaderboard across the network.

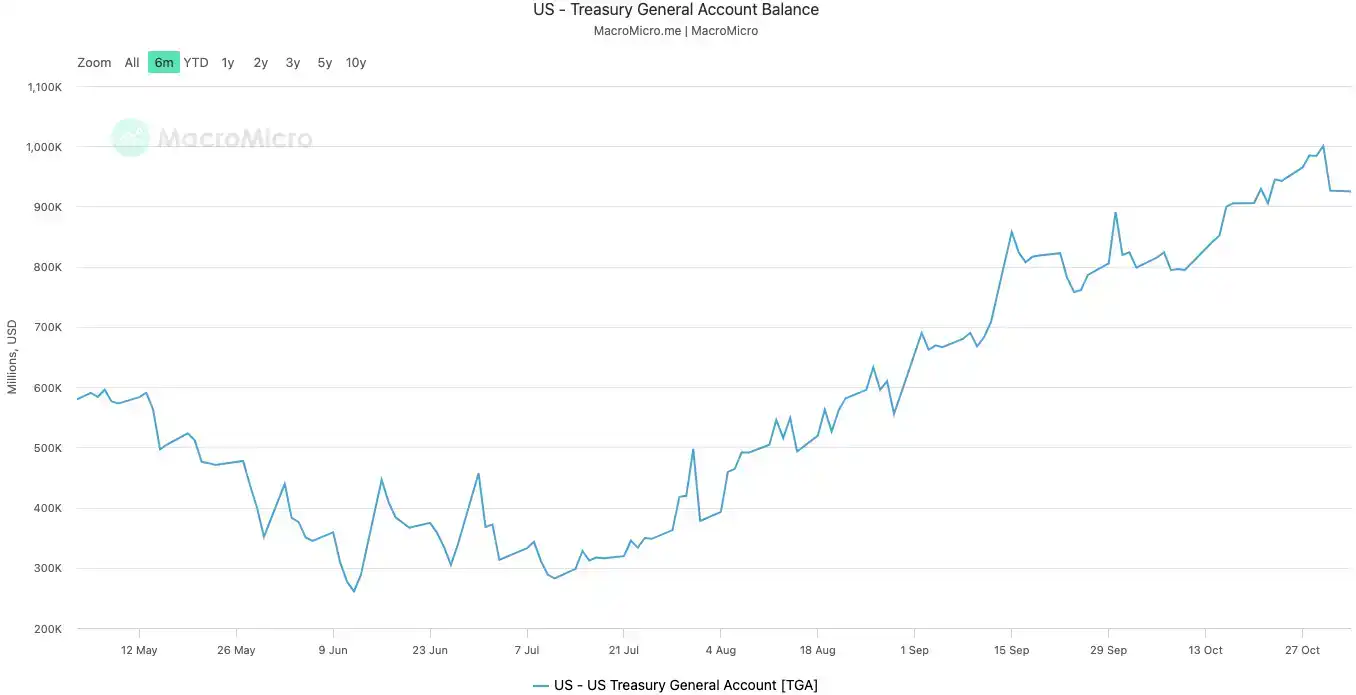

Previous analyses from Wall Street indicated that the shutdown forced the U.S. Treasury to increase its balance in the Federal Reserve's General Account (TGA) from about $300 billion to over $1 trillion in the past three months, reaching a nearly five-year high. This process effectively withdrew over $700 billion in cash from the market.

With the market short on cash, the cryptocurrency space has also seen liquidity drained.

From October 29 to November 3, BlackRock's IBIT, the largest Bitcoin spot ETF with a 45% market share, saw a cumulative net outflow of $715 million over four trading days, accounting for more than half of the total outflow of $1.34 billion in the U.S. Bitcoin ETF market.

Looking at the entire week, from October 28 to November 3, IBIT had a net outflow of $403 million, representing 50.4% of the total market outflow of $799 million, with a single-day outflow of $149 million on October 31, setting a record for the highest single-day outflow in the industry.

Even more significant than ETFs are the long-term holders on the blockchain.

In the past 30 days (from October 5 to November 4), wallets holding Bitcoin for over 155 days, commonly referred to as "long-term holders" (LTH), have cumulatively net sold about 405,000 BTC, accounting for 2% of the circulating supply. Based on an average price of $105,000 during this period, they cashed out over $42 billion.

When Will the Market Rise?

Although the government funding plan has not yet fully materialized, the market has already shown some movement, with U.S. stock index futures rising sharply during the Asian morning session.

We can continue to track the following dimensions to help assess the direction of fiscal policy and liquidity moving forward.

First is the U.S. Treasury General Account (TGA). Related reading: "Why Does the U.S. Government Need to Open for Bitcoin to Rise?."

This can be understood as the central checking account established by the U.S. government at the Federal Reserve. All federal revenues, whether from taxes or the issuance of national debt, are deposited into this account. All government expenditures, from paying civil servant salaries to defense spending, are also drawn from this account. Under normal circumstances, the TGA acts as a transit station for funds, maintaining a dynamic balance. The Treasury collects money and then quickly spends it, flowing into the private financial system, becoming bank reserves, and providing liquidity to the market.

The government shutdown has disrupted this cycle. The Treasury continues to collect money through taxes and bond issuance, causing the TGA balance to grow. However, due to Congress not approving the budget, most government departments are closed, and the Treasury cannot spend as planned. The TGA has become a financial black hole that only takes in funds.

Since the shutdown began on October 10, 2025, the TGA balance has ballooned from about $800 billion to over $1 trillion by October 30. In just 20 days, over $200 billion in funds have been withdrawn from the market and locked in the Federal Reserve's vault.

U.S. government's TGA balance | Source: MicroMacro

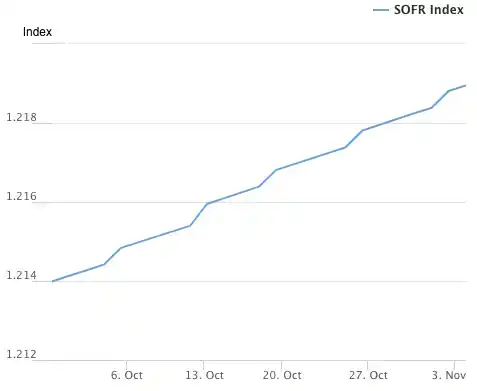

The TGA is the "cause" of the liquidity crisis, while soaring overnight borrowing rates are the most direct symptom of the financial system "running a fever."

The overnight borrowing market is where banks lend short-term funds to each other, serving as the capillaries of the entire financial system. Its interest rate is the most accurate indicator of the tightness of interbank "money roots." When liquidity is abundant, banks can easily borrow from each other, and rates remain stable. However, when liquidity is drained, banks begin to run short on cash and are willing to pay a higher price to borrow overnight.

This leads to two other key indicators: SOFR (Secured Overnight Financing Rate) and the usage of the Fed's SRF (Standing Repo Facility).

On October 31, SOFR surged to 4.22%, marking the largest daily increase in a year. This not only exceeded the Federal Reserve's upper limit of the federal funds rate of 4.00% but also surpassed the effective federal funds rate by 32 basis points, reaching the highest point since the market crisis in March 2020. The actual borrowing costs in the interbank market have spiraled out of control, far exceeding the central bank's policy rate.

Secured Overnight Financing Rate (SOFR) index | Source: Federal Reserve Bank of New York

The SRF is an emergency liquidity tool provided by the Federal Reserve for banks. When banks cannot borrow money in the market, they can pledge high-grade bonds to the Fed in exchange for cash. On October 31, the usage of the SRF soared to $50.35 billion, setting a record high since the pandemic crisis in March 2020. The banking system is facing a severe dollar shortage and has had to knock on the last help window of the Federal Reserve.

Standing Repo Facility (SRF) usage | Source: Federal Reserve Bank of New York

Beyond the fiscal side, we can also track the pace of U.S. Treasury issuance, short-term interest rates, and the response of RRP (Reverse Repurchase Agreement) balances. If a combination of "the Treasury issues a large amount of debt + a significant decrease in RRP balances" occurs, it indicates that liquidity is being transferred from money market funds to Treasuries, which will further influence the performance of risk assets. Additionally, the quarterly refinancing plan (QRA) released by the Treasury at the end of the month is also an important signal to observe government cash needs and financing pressures.

Moreover, there are still several key procedural steps worth noting. Even if the House passes the vote, it still needs to go through the Senate vote and presidential signing processes.

According to relevant information, after the procedural vote passes, the Senate must amend three appropriations bills (legislative, military construction, and agriculture, including the SNAP program) and then send them back to the House. Each amendment will trigger a 30-hour debate period, which could delay the process.

If the Democrats choose to extend these debates, the government may not reopen until Wednesday or Thursday. However, if they expedite the "end of the government shutdown" process, it could be completed tonight, allowing the U.S. government to reopen tomorrow night. Any delays would mean that the "shutdown risk" has not been completely eliminated.

Therefore, completing the entire process of "opening the government" is expected to take a few days to a week. For cryptocurrency, this may be the last "entry zone" before a potential small bull market arrives.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。