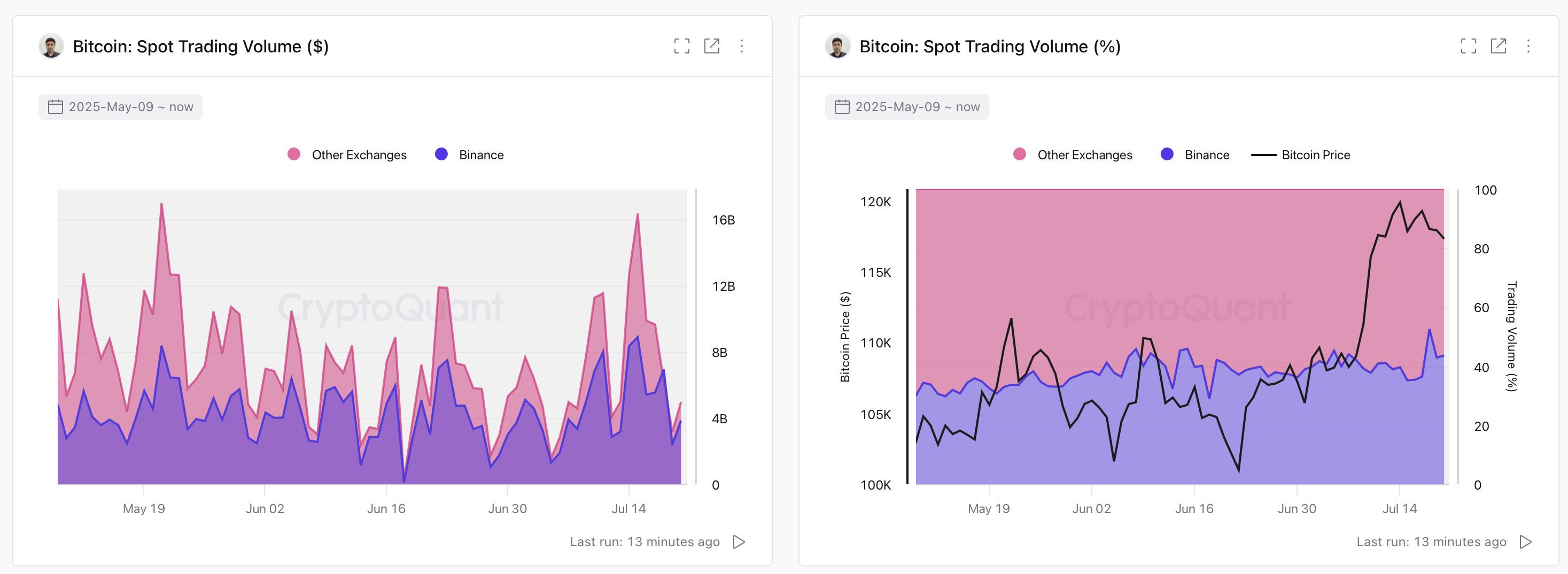

Spot trading really heated up on July 13 and July 14 as bitcoin neared and then smashed its previous peak. Binance’s bitcoin spot volume shot up from $3.1 billion to $8.4 billion, nearly tripling. Other exchanges saw their volumes climb too, moving from $5 billion to $12.7 billion, a jump of 2.6 times, according to Julio Moreno, the head of research at cryptoquant.com.

Altcoins joined the party with similar energy. Binance’s altcoin spot volume ballooned from $11.5 billion on Jul. 13 to $20.4 billion on July 14—that’s a 77% pop. Meanwhile, combined altcoin volumes on other centralized platforms rose from $22.3 billion to $33.6 billion, a solid 51% gain.

Source: cryptoquant.com

Binance didn’t just grow more; it gobbled up extra market share. Its slice of the total bitcoin spot pie grew from 39% to 48% the day after the record high. Similarly, Binance’s share of altcoin trading volume jumped from 34% to 47% over those same two exciting days.

By July 18, Binance commanded 52.6% of all bitcoin spot trading, firmly in the lead. For altcoins, it captured 49.41% of the action. These levels left rivals in the dust: Bybit (11.67% bitcoin, 8.11% altcoin), OKX (6.9% bitcoin, 7.88% altcoin), and MEXC (2.98% bitcoin, 10.4% altcoin).

The excitement wasn’t confined to spot markets. When bitcoin hit its high, open interest (OI) in perpetual futures across centralized platforms hit a fresh peak of $43 billion, the Cryptoquant research shows. Binance topped the list with $14.1 billion in open interest, chased by Bybit and Gate.io, each hovering near $9 billion.

In the 30 days before the peak, Binance racked up the biggest cumulative open interest rise at $3.6 billion. Gate.io and Bybit trailed with increases of $2.3 billion and $2.5 billion, respectively. This jump in open interest pointed to more money flowing into derivatives, likely as traders piled in, betting big on even higher prices.

Binance kept its foot on the gas even after bitcoin cleared $120,000. On July 15, its 24-hour bitcoin spot volume hit $8.8 billion. Others, however, saw a 25% dip, falling to $9.5 billion. This hints that Binance didn’t just draw a wave of users during the rally; it held onto its trading mojo as others slowed down.

Beyond Binance, MEXC took second place in altcoin spot volume with 10.4%, followed by Bybit, OKX, and HTX at 8.11%, 7.88%, and 7.35%. Cryptoquant’s data shows trading focused heavily on a few big exchanges as participants chased liquidity in this whirlwind of volatility.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。