Saylor Unveils Bitcoin Defense Unit to Boost Accumulation Strategy

Michael Saylor , the executive chairman and co-founder of Strategy (formerly MicroStrategy), has unveiled a new initiative titled the "Bitcoin Defense Department." The announcement was made via his official X account , just one day after Strategy proposed a new stock offering aimed at increasing its Bitcoin holdings.

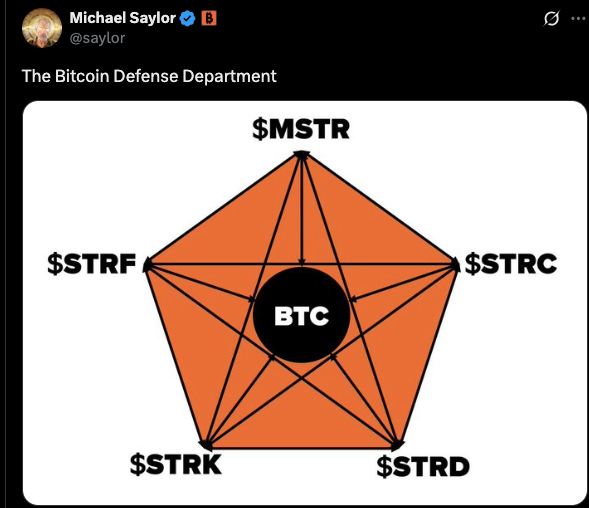

Source: Tweet

The company introduced a new preferred stock under the ticker STRC, known as the Variable Rate Series A Perpetual Stretch Preferred Stock. Five million shares of STRC are expected to be offered at $100 each. Proceeds will be allocated to general corporate activities, including Bitcoin purchases and strengthening operational liquidity.

Bitcoin Defense Department Symbolizes Institutional Strategy

Saylor’s post featured an image resembling the Pentagon, symbolizing a stronghold. Each corner of the pentacle displayed one of Strategys stock tickers, MSTR at the top, followed clockwise by STRC, STRD, STRK, and STRF. These stocks have been instrumental in raising funds from institutional investors to fuel Strategy’s Bitcoin-focused agenda.

The launch of the BTC Defense Department is part of Saylor’s broader effort to formalize the company’s BTC acquisition formerly MicroStrategy. The branding highlights formerly MicroStrategy commitment to defending and expanding its Bitcoin treasury through structured financial tools.

This move reinforces Saylor’s position as a leading voice in corporate BTC advocacy. It also marks a new chapter in institutional adoption strategies centered on Bitcoins accumulation, executed through publicly traded financial instruments.

Strategy Announces STRC Stock Public Offering

On July 21, 2025, formerly MicroStrategy (Nasdaq: MSTR; STRK; STRF; STRD) revealed plans for an initial public offering. The company will offer 5,000,000 shares of its Variable Rate Series A Perpetual Stretch Preferred Stock, known as STRC Stocks. The offering is subject to market conditions and SEC registration.

Strategy intends to allocate the proceeds toward general corporate activities, including working capital and further Bitcoins acquisitions. The STRC Stocks will carry a starting dividend of 9.00% annually, paid monthly, beginning August 31, 2025. The rate may adjust, but only within specific limitations.

The company has the right of redemption of shares once they are listed in Nasdaq or NYSE at a minimum of $101 plus unpaid dividends. There are also some conditions on which redemptions can be made and these include a change in tax or the low volume of outstanding shares.

https://x.com/saylor/status/1947611867113001307

Holders can request repurchase if a fundamental change occurs, at $100 per share plus any owed dividends. The stocks liquidation preference begins at $100 and adjusts based on trading activity or prior sale prices.

Morgan Stanley, Barclays, Moelis & Company, and TD Securities are leading the offering. Additional co-managers include The Benchmark Company and Keefe, Bruyette & Woods. Strategy continues its dual focus on Bitcoins investment and AI-powered analytics.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。