Written by: Yangz, Techub News

Waking up, the industry welcomes good news again. On Thursday, Eastern Time, the U.S. House of Representatives passed three key cryptocurrency legislations with overwhelming support, including the CLARITY Act, the GENIUS Act, and the Anti-CBDC Surveillance National Act (for specific details on the three bills, refer to: “Crypto Week” is Here: What Impact Will the Three Major Bills Under Review by the U.S. House Have on the Industry?). Among them, the CLARITY Act and the Anti-CBDC Surveillance National Act will be sent to the Senate for review, while the GENIUS Act is expected to be signed into law by Trump on Friday local time.

Despite some setbacks, this critical moment referred to by industry insiders as "Crypto Week" is likely to achieve great success. Even more exciting for the market is that, according to The Financial Times citing informed sources, the Trump administration is preparing an executive order that would allow 401(k) retirement plans to invest in cryptocurrencies and other assets. This series of policy "combination punches" marks the acceleration of the regulatory framework for digital assets in the U.S., yet amidst the cheers, doubts and opposition continue to brew.

A Bumpy "Crypto Week"

Although the three key cryptocurrency bills are advancing rapidly, the process has not been smooth. Earlier this week, a few Republicans failed to reach a consensus on the final vote for these three bills due to policy disputes. Informed sources revealed that the House leadership did not fully consult with the Republican caucus before announcing "Crypto Week," leading to repeated setbacks in the legislative process this week.

According to CNN, on Tuesday, more than a dozen Republican lawmakers, including Trump ally Marjorie Taylor Greene, suddenly launched an attack, voting against submitting the GENIUS Act for a full House vote. These lawmakers, mainly from the conservative "Freedom Caucus," insisted that the bill must include a clear prohibition on central bank digital currencies (CBDCs) to echo the executive order signed by Trump in January this year. This sudden "rebellion" forced House Speaker Mike Johnson to postpone the final vote, nearly derailing the carefully planned "Crypto Week" agenda.

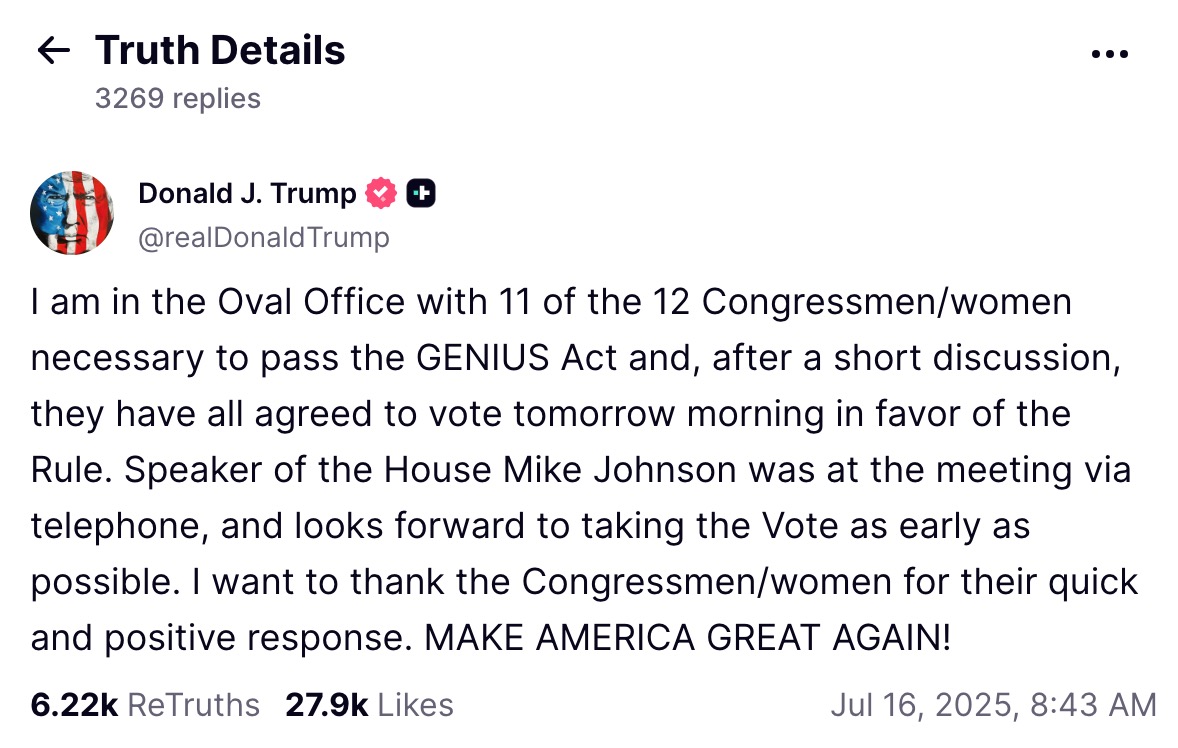

In a crisis, Trump personally intervened to mediate. On Tuesday evening, he held an emergency meeting with Republican caucus members at the White House, emphasizing the importance of passing the GENIUS Act to maintain America's leadership in the digital asset space. After an all-night negotiation, both sides finally reached a compromise: the CBDC prohibition clause would be included in the defense authorization bill that must be passed later this year. This political deal broke the deadlock but also created the longest voting record in the modern history of the U.S. House—Wednesday's procedural vote lasted an astonishing 9 hours and 40 minutes. On July 16, Trump posted on Truth Social, stating, "I am meeting with 11 of the 12 members of Congress needed to pass the GENIUS Act in the Oval Office. After a brief discussion, they all agreed to vote in support of the bill tomorrow morning. House Speaker Mike Johnson participated in the meeting by phone and looks forward to voting soon. I want to thank the Congress members for their quick and positive response. MAKE AMERICA GREAT AGAIN!" Subsequently, Mike Johnson also tweeted indicating that Republicans agreed to push cryptocurrency legislation.

Voices of Opposition

Despite the legislative process moving forward, the controversy surrounding these three bills has not diminished in the slightest.

Democratic Congresswoman Maxine Waters sharply pointed out in an MSNBC column that these bills, cloaked in the guise of innovation, are merely repeating the mistakes of past financial crises. She emphasized that these bills lack effective regulatory measures and do not impose any restrictions on the Trump family's substantial cryptocurrency holdings. "Most importantly," she wrote, "these bills have a special, deliberate design that makes them particularly dangerous: they will legalize unprecedented cryptocurrency corruption by the U.S. president." Maxine Waters pointedly stated that the "post-regulation" model established by the CLARITY Act would reduce the SEC to a "financial coroner"—only able to investigate after investors suffer losses, a design that essentially condones a repeat of FTX-style fraud. The GENIUS Act, she argued, resembles a "toothless tiger," lacking a regulatory budget, and its so-called consumer protection provisions lack the most basic community reinvestment requirements and third-party audit mechanisms found in bank regulation.

On a national security level, Waters' criticism is equally direct. In her view, the CLARITY Act's so-called "compliance" with the Bank Secrecy Act is merely lip service, while its comprehensive regulatory exemption for decentralized finance conveniently provides regulatory arbitrage opportunities for Trump-affiliated businesses. Even more concerning is that the GENIUS Act opens the door for foreign cryptocurrencies with significant national security risks.

Additionally, Waters pointed out that these bills, which claim to promote "financial democratization," could ultimately create "Wall Street 2.0"—by imposing high compliance costs, effectively pushing small and medium-sized innovators out of the market. She warned, "If these bills ultimately become law, the U.S. will face its first cryptocurrency financial crisis."

Hilary Allen, a professor at an American law school, stated that these bills are essentially tailored by the cryptocurrency industry for itself. She warned that the GENIUS Act allows corporate giants like Walmart and Meta to issue stablecoins, potentially recreating the chaos of the 19th-century "wildcat banking" era, ultimately leaving taxpayers to bear the rescue costs for those "too big to fail" tech companies. Meanwhile, Hilary Allen half-jokingly suggested that the public "learn to grow potatoes" in preparation for possible turmoil in the financial system.

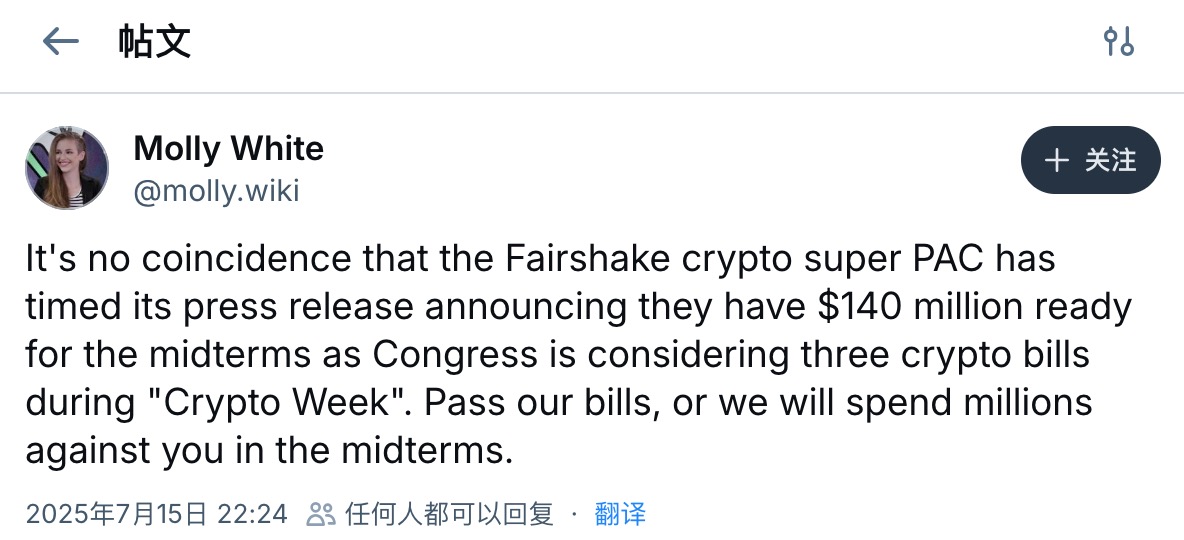

Furthermore, the cryptocurrency industry's remarkable political lobbying power has also drawn attention. The cryptocurrency super PAC Fairshake recently announced it is prepared to spend $140 million on the midterm elections. Given its dominance in political spending for the 2024 election, investing $131 million in congressional campaigns and helping dozens of pro-cryptocurrency lawmakers get elected, independent journalist and tech researcher Molly White wrote on Bluesky that Fairshake's choice to release a press release at this time is no coincidence; it is essentially a hint that "if the bill does not pass, we will confront you in the midterm elections."

Conclusion

The deeper significance of this legislative tug-of-war lies in the fact that it is not just a technical discussion about how to regulate cryptocurrencies, but also a difficult exploration of how the U.S. seeks to find a balance between promoting innovation and preventing risks in the digital economy era. The strong intervention of the Trump administration, the $140 million lobbying pressure from Fairshake, and the sharp criticisms from academia all highlight that this game has transcended the nature of mere regulatory discussions. As 401(k) pensions may allocate Bitcoin and tech giants gain the right to issue stablecoins, "Crypto Week" may just be the prologue, with the real test gradually unfolding in market practice.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。