According to a report by Reuters, the U.S. House of Representatives passed the groundbreaking "GENIUS Act" on Thursday with a decisive vote of 308 to 122. This marks the first time Congress has approved comprehensive stablecoin legislation, and the historic bill is now set to be signed by President Donald Trump.

The bill establishes a federal regulatory framework for the $250 billion stablecoin market, requiring issuers to maintain 100% high-quality liquid asset reserves, undergo monthly audits, and register with federal or state regulatory agencies. The legislation received strong bipartisan support, with 206 Republicans and 102 Democrats backing the measure.

"This is a watershed moment for the digital asset industry," said Steven Goldfeder, creator of Arbitrum and CEO and co-founder of Offchain Labs, to Blockhead. "The biggest benefit is clarity—it removes much of the legal ambiguity that has hindered institutional entry."

The vote concluded a tumultuous "crypto week," during which conservative Republicans initially obstructed the legislation before reaching an agreement with President Trump. Earlier this week, House Speaker Mike Johnson had to cancel a vote due to a procedural rebellion from a dozen conservatives who demanded that the stablecoin bill be packaged with broader crypto legislation.

After dissenters met with Trump at the White House, the farce was resolved, and they ultimately agreed to advance the "GENIUS Act" as a standalone bill while bundling the ban on central bank digital currencies with the annual defense authorization bill.

Initial Regulatory Framework

Under the new framework, stablecoin issuers must choose between federal licensing from the Office of the Comptroller of the Currency or state-level oversight. The legislation stipulates that issuers must back their tokens with cash, Treasury bills, or other approved high-quality assets and require monthly third-party audits to verify reserves.

The bill also prohibits algorithmic stablecoins—digital tokens that maintain their peg through code rather than asset backing—following the collapse of TerraUSD in 2022, which wiped out $60 billion in value.

"Omar Elassar, head of global strategic partnerships for Animoca Brands in the Middle East, commented to Blockhead, 'Markets like the UAE have already proven that clearly defined rules can accelerate innovation and adoption.' With the U.S. now aligned, we are entering a phase where stablecoins can not only support Web3 but also underpin the future of global finance."

Industry Celebration, Critics Concerned

The cryptocurrency industry has poured significant funds into candidates who support crypto during the 2024 election cycle, praising the legislation as a validation of their lobbying efforts. The House also passed the "CLARITY Act," which delineates the regulatory authority of the U.S. Securities and Exchange Commission (SEC) and the U.S. Commodity Futures Trading Commission (CFTC) over digital assets, sending it to the Senate.

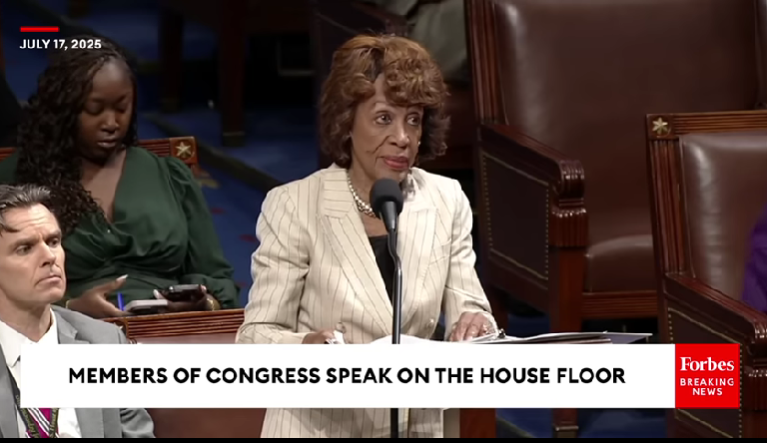

However, Democratic critics have expressed concerns about potential conflicts of interest and insufficient consumer protections. Maxine Waters, the top Democrat on the House Financial Services Committee, warned that the legislation is inadequate.

"Waters said during the floor debate that by passing this bill, Congress will tell the world that it can accept corruption and allow foreign companies to buy influence."

Some Democrats are also concerned about the Trump family's cryptocurrency investments, as reports suggest that the family's wealth has increased by billions of dollars with the government's easing of cryptocurrency regulations. The White House denies any conflict of interest, stating that Trump's assets are held in a trust managed by his children.

Market Impact

The passage of the legislation is expected to unleash a significant amount of institutional capital that has been waiting on the sidelines for regulatory clarity. Due to regulatory uncertainty, large financial institutions have been hesitant to enter the stablecoin space, but the new framework provides the compliance structure they have been seeking.

The bill's impact extends beyond stablecoins and has the potential to accelerate the integration of digital assets with traditional finance. With clear rules in place, banks, brokers, and other financial institutions can begin developing crypto products and services without fear of enforcement actions.

Last month, the Senate overcame initial Democratic opposition to approve stablecoin legislation. With President Trump's support and the overwhelming approval from the House, the "GENIUS Act" is expected to be signed into law in the coming days, solidifying the U.S. position as a global leader in digital asset regulation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。