Source: The Token Dispatch

Author: Thejaswini M

Original Title: Decentralisation, But Make It BlackRock

Translation and Compilation: BitpushNews

Discussing blockchain tracks, proprietary control, and the $68 trillion infrastructure trick.

In every revolution, there comes a moment when you realize the rebels have won.

Not because they have overthrown the old system, but because they have become the new system.

Watching Larry Fink speak with the enthusiasm of a 2017 ICO founder about tokenization feels quite strange. This is the same guy who called Bitcoin a "money laundering index" back in 2017.

Now, he states on CNBC that cryptocurrency plays a "critical role" in diversifying investment portfolios and that "all financial assets will be tokenized."

What has changed?

I don’t think Fink has had some "Damascus moment," suddenly realizing the brilliance of Satoshi Nakamoto’s white paper.

I think he has realized something more practical: If you can’t beat them, then co-opt them.

And if you’re going to co-opt, you need to do it so thoroughly that in ten years, people won’t remember there was ever another option.

That is the true core of BlackRock’s tokenization plan. From a dystopian perspective, it’s quite "clever."

Alright, let me break it down, because BlackRock is very good at making this sound complex and visionary, while in reality, it’s quite straightforward.

BlackRock manages $13.5 trillion in assets. They have identified that by 2040, the world will need about $68 trillion in infrastructure investment—new power grids, data centers, bridges, ports, and all those boring but essential things that keep modern life running. Governments are out of money. Banks are constrained. So, where will the money come from?

The savings of ordinary people, your money, my money. That $25 trillion is sitting in U.S. bank accounts and money market funds, earning almost no interest.

The problem is, no one wants to lock their savings into illiquid infrastructure projects for 30 years. You need to access your money. Maybe not today, maybe not tomorrow, but you need to know you can get it when you need it. That’s precisely why your money is in a bank account in the first place.

BlackRock’s solution? Tokenization. They plan to put these infrastructure assets on the blockchain, break them into tiny pieces, and make them tradable 24/7. Suddenly, that 30-year bridge project doesn’t seem so daunting because, hey, you can sell your tokens anytime. It becomes liquid.

But… is it really?

This is where my philosophical thinking starts to kick in. What is liquidity, really?

If I own a house, it is illiquid. I can’t turn it into cash immediately. But if I own a share of a real estate investment trust that holds the house, that is liquid; I can sell those shares right away. The house itself hasn’t changed. It’s still a house. But somehow, the financial instrument representing it has become liquid.

Tokenization does the same thing, just to a greater extent. BlackRock wants to take a data center (illiquid) and then create tradable tokens representing ownership of that data center (liquidity). You can trade these tokens on the blockchain 24/7. Problem solved, right?

Not quite. Because the asset itself is still illiquid.

That data center still takes 20 years to generate returns. That bridge still takes 30 years to break even. What tokenization does is distribute that illiquidity among many people, each of whom feels they have liquidity because they can sell to the next person.

This isn’t inherently bad; financial markets have always done this. But let’s be honest about what’s happening. BlackRock isn’t solving the liquidity problem. They are solving a perception problem. They make illiquid assets feel liquid, which is actually more powerful than making them truly liquid because it means people will willingly put their money into these investments.

I can clearly see the "decentralized centralization."

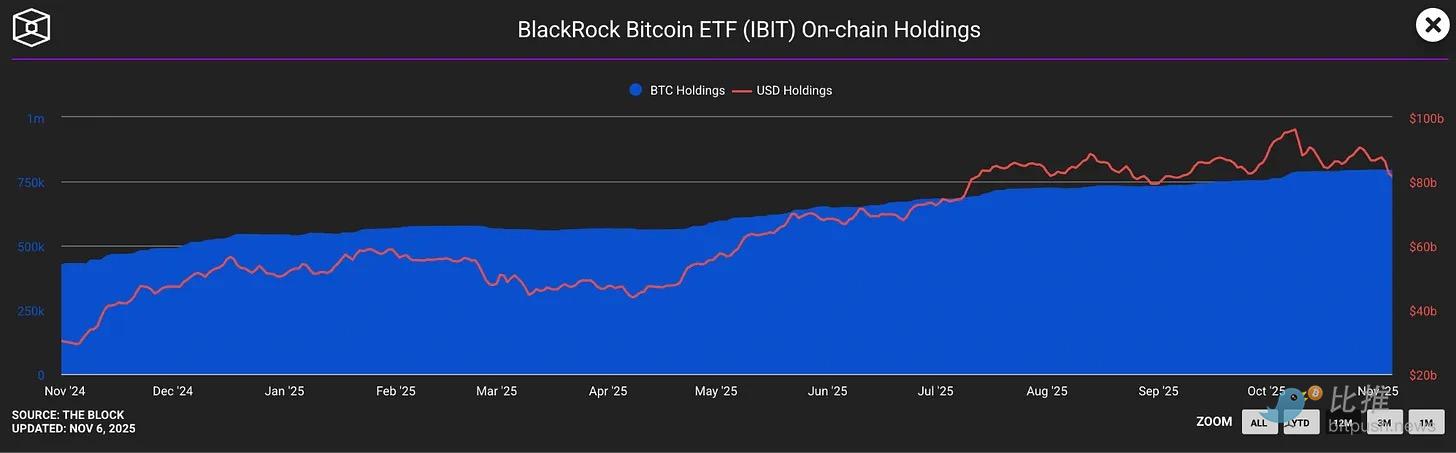

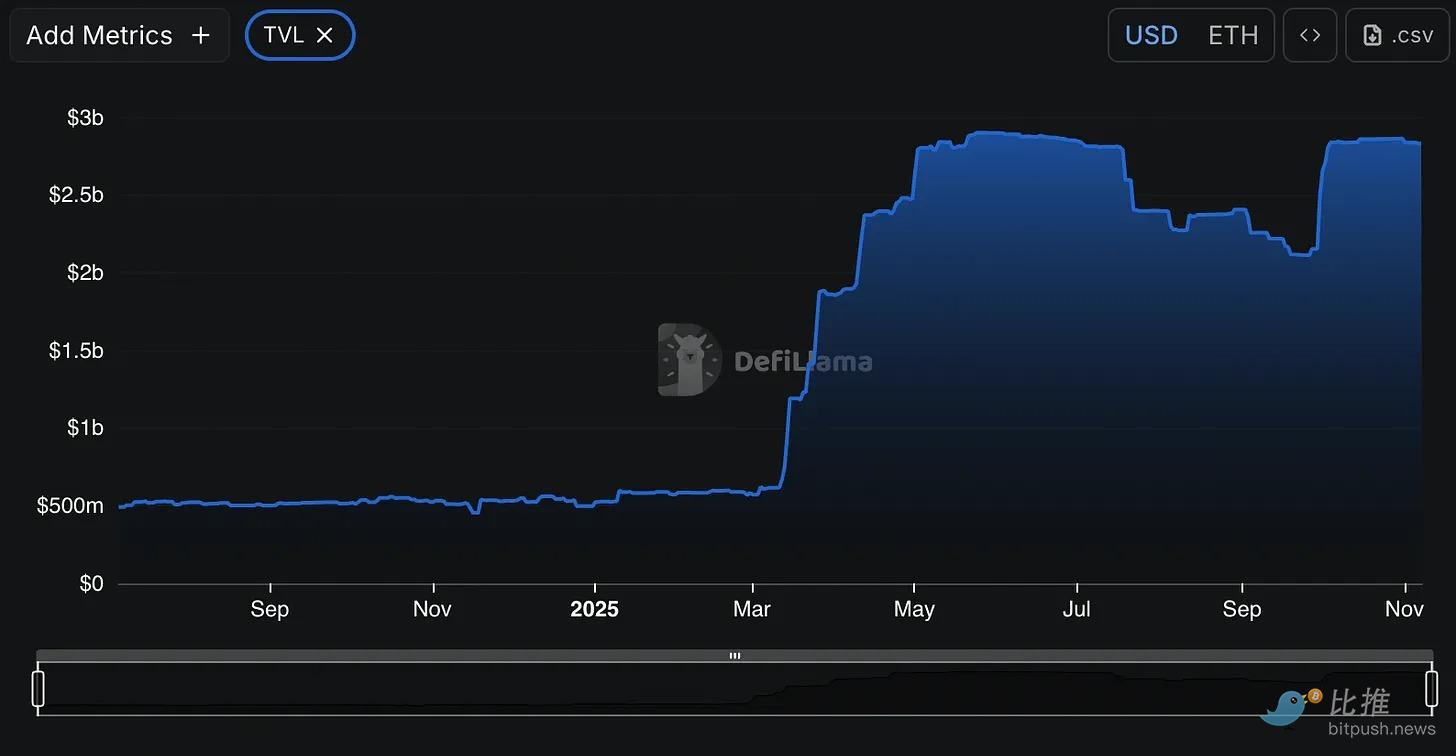

BlackRock doesn’t even hide this. They are explicitly building proprietary tokenization infrastructure. Not using Ethereum (too decentralized, uncontrollable). Not using public blockchains for critical parts (though they will use them when convenient, like tapping into DeFi liquidity with their BUIDL fund). They are joining private, permissioned blockchains with Goldman Sachs and BNY Mellon.

Let me repeat: Private. Permissioned. Blockchain.

Do you know what that is? That’s a database. A very fancy, expensive, cryptographically signed database, but it’s still a database controlled by BlackRock.

I’m not even angry about this. I’m actually a bit impressed. It takes real guts to look at a technology designed to eliminate you and then figure out how to use it to make yourself more indispensable. It’s like the record industry inventing Napster.

Let’s break down what BlackRock is building because the scope is indeed astonishing:

Platform: They are creating the infrastructure on which tokenized assets will exist. Not using someone else’s blockchain, but building their own track and integrating it with their Aladdin risk management system.

Compliance Layer: Their "sToken framework" embeds KYC/AML directly into smart contracts. Transfer limits, ownership rights, jurisdictional restrictions—all enforced by code. Their code.

Custody: They hold the actual assets. You own tokens representing those assets, but BlackRock owns the bridges, data centers, and real estate.

Distribution: Through their ETF platform, their institutional relationships, and their partnerships with firms like Securitize.

Pricing: Because they control issuance and have access to data (thanks to the acquisition of Preqin), they effectively control the price discovery of these tokenized assets.

So… which part of this is decentralized? The blockchain? Great. The technology is decentralized, but the power is completely centralized.

Here’s an interesting detail: Vanguard—whose executives have publicly stated that Bitcoin "has no intrinsic economic value"—is now the largest shareholder of MicroStrategy, a company whose sole purpose is to hold Bitcoin.

How did that happen? Through index funds. Vanguard is required to buy anything included in the index, even if they think it’s a bad idea.

Now, imagine if BlackRock successfully tokenizes everything. Tokenized ETFs are added to the index. About 40% of the U.S. stock market index funds are forced to buy them. Trillions of dollars in passive capital will automatically flow into BlackRock’s ecosystem, regardless of whether it makes sense.

That’s the real genius of it. BlackRock isn’t trying to convince everyone that tokenization is good. They are trying to make it inevitable. Once it enters the index, the money will flow automatically.

The $68 Trillion Trick

Back to that infrastructure funding gap—$68 trillion. A huge number. Where will the money come from?

BlackRock’s pitch is essentially: "We will tokenize these infrastructure assets, allowing ordinary investors to access them by fragmenting ownership, democratizing investments that were previously exclusive to a few."

This sounds great. But notice what has happened: your liquid savings (in a bank account, available when needed) are now funding an illiquid infrastructure project (locked up for decades). Tokenization creates the illusion of liquidity, allowing you to feel comfortable doing so.

Your capital has now become illiquid. You just don’t feel it because you can trade your tokens.

Again, this isn’t necessarily evil. Infrastructure needs funding. Your savings need returns. But let’s not pretend this is purely about innovation. This is about finding a socially acceptable way to shift retail savings from safe, liquid instruments to risky, illiquid ones. Tokenization is just the "psychological packaging" that makes this acceptable.

So, what exactly is happening?

I’ve pondered this question late into the night, and here’s what keeps coming to mind:

BlackRock has a problem: a massive infrastructure funding gap, and the only realistic source of capital is retail savings, but people are unwilling to lock their money up for 30 years.

They have a solution: tokenization creates the illusion of liquidity, making people more comfortable putting their savings into illiquid assets.

They have an opportunity: by building proprietary infrastructure, they can control the entire ecosystem—issuance, compliance, custody, distribution, pricing—while using "democratization" language to make it sound like they are helping you.

But this could really succeed. Not because it’s the best solution, but because BlackRock is so large that they can make it the only solution. Once tokenized products enter major indices, capital will flow in automatically. Once capital flows in, the ecosystem is established. Once the ecosystem exists, alternatives become obsolete.

I’m not saying that tokenization itself is bad. I’m not even sure if it is. Financial innovation often creates winners and losers, and the losers are usually those who only realize what’s happening when it’s too late.

However, what troubles me is the language being used here: "democratization"; "completing the work that began 400 years ago"; "bringing finance to the people."

BlackRock is not bringing finance to the people.

They are bringing the people’s money to infrastructure projects that need funding.

That’s not the same thing.

To me, true democratization is about autonomy. It’s the difference between being invited to the table and actually having a voice at the table.

When your retirement savings automatically flow into an index you never chose because of tokenized infrastructure, that’s not participation. That’s just a more complex way of being told how to handle your money.

Democracy requires the ability to say "no." And BlackRock’s system is built on the assumption that you won’t say "no."

Maybe that’s okay. Maybe we do need a more efficient way to finance infrastructure. Maybe tokenization is true innovation. Maybe I’ve just become cynical from witnessing financial innovation consistently benefit innovators more than participants.

But when the world’s largest asset management company tells me they will use their centralized, proprietary technology that controls every layer to "democratize" finance… buddy, I don’t know, but that doesn’t sound like democracy to me.

It sounds like something else. Some impressive, possibly inevitable, even necessary thing.

But not democracy.

That’s everything about "BlackRock-style" tokenization.

Examine everything, especially the details.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。