CoinW Research Institute

Key Points

The total market capitalization of cryptocurrencies is $3.91 trillion, down from $3.97 trillion last week, representing a 1.5% decrease this week. As of the time of writing, the cumulative net inflow of the U.S. Bitcoin spot ETF is approximately $61.19 billion, with a net outflow of $607 million this week; the cumulative net inflow of the U.S. Ethereum spot ETF is approximately $14.37 billion, with a net inflow of $114 million this week.

The total market capitalization of stablecoins is $304.8 billion, with USDT's market cap at $183.5 billion, accounting for 60.2% of the total stablecoin market cap; followed by USDC with a market cap of $75.8 billion, accounting for 24.86%; and DAI with a market cap of $5.37 billion, accounting for 1.76%.

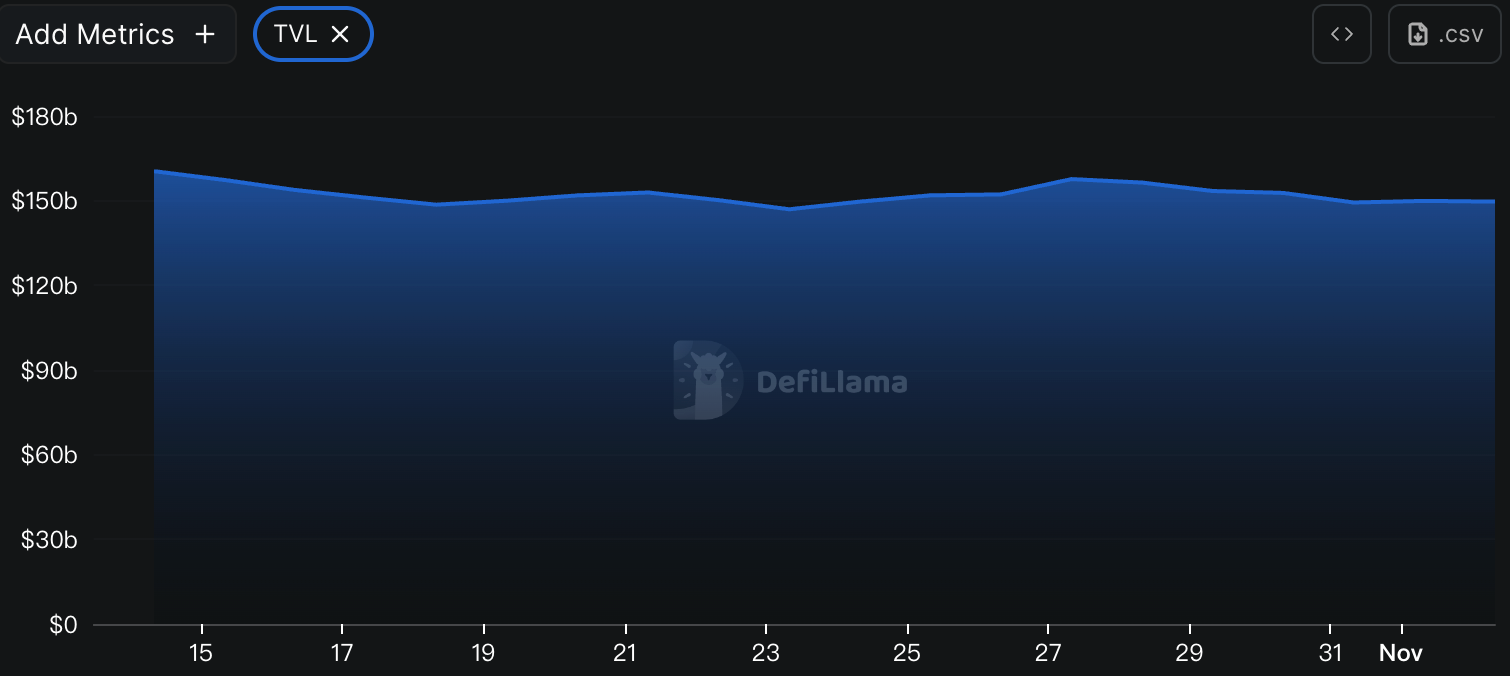

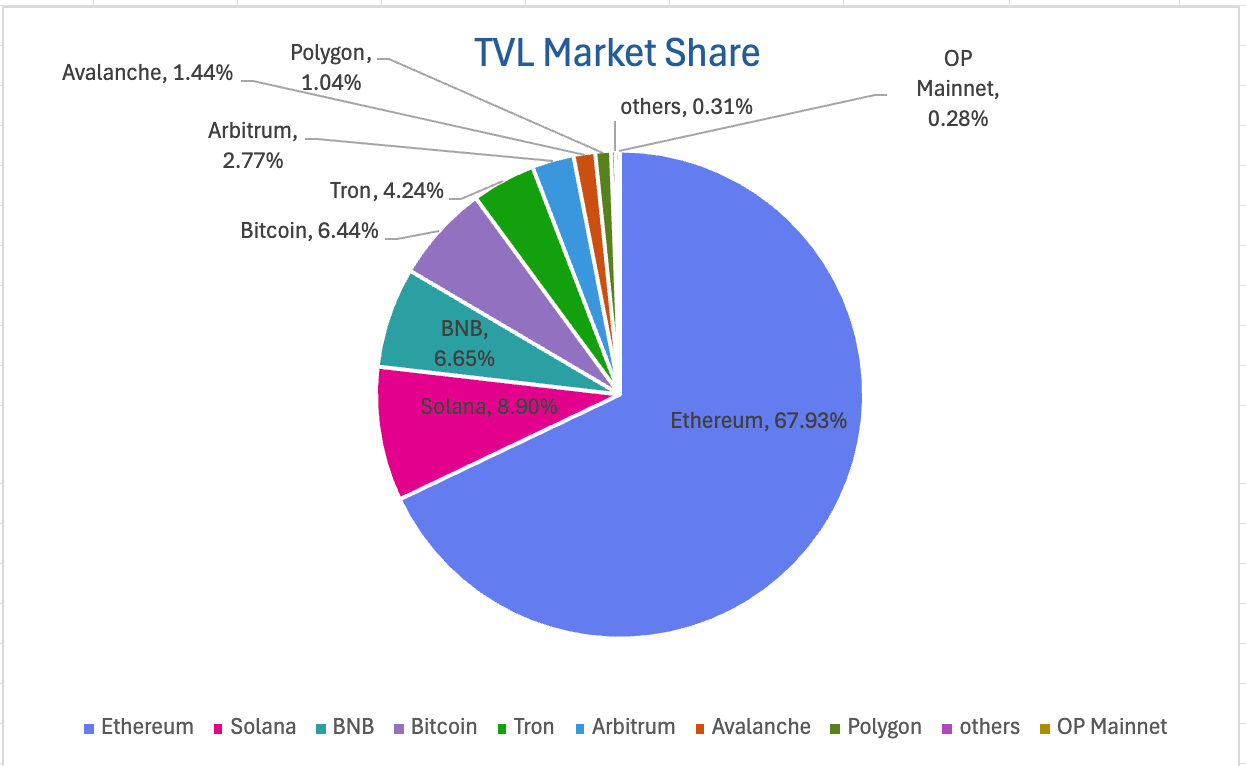

According to DeFiLlama, the total TVL of DeFi this week is $149.6 billion, down from $157.5 billion last week, a decrease of about 5.01%. By public chain, the top three chains by TVL are Ethereum at 67.93%; Solana at 8.9%; and BNB Chain at 6.65%.

This week, the overall activity of public chains has slightly declined. Ton has become a rare highlight, with daily trading volume increasing by 11.24% and active addresses rising by 29.08%; while Sui performed the weakest, with trading volume dropping by 50.44% and TVL decreasing by 22.23%. Ethereum, BNB Chain, Solana, and Aptos all experienced varying degrees of decline in daily trading volume, with BNB Chain showing the smallest drop (-1.39%). In terms of transaction fees, fluctuations across chains were minimal, with Aptos rebounding by 13.71%, while Solana and Sui decreased by 20.23% and 11.11%, respectively. Overall, capital and activity are showing a phase of adjustment.

New project focus: Loon Finance is a company focused on stablecoins and payment solutions, launching a stablecoin pegged 1:1 to the Canadian dollar, known as CADC, also referred to as the "Canadian digital dollar." Standard Economics is a company focused on digital dollar wallet infrastructure, aiming to allow users to convert cash into "digital dollars" and conveniently spend through wallets or associated Visa cards. Accountable is a digital finance platform designed to help businesses verify and share their asset-liability data in a privacy-protecting manner while providing verifiable yield opportunities for retail investors.

Table of Contents

I. Market Overview

Total Cryptocurrency Market Cap / Bitcoin Market Cap Proportion

Fear Index

ETF Inflow and Outflow Data

ETH/BTC and ETH/USD Exchange Rates

Decentralized Finance (DeFi)

On-chain Data

Stablecoin Market Cap and Issuance

II. This Week's Hot Money Trends

Top Five VC Coins and Meme Coins by Growth This Week

New Project Insights

III. Industry News

Major Industry Events This Week

Major Upcoming Events Next Week

Important Investments and Financing from Last Week

IV. Reference Links

I. Market Overview

1. Total Cryptocurrency Market Cap / Bitcoin Market Cap Proportion

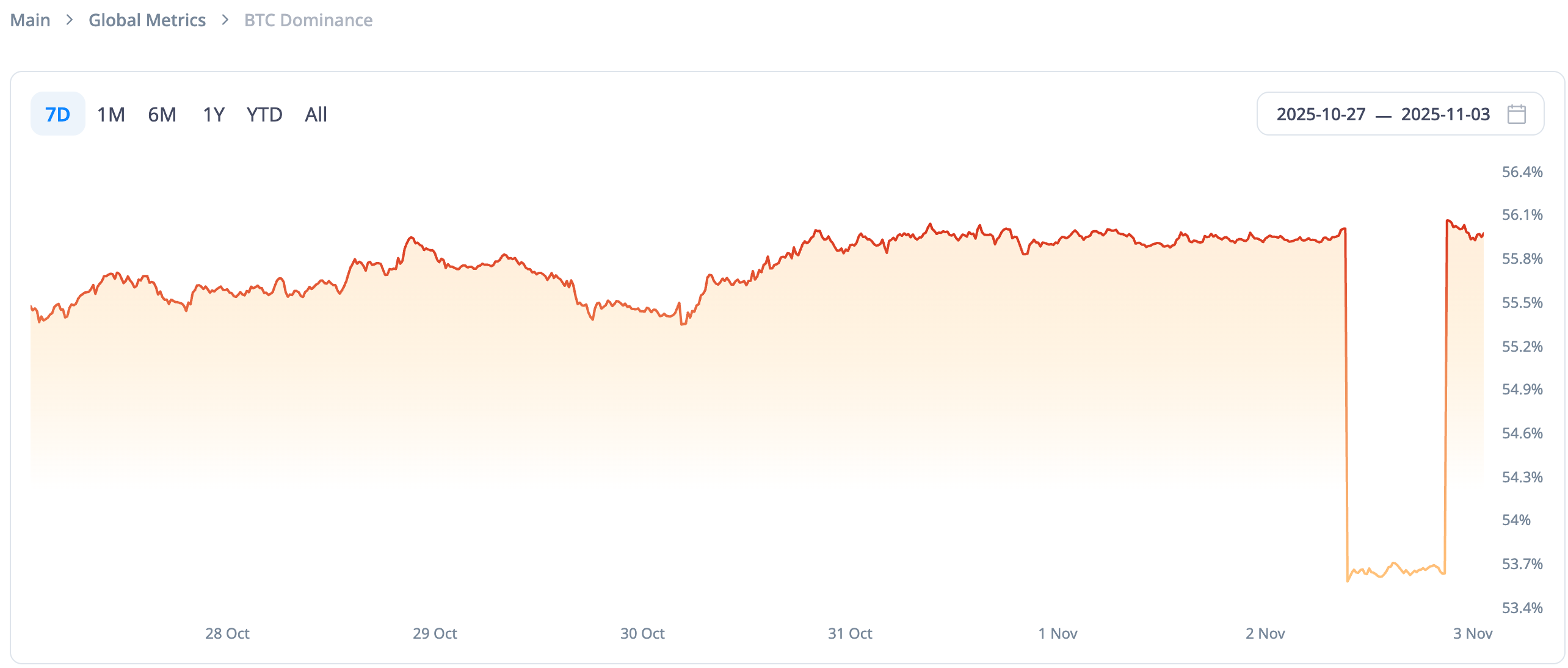

The total market capitalization of cryptocurrencies is $3.91 trillion, down from $3.97 trillion last week, representing a 1.5% decrease this week.

Data Source: cryptorank

Data as of November 2, 2025

As of the time of writing, the market cap of Bitcoin is $219 billion, accounting for 56% of the total cryptocurrency market cap. Meanwhile, the market cap of stablecoins is $304.8 billion, accounting for 7.79% of the total cryptocurrency market cap.

Data Source: coingeck

Data as of November 2, 2025

2. Fear Index

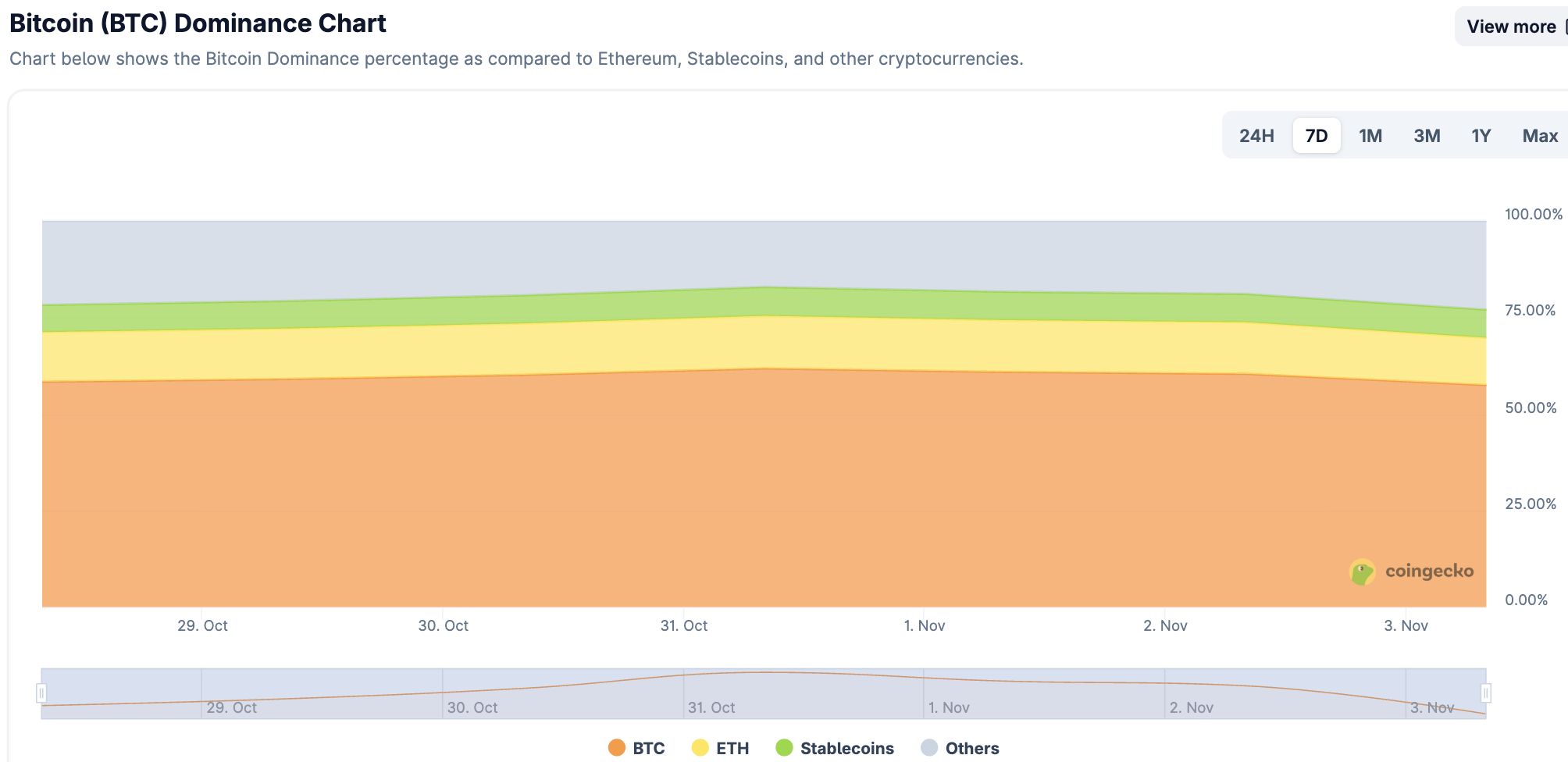

The cryptocurrency fear index is at 43, indicating a neutral sentiment.

Data Source: coinglass

Data as of November 2, 2025

3. ETF Inflow and Outflow Data

As of the time of writing, the cumulative net inflow of the U.S. Bitcoin spot ETF is approximately $61.19 billion, with a net outflow of $607 million this week; the cumulative net inflow of the U.S. Ethereum spot ETF is approximately $14.37 billion, with a net inflow of $114 million this week.

Data Source: sosovalue

Data as of November 2, 2025

4. ETH/BTC and ETH/USD Exchange Rates

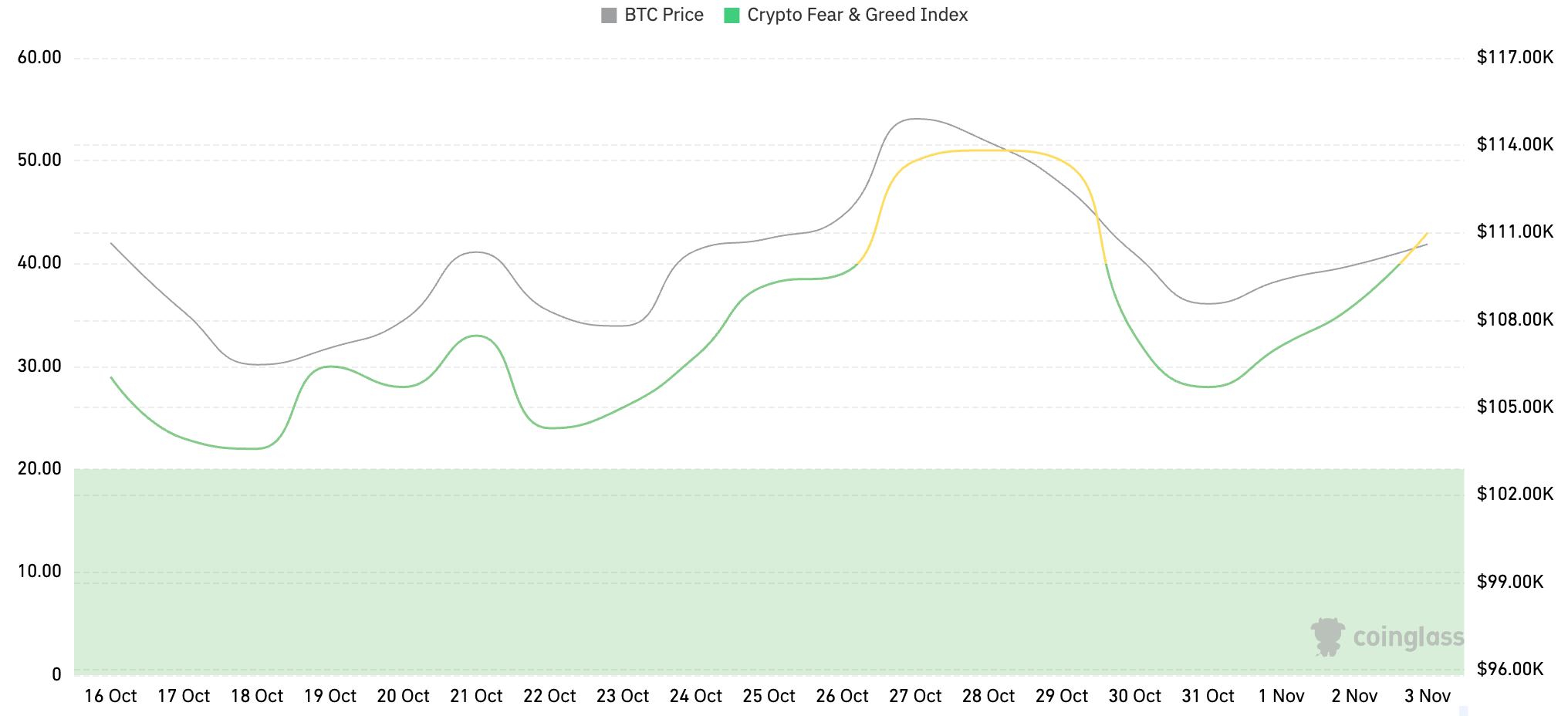

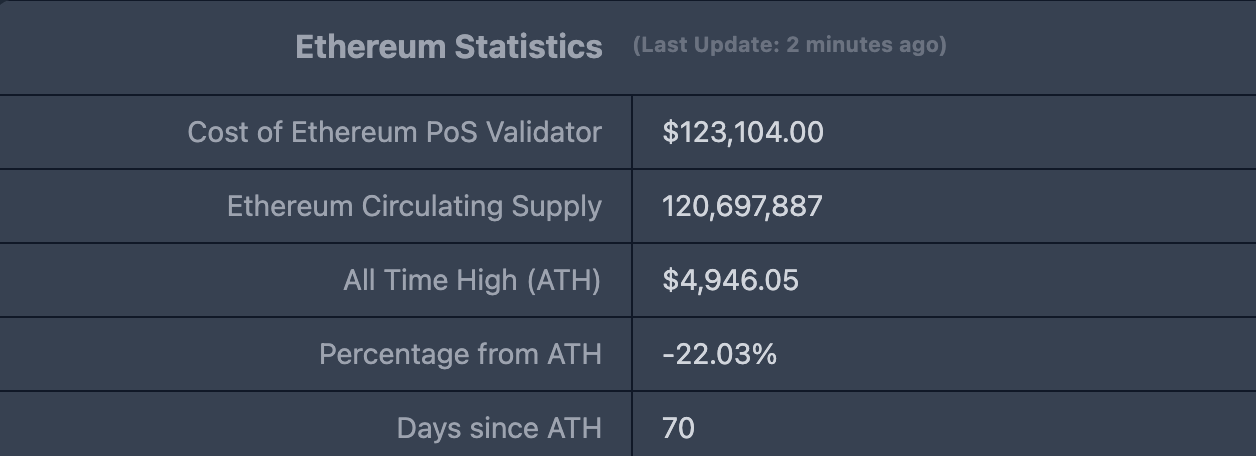

ETHUSD: Current price $3,850.54, historical highest price $4,878.26, down approximately 22.03% from the highest price.

ETHBTC: Currently at 0.035111, historical highest at 0.1238.

Data Source: ratiogang

Data as of November 2, 2025

5. Decentralized Finance (DeFi)

According to DeFiLlama, the total TVL of DeFi this week is $149.6 billion, down from $157.5 billion last week, a decrease of about 5.01%.

Data Source: defillama

Data as of November 2, 2025

By public chain, the top three chains by TVL are Ethereum at 67.93%; Solana at 8.9%; and BNB Chain at 6.65%.

Data Source: CoinW Research Institute, defillama

Data as of November 2, 2025

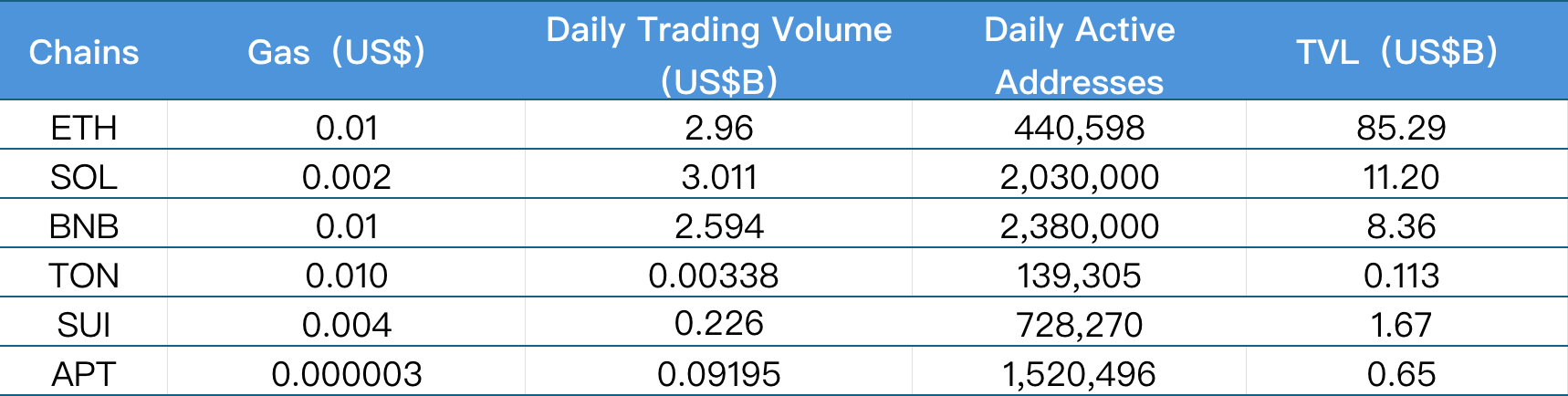

6. On-chain Data

Layer 1 Related Data

Mainly analyzing the current data of major Layer 1 chains including ETH, SOL, BNB, TON, SUI, and APTOS based on daily trading volume, daily active addresses, and transaction fees.

Data Source: CoinW Research Institute, defillama, Nansen

Data as of November 2, 2025

Daily Trading Volume and Transaction Fees: Daily trading volume and transaction fees are core indicators of public chain activity and user experience. In terms of daily trading volume, this week only Ton increased by 11.24%, while other chains experienced varying degrees of decline, with Sui showing the largest drop at 50.44%; BNB Chain had the smallest drop at 1.39%. The remaining chains saw declines of Ethereum (-20.61%), Aptos (-8.75%), and Solana (-2.96%). In terms of transaction fees, this week Ethereum, BNB Chain, and Ton remained stable compared to last week; Solana and Sui saw some declines, with drops of -20.23% and -11.11%; Aptos rebounded by 13.71%.

Daily Active Addresses and TVL: Daily active addresses reflect the ecological participation and user stickiness of public chains, while TVL reflects user trust in the platform. In terms of daily active addresses, this week BNB Chain remained almost flat compared to last week, while Solana and Sui chains saw slight declines of -4.69% and -0.24%; Ton, Ethereum, and Aptos grew by 29.08%, 15.86%, and 5.61%, respectively; Solana and Sui chains decreased by 4.68% and 0.24%. In terms of TVL, all chains saw declines this week, with Sui experiencing the largest drop at -22.23%; Ton chain decreased by 5.83%; the remaining chains had relatively small declines, with Solana (-4.7%), Ethereum (-4.49%), Aptos (-3.97%), and BNB Chain (-3.28%).

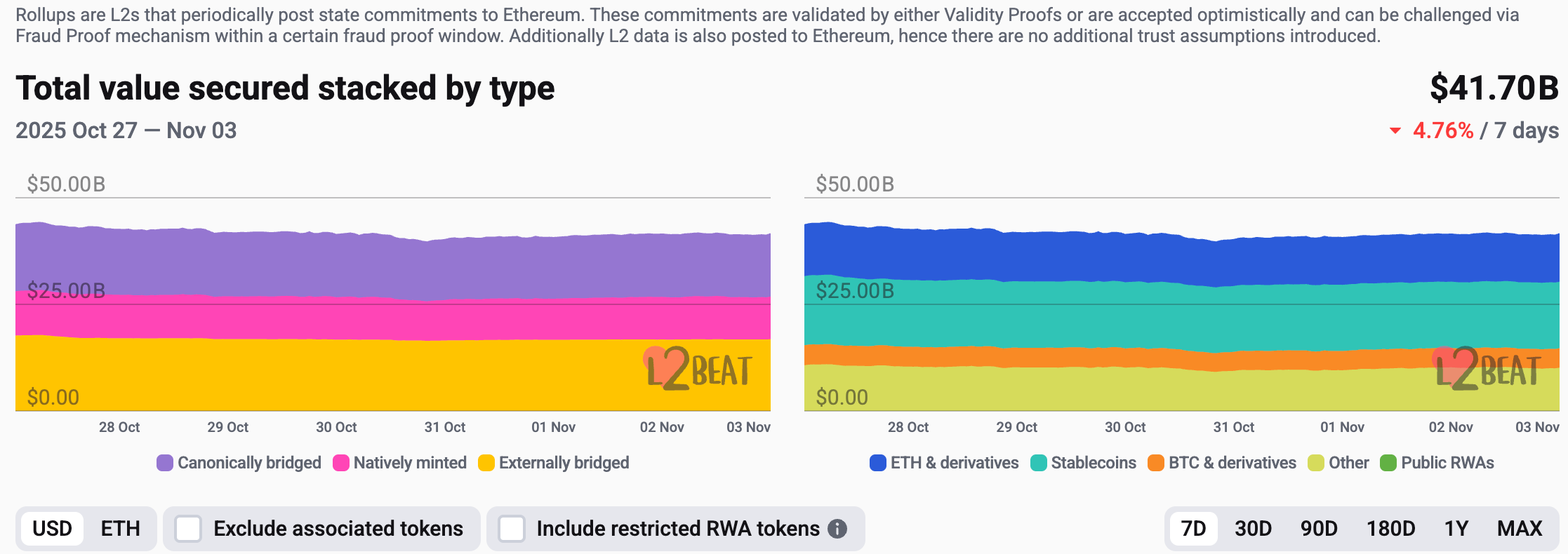

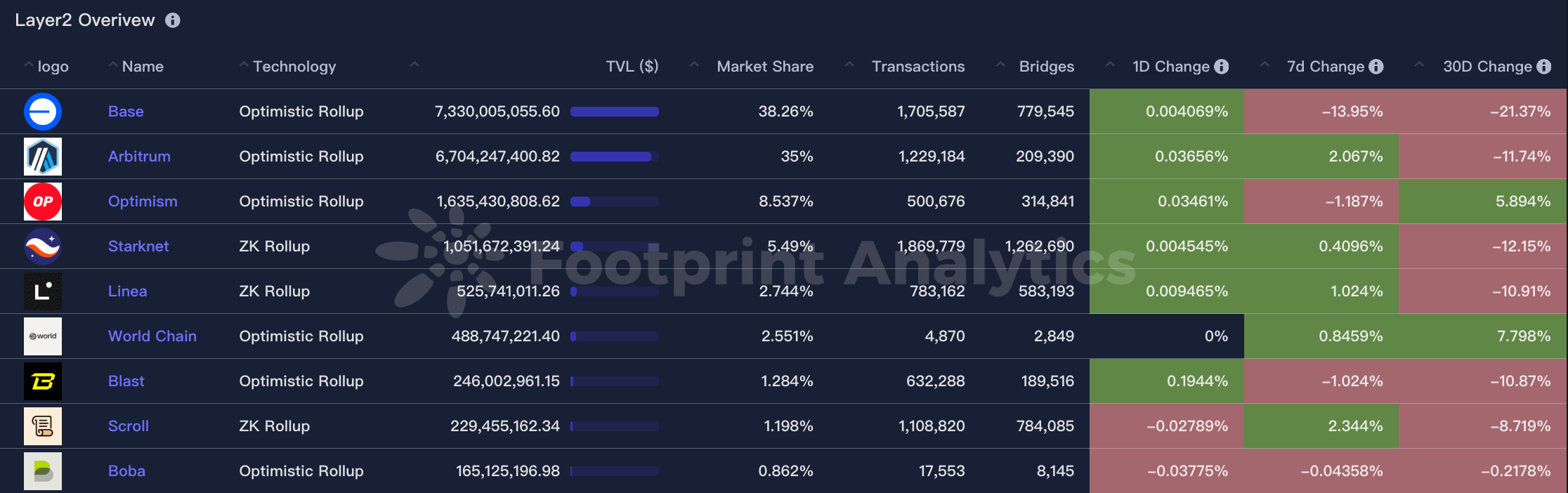

Layer 2 Related Data

According to L2Beat, the total TVL of Ethereum Layer 2 is $41.7 billion, down 4.6% from last week ($43.73 billion).

Data Source: L2Beat

Data as of November 2, 2025

Base and Arbitrum occupy the top positions with market shares of 38.26% and 35%, respectively. Base chain saw a slight decrease in market share over the past week, while Arbitrum saw a slight increase.

Data Source: footprint

Data as of November 2, 2025

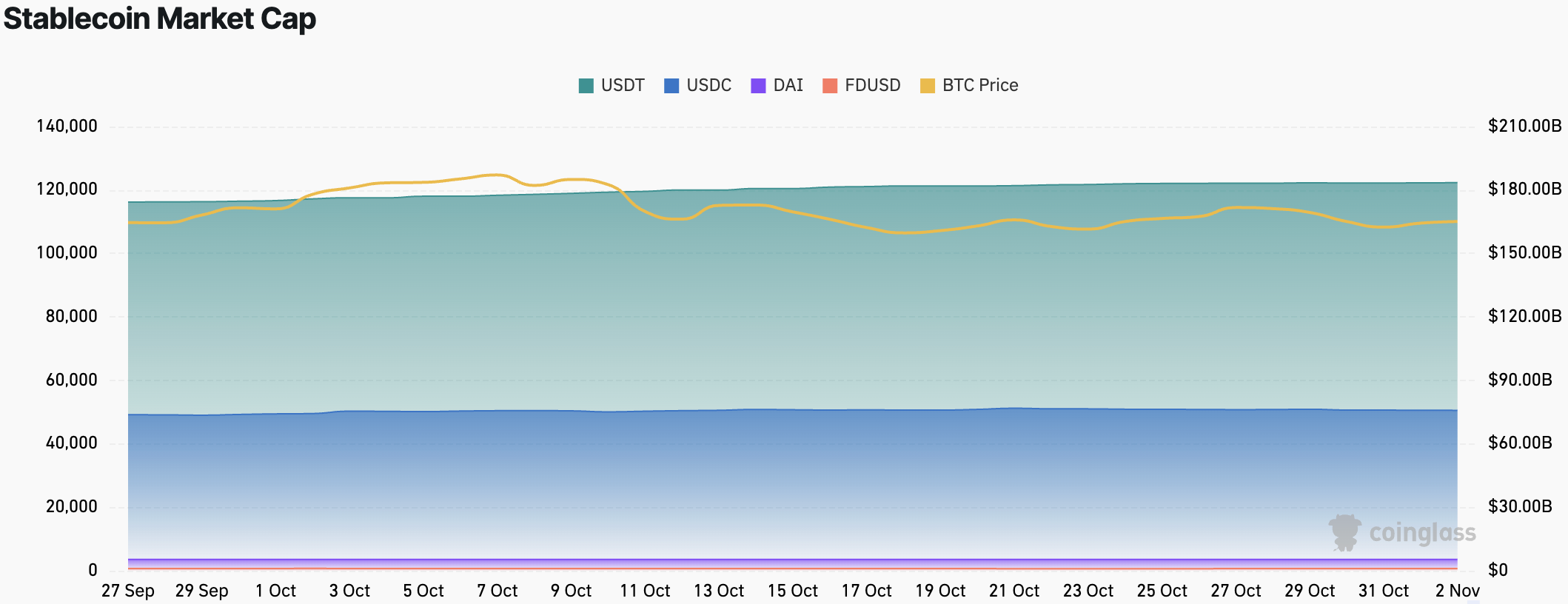

7. Stablecoin Market Cap and Issuance

According to Coinglass data, the total market capitalization of stablecoins is $30.48 billion, with USDT's market cap at $18.35 billion, accounting for 60.2% of the total stablecoin market cap; followed by USDC with a market cap of $7.58 billion, accounting for 24.86%; and DAI with a market cap of $537 million, accounting for 1.76%.

Data Source: CoinW Research Institute, Coinglass

Data as of November 2, 2025

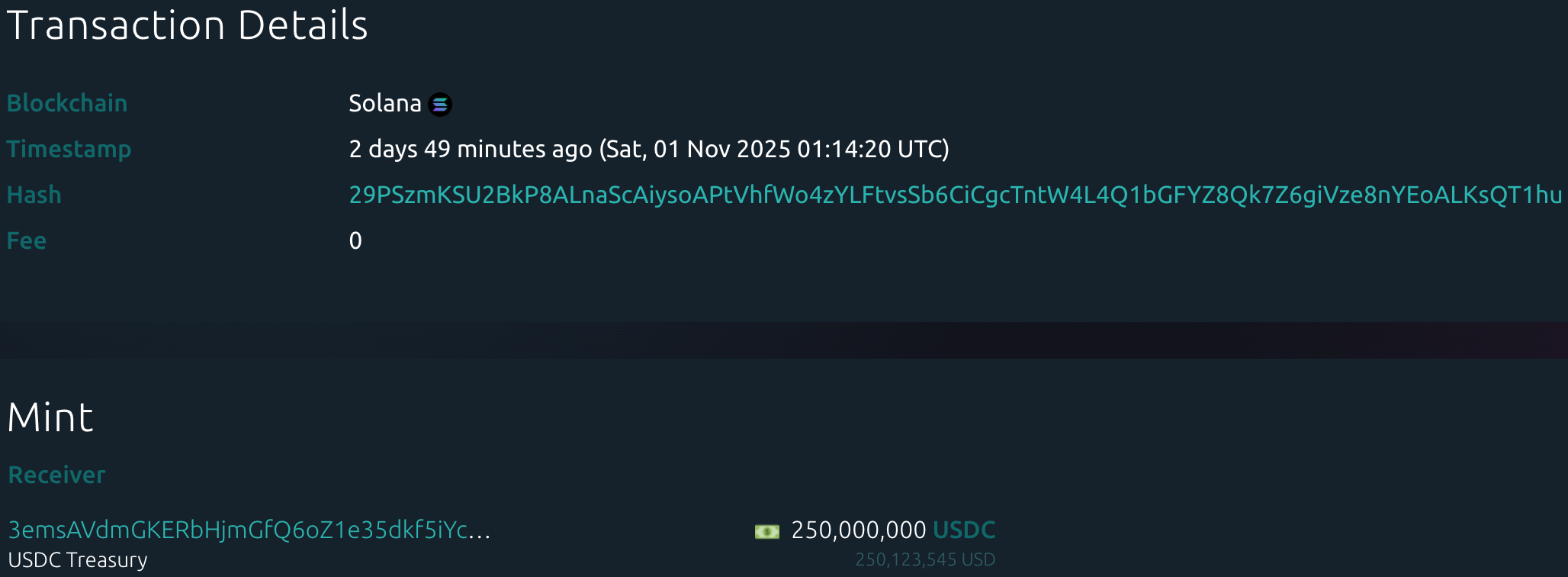

According to Whale Alert data, this week the USDC Treasury issued a total of 2.115 billion USDC, while Tether Treasury had no issuance of USDT this week. The total issuance of stablecoins this week was 2.115 billion, an increase of 8.35% compared to last week's total issuance of 1.952 billion.

Data Source: Whale Alert

Data as of November 2, 2025

II. This Week's Hot Money Trends

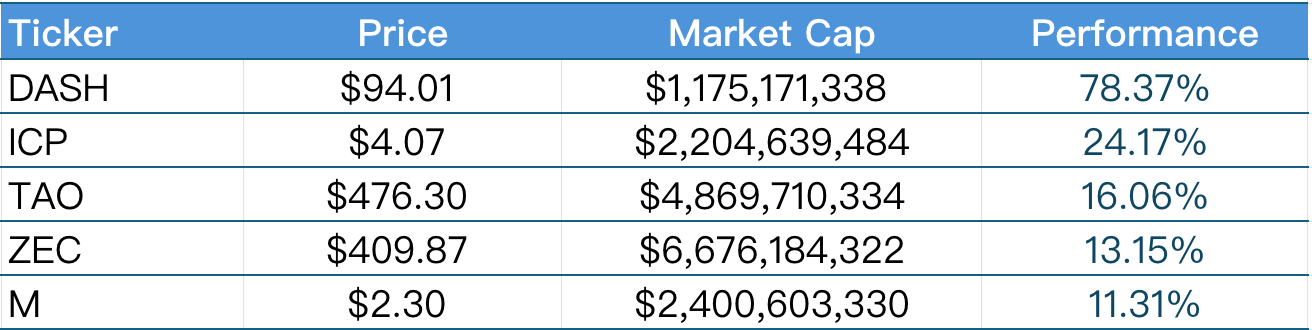

1. Top Five VC Coins and Meme Coins by Growth This Week

The top five VC coins by growth over the past week

Data Source: CoinW Research Institute, coinmarketcap

Data as of November 2, 2025

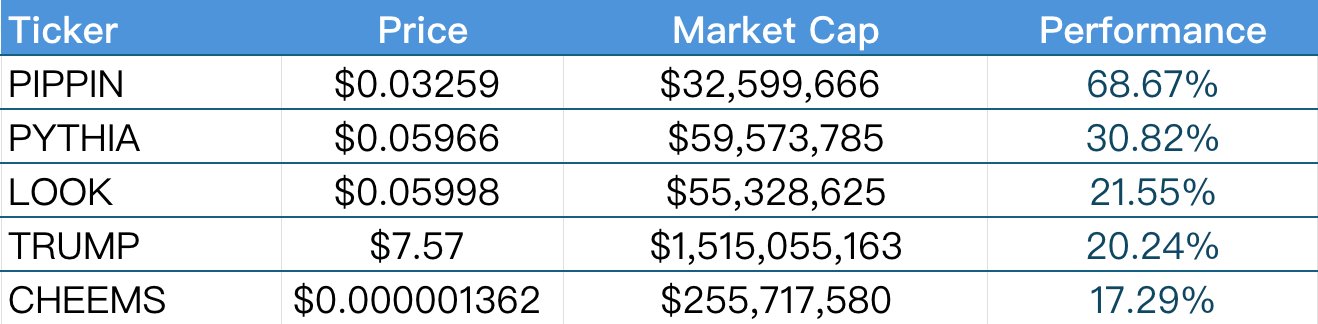

The top five Meme coins by growth over the past week

Data Source: CoinW Research Institute, coinmarketcap

Data as of November 2, 2025

2. New Project Insights

Loon Finance is a company focused on stablecoins and payment solutions, launching a stablecoin pegged 1:1 to the Canadian dollar, known as CADC, also referred to as the "Canadian digital dollar." Users can use CADC for transfers, payments, or cross-border transactions just like regular Canadian dollars. This stablecoin is backed by 100% fiat reserves, allowing for instant on-chain settlement, lower costs, and faster speeds. Loon aims to make it easier for Canadian and global users to use Canadian dollars for digital payments and international settlements.

Standard Economics is a company focused on digital dollar wallet infrastructure, aiming to allow users to convert cash into "digital dollars" and conveniently spend through wallets or associated Visa cards. Its goal is to enhance payment convenience and financial inclusion, enabling unbanked populations to participate in the digital economy.

Accountable is a digital finance platform designed to help businesses verify and share their asset-liability data in a privacy-protecting manner while providing verifiable yield opportunities for retail investors. The platform aims to eliminate trust barriers and reduce fraud risks, striving to create a more efficient and secure path for financial growth.

III. Industry News

1. Major Industry Events This Week

On October 30, MilkyWay (a liquid staking protocol based on Celestia) announced that the third phase of its "Massdrop" airdrop is officially open for claims. This phase covers 100 million MILK tokens, accounting for 10% of the total supply, distributed to mPoint holders, Moolitia NFT holders, and milkINIT test users, with the airdrop divided into four release phases.

On October 28, South Korea's leading shared power bank project Piggycell officially launched the TGE (Token Generation Event) for its token PIGGY. The project combines offline power bank rental services with blockchain incentive mechanisms, rewarding device users and partner merchants through the issuance of PIGGY tokens, promoting the digital upgrade of shared devices. It is reported that the total supply of PIGGY tokens is 100 million, and the TGE marks the project's official entry into the tokenization and ecological incentive phase.

On October 29, the metaverse gaming platform Pieverse officially completed its token generation event (TGE), which took place at 16:00 Beijing time on October 29. The project had previously opened a Pre-TGE subscription event from 08:00 to 10:00 (UTC) on October 29 and launched Booster Phase 4 on October 28. Pieverse aims to build a virtual world ecosystem that integrates gaming, social interaction, and digital assets, allowing users to earn token rewards through game interactions and task participation.

On November 1, the Story ecosystem IP RWA protocol Aria announced at an offline Meetup held in Seoul, South Korea, that it will increase the airdrop ratio for the IP community from 2% to 10% to thank the Story community for its long-term support. The airdrop will be gradually unlocked for eligible IP holders after the token goes live. Currently, Aria has launched as the first project on the Buidlpad Vibe platform for community issuance, raising $600,000, with a project FDV of $60 million. The issuance KYC and subscription period will end at 10 PM on November 2, and the contribution phase will begin at 10 AM on November 3.

On November 2, Momentum announced on the X platform that the first round of token airdrop subscriptions is now live, allowing users to complete eligibility verification and subscribe within the next 48 hours to participate in the first round of MMT distribution.

2. Major Upcoming Events Next Week

The Monad airdrop claim will end on November 3. Previously, Monad officially opened the "Airdrop Amount Reveal" feature on October 28, allowing eligible users to check their personal token allocation. This airdrop covers approximately 230,000 addresses, with the snapshot completed on September 30, and the claim channel opened on October 14, continuing until November 3. Monad confirmed on October 30 that this airdrop has no lock-up restrictions, and tokens can be freely traded after claiming.

On November 3, the Capybobo airdrop query interface will officially go live, allowing users to check their personal $PYBOBO token allocation. At the same time, a special event for the Capybobo airdrop season will also begin, with specific participation rules to be announced soon. Capybobo completed its TGE snapshot on November 2. As the first trendy toy project in the TON and KAIA ecosystem, Capybobo is preparing to launch "Crypto Doll Clothes," creating its own trendy toy IP. Capybobo is the first project in the Catizen ecosystem to deeply integrate Web3 gaming with physical trendy toys, extending digital assets into tangible collectibles through a complete chain of "game skins - doll clothes design - physical products."

Polymarket recently announced that its return plan for U.S. users is expected to launch by the end of November 2025. The platform was previously shut down in the U.S. in 2022 due to unregistered derivatives trading and was penalized by the Commodity Futures Trading Commission (CFTC). After the U.S. business resumes, the platform has confirmed that it will issue a native token, POLY, and conduct an airdrop event, prioritizing rewards for active users.

The cross-chain infrastructure project edgeX initiated a token name voting activity on its official X (formerly Twitter) account on October 28 and publicly unveiled its project mascot MARU for the first time. The community generally believes that this move indicates edgeX is gearing up for the upcoming TGE (Token Generation Event), laying the groundwork for subsequent token issuance and brand building.

3. Important Investments and Financing from Last Week

U.S. publicly listed health tech company Prenetics (Nasdaq: PRE) has completed an oversubscribed equity financing of $46.8 million, with investors including Kraken and Exodus. If all warrants are exercised, the total financing could reach up to $212 million. The funds will be used to globally expand its health brand IM8 and accelerate its Bitcoin treasury strategy, with the company planning to purchase one Bitcoin daily, aiming for $1 billion in revenue and corresponding Bitcoin reserves within five years. Prenetics is a tech company focused on health and longevity innovation, combining cash flow business with Bitcoin reserves through its "Bitcoin flywheel" model to promote the integration of health tech and digital assets. (October 27, 2025)

Stablecoin infrastructure company ZAR announced the completion of a $12.9 million financing round, led by a16z, with participation from Dragonfly, VanEck Ventures, Coinbase Ventures, and Endeavor Catalyst. ZAR plans to popularize stablecoin applications through street shops in Pakistan, allowing users to exchange cash for digital dollars and spend via wallets and Visa cards, aiming to address the payment needs of the country's large unbanked population. If successful, ZAR plans to expand into the African market in 2026. ZAR provides secure and convenient digital dollar wallet services, enabling users to exchange cash and cryptocurrency through nearby merchants. (October 28, 2025)

Nasdaq-listed company Metalpha Technology announced a strategic private placement financing agreement of approximately $12 million with Gortune International Investment Limited Partnership and Avenir Group, expected to close by November 30. The funds from this round of financing will be used to accelerate the layout of blockchain trading services, invest in innovative digital asset technologies, and supplement working capital. Metalpha, headquartered in Asia, is a global crypto wealth management company with a core team from top Wall Street investment banks, focusing on providing crypto derivatives services to institutional clients, including exchanges, mining companies, investment funds, and family offices, and is one of the largest crypto derivatives traders in Asia. (October 30, 2025)

Bron Labs announced the completion of a $15 million financing round, with participation from approximately 140 investors, including notable institutions such as LocalGlobe, Fasanara Digital, and GSR. The project is a platform featuring a "zero custody" wallet and multi-chain DeFi access, aiming to combine institutional-level asset security with a user-friendly experience: supporting multi-chain wallets, cross-chain swaps, hidden accounts, staking services, and advanced security features such as the "guardian recovery model." (October 30, 2025)

IV. Reference Links

Loon Finance: https://loon.finance/

Standard Economics: https://www.standardeconomics.com/

Accountable: https://www.accountable.capital/

Bron Labs: https://bron.org/

Metalpha: https://www.metalpha.finance/

Prenetics: https://www.prenetics.com/

ZAR: https://www.zar.app/

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。