On November 4th, two highly watched whales in the market—“1011 Insider Whale” and “100% Win Rate Whale”—unexpectedly chose to go long on BTC on the same day, immediately drawing close attention from the entire crypto community.

The “1011 Insider Whale,” which accurately predicted the market crash on October 11th and made nearly $200 million in profit, has turned bullish for the first time after more than a month of silence. Meanwhile, the “100% Win Rate Whale,” which has incurred nearly $40 million in losses over the past week, still holds onto a remaining long position valued at $148 million after cutting losses on a $258 million long position.

What do the synchronized actions of these two legendary traders signify? Are they heralding the market's bottom, or are they a precursor to another storm?

1. Full Disclosure of Whale Operations Today

● According to on-chain analyst Ai Yi's monitoring, on November 4th, the 1011 Insider Whale deposited $20 million USDC into Hyperliquid as margin, opening 3x leveraged long positions in BTC and ETH. This marks the whale's first shift to a bullish strategy since profiting from the “1011 crash.”

● Specifically, its positions include: 350 BTC (valued at $37.29 million, opening price $106,002.1) and 5,000 ETH (valued at $17.98 million, opening price $3,575.23). As of the time of writing, these positions have realized a floating profit of $256,000.

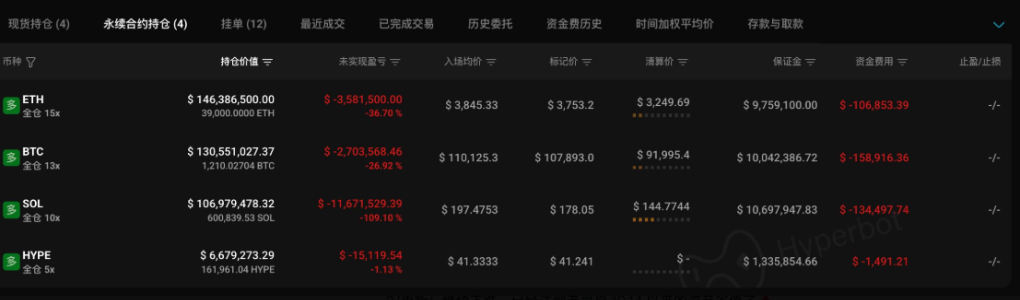

● Meanwhile, the “100% Win Rate Whale” closed out $258 million worth of long positions in BTC, ETH, and SOL eight hours ago after experiencing a week of significant floating losses, with an actual loss of $15.65 million. However, this whale still holds long positions in ETH, SOL, and HYPE valued at $148 million, currently facing a floating loss of $18.86 million, with only 8% remaining before liquidation.

● Although both whales are going long, their situations are starkly different. One is cautiously testing the waters with a small profit; the other is fighting a desperate battle, facing liquidation risk.

2. Market Impact and Chain Reactions

The synchronized actions of the whales have triggered multiple chain reactions in the market.

● In terms of price and trading, the 1011 Insider Whale's shift has provided short-term confidence support to the market. A follower stated, “The Insider Whale has always been accurate; his shift to long may indicate that the market has found a short-term bottom.” This sentiment is quite representative in the community.

However, danger also lurks. “The 100% Win Rate Whale's positions are only 8% away from liquidation, with the ETH liquidation price at $3,196 and SOL at $143.5. If these key price levels are breached, it could trigger a chain liquidation, accelerating the market's decline.” On-chain analyst Yu Jin warned.

● In terms of on-chain fundamentals, the frequency of whale operations has noticeably increased. From previously holding positions for weeks to now frequently adjusting within a day, this indicates a sharp rise in market uncertainty. Large funds are rapidly adjusting to cope with the heightened volatility.

● Regarding funds and liquidity, the activity of decentralized derivatives exchanges like Hyperliquid has significantly increased, indicating that the DeFi derivatives market can accommodate large trading demands. Meanwhile, the recent market downturn has led to a massive liquidation of long positions, with a total liquidation amount of $1.279 billion across the market in the past 24 hours; the decrease in leverage may create space for subsequent rebounds.

● In terms of industry and sentiment, security incidents such as the Balancer protocol suffering a hack with losses exceeding $100 million have somewhat offset the positive sentiment brought by the whales going long. The market is exhibiting a state of panic mixed with opportunity, with investor divergence becoming increasingly pronounced.

3. Review of Whale Operation History

To understand the significance of today's operations, we need to review the recent operational trajectories of the two whales over the past month.

● The 1011 Insider Whale earned its name from its precise operations on October 11th. Before the crash occurred, this whale opened short positions in BTC and ETH worth a total of $1.1 billion, subsequently making an estimated profit of $190 million to $200 million in a single day during the market plunge. On November 2nd, it transferred 1,200 BTC (valued at $132 million) to Kraken, completing its spot profit-taking.

● The 100% Win Rate Whale has experienced a rollercoaster ride from heaven to hell. This whale once achieved a remarkable record of 14 consecutive wins, earning $15.83 million. However, its fate reversed after shifting to long positions at the end of October.

From the table, it is clear that the 100% Win Rate Whale has nearly completely given back the approximately $15.83 million profit earned from 14 trades over the past 20 days, marking its biggest setback since its rise to fame.

4. Market Reaction and Investment Insights

The synchronized long positions of the whales have sparked intense discussions in the community. Several analysts point out that this phenomenon needs to be viewed rationally.

● Ai Yi analyzes, “The 1011 Insider Whale's shift to long positions is worth noting, but investors should be aware that this may be a tentative build-up rather than a full bullish outlook. The position size is relatively small compared to its total assets, indicating that the signal is more significant than the actual meaning.”

● In contrast, Yu Jin is more concerned about the other whale's situation: “The 100% Win Rate Whale has given back all previous profits and is now facing a floating loss on its principal, putting it in a dangerous position. Its positions are only 8% away from the liquidation line, and in the context of increasing market volatility, such high-leverage positions are extremely fragile.”

● The following behavior in the market also warrants reflection. Data shows that two addresses following these two whales have recently lost over $1.2 million, with one address incurring a loss of about $217,000 in just 4 hours. “There are no shortage of followers in the market, and as the market continues to decline, followers quickly learned their lesson.” Odaily Planet Daily described in its report.

From an investment perspective, investors should focus on the following points:

● First, whale operations are not always correct. The massive losses of the 100% Win Rate Whale are the best example. Even the top traders can misjudge at market turning points.

● Second, high leverage is a double-edged sword. The 100% Win Rate Whale's transition from a floating profit of $20 million to a loss of $15.65 million occurred in less than a week. High leverage amplifies profits while also accelerating losses.

● Finally, position management is crucial. The 1011 Insider Whale's ability to shift calmly is directly related to its prior profit-taking and maintaining ample ammunition. In contrast, the 100% Win Rate Whale fell into a passive position due to full exposure.

The synchronized long positions of the whales have brought a glimmer of hope to the crypto market, which has been declining for several days, but building a market bottom is not an overnight task. Although both whales are operating in the same direction, their position sizes, risk exposures, and situations are entirely different, reminding investors that in a market of increasing volatility, maintaining rationality and effective risk control is more important than chasing any whale.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。