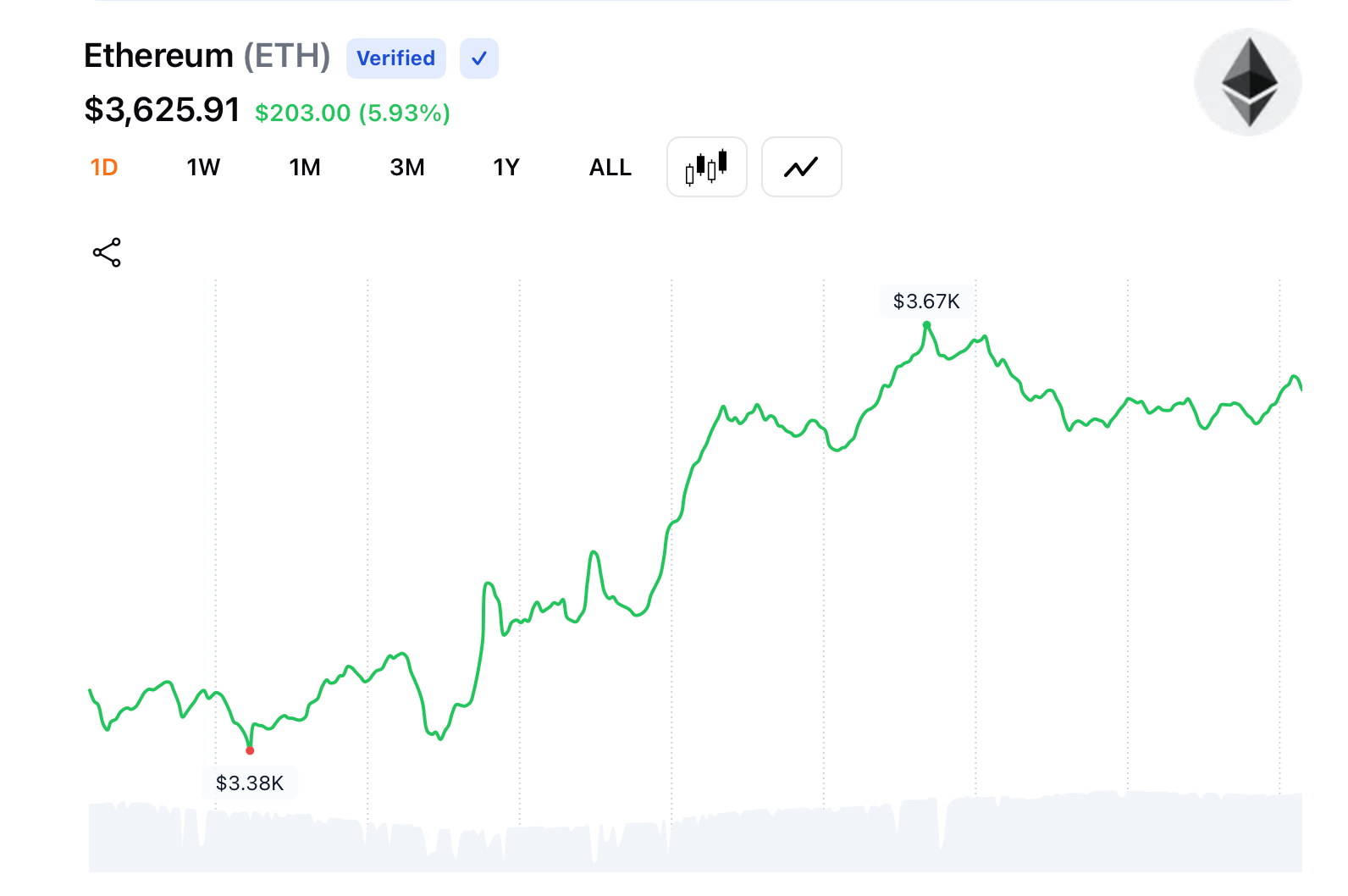

On Thursday, ethereum (ETH) changed hands at 0.029 BTC, priced at $3,408 per coin at 11 a.m. Eastern time (ET). At present, 9:30 a.m. ET, it’s trading at $3,625 per coin, or 0.03038 BTC in comparison to the leading crypto asset bitcoin. Yesterday, ETH’s share of the $3.91 trillion crypto market stood at 10.9%. By Friday, that figure had edged up to 11.2% of the total valuation.

In the derivatives arena, ETH shorts have dominated the liquidation tally. Of the $819.79 million wiped out, $130.49 million came from short positions betting against ether, while another $102 million was tied to liquidated long ETH plays. If the price momentum holds, the market could be staring down one of the biggest short squeezes in history, with bulls steadily driving ether higher.

Ethereum options are buzzing with bullish energy, according to metrics collected by Coinglass. Call contracts are firmly in control, accounting for 66.31% of open interest and 62.19% of 24-hour volume. That translates to over 2.25 million ETH in calls, stacked against roughly 1.15 million ETH in puts.

The standout favorite? Deribit’s September 2025 calls at the $4,000 ETH strike, now leading open interest with 98,264 ETH. In terms of volume, the $3,800 ETH call for the same expiry takes the crown, with more than 23,000 ETH changing hands. Whether traders are eyeing July, September, or December, the bet is clear—there’s fuel left in ether’s tank.

As capital flows and sentiment shift, ethereum’s current trajectory suggests traders are positioning for a decisive break from recent norms. The alignment of technical strength, derivatives pressure, and rising market share paints a picture of growing conviction. Whether driven by speculation or fundamentals, ether now stands at a crossroads where momentum could evolve into something far more structurally significant.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。