Original Title: "Review of 8 Mainstream Public Chains' Data Performance Over the Past 3 Months: Ethereum's Return to Glory, Base and Hyperliquid Data Surge"

Original Author: Frank, PANews

In the past three months, the cryptocurrency market has experienced a significant rebound. The performance of mainstream public chains has become the focus of the market, with Ethereum staging a return to glory driven by both ETF funds and purchases from publicly listed companies. The prices of Solana, Sui, Hyperliquid, and others have also seen substantial increases. From the price trends, it seems the market is entering a long-awaited altcoin season. But behind the price movements, what is the actual development status of these public chains?

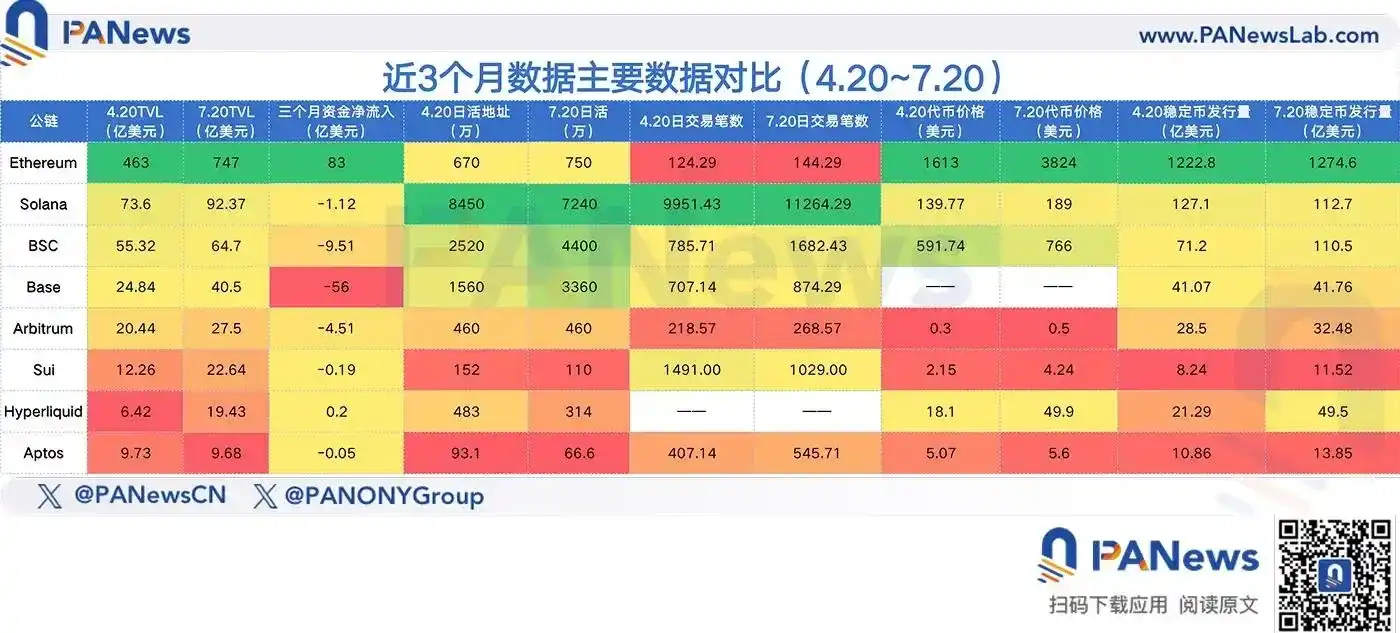

This article summarizes the core indicators of 8 major public chains with high TVL amounts and popularity over the past three months—price, TVL, capital flow, on-chain activity, and ecological progress—aiming to outline the true state of this round of public chain competition. The data period is from April 20 to July 20.

Ethereum: The Capital-Catalyzed Return of the King

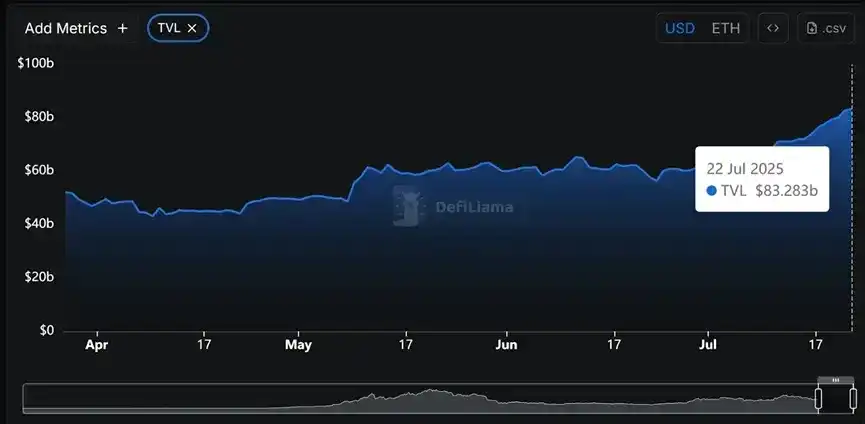

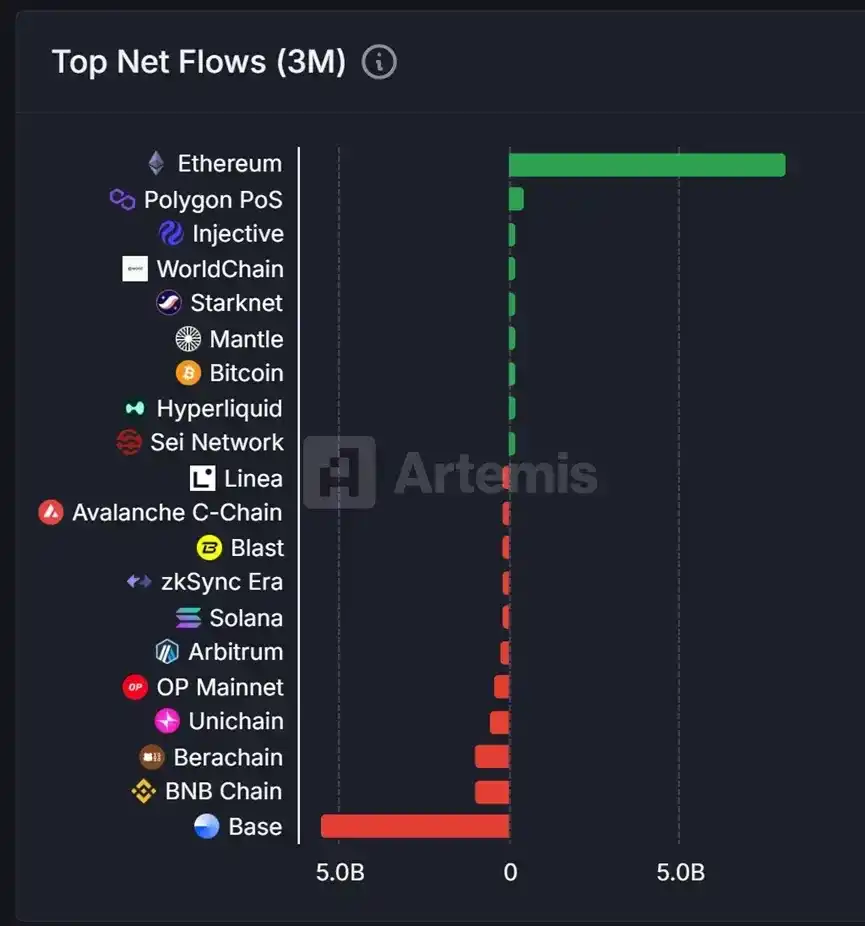

Ethereum has recently seen significant improvements across various data points, which aligns closely with its price performance. Over the past three months, Ethereum's price increased from $1,600 to a peak of over $3,800, a rise of more than 130%. Behind this price surge, the TVL of the Ethereum ecosystem also grew by 61.34% during the same period, with a net inflow of on-chain capital reaching $8.3 billion, making it the public chain with the largest inflow of funds once again. However, the growth in TVL is primarily attributed to the rise in ETH token prices. In terms of ETH quantity, the amount of ETH in the Ethereum ecosystem has been on a downward trend, decreasing from 28.39 million in April to about 22.28 million currently, a reduction of 21%.

In terms of on-chain daily active users and transaction counts, there was an increase of 11.94% and 16% respectively over the past three months, with no particularly noticeable improvements. Additionally, Ethereum's spot ETF saw a significant increase during this three-month period, with a net growth of about $5 billion. Coupled with several publicly listed companies in the U.S. following MicroStrategy's lead by adopting Ethereum as a reserve token, this has provided Ethereum with more buying pressure and positive market sentiment. Overall, capital-driven factors may be the main reason for Ethereum's significant price increase.

Solana: Market Cap Recovery Amidst Decreased Activity

In contrast to Ethereum, while SOL's price has also seen a significant increase recently, rebounding from $139 to a peak of $189, multiple data points from the Solana ecosystem show no significant improvement and even a downward trend. Over the past three months, there was a net outflow of approximately $112 million in on-chain capital, and the number of daily active addresses decreased by 14%. The issuance of stablecoins also saw a slight decline, reducing by about $1.5 billion.

The TVL amount increased during this period, rising from $7.3 billion to $9.237 billion. In terms of ecosystem performance, Pump.fun remains the largest platform in the Solana ecosystem by trading volume, contributing a trading volume of $234 billion in the past month. Additionally, among the top DEXs, OKX DEX ranked in the top ten with a monthly trading volume of $4.6 billion, which was unexpected.

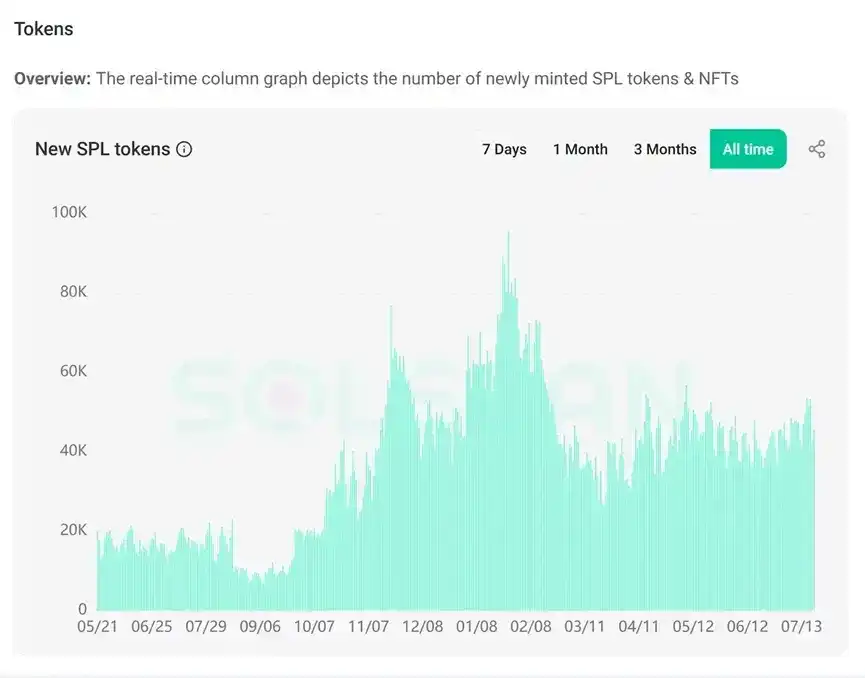

In the MEME coin sector, the current daily issuance of new tokens on Solana is about 40,000 to 50,000, a significant decline compared to the 90,000 to 100,000 level in January this year. However, overall, it remains relatively stable without a cliff-like drop.

Currently, Solana's staking rate is about 66%, but it is evident that the number of validators is decreasing, indicating that larger validators on Solana are gradually replacing smaller ones.

BSC: Alpha Activities Ignite On-Chain Revival

The data performance of BSC seems to be the complete opposite of Solana. In terms of token price, BNB's changes over the past three months have not been significant, rebounding nearly 30%. However, there has been a noticeable increase in on-chain daily active users, transaction counts, and stablecoin issuance. First, the number of daily active addresses grew from 25.2 million to 44 million, an increase of 74.6%; daily transaction counts rose from 7.85 million to 16.82 million, an increase of about 114%; and stablecoin issuance increased from $7.12 billion to $11 billion, a growth of 55%. From these data, BSC has seen a significant change in data over the past three months, likely driven by the Alpha activities.

Although on-chain activity has increased significantly, BSC experienced a net outflow of $950 million in on-chain capital over the past three months. Converting the active users brought in by activities into retained capital may be a challenge BSC needs to address moving forward.

Base: High-Speed Expansion Providing Lifeblood to Ethereum

Base's on-chain data performance is also quite impressive, with TVL increasing from $2.4 billion to $4 billion over three months, a growth of 63%. The number of daily active addresses grew from 15.6 million to 33.6 million, an increase of 115%, and daily transaction counts rose by 23%. Overall, Base's on-chain data has seen significant improvements, but there has been a large outflow of funds, with a net outflow of $5.6 billion over three months, making it the public chain with the largest net outflow. The data shows that these funds ultimately flowed to Ethereum. Base has also become the largest source of funds for the Ethereum mainnet recently.

Additionally, Base has launched Flashblocks technology, reducing block generation time from 2 seconds to 200 milliseconds, making it the fastest EVM chain currently. Meanwhile, Coinbase has introduced the Base App, creating a one-stop social and trading platform, which will further promote the development of the Base ecosystem.

Arbitrum: A Period of Accumulation for the L2 Runner-Up

Overall, Arbitrum's data has not changed significantly, with the exception of a 34% increase in TVL and a 22% increase in transaction counts. The number of daily active addresses has remained almost unchanged, at 4.6 million both three months ago and currently. However, ARB's price has recently rebounded by 66%, making it relatively strong among several major public chains. This may be attributed to the upward effect of Ethereum's price; although Arbitrum's data changes are minimal, it still firmly holds the second position among Ethereum L2s.

Sui: TVL and Token Price Soar Together

SUI's price has recently seen a significant increase, rising from $2.15 to a peak of $4.24, a growth of 97%, nearly doubling. Behind this surge, there is also some underlying data support. The TVL data increased from $1.2 billion in April to $2.2 billion, a rise of over 84%. Additionally, the issuance of stablecoins has also surpassed $1 billion. In terms of daily active addresses, Sui experienced a rollercoaster from May to June, first dropping from 1.5 million daily to 400,000 daily, then rebounding to around 1 million in early July. However, it has not yet returned to its previous peak levels.

Hyperliquid: Rocketing After Trust Issues

Hyperliquid has been one of the best-performing public chains over the past three months, with its token price soaring from $18 to $49.9, and its market cap surpassing $15 billion, ranking thirteenth among all tokens.

Reflecting on-chain data, the TVL increased from $640 million to $1.943 billion, a rise of 202%. The issuance of stablecoins grew from $2.1 billion to $4.9 billion, quickly becoming the fifth-largest public chain by issuance. After experiencing a previous crisis of decentralized trust, Hyperliquid's treasury HLP yield has also climbed back up recently, surpassing $68 million, setting a new historical high. Entering July, Hyperliquid's daily new user count has also risen again to over 3,000.

Aptos: A Lurker Amidst Data Slowdown

Compared to other public chains, Aptos appears somewhat underwhelming in both on-chain data and price performance. The price increased by 10% over three months, while key data such as TVL, capital inflow, and daily active addresses are all in the negative. The most significant change may be a 34% increase in daily transaction counts, with stablecoin issuance increasing by $300 million. Compared to Sui, which also uses the MOVE language, Aptos seems to be lagging behind in multiple data dimensions.

Overall, the recent performance of public chain data does not seem as intense as the market's reaction to token prices. Although networks like Sui, Hyperliquid, and Base have shown significant improvements in data driven by market momentum, the extent of these improvements is clearly lower than the rise in token prices. It is evident that this is a phase of recovery where capital precedes the ecosystem. Behind this recovery, whether the performance of token prices can translate into ecological prosperity for various public chains, and whether it can drive actual application tracks like DeFi and blockchain games as in previous bull markets, may be the core factor that sustains this round of altcoin season for a longer duration. Therefore, although the current prices and on-chain data seem out of sync, these data may become decisive factors for prices in future developments.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。