Author: Golem (@web3_golem)

On July 22, informed sources revealed that the crypto prediction market platform Polymarket is evaluating the possibility of launching its own stablecoin, aiming to capture the profits generated by the substantial reserves backed by Circle's USDC. Although Polymarket has not made a final decision, a series of recent actions, including the U.S. Department of Justice concluding its investigation into Polymarket and the platform completing its acquisition of the U.S. compliant trading platform QCX, have led many users to speculate that a token launch from Polymarket is on the horizon, thus increasing interaction frequency.

Rumors about Polymarket launching a token have been circulating since 2024, leading to studios engaging in interactions for nearly a year. So, for users who have never interacted with Polymarket or have done so infrequently, is it still necessary and timely to start engaging with Polymarket now?

Polymarket Remains Competitive After the U.S. Election

Before considering whether it is timely to start interacting with Polymarket, we need to understand the current operational status of the platform. Polymarket's popularity stems from the 2024 U.S. presidential election, where it gained fame for successfully predicting Trump's victory and handling up to $8 billion in betting funds. However, since the conclusion of the U.S. election, the frequency of mentions of Polymarket in the media has begun to decline, leading to the view that Polymarket would lose a significant number of users after the election topic faded. But the reality may disappoint them; the following data reveals that after the hype of the U.S. election and outside the political realm, Polymarket remains a popular platform processing hundreds of thousands of transactions daily and serving tens of thousands of users.

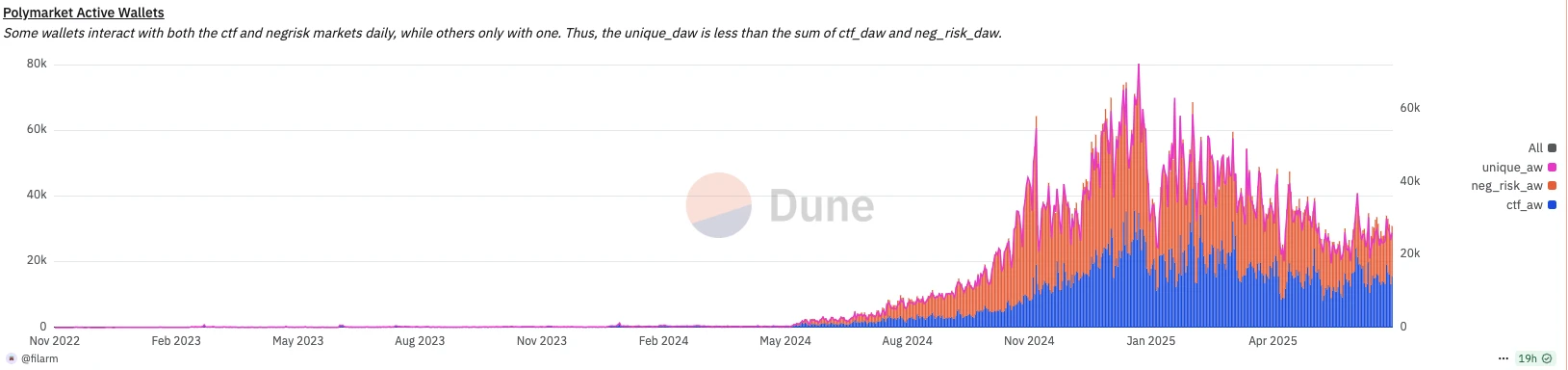

Daily Active Wallets

According to Dune data, since May 2024, the number of daily active wallets on Polymarket has surged from nearly 0 to 70,000 over six months. Although there was a decline in wallet activity around the end of January to early February 2025 due to Trump's official inauguration, it has since rebounded. Currently, the daily active wallets on Polymarket remain between 20,000 to 30,000. While this cannot be compared to the daily active users of Meme launch platforms like Pump.fun, it still surpasses Layer 2 solutions like Starknet and ZKsync. The sustained high wallet activity after the hype validates Polymarket's solid product-market fit.

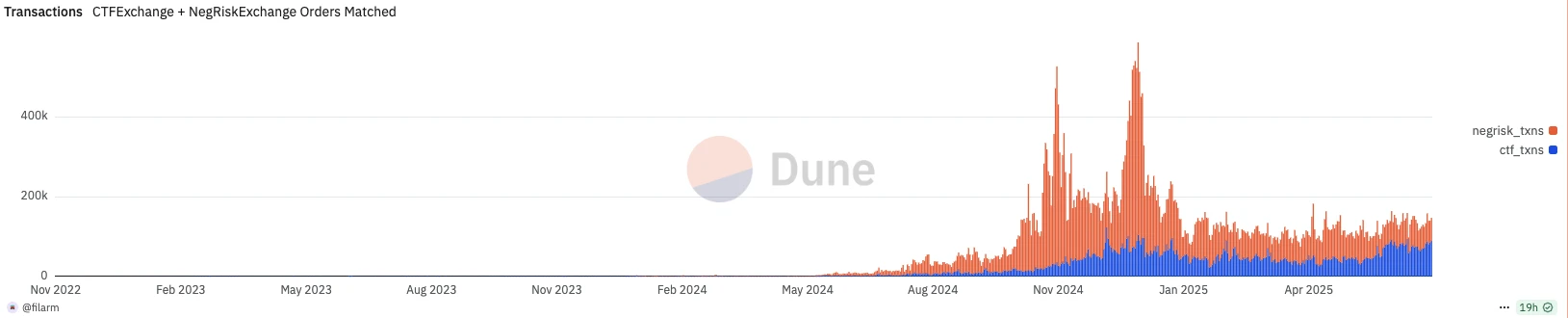

Daily Transaction Count

Similarly, the daily transaction count on Polymarket peaked during the 2024 U.S. election, reaching nearly 500,000 transactions. However, even after the election cooled down, the transaction count on the Polymarket platform remains above 100,000. This indicates that while the usage of Polymarket has decreased since the election, it still retains a significant number of loyal users compared to before 2024.

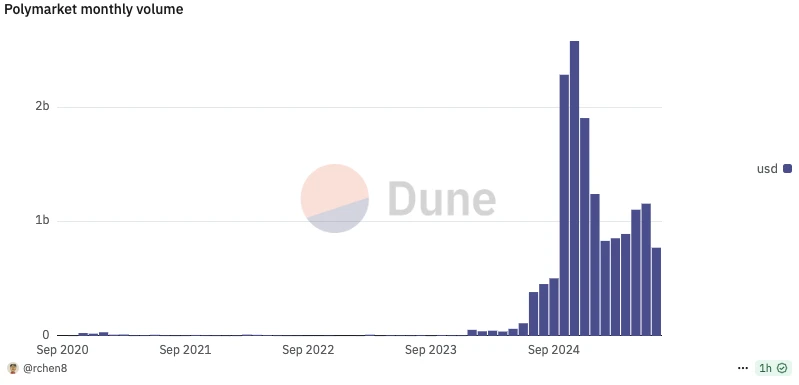

Monthly Transaction Volume

According to Dune data, the monthly transaction volume on Polymarket peaked in November 2024, reaching $2.5 billion. However, since the election concluded, from February 2025 to the present, Polymarket has maintained a monthly transaction volume of $700 million to $1.1 billion. According to DeFiLlama data, in the past 30 days, Polymarket ranks 40th in transaction volume, ahead of established DEXs like Sushi and GMX.

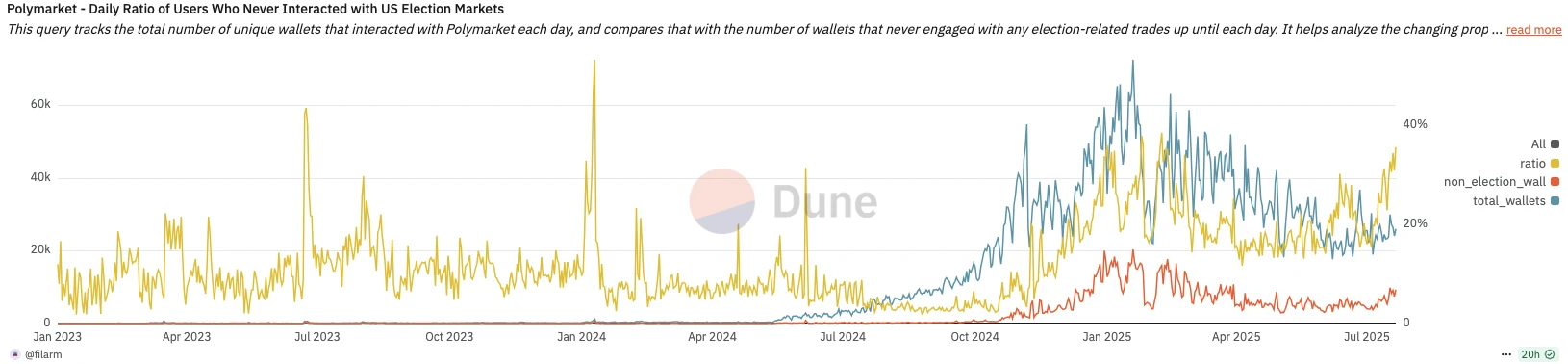

User Ratio Outside the U.S. Election

The above chart reflects the proportion of users who have never participated in the U.S. election market. From the chart, it can be seen that after the U.S. election concluded, the total number of wallets has decreased, but the number of wallets that have never participated in the U.S. election remains stable. This indicates that while Polymarket has lost a significant number of short-term speculative users after the election, the number of loyal platform users has not significantly decreased. The proportion of users who have never participated in the U.S. election market is gradually increasing.

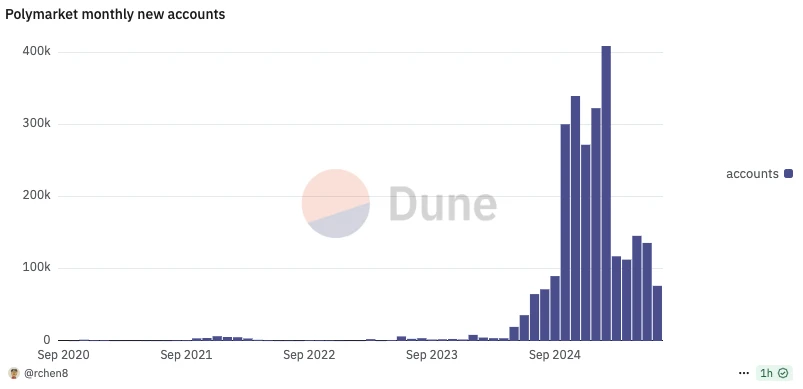

Monthly New Users

The above chart reflects the monthly new users on Polymarket. The period of the U.S. election was the peak time for new user acquisition on Polymarket, marking a significant growth phase for the platform. However, after the election, as speculators left, Polymarket has still maintained a growth of 110,000 to 140,000 accounts per month since March 2025. This indicates that aside from the U.S. election, other prediction areas on Polymarket continue to attract players, representing a significant shift in the user base from short-term speculative events to long-term usage.

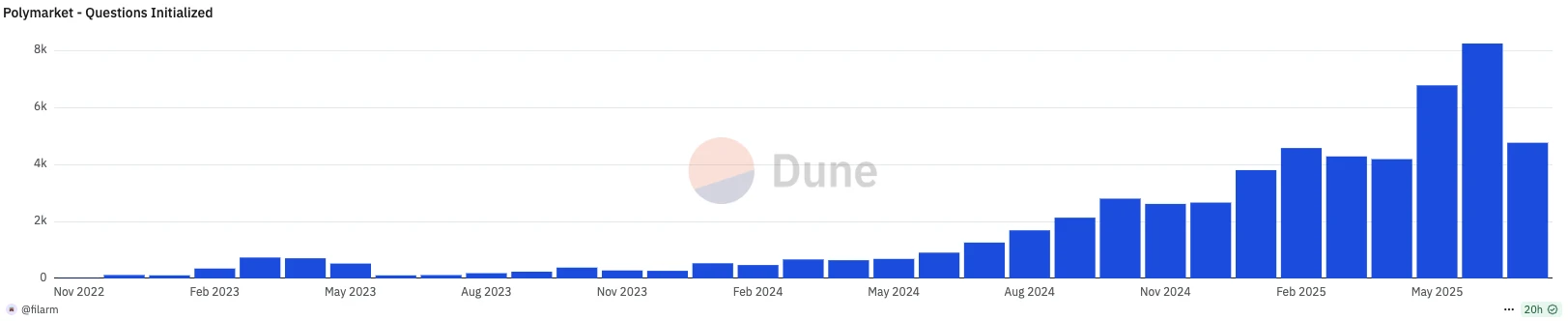

Number of Prediction Pools

The above chart reflects the number of prediction pools on the Polymarket platform each month. As shown in the chart, since 2025, the number of prediction pools on Polymarket each month has exceeded that during the 2024 U.S. election period. In May and June 2025, the number of prediction pools even surpassed 5,000, reaching 6,771 and 8,238, respectively. This indicates that the prediction betting field on the Polymarket platform is continuously expanding, likely attracting more players with diverse interests.

Is it still timely to engage with Polymarket?

From the data above, it is evident that the Polymarket platform is still relevant, and projects with strong product-market fit are highly sought after in the funding market. According to Rootdata, Polymarket has completed three rounds of financing, totaling $74 million. Additionally, as of June, Polymarket is seeking nearly $200 million in funding at a valuation exceeding $1 billion.

For an application like Polymarket, which has influenced traditional political media and brought crypto into the mainstream, a $1 billion valuation is not particularly high. If a token is indeed launched, even a 10% airdrop of the token supply to platform users could represent a significant opportunity. Therefore, considering whether it is timely to engage with Polymarket essentially involves evaluating the level of competition among platform users and various transaction costs.

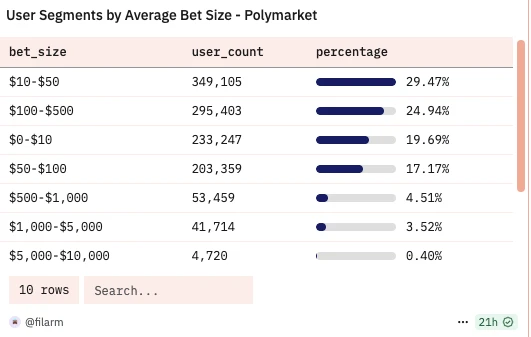

Engaging with Polymarket is Not Competitive

The above chart reflects the distribution of betting funds among Polymarket users. As shown, over 90% of users have betting funds below $500, with whales betting between $5,000 and $10,000 accounting for only 0.4%. Therefore, if the airdrop conditions include transaction rankings, it is currently not very difficult to rank in the top 10%, which indirectly reflects that engaging with Polymarket is not highly competitive; most users are still engaged in low-frequency, small-amount transactions.

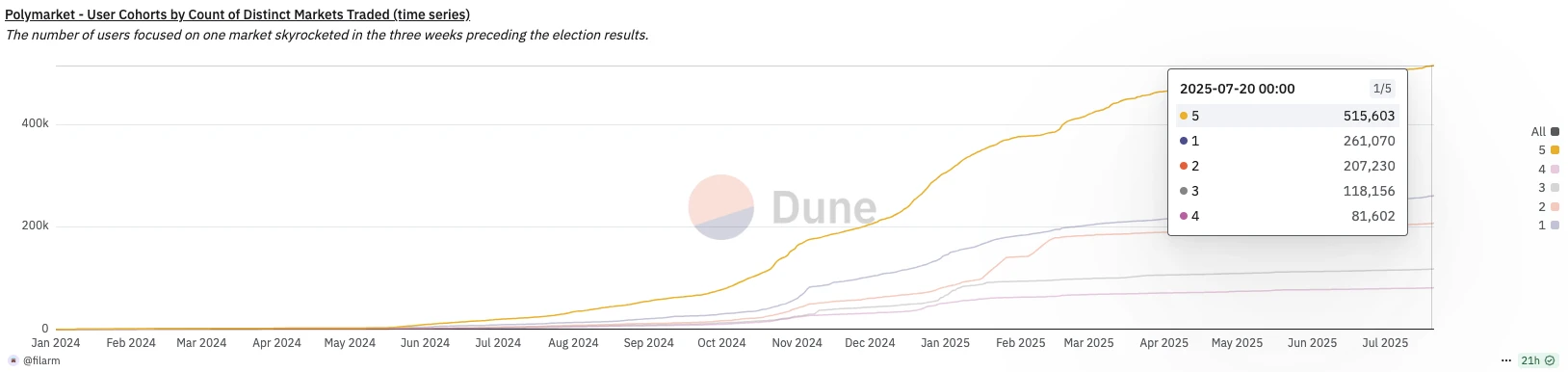

Additionally, among the approximately 1.2 million wallets on the Polymarket platform, around 510,000 wallets have participated in five or more different markets, which is less than 50%. Participating in different markets is also considered an important dimension of engaging with Polymarket. This metric indirectly reflects the number of wallets eligible for the Polymarket airdrop. Combining this with the previous data showing 20,000 to 30,000 daily active wallets on Polymarket, it can be inferred that only a few tens of thousands of wallets are continuously engaging with Polymarket. Compared to public chains that often have hundreds of thousands of interacting addresses, this qualifies as a "treasure protocol."

How Should Retail Investors Engage Now?

In the early days, users speculated on the dimensions that Polymarket might consider for a token airdrop:

Transaction volume

Transaction count

Transaction frequency

Number of different markets participated in

Transaction methods (market order, limit order, AMM)

Holding time

Single transaction amount (e.g., at least one transaction amount greater than $500)

The above dimensions are merely a reference. As a retail investor, it may be most important to focus on trading volume, transaction count and frequency, and holding time, while also controlling the cost of investment. For holding time, players can bet on the "2028 U.S. presidential election," as this prediction pool is relatively large, and the long time until settlement makes it less prone to drastic fluctuations. Additionally, there is a 4% annualized holding reward from the official side.

To boost trading volume and reduce wear and tear, crypto blogger SIiipy shared his strategy, which involves finding a prediction pool with low liquidity and using two wallets to trade back and forth. The specific operation is shown in the image below.

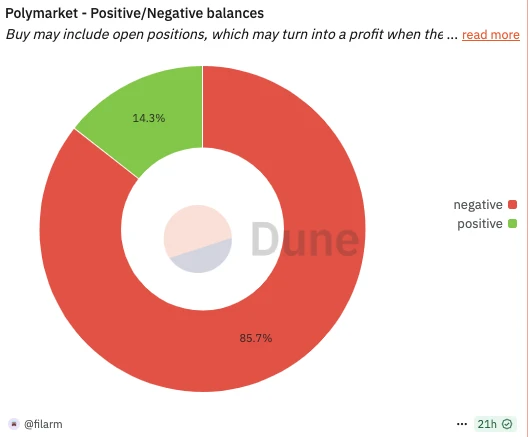

In addition to the above small, high-frequency trading, users can also choose to act as real users and place genuine bets on the Polymarket platform, while also vying for future airdrop opportunities. However, the principle of "nine out of ten bets lose" also applies on Polymarket. According to Dune data, only 14.3% of Polymarket users are in a profitable state, while about 86% of user accounts have negative balances.

Polymarket's positive and negative account balance ratio

Therefore, to reduce interaction costs, a new Polymarket strategy using options arbitrage has emerged. This strategy is limited to the Crypto market on Polymarket, such as the prediction pool "Will BTC fall below $118,000 on July 28?" The specific operation involves purchasing a $118,000 put option expiring on July 28 from an exchange, and then buying a "no" position on Polymarket (betting that BTC will not fall below $118,000 on July 28). This way, you provide your own hedge, but players should also be aware of the time difference risk caused by the inconsistent settlement times between the exchange and Polymarket. (Related reading: Is there a new way to play Polymarket? Using options arbitrage)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。