Overview:

- Ethereum is increasingly seen as a reserve asset in the digital dollar economy, with over 54% of stablecoins issued on Ethereum.

- Fidelity views Ethereum as a sovereign digital economy, where ETH serves both as a store of value and a medium of exchange.

- Recent reports indicate that the decline in ETH fees is a strategic move to scale through L2s, laying the groundwork for mass adoption and future value accumulation.

Last week, Ether (ETH) surged by 23%, outpacing Bitcoin's 13% increase and the overall cryptocurrency market's 10% rise. However, Ether's current trading price of $3,400 remains well below its historical high of $4,855 set in November 2021. While Bitcoin has entered a price discovery phase, Ethereum seems to have greater upside potential if the right narrative holds.

Every major bull market requires a resonant story. In 2021, Ethereum rebounded on the back of NFTs and DeFi. But today, overpriced JPEGs and decentralized exchanges no longer generate the same market excitement. Instead, Ethereum's appeal lies in its increasingly close integration with traditional finance (TradFi), primarily through its role in stablecoins and the tokenization of real-world assets (RWA).

These evolving use cases are redefining Ethereum as more than just a utility token. It is increasingly viewed as a reserve asset, a store of value, and even as digital oil.

ETH as a Reserve Asset

A new report from Electric Capital highlights Ethereum's leadership in stablecoin issuance and settlement.

Despite declining trust in the dollar, global demand for the dollar remains strong among individuals and businesses. Thanks to blockchain technology, for the first time in history, anyone with internet access can hold and use digital dollars without a bank. Since 2020, the usage of stablecoins has grown 60-fold, now exceeding $200 billion.

These stablecoins are evolving into financial instruments. According to data from The Block, yield-bearing stablecoins currently have a market cap exceeding $4 billion, making it the fastest-growing sector where users can earn passive income through stable assets.

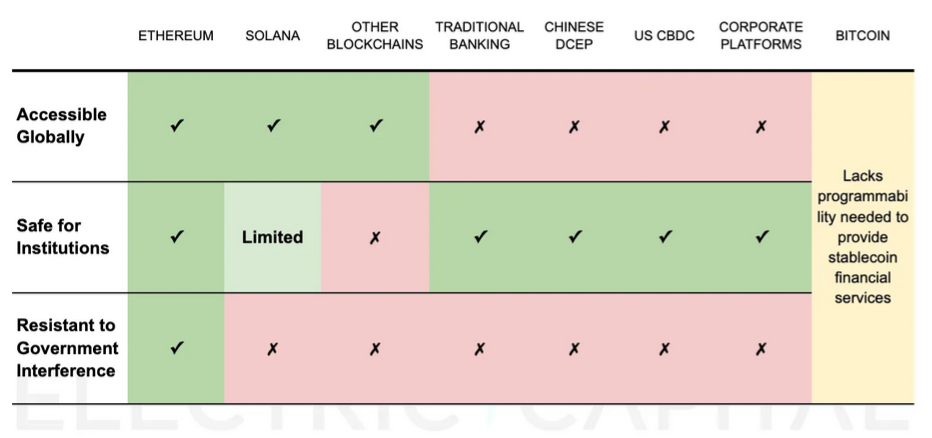

Ethereum still dominates this space, holding over 54% of stablecoins. Electric Capital outlines three key criteria for stablecoin platforms: global accessibility, institutional security, and political neutrality. Ethereum is the only network that consistently meets all three criteria. Tron ranks second with 32%, but its low-cost advantage is being eroded as usage increases. Meanwhile, Ethereum's fees have decreased due to upgrades and reduced congestion, giving it the opportunity to solidify its position as the core layer of the on-chain dollar economy.

Comparison of stablecoin infrastructure. Source: Electric Capital

As this ecosystem develops, ETH's function as a reserve asset is also being enhanced. Like government bonds or gold in TradFi, ETH provides collateral, settlement, and yield. It is scarce, non-custodial, reliable, and deeply embedded in DeFi, having supported over $19 billion in loans. Electric Capital believes that in the long run, ETH could carve out a place in the global $500 trillion value storage market. It not only possesses Bitcoin's resilience but also offers yield, a characteristic favored by American households, which currently hold $32 trillion in dividend stocks but less than $1 trillion in gold.

ETH as a Store of Value

Fidelity's latest report suggests that blockchains like Ethereum are best understood as sovereign digital economies rather than Web2 platforms. Like an open economy, Ethereum allows anyone to consume or produce services, with ETH serving as the base currency coordinating decentralized participants.

Fidelity recommends using a GDP-like framework to measure blockchain economic activity, where "consumption" refers to protocol fees, "government" includes expenditures by the Ethereum Foundation, "investment" encompasses changes in ETH staking and DEX liquidity, and "net exports" involve value flows across blockchains, through DePIN to the physical world, and into the traditional economy via stablecoin issuance.

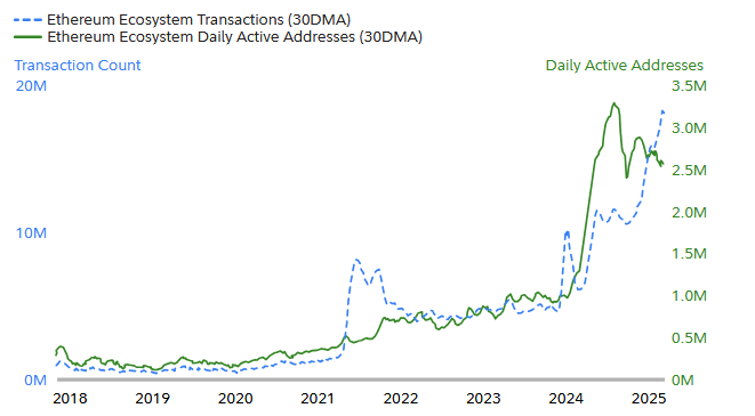

Fidelity analysts believe that in this model, Ethereum serves both as a medium of exchange and a store of value. As the Ethereum ecosystem expands, demand for ETH is also increasing. So far, trends support this assertion: according to data from Artemis, the number of daily active wallets on Ethereum has now surpassed 2.5 million, with transaction volumes reaching a historical high of approximately 19 million.

Ethereum ecosystem transactions and daily active addresses. Source: Fidelity

Fidelity's framework can be applied to most blockchains, providing a more direct method for assessing smart contract platforms for TradFi, similar to how they understand Bitcoin. The choice to highlight Ethereum likely stems from its status as the most advanced blockchain economy, indicating that an increasing number of institutions recognize Ethereum's potential.

Ethereum as Digital Oil

Key stakeholders in Ethereum outlined a third perspective in a recent report. The authors argue that Ethereum plays a productive and yield-generating role at the core of the on-chain economy. As the global financial system transitions to fully digital and decentralized infrastructure, Ethereum is becoming a core settlement layer, security provider, and reserve asset. Bitcoin embodies the notion of "digital gold," while Ethereum combines value storage with utility, powering computation and decentralized finance while also providing native yield through staking.

The metaphor of "digital oil" reflects Ethereum's multifaceted role: it fuels every transaction, can be used as collateral (about one-third of the Ethereum supply secures stablecoins, tokenized assets, and DeFi protocols), and due to design reasons, its issuance remains scarce, with an annual issuance cap of approximately 1.51%.

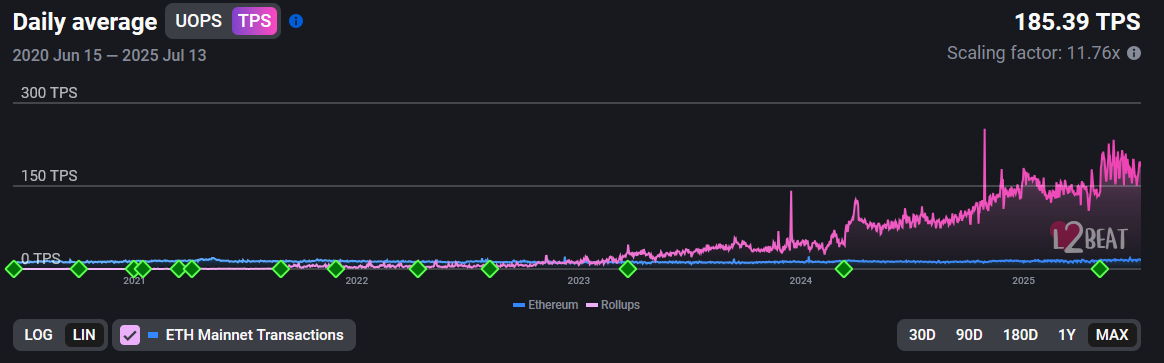

The report also mentions Ethereum's fee revenue, which has sharply declined from a peak of $82 million during the 2021 rebound to just $3 million currently. According to the report's authors, this is not a failure but a strategic move to scale. Like Amazon or Tesla in their early development stages, Ethereum prioritizes long-term adoption over short-term revenue, reducing transaction costs through layer two scaling. While this temporarily depresses fee revenue, it expands Ethereum's total addressable market and will ultimately increase Ethereum's consumption and staking rewards.

Ethereum mainnet and Rollups daily TPS. Source: L2Beat Source: L2Beat

While the fundamental logic of these three reports can apply to other smart contract platforms, each report implies—or directly states—that Ethereum has a distinct advantage. This advantage often boils down to its "industrial-grade" quality: Ethereum remains the most decentralized blockchain, with the most secure protocols and the most developed ecosystem in the field.

As Ethereum's appeal to TradFi grows, even its well-known scalability limitations (now alleviated by layer two solutions) no longer seem to be a barrier to institutional adoption. Just as institutional interest drove Bitcoin's rebound in this cycle, Ethereum is now poised to do the same.

This article does not contain investment advice or opinions. Any investment and trading activities carry risks, and readers should conduct their own research before making decisions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。