Original Author |@0xArtikal

Compilation | Odaily Planet Daily (@OdailyChina)

Translator | Dingdang (@XiaMiPP)

This article is compiled from two tweets by @0xArtikal and assembled by Odaily Planet Daily. As the current market heat continues to rise, this article attempts to provide readers with observations and judgments from market participants from the perspective of capital flow and cyclical evolution, listening to the voice of the market. The views in this article are for reference only and do not constitute any investment advice.

Bitcoin has broken its historical high, with the price reaching as much as $123,000. This trend has sparked market divergence: some investors are bullish up to $200,000, believing there is still room for growth; others believe it is nearing the cycle top and suggest taking profits.

However, compared to these market sentiments, what is more noteworthy is the data itself. An analysis of trading behavior and capital flow shows that the current market is far more complex than it appears on the surface.

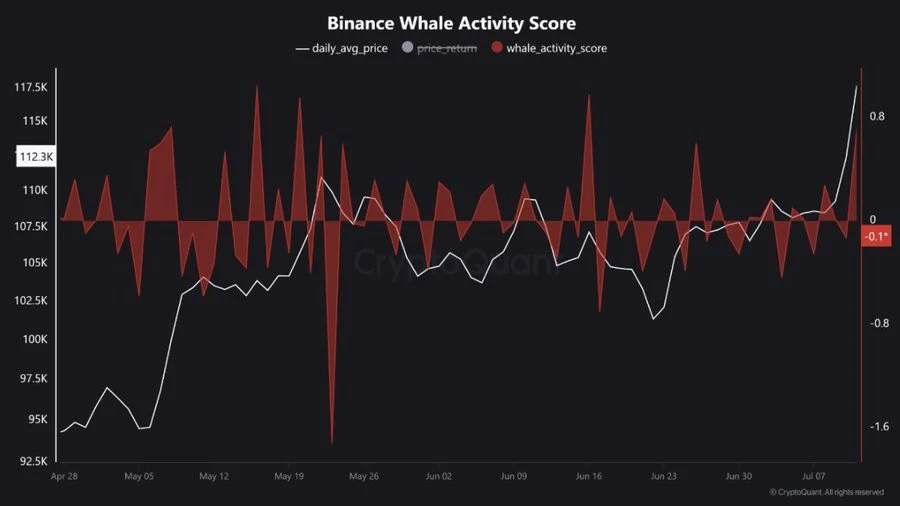

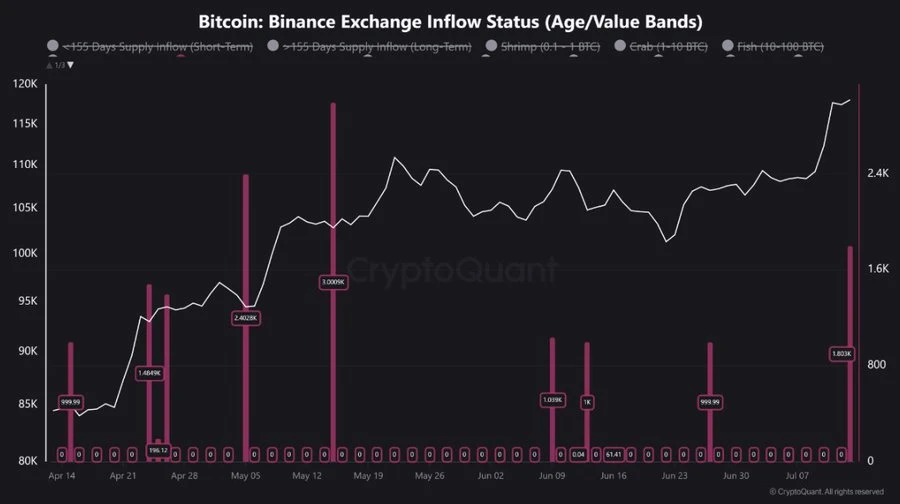

As BTC surged to new highs, significant changes occurred in the behavior of large holders on Binance. The whale activity indicator suddenly rose, indicating that market sentiment may be shifting. In just one day, over 1,800 BTC net flowed into Binance, meaning a large amount of capital is moving towards more liquid trading platforms.

Further observation reveals that over 35% of these inflows came from single transactions exceeding $1 million, clearly not from retail investors. A large amount of data indicates that this is a collective response from several large holders to the new high, showing strong coordination.

Additionally, data shows that most of the coins flowing into exchanges have been held for less than three months, indicating a strong speculative nature. However, at the same time, some long-term holders who have held their coins for over a year are also transferring tokens to exchanges, adding a layer of uncertainty to the market's future direction.

The first possibility is typical profit-taking. Transferring BTC to exchanges immediately after the price hits a new high likely means that investors intend to cash in on their profits. This operation is not uncommon; they often prefer to lock in profits at high levels and then look for opportunities to re-enter the market. If this trend continues, the market may experience a mild correction in the coming days.

The second possibility is more strategic. The movement of these large funds may be for risk hedging or to establish leveraged positions using Binance's deep liquidity. This means that these large holders may anticipate further market volatility and are currently preparing for the next round of market movements. If this is the case, even if a short-term adjustment occurs, its magnitude may be small, and the market is expected to quickly regain balance.

What is even more noteworthy is that this wave of capital flow involves both short-term speculators and long-term holders, indicating that multiple large participants are likely executing some strategy in sync. In just one day, over 1,800 BTC were transferred to Binance, which significantly impacts the platform's short-term liquidity and increases the market's sensitivity to large orders.

The actions of these whales are likely driven by strategic considerations, aiming to seize the turning point of the trend. At this critical psychological juncture, the collective actions of large holders often exert pressure on retail sentiment. As prices hit new highs, market sentiment swings violently between excitement and tension, further catalyzing the speculative atmosphere and increasing the probability of short-term volatility.

Meanwhile, the overall liquidity on Binance is also rising, attracting more institutional traders to enter the market. For these professional players, the ability to quickly build positions and flexibly close them is particularly crucial. At this stage, whale behavior almost dictates the overall market sentiment and price direction. Therefore, for all investors, closely tracking capital flows, especially real-time large transfers, is particularly important.

Regardless of whether the market chooses to correct or continue to oscillate upward, one thing is certain: current volatility is rising, and risks are increasing. Any subtle changes in sentiment and liquidity will almost immediately reflect in prices. The entire market is in an extremely sensitive period, where even minor events could become the trigger for a market surge.

We have previously witnessed that merely one large holder's actions on Binance triggered a new round of Bitcoin breakout. This fully demonstrates the decisive impact of large capital behavior on market structure.

For long-term investors, this may not be a signal to "liquidate and flee," but rather a test of trend resilience. A large amount of BTC flowing into exchanges may simply be a strategic reallocation rather than a massive withdrawal. Of course, severe volatility in the short term is almost unavoidable and may also serve as a window for reconfiguring assets and optimizing positions.

Currently, the market is in a delicate balance: profit-taking coexists with strategic deployment. In the coming days, the movements of large holders on Binance and changes in the overall liquidity environment will continue to dominate market rhythm. Investors need to remain highly vigilant and be ready to adjust strategies based on market dynamics.

After all, Bitcoin is still in the spotlight, and its every move continues to affect the nerves of the entire crypto market.

Note: This tweet was published on July 17, 2025.

Cyclical Market Structure Evolution Path

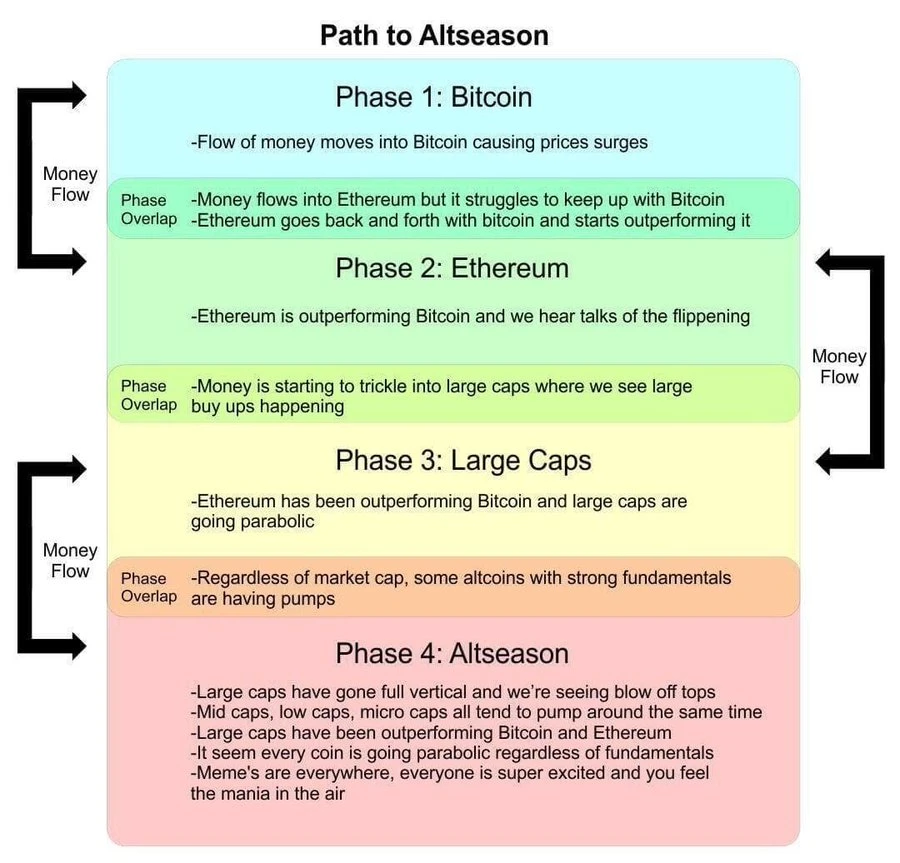

If we look at the typical evolutionary path of past crypto market cycles, how do we define our current position?

As BTC leads the price breakout, ETH is beginning to show relatively strong signs. From the ETH/BTC trend, the exchange rate has broken out of the consolidation range of several months, which is the first signal that the rotation structure is officially unfolding.

Generally speaking, market rotation always unfolds along this path: BTC leads → ETH follows → High market cap coins catch up → Ultimately leading to a full altcoin season. The fact that ETH is outperforming BTC indicates that market liquidity is shifting from the BTC-dominated structure to the next phase represented by ETH.

BTC usually launches the first offensive, and when ETH starts to catch up, even performing stronger, it indicates that broader capital is willing to take on higher risks. ETH is not just ETH; it is also a "bridge" to DeFi and other altcoins. Its strength signifies a recovery of confidence in the entire market.

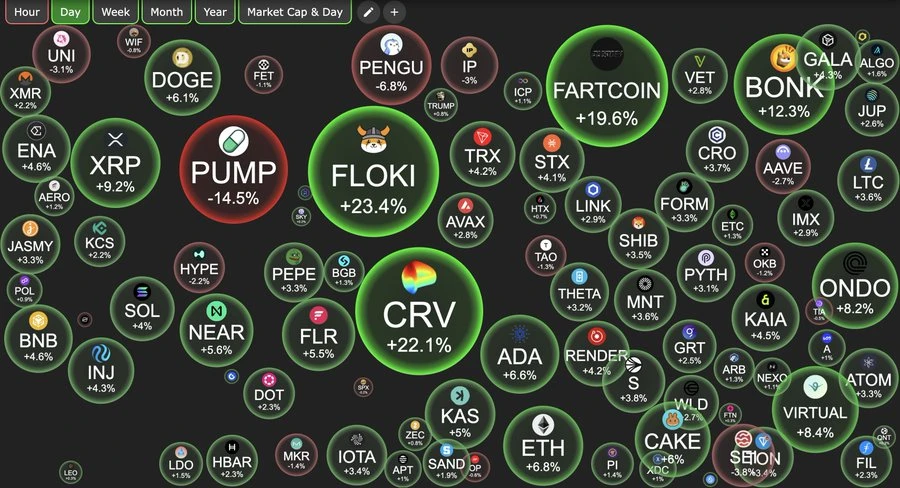

After ETH gains momentum, high market cap projects like SOL, XRP, and ADA have begun to see strong buying interest, typically serving as "index-like" alternative bets following ETH. Once these coins start to move, capital will continue to flow into mid-cap projects below $1 billion, retail attention will surge, and market narratives will change daily. Traders will accelerate capital rotation to seek higher Beta returns.

Mining coins (such as DCR) usually start to follow suit only after mid-cap coins have launched, at which point the market enters a highly reflexive state: the more prices rise, the more inflows there are, and the more inflows there are, the faster prices rise. This stage is a breeding ground for Memecoins to explode into short-term parabolic trends.

This entire rhythm is essentially a natural chain of "liquidity sinking." Starting from BTC leading, capital migrates step by step: ETH, mainstream altcoins, mid-cap coins, and then Meme and small-cap tokens. Throughout this process, volatility and market acceleration continuously increase.

Structurally, we are standing at the starting point of the "ETH phase": rotation is beginning to appear, it has not yet overheated, and the opportunity window is still open. ETH's strength will further drive liquidity to continue migrating downward, while retail FOMO sentiment has not yet been fully ignited. The Fear and Greed Index remains at 60–65, leaving room before reaching extreme sentiment. This also means that this cycle still has enough upward potential.

The overall direction of the market is already very clear: BTC has lit the fuse, ETH is taking over to accelerate, and high market cap tokens will quickly catch up. After this, the true full altcoin season will arrive as expected, with mid-cap coins, Memecoins, and various concept coins taking turns until all liquidity is exhausted.

ETH's leading performance is not only a confirmation of the trend but also the starting point for the next phase.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。