Written by: Eric, Foresight News

Starting from November 1, the long-silent Internet Computer (IC) token ICP has initiated a round of price increases. According to Bitget data, the ICP price surged from around $2.94 to a peak of approximately $8.6, nearly doubling in value over the course of seven days.

With the rise of ICP, a wave of small gains has also emerged among various Web3 storage infrastructure projects, with FIL, AR, STORJ, and others recording significant increases since yesterday.

For "legacy" tokens like ICP and FIL, any sudden price increase is often viewed as a last-ditch liquidity withdrawal by major funds before exiting. However, this time, the rise led by ICP is not entirely "without warning."

Internet Computer Rides the AI Wave

The core reason for ICP's recent surge likely lies in the Web3 AI payment narrative driven by x402. After numerous explorations, the market has discovered that utilizing blockchain infrastructure and stablecoins in the AI payment sector is a significantly better solution than current payment options, and it seems to be the only superior alternative. Thus, the market's logic for identifying targets has become "who is more Web3?"

As various chains seek solutions that support x402 and gasless payments, the IC, which is better suited for these needs in its underlying design but has been largely forgotten, has become the "chosen one."

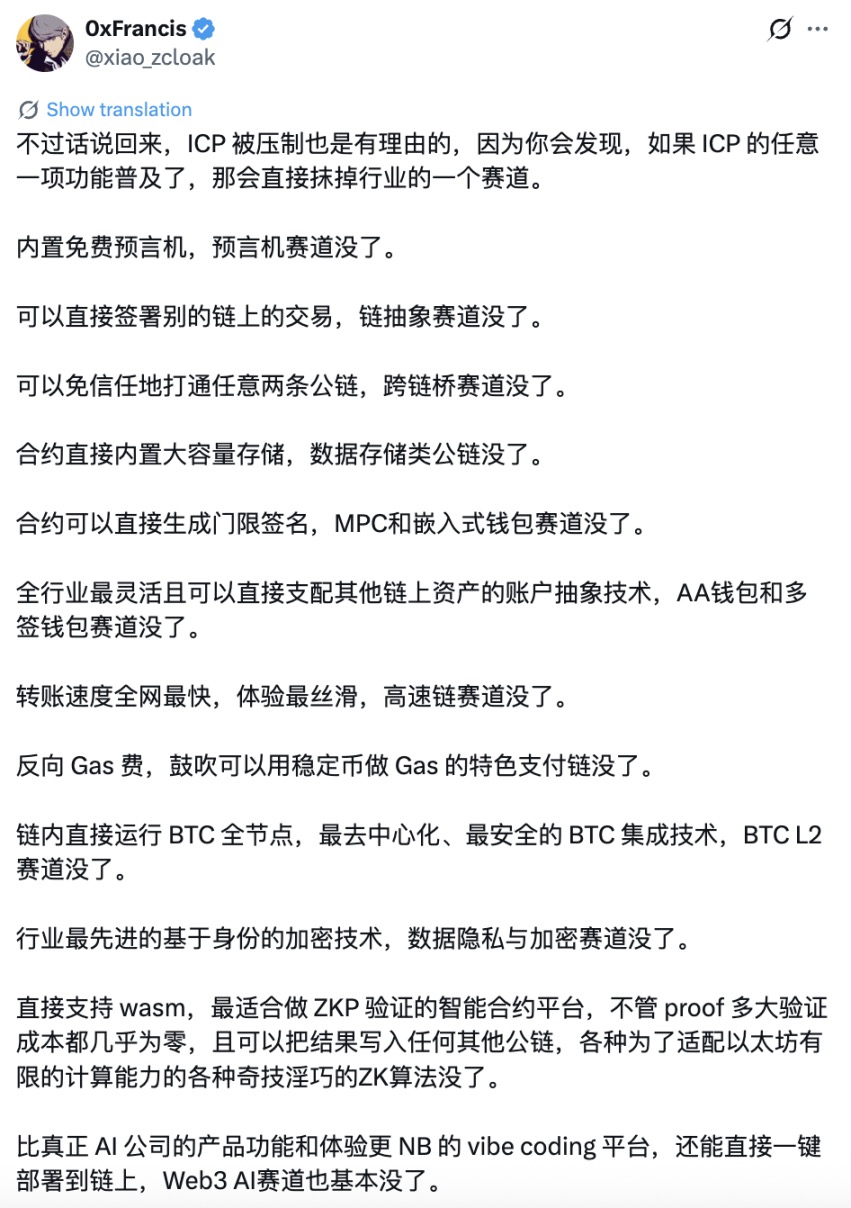

In 2021, IC was considered a project that was "too advanced." Strictly speaking, IC is not a pure blockchain; its architecture resembles a "new decentralized internet" that borrows from blockchain data structures and can even serve as a lower infrastructure layer for blockchains. As the founder of zCloak Network stated, IC essentially encompasses all so-called tracks currently on-chain at its foundational level: "Ethereum and other public chains are ledgers, while ICP is the real world computer."

However, what may have truly ignited the sentiment is not just that IC is the best infrastructure for Web3+AI, but also IC's latest flagship product, caffeine, which allows users to generate DApps directly through chatting with AI without any development operations, and then automatically launch them on IC.

X user Haotian's comments yesterday afternoon on how caffeine could bring more changes to AI payments further fueled the sentiment in the Chinese market.

Of course, as Haotian also mentioned, there is still some distance to go before everything is truly implemented. However, after x402 and AI have already been speculated upon, the relatively low-priced but more imaginative IC naturally becomes a hotspot for capital.

The Storage Protocols Working Quietly

The collective rise of storage protocol tokens may be overly attributed to the recent brief outage of AWS. I believe this is more about the market's confidence in Web3 native infrastructure spilling over from IC to other areas, with storage being the most easily thought-of and relatively high-quality track.

Setting aside emotions, although most token prices have been quite dismal, storage protocols have been quietly working hard.

Firstly, as a typical case of "peaking at the start," Filecoin has made several noteworthy advancements over the past year. In the fourth quarter of last year, the storage utilization rate of the Filecoin network increased from 18% to 30%. With its low-cost advantages, Filecoin's continuous improvement in usability has led many enterprises to start adopting its services.

Additionally, this year, new proof primitives for hot data (i.e., data that needs to be retrieved quickly and frequently) such as PDP (Proof of Data Possession), F3 (Filecoin Fast Finality) which shortens transaction finality from hours to seconds, the launch of EVM-compatible FVM, and the ongoing development of FWS (Filecoin Web Services) aimed at competing with traditional cloud services have all contributed to Filecoin achieving more real-world usage.

Arweave's Permaweb 2.0, launched at the end of last year, stores hot data on the mainnet and cold data in "Arweave-Lake," reducing storage costs by 38%. This year, Arweave has expanded beyond storage to launch the computing network AO, allowing it to handle not just storage but also complex computing needs, such as investment strategies. This aligns perfectly with Web3+AI.

The zkIPFS launched two months ago has turned Arweave nodes into "permanent IPFS with ZKP," allowing Solidity contracts to directly read off-chain metadata via zkCID, achieving trustless interoperability between EVM and Arweave. Overall, Arweave has opened up two new growth curves in high-concurrency computing and Ethereum interoperability while optimizing storage costs.

StorJ itself has not been closely related to blockchain, but it has been tirelessly promoting adoption. Last year, StorJ acquired Valdi.ai, a company focused on GPU computing, and PetaGene, which develops file management systems, to support AI training. This year, StorJ promoted Colby Winegar, who joined in 2022, to CEO in the first half of the year, further advancing its growth strategy. Additionally, StorJ optimized its token economic model this year, introducing buybacks and staking.

When Blockchain is Set to Change the World Again…

It must be acknowledged that the significant rise in tokens, including privacy coins, at this time inevitably reminds us of the fear dominated by the "Doomsday Chariot." Unlike in the past, this time the chariots are supported by several logically coherent narratives, and unlike before, the reasons for the rise are no longer just the "progress that won't attract mining if the token price doesn't rise" of the projects themselves, but rather that solid funds chasing hot topics have found new targets.

However, the necessary risk warnings cannot be overlooked. The biggest risk here is that we have once again arrived at a point where we believe blockchain can replace certain things. In the past, every time the market generated this self-assured yet dangerous notion, it marked the peak of emotions. This time, while we view it through a lens of rationality, there are indeed some differences from before, but I believe these differences are still not strong enough to "replace" anything, so we must remain cautious of the risk of emotional overload.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。