A sudden national-level technical report has torn apart the facade of "just law enforcement," revealing a meticulously planned five-year digital asset plundering scheme. 127,000 bitcoins, with a market value soaring from $3.5 billion to $15 billion, were not simply seized through law enforcement but rather resemble a "perfect scam" led by state-level hackers, with judicial procedures merely providing a veneer. This ultimate showdown of "black eating black" not only concerns immense wealth but also foreshadows the fangs of state hegemony extending into the "digital gold" era.

I. Timeline Decoding: Five Years of Precise Harvesting of "Steal First, Occupy Later"

On the surface, this seems like old news: in October 2025, the U.S. Department of Justice announced the seizure of 127,000 bitcoins held by Chen Zhi, chairman of the Cambodian Prince Group. However, the report from the National Computer Virus Emergency Response Center paints a starkly different truth.

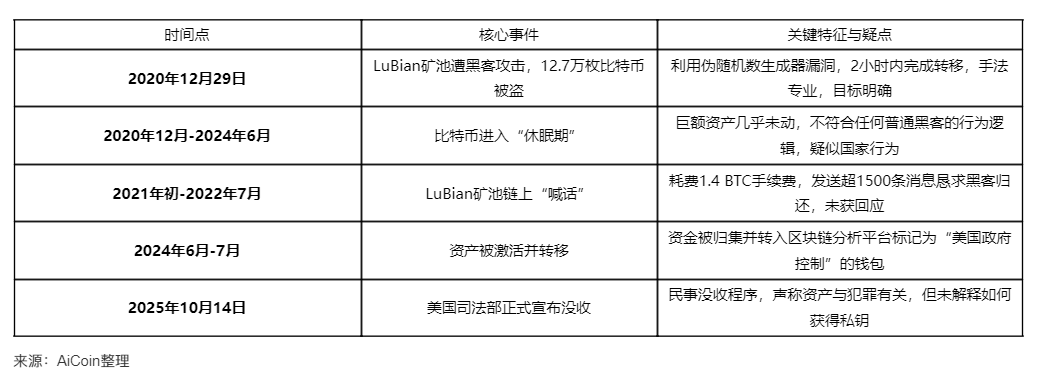

The table below clearly reveals that this operation was not a coincidence but a tightly interlinked precise layout:

Interpretation and Doubts:

● "Sleeping" Illicit Funds: No hacker can resist cashing out such a huge sum. The nearly four-year "dormancy" only indicates one thing: the attackers aimed for long-term control of the assets, rather than short-term profit, reflecting a state-level strategic patience.

● Perfect "Buy Low, Announce High": The U.S. government completed substantial control when the price of bitcoin was about $48,000 in 2024, but only announced the seizure after the price soared to $118,000 in 2025. This was not a spur-of-the-moment law enforcement action but a precise wealth harvesting, perfectly capturing the massive premium in the bitcoin cycle.

II. The Myth of "Decentralization" Crumbles Before State Violence

The report reveals even more shocking technical details: how the so-called "digital fortress" was shattered from within.

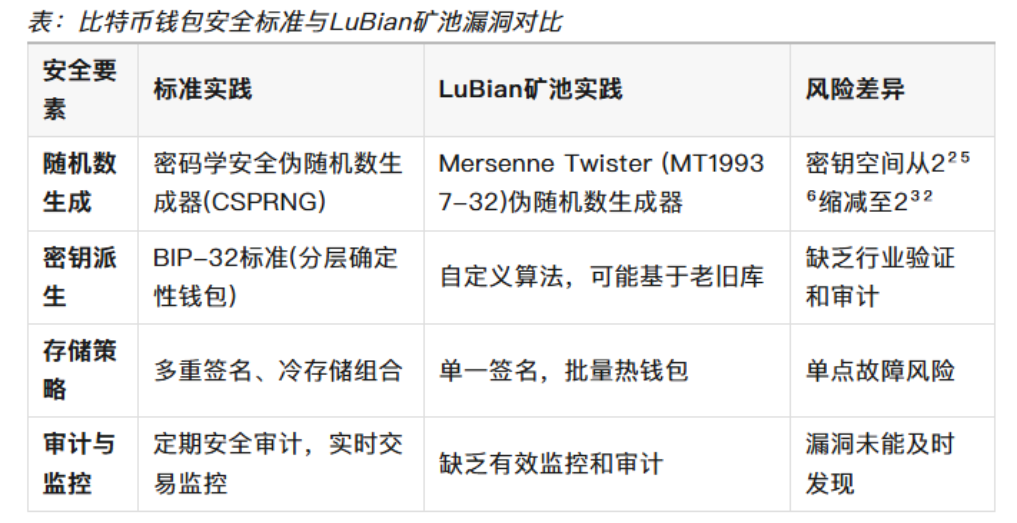

● Fatal Flaw: Pseudo-Random Number Generator (PRNG)

○ Theoretical Security: A standard bitcoin private key is a 256-bit binary number, with 2²⁵⁶ possibilities (about 1.16×10⁷⁷), requiring more time than the age of the universe to brute-force crack with a supercomputer.

Source: Wall Street Journal, compiled by AiCoin

○ Reality Collapse: The LuBian mining pool used the Mersenne Twister (MT19937-32), an insecure pseudo-random number generator. Its effective entropy is only 32 bits, reducing the possible combinations of private keys from cosmic levels to about 4.29 billion (2³²).

○ Vulnerable: Exploiting this flaw, attackers could use a supercomputer for brute-force searching, potentially traversing all possible private keys in about 1.17 hours. This is akin to replacing a quantum password lock on a vault with a simple four-digit luggage lock.

Source: Wall Street Journal, compiled by AiCoin

● Betrayal of Transparency

The public ledger of blockchain, combined with the specific transaction patterns of the Prince Group, allowed U.S. investigators to easily lock onto and track targets using clustering algorithms. The openness of the code became a double-edged sword in the face of state-level analytical capabilities.

When the generation of private keys has flaws, and state power masters the technical vulnerabilities, transferring bitcoins becomes as simple as operating one's own bank account. The U.S. completed substantial control of the assets as early as 2024 through this technical means, with the so-called "seizure" merely a legal performance completed afterward.

III. The Duet of "Long-Arm Jurisdiction" and "Civil Forfeiture"

In this case, the U.S. Department of Justice performed a brilliant legal magic trick, successfully "cleaning" the assets of "black eating black."

● Unlimited Expansion of "Long-Arm Jurisdiction"

○ The main criminal acts and the nationality of the suspects are both in Cambodia. The U.S. forcibly claims jurisdiction based on its "minimum contacts principle" (such as possibly using U.S. technological infrastructure).

○ This is a typical "digital long-arm jurisdiction," placing its domestic laws above the judicial sovereignty of other countries, aiming to seize the rule-making power in the digital finance sector.

● Procedural Trap of "Civil Forfeiture"

○ The U.S. employs a civil forfeiture procedure, which centers on "in rem" actions rather than "in personam" actions. This means the government only needs to prove, by "preponderance of evidence" (more likely than not), that the assets are related to a crime, rather than proving the owner's guilt.

○ Burden of Proof Reversal: The asset owner (Chen Zhi) must provide evidence to prove the "legitimacy" of the assets, which is extremely difficult in practice. This is a "pre-judgment," "seize first, prove later" model that severely undermines procedural legitimacy.

● Strategic Intent of Asset Destination

○ According to U.S. law, seized criminal proceeds typically prioritize compensation for U.S. domestic victims. The victims in this case may be global, potentially preventing international victims from receiving fair compensation.

○ More notably, in March 2025, the Trump administration signed an executive order to establish a "Strategic Bitcoin Reserve." This means that the seized bitcoins may not be auctioned but rather directly incorporated into the U.S. treasury, becoming a national strategic asset. This raises ethical questions about whether the U.S. is using judicial actions to enrich national assets.

IV. Competing for the Pricing Power of "Digital Gold": The U.S. is Launching a "Digital 911"

The transfer of ownership of these $15 billion worth of bitcoins cannot simply be viewed as a law enforcement action. Behind it lies a deeper strategic intent:

● Nature of Hegemony, Plundering Wealth: Under the guise of "cracking down on telecom fraud," it effectively serves to "enrich the national treasury." The influx of this massive bitcoin will add a heavy "digital gold" weight to the U.S. national balance sheet, marking a key step in its "nationalization of digital assets" strategy.

● Rule-Making, Establishing Hegemony: Through this case, the U.S. is declaring to the world: in the battlefield of digital assets, code belongs to code, but hegemony ultimately belongs to hegemony. It attempts to inform the world who truly holds the ultimate interpretation and control over digital currencies.

● Ultimate Questioning of "Digital Gold" Status: Bitcoin is hailed as "digital gold" due to its scarcity and decentralization. However, when the most powerful state machinery is willing to systematically devour it using technical vulnerabilities and legal tools, we must ponder: does the ultimate premium of bitcoin come from code consensus or the potential backing of state violence in the future?

A Wake-Up Call for Global Holders of Digital Currency

From discovering the vulnerability in 2020 to completing the "legal" seizure in 2025, the U.S. has staged a perfect closed loop of "discovering vulnerabilities—technical control—waiting for appreciation—completing procedures" over five years. This is not only a tragedy for the Prince Group but also a deafening wake-up call for global digital currency holders.

When state hegemony extends its fangs, the paradise of "digital gold" is no longer peaceful. This 127,000 bitcoin conundrum is likely just the tip of the iceberg. It forces every market participant to re-examine: in the triangular relationship of technical security, legal boundaries, and state power, where exactly do our digital assets stand?

Join our community to discuss and become stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX Benefits Group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance Benefits Group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。