Stream collapses, affecting multiple platforms.

Author: thedefinvestor

Translation: Baihua Blockchain

Last week was a terrible week for DeFi.

Not just because of the market crash. Last week:

Balancer, a top DeFi protocol, was exploited, resulting in a loss of $128 million

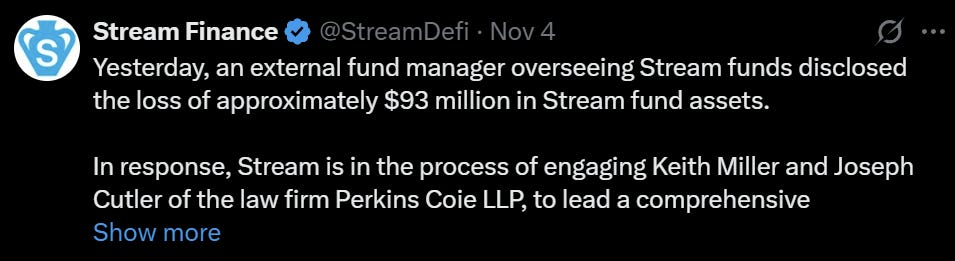

Stream Finance, a protocol primarily generating yield through stablecoins, announced a loss of user assets worth $93 million and is preparing to declare bankruptcy

Moonwell lost $1 million in an attack

The Pod LP TVL (Total Value Locked) of Peapods dropped from $32 million to $0 due to liquidation

So far, the most devastating loss is that of Stream Finance.

Because it not only affected its depositors but also impacted some of the largest lending protocols in the space (including Morpho, Silo, and Euler) that used stablecoins.

In short, here's what happened:

CBB, a well-known figure on CT (Crypto Twitter), began advising people to withdraw from Stream due to its lack of transparency

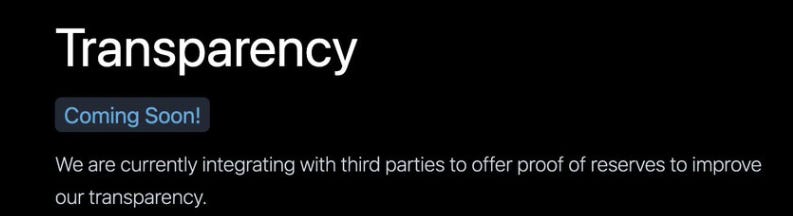

Stream was reportedly running a "market-neutral strategy" in DeFi but failed to monitor its positions, and its transparency page had been "coming soon."

This triggered a bank run, with a large number of users attempting to withdraw funds simultaneously

Stream Finance halted withdrawal processing because it had secretly lost a significant amount of user funds ($92 million) shortly before and could not handle all withdrawal requests

This led to the collapse of its xUSD (Stream's interest-bearing "stablecoin") price

This already sounds bad, but the story isn't over.

A huge problem is that xUSD is listed as collateral on money markets like Euler, Morpho, and Silo.

Worse, Stream had been using its so-called stablecoin xUSD as collateral to borrow funds through money markets to execute its yield strategy.

Now that the xUSD price has collapsed, many lenders who lent USDC/USDT to xUSD borrowers on Euler, Morpho, and Silo can no longer withdraw their funds.

According to the DeFi user alliance YAM, at least $284 million in DeFi debt across major money markets is tied to Stream Finance!

Unfortunately, a large portion of this money may never be recovered.

As a result, many stablecoin lenders have suffered heavy losses.

What Can We Learn From This?

Over the past 2-3 years, I have personally been deeply involved in farming DeFi protocols.

But after the recent events, I plan to reassess my DeFi portfolio positions and become more risk-averse.

The profits from yield farming can be very high. I have made some substantial gains from it over the past few years, but such events can lead to significant losses.

I have a few suggestions:

Always verify the exact source of yields

Stream is not the only DeFi protocol claiming to generate yields through a "market-neutral strategy." Be sure to look for transparency dashboards or proof of reserves reports where you can clearly see that the team is not gambling with your assets.

Don't blindly trust a protocol just because its team seems reputable.

Consider whether the risk-reward ratio is good enough

Some stablecoin protocols offer annual percentage rates (APR) of 5-7%. Others may offer over 10%. My advice is not to blindly deposit funds into the protocol offering the highest yields without doing proper research.

If its strategy is opaque, or if the yield generation process seems too risky, then risking your funds for a double-digit annual return is not worth it.

Alternatively, if the yields are too low (e.g., 4-5% APR), ask yourself if it's worth it.

No smart contract is risk-free, and we have even seen established applications like Balancer being attacked. Is it worth risking for a low annual yield (APY)?

Don't put all your eggs in one basket

As a general rule, I never deposit more than 10% of my portfolio into a single dApp.

No matter how enticing its yields or airdrop opportunities may seem. This way, if a hack occurs, the impact on my financial situation will be limited.

In summary, when building your portfolio, prioritize survival over making money.

It's better to be safe than to regret it.

Article link: https://www.hellobtc.com/kp/du/11/6107.html

Source: https://www.thedefinvestor.com/p/wtf-just-happened-in-defi?hideintropopup=true

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。