Author: Frank, PANews

The year 2025 is a pivotal year in the development of stablecoins.

In this year, stablecoins not only set records in market size and trading activity, but regulatory policies and capital interest also accelerated simultaneously. An asset class that originally emerged as a "safe haven" tool within the crypto market is gradually moving towards the forefront of global payments, cross-border trade, DeFi infrastructure, and even sovereign credit.

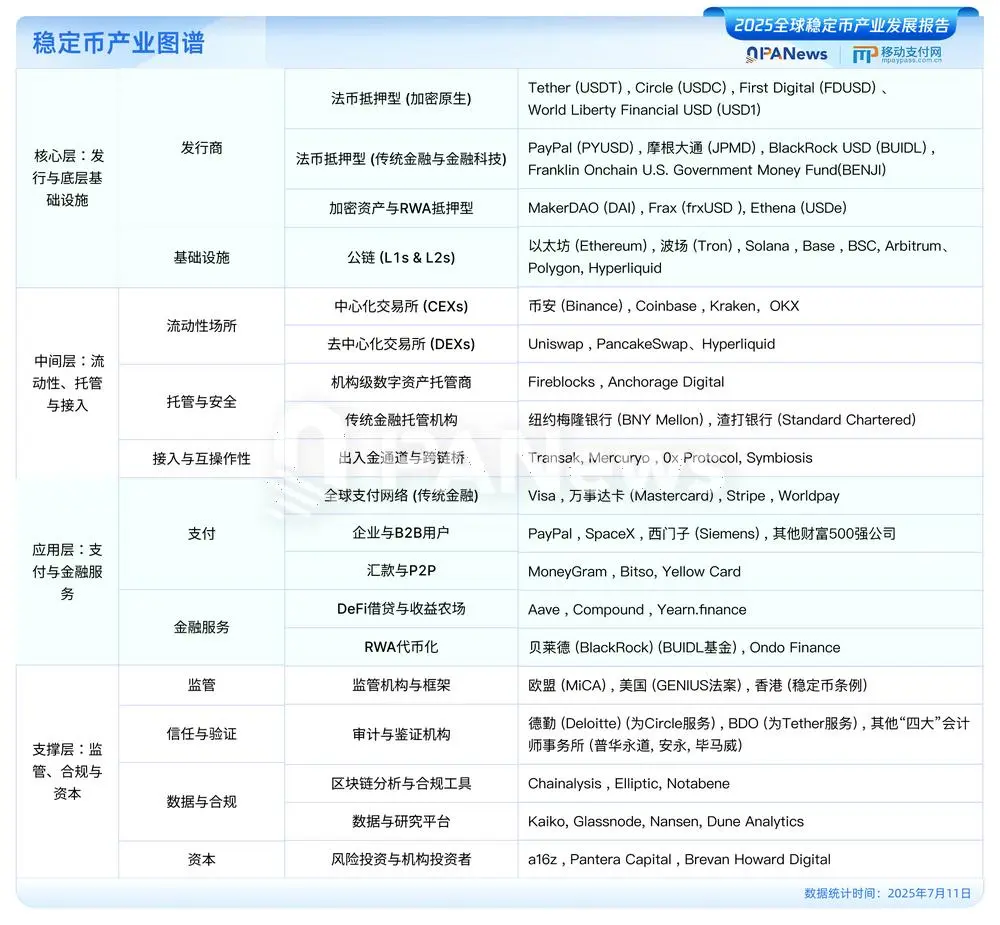

The "2025 Global Stablecoin Industry Development Report" jointly released by PANews and Pionex points out that stablecoins have become one of the most critical infrastructures connecting traditional finance and the crypto world, and are changing the global financial operating landscape. The report tracks and analyzes the stablecoin industry comprehensively, combining on-chain transaction data, policy developments, and industry evolution paths, systematically sorting and analyzing from six dimensions: development history, market structure, application scenarios, global regulation, development potential, and potential risks.

US Dollar Stablecoins Hold Absolute Advantage

The report finds that in the global stablecoin market, US dollar stablecoins hold an absolute market share, with an issuance volume reaching $256.4 billion, while stablecoins of other fiat currencies are still in their infancy, with the euro stablecoin ranking second at only $490 million. Stablecoins for the Japanese yen, British pound, South Korean won, and Turkish lira range from hundreds of thousands to tens of millions of dollars. This indicates that non-US dollar fiat stablecoins still have significant potential.

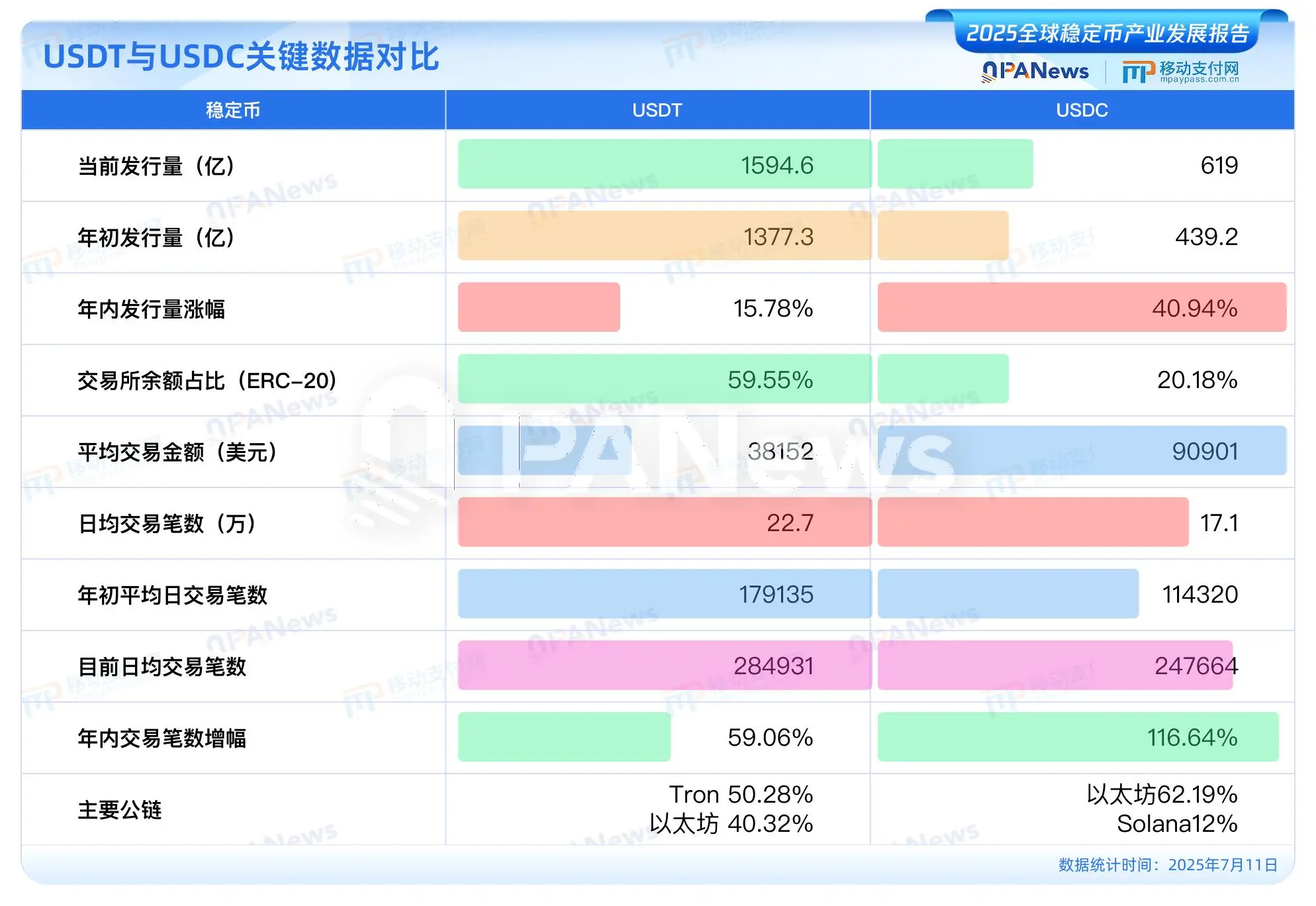

As of July 2025, the total market capitalization of global stablecoins has exceeded $250 billion, showing significant growth since the beginning of the year. Among them, Tether (USDT) and Circle's USDC together account for 86.5% of the market, forming a dual oligopoly in the stablecoin sector. Meanwhile, the total on-chain transfer amount reached $36.3 trillion, surpassing the total annual transaction volume of Visa and Mastercard, becoming a new cornerstone of the global payment network. Additionally, USDC has shown significant growth in 2025, with an annual growth rate of 40.9%. Based on this growth rate, USDC is expected to surpass USDT around 2030.

This explosion is not a fleeting phenomenon but the result of multiple forces working together:

Major economies such as the US, Europe, and Hong Kong are gradually advancing stablecoin legislation, with regulatory paths becoming clearer;

Traditional financial and tech giants like JPMorgan, BlackRock, PayPal, JD.com, and Ant Group are all getting involved;

Circle, the parent company of USDC, successfully went public in the US, igniting the capital market's imagination for stablecoins;

Users in high-inflation regions (such as Argentina, Turkey, and Nigeria) view it as a "digital dollar" hedging tool;

Emerging scenarios such as DeFi, RWA, and payment settlements continue to inject real demand for stablecoins.

From the perspective of on-chain activity, the number of global monthly active stablecoin addresses has exceeded 30 million, and the total number of on-chain holding addresses has surpassed 168 million. According to Visa data, after excluding bots and exchange wallets, the proportion of transactions led by real users has increased from less than 15% in 2023 to around 22% currently, with the user structure gradually transitioning from arbitrage bots to enterprises and retail investors.

From Circle to JD.com, Stablecoins Enter the "Mainstream Battlefield"

The role of stablecoins is evolving from "trading hedging anchor" to "mainstream digital financial asset." This year, many global tech giants and financial institutions have successively increased their stablecoin layouts:

Circle's IPO: Stablecoin issuer Circle successfully listed on the US stock market, with a market value once approaching 100 billion RMB, becoming the first "quasi-systemically important financial company" in the stablecoin industry;

PayPal and Visa integrate stablecoin settlements: PayPal launched the PYUSD stablecoin and deployed it on high-performance public chains like Solana; Visa introduced USDC in B2B settlements with Worldpay;

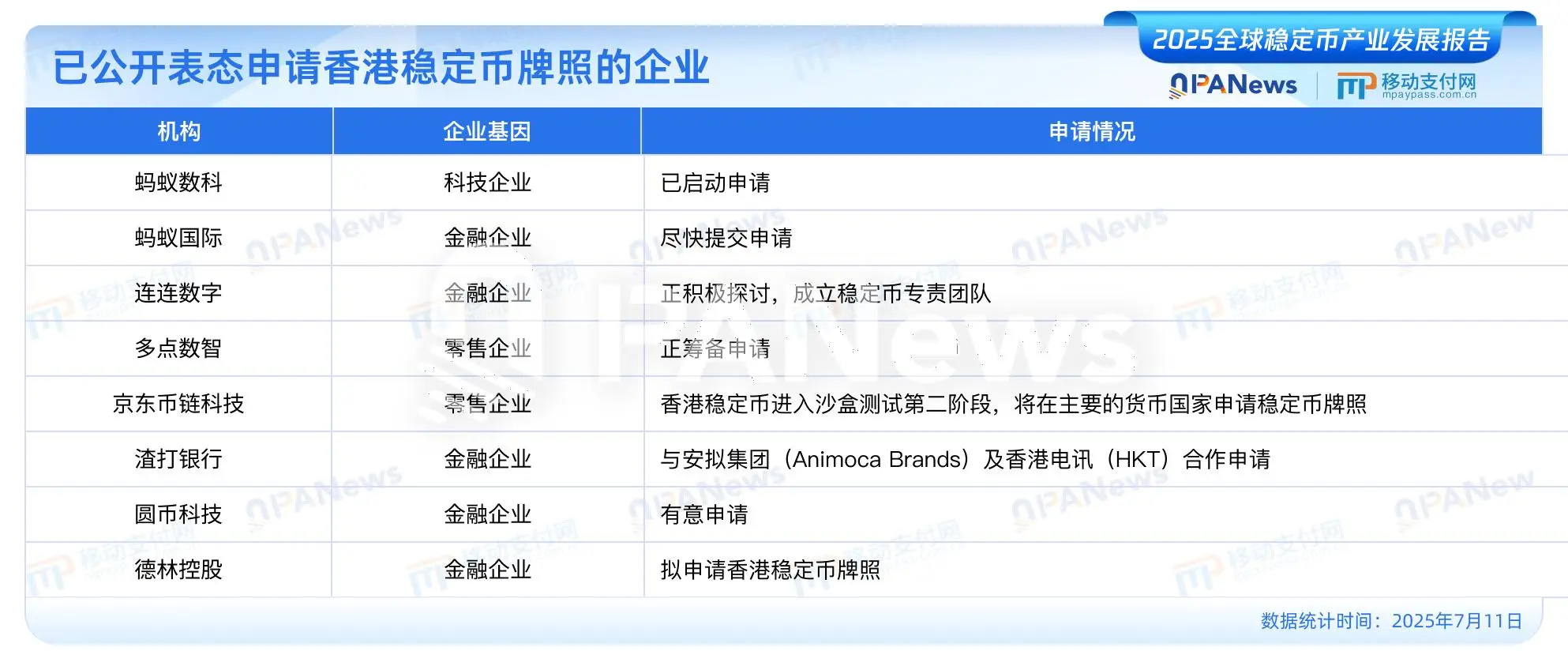

JD.com and Ant Group enter the Hong Kong stablecoin market: JD.com's stablecoin has entered the regulatory sandbox testing phase in Hong Kong, with application scenarios including cross-border payments, investment transactions, and consumer settlements;

Shopify and Walmart support stablecoin payments: Retail giants are promoting the direct use of stablecoins for online retail payments through partnerships with Stripe, Coinbase, and others;

Emerging public chains experience high growth: New public chains like Base and Solana attract a large number of stablecoin deployments due to low fees and high scalability, with Solana's stablecoin market value growing over 600% this year.

The joint efforts of traditional finance, internet platforms, and crypto-native forces have upgraded stablecoins from "crypto-specific settlement tools" to widely usable digital payment intermediaries, also raising higher requirements for their regulatory compliance.

Structural Uncertainties Remain Behind the Scale Boom

However, behind the hot market performance, stablecoins also face many structural challenges and controversies.

First is the issue of "real usage scale." The report points out that although the total transfer amount of stablecoins reaches $36 trillion, as much as 70-80% of this consists of "virtual traffic" such as transfers by bots and within exchanges, and the actual C-end or enterprise usage scale still needs further exploration and definition.

Second is the issue of "anchoring mechanisms and transparency." Although USDT is at the top of the industry, it has yet to release a complete audit report issued by one of the "Big Four" accounting firms, and its reserve asset structure and risk exposure have long been a focal point of market controversy; while USDC, despite being more transparent and compliant, still lags behind USDT in terms of application popularity and ecosystem integration.

Additionally, there are still differences and games among regulatory policies in various countries, with some regions not yet allowing stablecoin usage, while some markets (such as Hong Kong and Singapore) actively take on the role of experimental fields for institutional innovation.

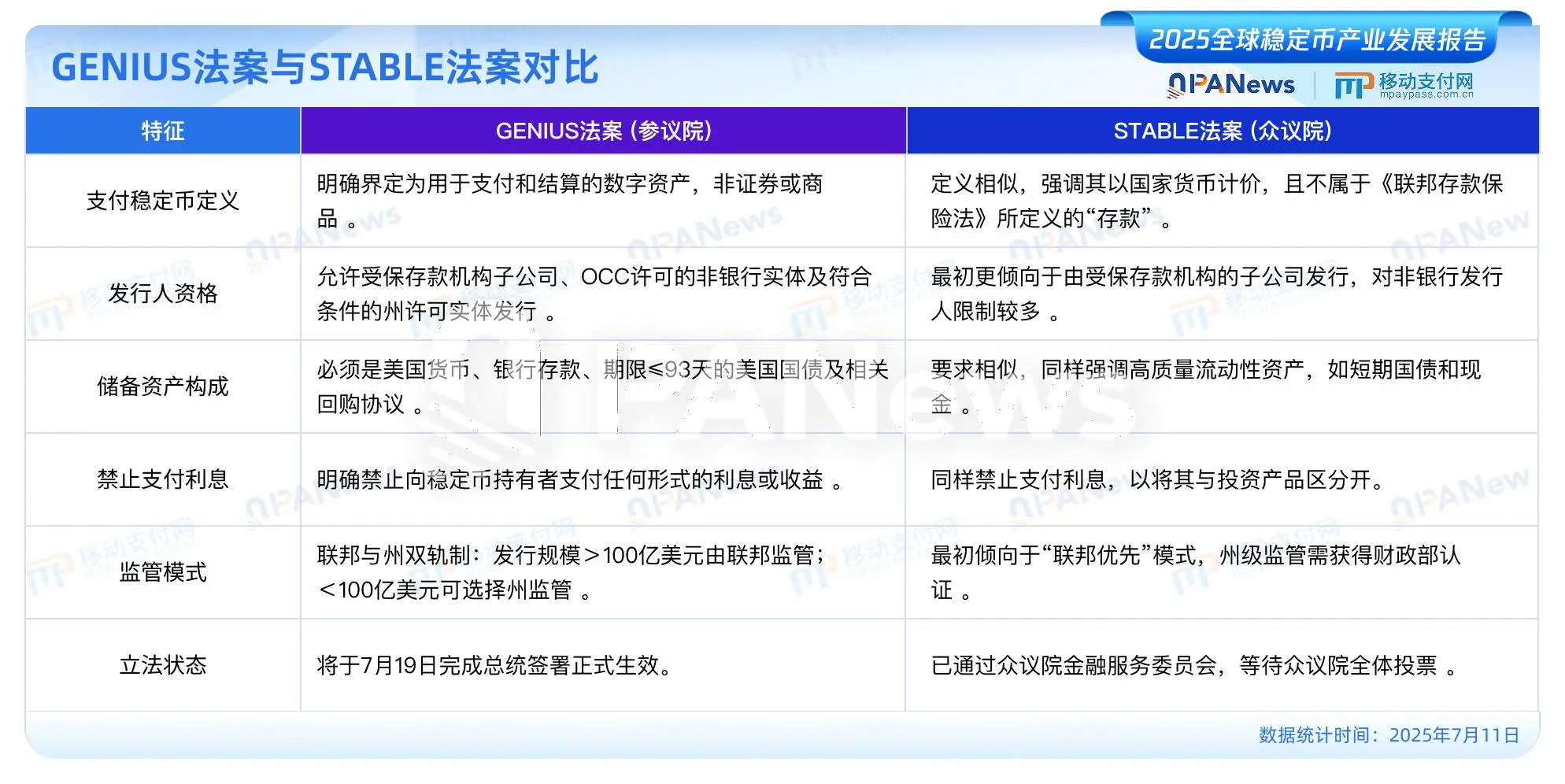

It is worth noting that the US "GENIUS Act" has clearly stated that stablecoins do not fall under securities, prohibits algorithmic stablecoins, and requires reserves to be 100% high-liquid assets (such as cash and short-term US Treasury bonds). If this legislation is formally enacted, it will profoundly impact the operational logic of existing mainstream stablecoins and the global compliance structure.

Report Highlights: A Six-Dimensional Panorama of Stablecoin Evolution

The report jointly released by PANews and Pionex adopts a method of on-chain statistics + classification tracking + public information cross-verification to comprehensively sort out the development of stablecoins, covering the following six dimensions:

Development history: From BitUSD to USDT, DAI, USDC, reviewing the ten-year evolution path of stablecoins;

Market structure: Detailed explanation of the "USDT + USDC" dual oligopoly structure, public chain issuance share distribution, monthly active user trends, and other core data;

Application scenarios: Focusing on the key roles of stablecoins in cross-border payments, DeFi, retail payments, and RWA;

Global regulation: Systematically sorting out the regulatory dynamics and legislative paths of major economies such as the US, China, Europe, Hong Kong, Japan, and South Korea;

Future potential: Analyzing how stablecoins can become a global payment network, the purchasing power of US Treasury bonds, and the competitive relationship with CBDCs;

Risk warnings: Covering potential challenges such as de-pegging, audit transparency, systemic attacks, and money laundering regulatory issues.

The report also specifically points out that non-US dollar stablecoins are still in the early stages of development: the market value of euro stablecoins is less than $500 million, and stablecoins for currencies like the Japanese yen, British pound, and South Korean won are mostly in the tens of millions of dollars, indicating there is still enormous room for expansion in the future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。