This article is merely a personal market opinion and does not constitute investment advice. Any trading based on this is at your own risk.

Looking back at the article from November 3rd, the afternoon post included a risk warning, and that evening the market broke down directly, heading below 100,000. The article mentioned that the pricing power of BTC is gradually shifting overseas and is becoming increasingly sensitive to macro data and geopolitical events. For the foreseeable future, BTC will still experience short-term fluctuations around external events. With the narrative of BTC as digital gold and a safe-haven asset collapsing, BTC is now purely a risk asset, extremely sensitive to liquidity. This is because liquidity can affect risk appetite; whenever there are expectations of tightening liquidity, risk asset prices fall, and vice versa.

Since Powell's speech, the expectations for a rate cut in December have significantly decreased, which is the source of the recent decline. Powell stated that more data is needed; however, the U.S. government has yet to reopen, and the Labor Department cannot release data. Without data, there can be no stable expectations for rate cuts, creating a vicious cycle.

Therefore, the key to breaking this cycle lies in when the U.S. government will reopen. The combination of the government reopening and rising unemployment data will significantly increase expectations for rate cuts, likely leading to a rebound in the market. Specifically, there may be a rebound upon reopening, followed by another rebound if the unemployment data is not ideal.

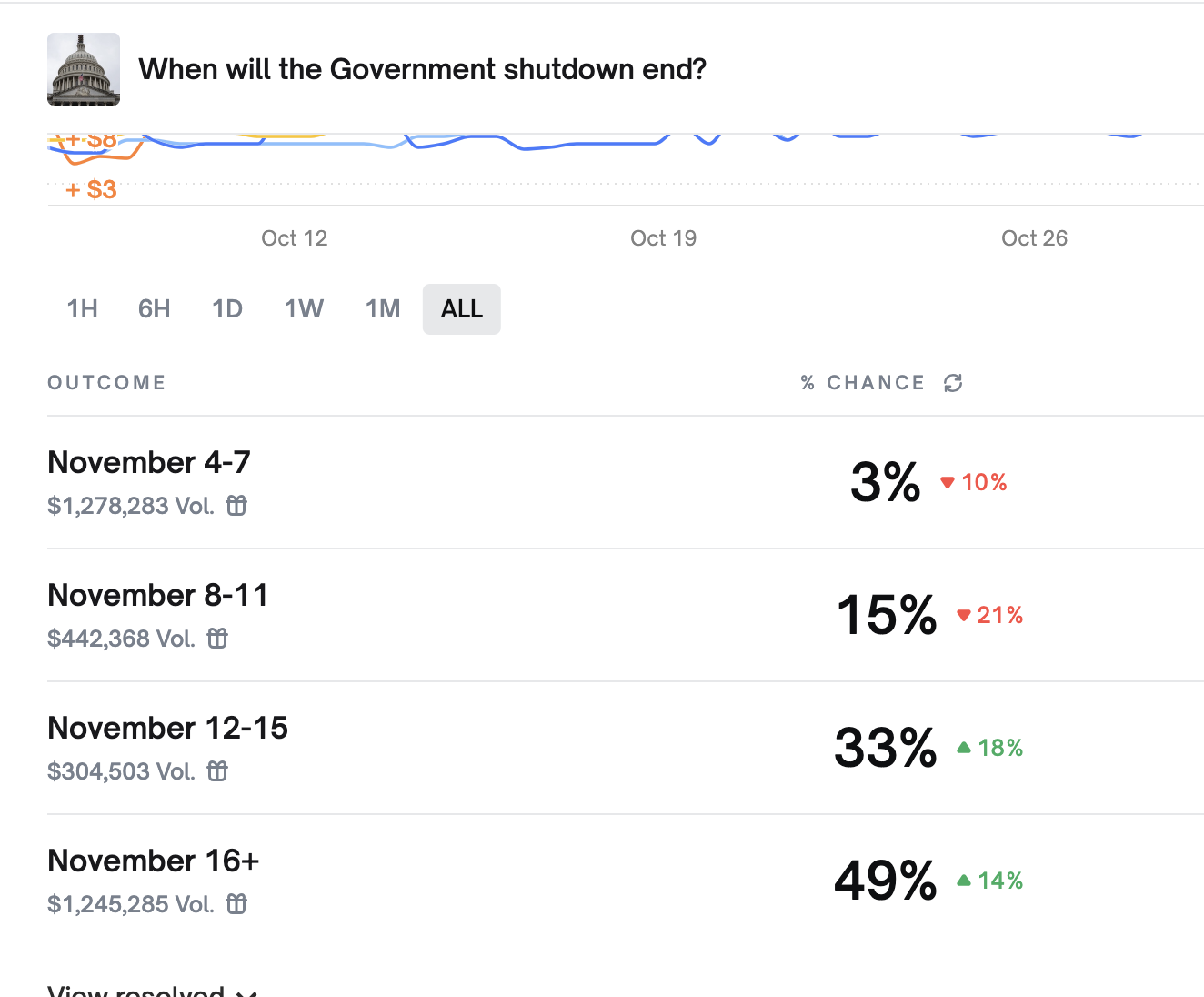

The following chart shows Polymarket's betting on when the U.S. government will reopen this month. From the chart, it can be seen that the market initially had some expectations for a rate cut to be completed this week, but today that probability has dropped significantly to 15%, essentially indicating that reopening this week is unlikely.

Combining the trends in the cryptocurrency market with predictions about the government's reopening and future Labor Department data, we can make certain projections to assist in trading decisions.

In the article on the 3rd, we mentioned that BTC formed a rectangular oscillation area between October 12 and November 3. According to technical analysis, the corresponding target pullback position is around 98,000, and this pullback has nearly reached its target. The current price is supported near the lows of May and June, initiating a short-term rebound. The chart also shows an orange line outlining a daily head and shoulders pattern, which has now broken below the neckline. Based on technical analysis and fundamental conditions, my views are as follows:

In the short term, without new external disturbances, I believe BTC will oscillate between 98,000 and 105,000 (the purple box in the chart), digesting time and forming a new oscillation range.

If good news comes soon—such as the government reopening next week and subsequent employment data being poor, leading to increased expectations for a December rate cut—then this decline will stop here and initiate a rebound, targeting first 110,000 (200-day line), then 115,000—the previous resistance level. A new high is unlikely for now.

If, unfortunately, the government remains closed and expectations for rate cuts further decline, the market may choose the worst trajectory, breaking below 96,000 and heading towards around 85,000 (the target position corresponding to the head and shoulders pattern).

This is the current market situation; liquidity expectations dominate risk appetite. For an investment like BTC, which is currently supported purely by capital, it can only rely on expectations of rate cuts or liquidity injections to support its price movement. If conditions are not ideal, it can drop significantly in an instant.

ETH is similar; it has also formed a head and shoulders pattern on the daily chart. As for how it will ultimately move, it will certainly follow BTC, with the same judgment criteria as above.

Follow me to maximize trend profits with minimal operations.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。