With the Federal Reserve signaling interest rate cuts and the continued favorable policies for cryptocurrencies, market liquidity has fully rebounded, leading to a surge in crypto assets. Bitcoin has strongly broken through $120,000, setting a new historical high; Ethereum is approaching $4,000, reaching its highest point in nearly six months. The spread of altcoins continues, combined with the resonance of ETFs and macro policies, rapidly heating up market sentiment, with FOMO emotions spreading widely.

After experiencing this intense upward movement, what will be the subsequent trends for BTC and ETH? Let's take a look at the latest views from top traders in the market.

Macro Analysis Group

@CryptoHayes

ETH is gradually breaking free from its sideways movement, becoming the core infrastructure for the tokenization of Wall Street assets and the expansion of stablecoins. With the rising demand for stablecoins like USDC and USDT, and the continuous deployment of real-world assets (RWA) on Ethereum, the utility and on-chain activity of ETH have significantly rebounded. Meanwhile, the recovery of risk appetite and expectations of interest rate cuts from the Federal Reserve are jointly driving liquidity back into the market, accelerating ETH's upward momentum. The structural benefits for ETH are also being transmitted to its ecosystem, with DeFi protocols experiencing a rebound in trading and staking demand, and the NFT sector's activity also rising, as the entire Ethereum ecosystem is regaining growth momentum.

Technical Analysis Group

@Cato_CryptoM

From a technical perspective on BTC, the price has been rising continuously for an hour, nearing a breakout of the range limit, with a clear divergence appearing in the hourly range; the price is at the resistance position of the upper range in the four-hour chart, showing strong movement with no divergence; the daily price has once again broken through MA7, maintaining an optimistic and strong trend.

Support: short-term reference at $117,000 for the 4-hour support, with key support at $113,700. Expand the support range to guard against potential large fluctuations tonight. Resistance: short-term resistance at $119,000, with key resistance at the previous high of $121,000. If this level breaks and holds, we can look to test new highs.

@biupa

The second round of Bitcoin's rise may be starting. Currently, Bitcoin has been consolidating for eight days since its peak, and there are signs of a breakout at the end of the triangle convergence. The upper resistance levels are $121,000 and $123,200; if broken, it could reach between $126,000 and $130,000. If Bitcoin breaks out, market attention may refocus on Bitcoin, while Ethereum will enter a consolidation phase, and altcoins may continue to rise in sync with Bitcoin (excluding E series). Therefore, attention can be given to SOL-related coins.

@market_beggar

Currently, the URPD gap is located around $111K to $115K, and on the price chart, it roughly falls around $112K to $115K. As shown in the chart, if the current small-level oscillation range is broken downwards, the gap area may not effectively stop the decline due to weak support. Therefore, when determining the first support level, I personally would reference $112K.

The logic behind this $112K is simple: it is the top of the consolidation area from May 9 to July 9, and on July 10, the price strongly broke through this area. We can temporarily assume that this consolidation area is where the main funds are accumulating.

The second position worth noting is $104,059, which corresponds to the average cost of current short-term holders (STH-RP), also located within the aforementioned consolidation area.

Data Analysis Group

@Murphychen888

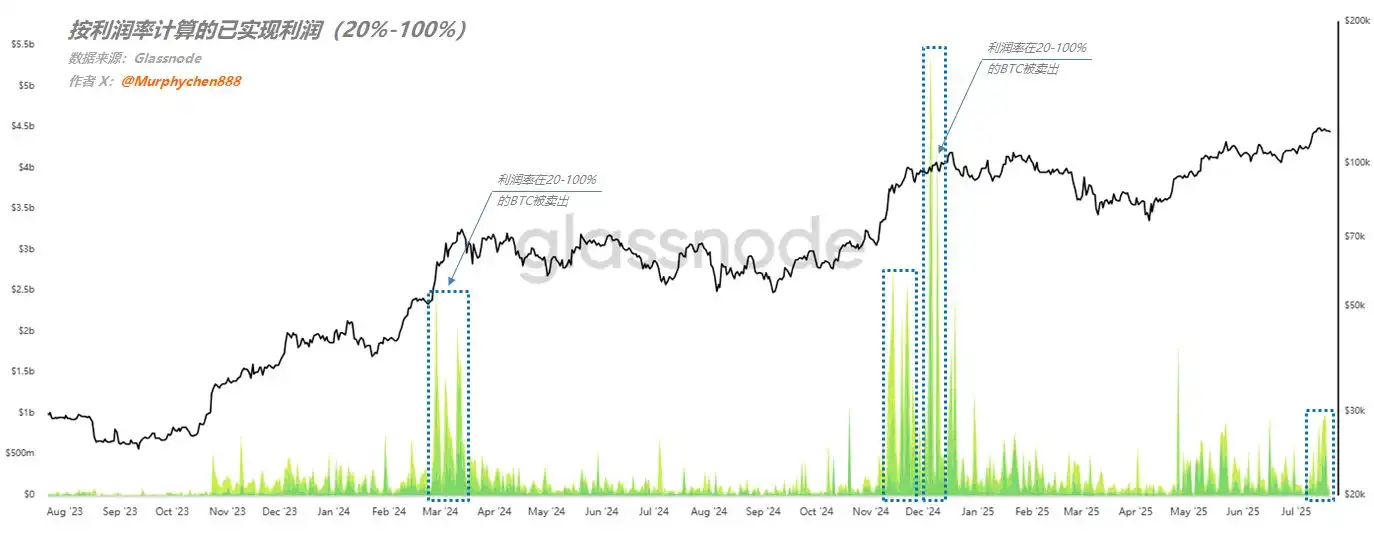

The true representation of overall market sentiment comes from the more active investors, whose BTC holdings do not have such high profit margins when sold, mostly in a reasonable range of 20%-100%. As we can see from Chart 2, whenever this group realizes profits densely, it is the hottest time for market sentiment. Currently, the data shows a significant gap compared to the previous two market cycles.

Therefore, even though we have seen high realized profits after BTC broke the historical high of $120,000, if we break it down, the selling behavior of some ancient whales has a significant impact on this data. However, the overall sentiment is not at the most FOMO stage yet, or in other words, the market pressure is not that heavy.

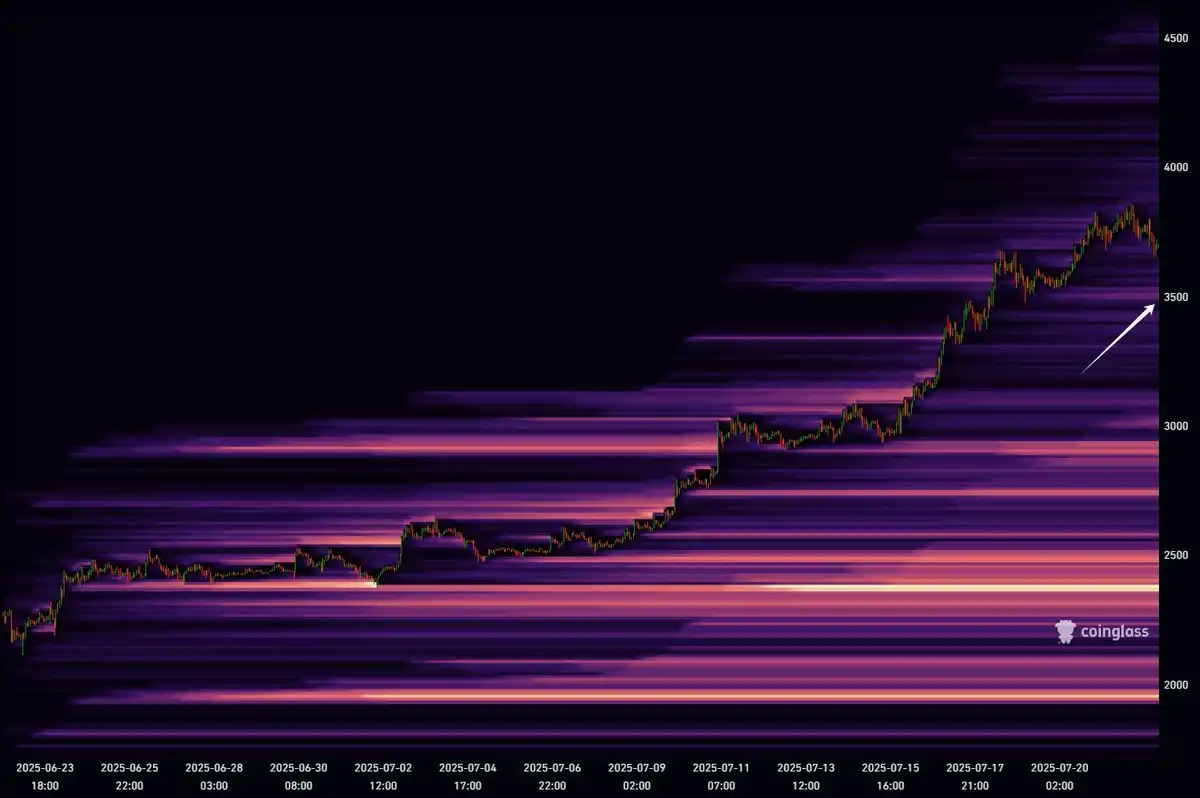

ETH currently has a small liquidation zone around $3,500. If the price has sustained downward momentum this week, then $3,500 is the entry point for you.

It has been clearly expressed before that the main driving force behind this strong bullish trend for ETH comes from spot buying, likely related to the subscription of coin stocks, which will bring a large demand for spot purchases.

However, the accompanying question is whether these coin stocks can obtain continuous financing like MicroStrategy?

If it is simply about raising the coin and stock prices and then opportunistically issuing more shares to cash out, then ETH will lose continuous spot buying and start oscillating at this position.

Once it starts oscillating, the liquidity in the futures market will dominate price behavior…

Therefore, in addition to focusing on the support at $3,500 to look for buying opportunities, we should also pay attention to the stock prices of companies that are financing based on ETH, whether their actions are sustainable, and whether they can hold onto the spot, which will determine the final height of this round of ETH!

Overall, the trend structure of ETH remains a strong bullish trend, so even if a pullback is anticipated, it is not recommended to short, but rather to wait for opportunities to go long.

@AxelAdlerJr

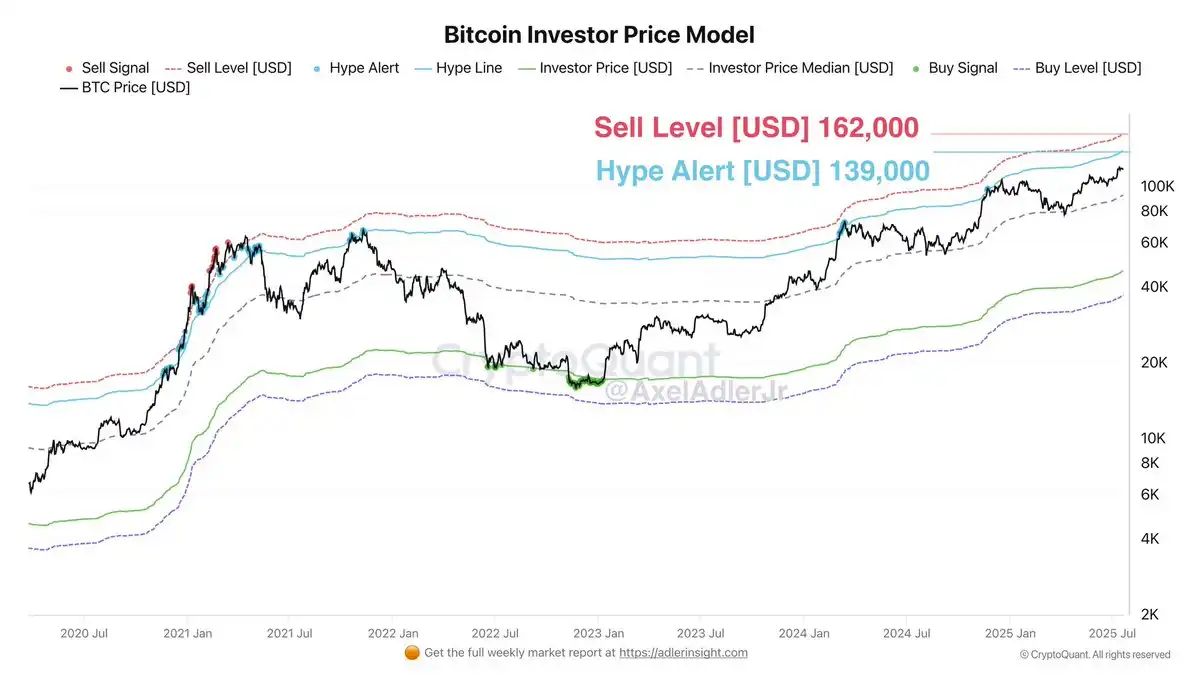

As of today, with a price of $117,000, Bitcoin is in a growth range between the median price for investors ($92,000) and the speculative alert level ($139,000). This indicates that buying activity is still supported by market participants: as long as the price remains above their comfort zone, they are willing to hold or increase their positions. Meanwhile, we have not yet entered an overly optimistic phase, and without serious overheating risks, Bitcoin still has room to rise further to $139,000.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。