Crypto ETFs Pull in $1.1 Billion As Ether Steals the Spotlight From Bitcoin

For the first time ever, ether ETFs outshone bitcoin ETFs in daily inflows, marking a significant milestone in ETF trading activity. Ether funds hauled in $602.02 million, narrowly edging out bitcoin’s $522.60 million, in a day that saw total crypto ETF inflows top $1.1 billion.

Once again, Blackrock’s ETHA dominated the ether side, bringing in a staggering $546.70 million. Grayscale’s Ether Mini Trust followed with $29.90 million, while Fidelity’s FETH pulled in $17.19 million.

Smaller but steady flows came from Bitwise’s ETHW ($4.44 million) and 21shares’ CETH ($3.78 million). Trading volume stayed at $2.29 billion, pushing ether ETF net assets to a record $17.32 billion.

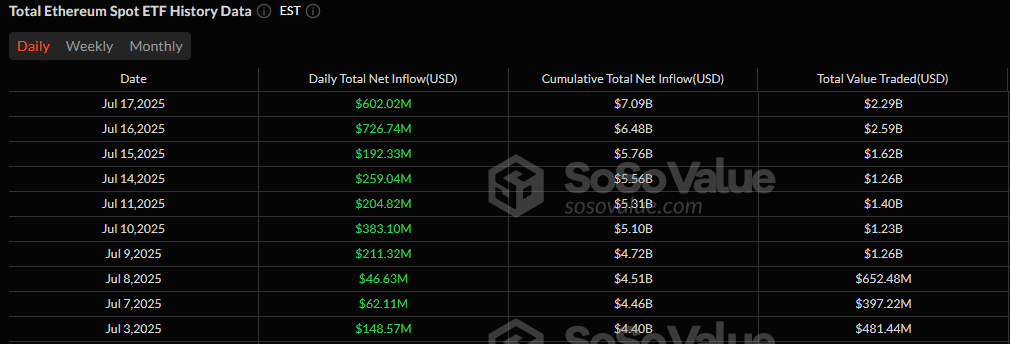

Source: Sosovalue

Bitcoin ETFs, though outpaced for the day, continued their winning streak with $522.60 million in net inflows, marking the 11th consecutive day of green flows.

Blackrock’s IBIT captured the lion’s share with $497.30 million, while Fidelity’s FBTC ($7.83 million), Invesco’s BTCO ($7.12 million), Grayscale’s Bitcoin Mini Trust ($5.27 million), and Vaneck’s HODL ($5.08 million) rounded out the pack. No outflows were recorded. Total trading volume reached $3.76 billion, with bitcoin ETF net assets rising to $154.61 billion.

As the competition between ether and bitcoin ETFs intensifies, one thing is clear: institutional demand is thriving on both sides of the crypto divide.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。