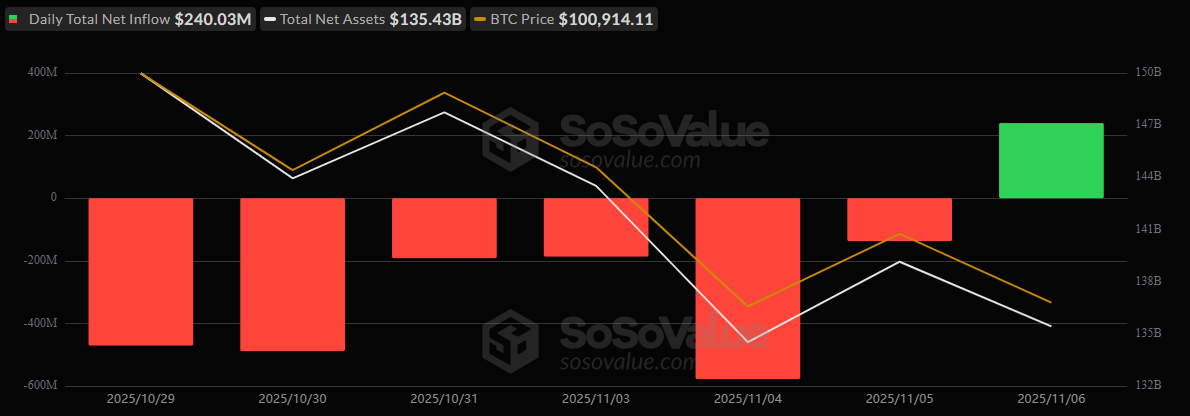

The streak finally snapped. After six straight days of bleeding red, U.S. spot bitcoin ETFs roared back with a wave of fresh inflows that signaled renewed investor appetite across the board. Ether funds followed suit, closing modestly in the green, while solana’s steady climb showed no signs of slowing.

Bitcoin ETFs reclaimed momentum with inflows totaling $240.02 million, marking their first net gain in a week. Blackrock’s IBIT was once again the day’s anchor, pulling in $112.44 million, while Fidelity’s FBTC added $61.64 million. Ark & 21Shares’ ARKB closely followed with $60.44 million, and Bitwise’s BITB contributed another $5.50 million. The buying surge helped bitcoin ETFs stabilize after nearly a billion dollars in cumulative outflows earlier in the week. Trading volume held strong at $4.77 billion, and net assets steadied at $135.43 billion.

Six-day outflow streak ends for bitcoin ETFs. Source: Sosovalue

Ether ETFs also found their footing, ending the day with $12.51 million in net inflows. Blackrock’s ETHA led with $8.01 million, followed by Fidelity’s FETH at $4.95 million and Bitwise’s ETHW at $3.08 million. While Grayscale’s ETHE recorded a minor $3.53 million outflow, it wasn’t enough to offset the broader rebound. Total trading value reached $1.62 billion, with net assets climbing to $21.75 billion.

Meanwhile, solana ETFs extended their unbroken winning streak. Bitwise’s BSOL drew in $29.22 million, pushing total net assets up to $538.38 million on $27.95 million in trading volume.

After days of relentless outflows, Thursday’s inflows marked a psychological win for crypto ETF investors. Bitcoin led the way, ether followed with quiet strength, and solana continued to prove it’s more than just a supporting act.

FAQ🌍

- What happened with Crypto ETF flows on Thursday?

Bitcoin and ether ETFs snapped their six-day outflow streak, bringing in $240 million and $13 million in inflows. - Which Bitcoin ETF led the rebound?

Blackrock’s IBIT topped the list with $112 million in new investor inflows. - How did Solana ETFs perform?

Solana ETFs extended their winning streak with $29 million in fresh capital. - What does this mean for the crypto market?

The return of inflows signals renewed investor confidence after a week of heavy redemptions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。