Global markets remain buoyant, yet crypto can’t seem to catch a break. Even with a supportive macro backdrop with rate cuts, the end of quantitative tightening (QT), and strong equity performance, digital assets are lagging.

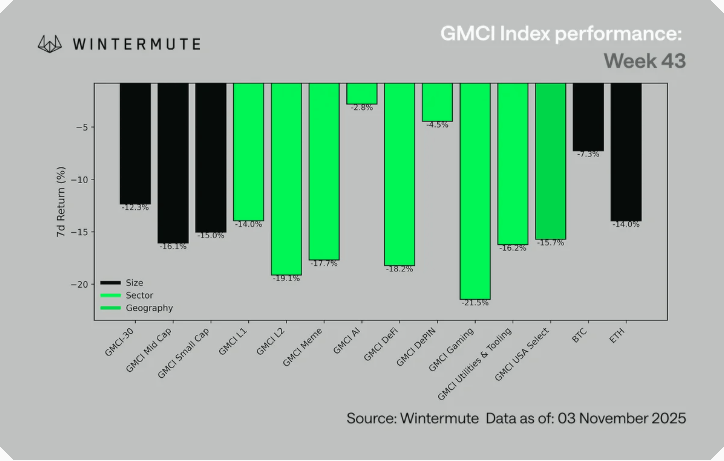

According to Wintermute’s report, the Federal Reserve’s 25bp cut last week came as expected, but Fed Chair Powell’s pushback against another December cut cooled risk appetite. Equities quickly recovered, but crypto didn’t, with bitcoin and ether remaining range-bound. The GMCI-30 index dropped 12% on the week, with steep losses across Gaming (-21%), L2s (-19%), and Memecoins (-18%). Only AI and DePIN tokens showed modest resilience.

The problem isn’t a lack of liquidity; it’s where the liquidity is going. Global money supply is expanding, but flows into crypto have dried up. ETF inflows have stalled at around $150 billion, and Digital Asset Treasury (DAT) activity has gone quiet, with volumes on major exchanges collapsing. Meanwhile, stablecoin supply continues to grow (+50% year-to-date), but it’s now the only functioning inflow engine.

Wintermute says it’s a distribution issue, not a macro one. Until ETF demand revives or new catalysts redirect capital on-chain, digital assets will likely keep trailing equities despite the favorable backdrop.

The market backdrop is still strong, as is evidenced by the equity market performance. Liquidity is just not reaching crypto yet.

For now, crypto’s structure looks solid: leverage is flushed, volatility is contained, and fundamentals remain intact. But without renewed flows, the sector may stay stuck in consolidation until liquidity finally returns its way.

FAQ 💸

- Why is crypto underperforming despite a strong macro environment?

Even with rate cuts and rising equities, liquidity isn’t reaching crypto, leaving digital assets range-bound. - Where is the global liquidity going instead of crypto?

Liquidity is flowing into equities and traditional markets, while ETF inflows and on-chain activity have stalled. - What’s causing the slowdown in crypto inflows?

ETF demand has plateaued at around $150 billion, and Digital Asset Treasury (DAT) volumes have dropped sharply. - What needs to change for crypto to recover?

Renewed ETF interest or new on-chain catalysts must redirect capital toward digital assets to spark momentum.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。