The stablecoin arena was anything but quiet this week, with Stream Finance’s XUSD and Stable Labs’ USDX both ditching their dollar pegs in dramatic fashion. It was a tale of triumphs and faceplants — and those two tokens nailed the latter.

Meanwhile, defillama.com stablecoin figures show Ethena’s USDe took the steepest reduction dive, sliding 7.91% over the week and hanging onto its $8.62 billion market cap like a parachute that didn’t quite deploy.

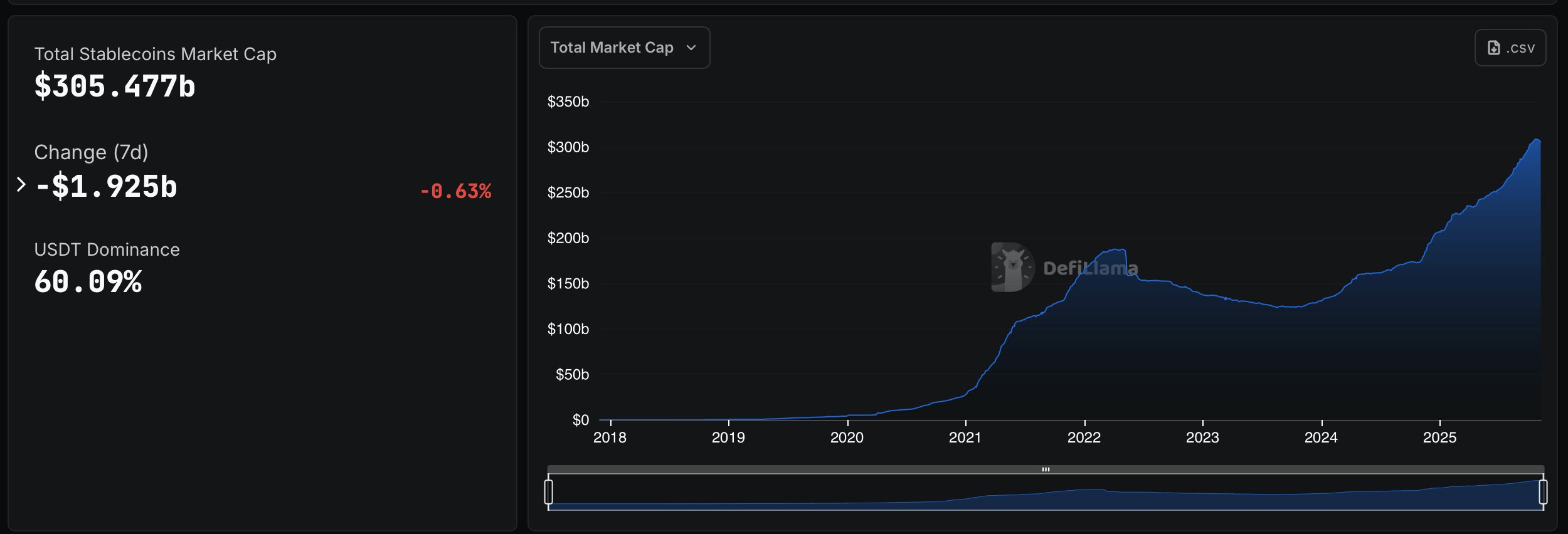

Stablecoin metrics on Nov. 8, 2025, via Defillama.

Sky’s DAI wasn’t far behind, gliding down 4.28% to a still-proud $4.88 billion. World Liberty Financial’s USD1, despite all its star-spangled swagger, slipped 3.53% to $2.88 billion. Even Paypal’s PYUSD and Falcon’s USDf caught the downdraft, easing 0.42% and 0.53% to $2.80 billion and $1.99 billion — modest dips, but dips nonetheless.

Defillama.com metrics show that even Blackrock’s mighty BUIDL saw a modest 0.23% decline, while Circle’s USDC slipped just 0.14%—a tiny wobble for a $75.39 billion giant and the second largest stablecoin by market cap. On the greener side of the ledger, Ethena’s USDtb eked out a small 0.10% rise to $1.83 billion, while Tether’s USDT, the industry heavyweight, nudged up 0.09% to maintain its colossal $183.55 billion lead.

Tether’s dominance still towers over the stablecoin scene, commanding 60.09% of the $305.477 billion market total as of 8 a.m. Eastern on Nov. 8. The week’s real attention-grabbers, though, were Sky’s USDS and Ripple’s RLUSD, which popped 11.34% and 9.04%, proving that even mid-tier stablecoins can put on a show when the spotlight hits.

Rounding things out, Global Dollar (USDG) posted a polite 0.53% uptick to $996.6 million — barely breaking a sweat, but quietly proud to stay in the green. The stablecoin market’s mix of dips and small victories proves there’s never a dull week in dollar-pegged drama — especially when two tokens slip their pegs. At press time on Saturday, USDX is below ten cents per unit, and XUSD is around 11 cents per coin.

- What caused the stablecoin market to drop this week?

A mix of depegged tokens and capital outflows shaved about $1.9 billion off the global stablecoin market. - Which stablecoins lost their dollar peg?

Stream Finance’s XUSD and Stable Labs’ USDX both slipped from their $1 targets during the week. - Which stablecoin saw the largest decline?

Ethena’s USDe took the steepest fall, dropping 7.91% to a market cap of $8.62 billion. - Who leads the global stablecoin market?

Tether continues to dominate with 60.09% of the $305.477 billion total market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。