Original Author: 1912212.eth, Foresight News

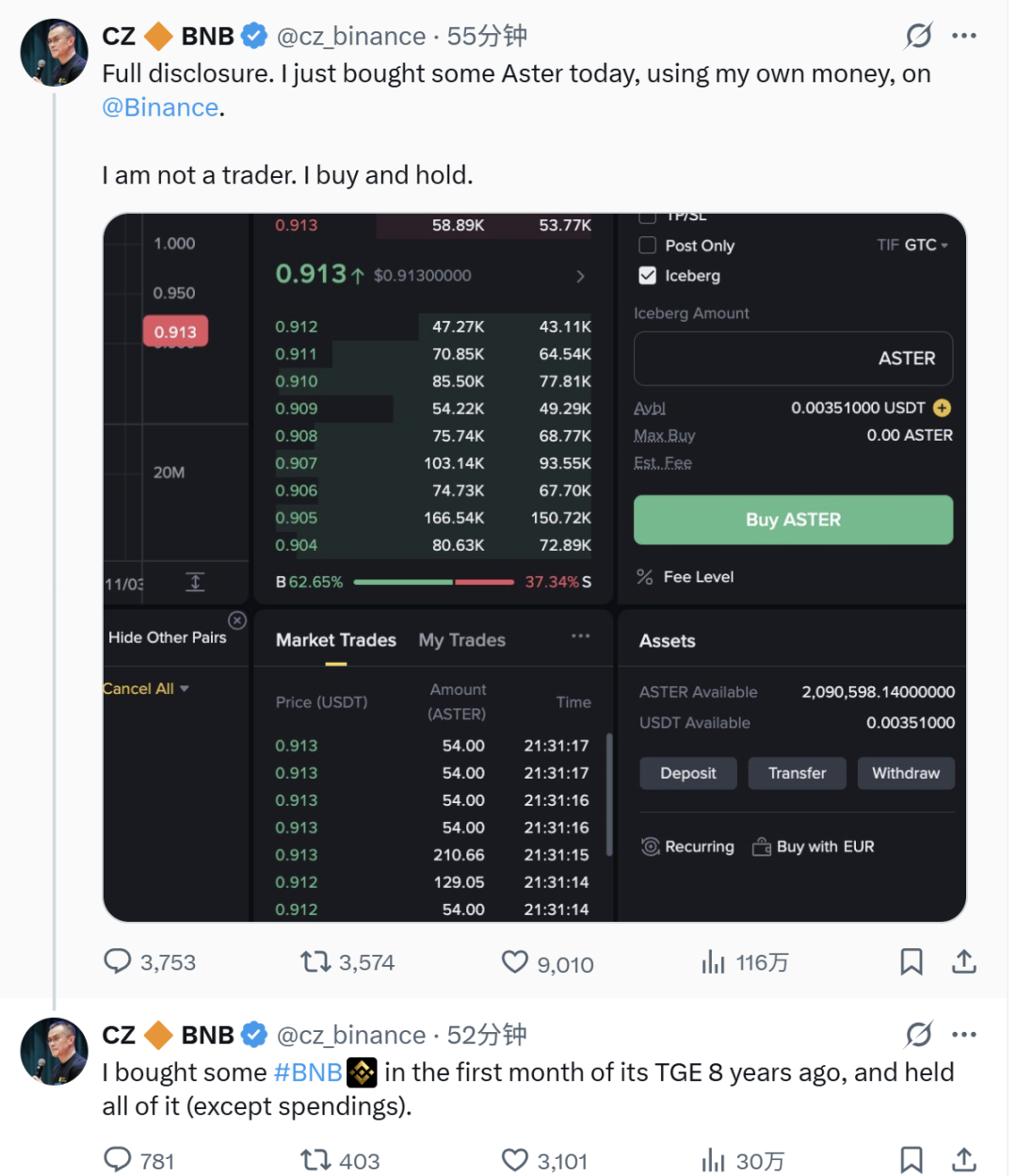

On the evening of November 2, Zhao Changpeng announced that he had purchased 2.09 million Aster tokens with his own money, and he further implied in a tweet, "Eight years ago, I bought some BNB in the first month of TGE and have held it ever since (except for the portion used for consumption)."

ASTER quickly surged from $0.9 to around $1.25, with an increase of nearly 30% in just one hour.

This was not a casual statement from Zhao Changpeng, but rather his first direct endorsement of a specific cryptocurrency in a public setting—prior to this, although he had mentioned the Aster project multiple times in posts and praised its innovation, he had never disclosed personal holdings or purchasing actions. This purchase marks Zhao Changpeng's strong endorsement of Aster.

In terms of trading details, according to the public records of Zhao Changpeng's Binance account, the average price was locked in at $0.913, with a total value exceeding $1.9 million. Zhao Changpeng emphasized that he is not a trader but a long-term holder, which aligns with his consistent investment style—buying and not frequently trading, focusing on the long-term value of the project.

From the timeline, this purchase occurred shortly after the Aster token was listed, during a period of market volatility. Zhao Changpeng's buying action led to a surge in trading volume, causing Aster's market capitalization to rise above $2 billion again.

The Battle for Hyperliquid?

As early as September, Zhao Changpeng had interacted multiple times with Aster-related content, praising its Hidden Order feature, which was implemented just 18 days after launch, much faster than over 30 similar projects. He also retweeted Aster's posts, emphasizing its multi-chain support and low fee advantages, promoting the growth of the BNB Chain ecosystem. However, these were project-level comments without personal investment disclosures. It wasn't until November 2 that he made a clear purchase.

Zhao Changpeng's investment in Aster is not a spur-of-the-moment decision but a well-considered strategic move.

Since stepping down as CEO of Binance, Zhao Changpeng has turned to investment and ecosystem development. His YZi Labs is a key supporter behind Aster, with Aster DEX incubated by YZi Labs, focusing on next-generation Perp DEX innovation. Zhao Changpeng's purchase of Aster is akin to casting a vote of confidence with real money for his own project, sending a signal to the market: Aster is not a short-term speculation but an infrastructure with long-term potential.

Aster is positioned as a multi-chain Perp DEX, supporting BNB Chain among others, with its core selling point being Hidden Orders—large orders are only revealed after matching, avoiding front-running and sniping. Aster addresses the pain points of traditional DEXs, such as the manipulability of public order books seen in competitors like Hyperliquid.

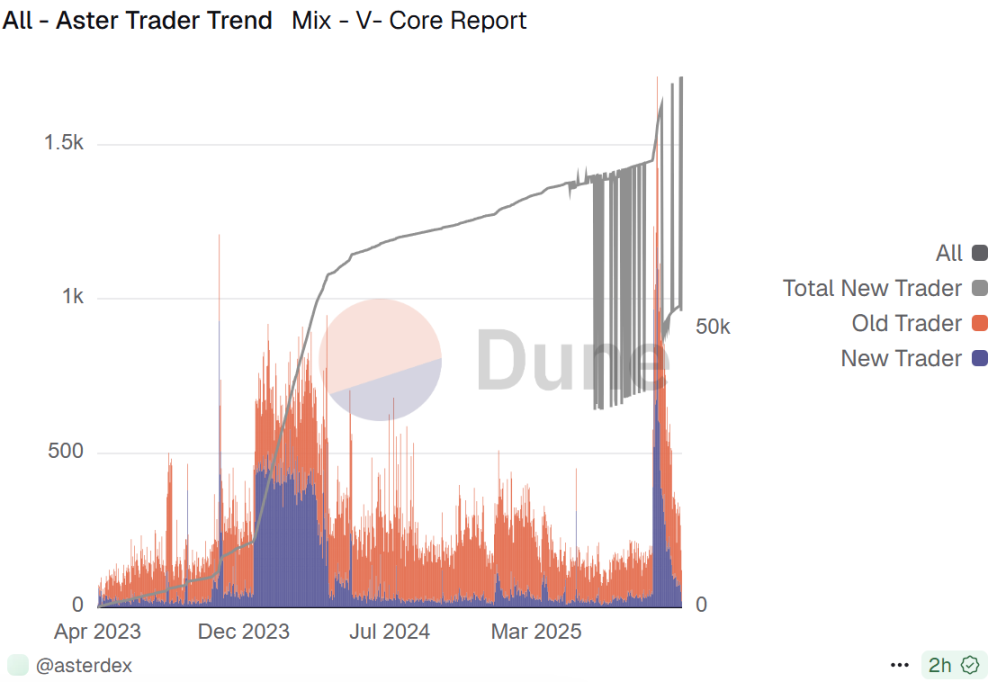

Zhao Changpeng's endorsement essentially aims to "drive traffic" to BNB Chain ecosystem products, bringing more liquidity into BNB Chain and stimulating gas fees and DeFi activities. According to the latest data from Dune, Aster currently has over 5.314 million total users, a total TVL exceeding $1.256 billion, and a staggering total trading volume reaching $29 trillion. From September to October this year, a large influx of new users has entered, with daily increases even surpassing the bull market at the beginning of 2024.

The competition in the Perp DEX space is fierce, and Aster's low fees, tokenized stocks, dark pool trading, and grid features set it apart. When Zhao Changpeng made his purchase, rumors were circulating that he had sold $30 million worth of ASTER (which was later debunked), highlighting his determination to defeat Hyperliquid in the perpetual contract DEX field.

Over the past few years, whether it was Pancake, wallet products, or Alpha, Binance was not initially a leader but always managed to become a strong competitor, even surpassing others later on, which makes the market pay attention to whether Aster can challenge the leading position in the Perp DEX space.

Perhaps the real battle for derivatives is yet to come.

Can On-Chain Buybacks Save the Large Unlocks in November?

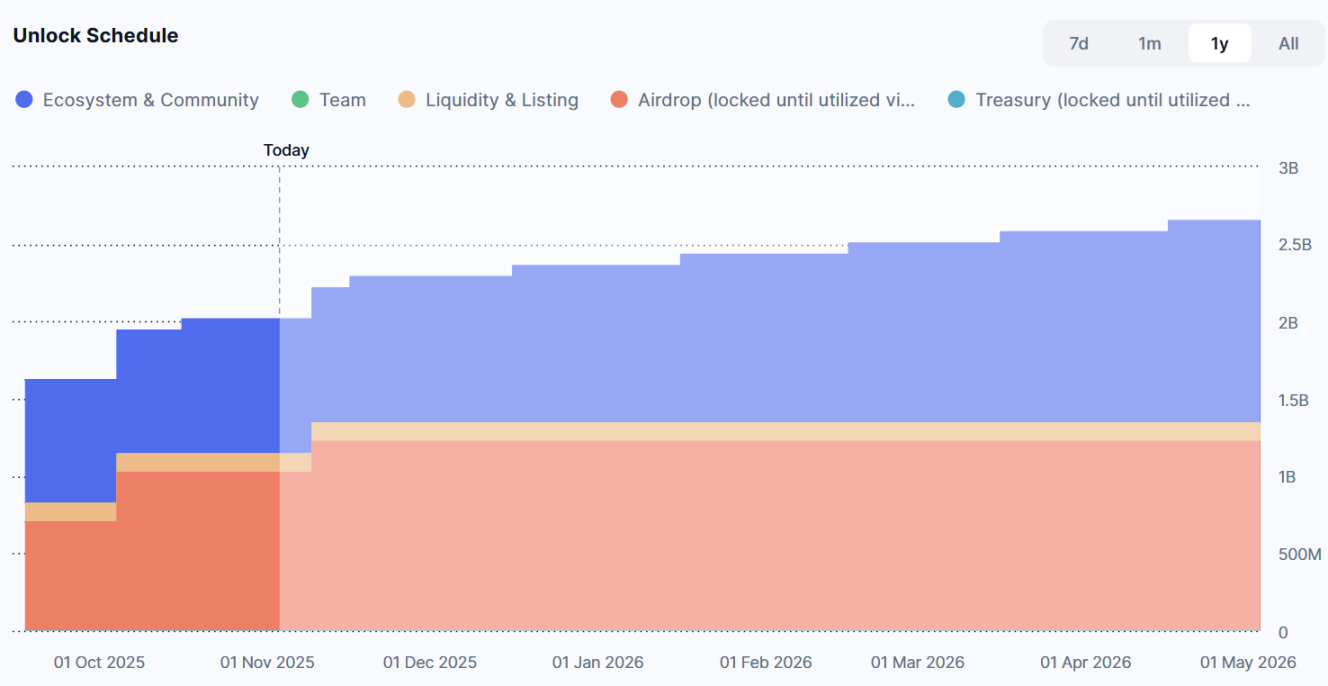

The Aster token economic model is designed for gradual release, with a total supply of 8 billion tokens. In November, Aster will face two cliff unlocks.

According to Binance APP data, approximately 200 million tokens (2.5% of total supply) will be unlocked on November 10, valued at about $240 million (based on current prices); on November 17, approximately 72.73 million ASTER tokens (0.91% of total supply) will be unlocked, valued at about $87.276 million.

With the overall market lacking liquidity, S3 selling pressure, and token unlocks, investor sentiment in the market is quite cautious.

On October 30, Aster officially stated that its S3 buyback is completely transparent and 100% executed on-chain, buying tokens daily from the open market until the cumulative amount reaches the target range of 70%-80% of the trading fees during the S3 period. The S3 phase will last for 35 days, ending on November 9. Additionally, the S3 airdrop will start after all buybacks are completed, prioritizing the use of tokens from the buyback address for distribution; any shortfall will be unlocked from the airdrop allocation pool to ensure sufficient distribution.

According to the latest data from DefiLlama, Aster's recent daily average trading fees are around $1.93 million, which suggests that the recent daily buyback amount is approximately $1.35 million to $1.54 million.

On October 31, the official announcement stated that 50% of all buyback funds (including S2 and S3) will be destroyed through a public buyback address to reduce supply and consolidate the long-term value of ASTER. The remaining 50% will flow back to the locked airdrop address, thereby reducing circulation and reserving more shares for potential future airdrops to reward genuine Aster users and long-term holders.

The official buyback efforts continue to support its token price, and perhaps when market liquidity improves and the overall market turns favorable, the impact of unlock selling pressure may diminish.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。