Core Points

XT's staking and lending provide ultra-low interest rate funding support for arbitrage, with operations completed entirely on the platform, eliminating the need to transfer coins, resulting in lower risk and greater peace of mind.

Replacing traditional leveraged trading, fixed-rate staking and lending can substitute high-interest margin financing, reducing interest costs by over 90%.

Utilize perpetual contract funding rate arbitrage by borrowing BTC or ETH to short, allowing for stable daily passive income.

All three strategies are based on XT platform's internal functions, simple and safe, requiring no platform switching or wallet changes, making them particularly suitable for beginners.

By reasonably setting loan periods, monitoring funding rates, and making early repayments, you can further enhance arbitrage returns and risk control efficiency.

If you could increase your crypto earnings without frequent trading and taking on too much risk, would you be willing to give it a try?

This is the charm of arbitrage—it is not a gamble of wild price fluctuations, but a way to steadily earn coins through differences in funding rates or market mechanisms.

Many people mistakenly believe that arbitrage has a high threshold, requiring multiple exchanges, cross-platform operations, and real-time monitoring, but in fact, XT's staking and lending service has simplified arbitrage operations to "be completed within a single platform." You can borrow BTC or ETH at low rates and then complete arbitrage operations within XT's spot, leverage, and perpetual contract markets.

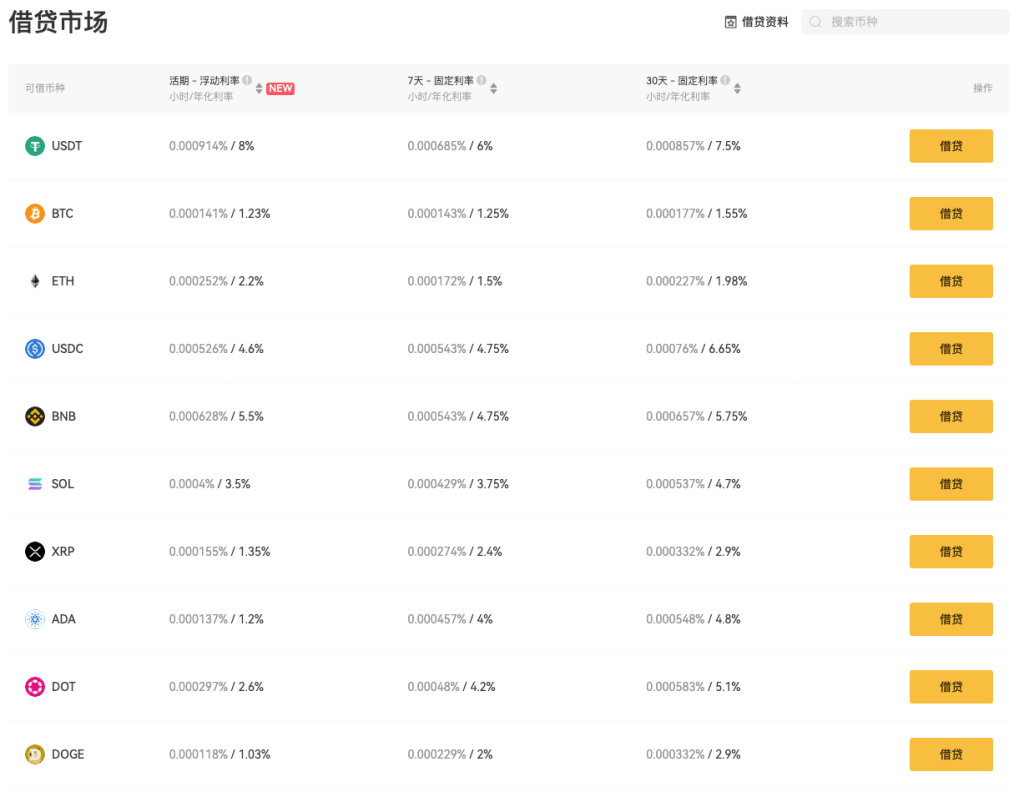

Currently, the fixed annualized rates for XT's staking and lending are very competitive: as low as 1.23% for BTC and only 1.50% for ETH. Previously, these arbitrage opportunities were mostly in the hands of institutions, but now ordinary users can easily get started.

This article will introduce you to three low-risk, clear-operation arbitrage strategies suitable for both beginners and advanced users. More importantly: your funds remain on XT throughout the process, eliminating the need for transfers, resulting in higher efficiency and greater security.

Whether you are a beginner just getting into crypto arbitrage or a trader looking to expand your strategies, these three strategies can be applied immediately, starting your journey to passive income with BTC and ETH.

Table of Contents

What is XT Staking and Lending? Borrow BTC and ETH at Ultra-Low Rates

Strategy 1: Replace Leveraged Financing with XT Staking and Lending, Saving 90% in Costs

Strategy 2: Earn Daily Income through BTC Perpetual Contract Arbitrage

Advanced Tips: How to Maximize Your Arbitrage Returns

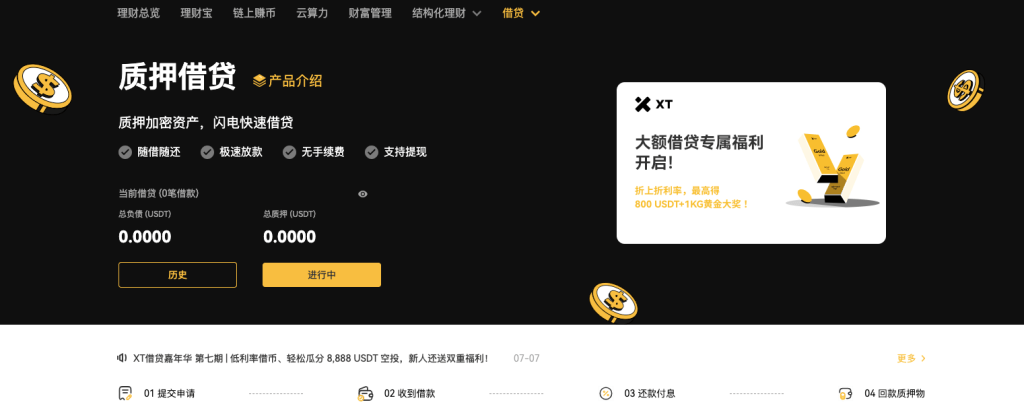

What is XT Staking and Lending? Borrow BTC and ETH at Ultra-Low Rates

XT Staking and Lending is a convenient financial service launched by XT.com, allowing users to borrow popular cryptocurrencies directly on the platform, such as Bitcoin (BTC), Ethereum (ETH), and USDT. You can temporarily release the value of your funds without selling your holdings, preserving long-term positions while gaining immediate liquidity, making it ideal for arbitrage, rebalancing, or short-term operations.

How to Use XT Staking and Lending? 4 Easy Steps:

- 1. Pledge Collateral

Choose BTC, ETH, or other mainstream tokens supported by the platform as collateral to lock in your borrowing limit.

- 2. Select Borrowing Currency and Term

Choose to borrow BTC, ETH, or USDT as needed, and set the term (flexible borrowing, 7 days, or 30 days).

- 3. Funds Arrive Instantly

The borrowed coins will be directly credited to your spot account, with no waiting or transfers required, ready for immediate use.

- 4. Repay Anytime Without Fees

You can repay early at any time during the term without any additional fees, and your collateral will be released immediately upon repayment.

Latest XT Lending Rates (Updated July 16, 2025)

Four Major Advantages of XT Staking and Lending

- – Ultra-low rates, highly competitive costs

Much lower than traditional leveraged trading or DeFi lending rates, allowing for more room in arbitrage and short-term operations.

- Transparent rates, calculated hourly

All rates are fixed, with no hidden fees, making interest costs clear and straightforward.

- Flexible repayments, no penalty clauses

Early repayments incur no extra fees, making it particularly suitable for short-term arbitrage and low-risk strategies.

- All assets remain within the XT platform, safe and convenient

No need to transfer coins back and forth; both the pledged and borrowed coins are managed within XT accounts, enhancing security and management.

In XT lending, the maximum collateralization ratio can reach 80%. Once the warning line is triggered, the system will automatically remind you to add margin; if you do not replenish in time and the collateralization ratio continues to rise, reaching the liquidation line, the order will be forcibly liquidated (commonly referred to as a margin call). This mechanism is designed to protect your asset security while allowing strategies like arbitrage to be executed in a lower-risk, lower-cost environment.

Strategy 1: Replace Leveraged Financing with XT Staking and Lending, Saving 90% in Costs

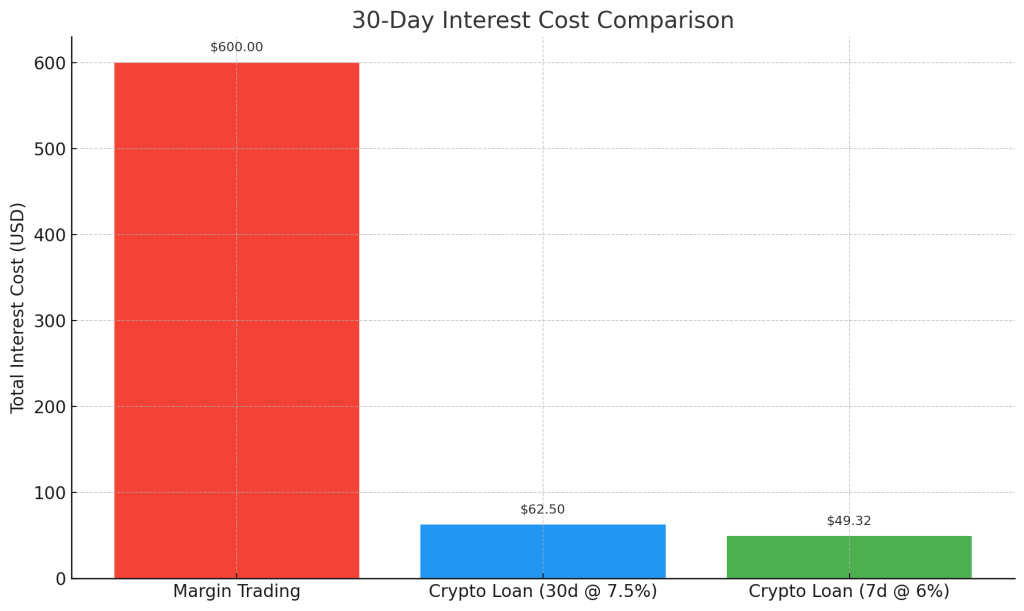

Using leveraged trading on XT allows you to quickly establish long or short positions, making it a common tool for many short-term traders. However, this convenience comes with a hidden "killer"—high interest costs. The daily interest rate for leveraged borrowing is typically around 0.2%, with an annualized rate close to 73%. If the holding period is slightly longer, profits can easily be consumed by interest.

Why Use XT Staking and Lending Instead of Traditional Leverage?

XT Staking and Lending is a very practical alternative. Compared to traditional leveraged borrowing, XT's lending has a much lower fixed annual interest rate (currently 6% annualized for 7-day USDT lending and 7.5% annualized for 30-day), allowing you to gain the same leveraged exposure at a lower cost, significantly enhancing overall returns while reducing potential risks from compound interest.

Overview of the Process: Step-by-Step Guide

- 1. Borrow USDT through XT Staking and Lending

Choose a fixed borrowing term (7 days at 6% annualized, or 30 days at 7.5% annualized) based on your trading plan.

- 2. Buy BTC or ETH on the XT Spot Market

Use the borrowed USDT to purchase BTC or ETH, effectively establishing a long position similar to traditional leveraged trading.

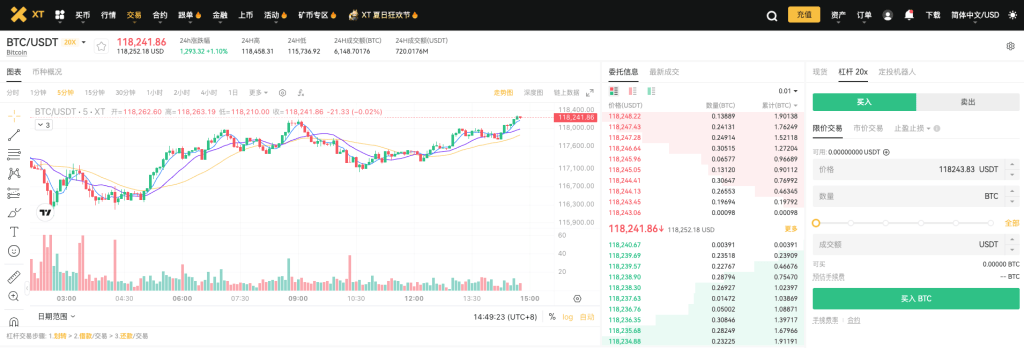

XT.com BTC/USDT leveraged trading pair

- 3. Hold + Close Position + Repay

Once you reach your profit target, sell the BTC or ETH back to USDT, repay the principal and interest of the XT loan, and the remainder is your net profit—plus, the interest cost is much lower than traditional leverage!

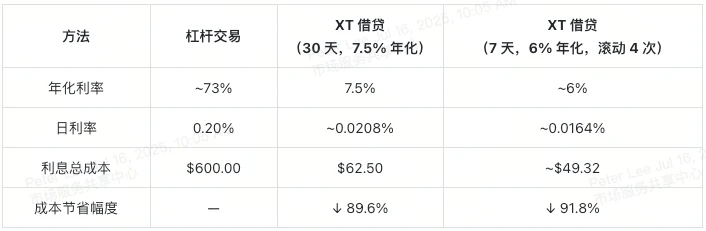

Actual Cost Comparison (Based on a 30-Day Holding Period, $10,000 Example)

Why Choose XT Staking and Lending?

- Lower Costs:

Interest expenses drop by 90%, providing greater room for arbitrage and rebalancing, resulting in more substantial profits.

- Transparent Interest:

Fixed annualized + hourly interest calculation, with no hidden fees, so you don't have to worry about interest "compounding excessively."

- Clear and Transparent Risk Control:

The maximum collateralization ratio can reach 80%, and triggering the warning line will automatically remind you to add margin; if it reaches the liquidation line, the system will execute forced liquidation to ensure the safety of borrowers and the platform.

- Suitable for Various Strategies:

Whether it's swing arbitrage, low-frequency trading, or medium to short-term holdings (2-3 days or more), you can find a more secure low-cost execution method in XT lending.

Strategy 2: Earn Daily Income through BTC Perpetual Contract Arbitrage

For users who do not want to sell their altcoins but wish to obtain stable passive income, BTC perpetual contract funding rate arbitrage is an excellent choice. By using XT Staking and Lending, you can borrow BTC at a low interest rate and earn stable daily income in XT's BTC Coin-Margined Perpetual Contract market.

How Does BTC Perpetual Contract Arbitrage Make Money?

When the market is bullish, long users typically have to pay funding rates to short users regularly. You only need to borrow BTC through XT and then open a short position to receive these funding fees regularly. Throughout the process, you don't need to monitor market fluctuations; as long as the funding rate is positive, you can continue to earn passively.

Follow these steps to get started easily:

- 1. Stake your altcoins or stablecoins:

Pledge mainstream altcoins like ETH, SOL, XRP, or stablecoins like USDT, USDC on XT.com to obtain borrowing limits for BTC.

- 2. Borrow BTC through XT Staking and Lending:

Choose an appropriate borrowing period; currently, the fixed annualized rate for BTC is 1.55% for 30 days.

- 3. Open a Short Position:

Immediately sell the borrowed BTC in XT's BTC Coin-Margined Perpetual Contract market to establish a short position.

XT.com BTC/USD Coin-Margined Perpetual Contract Trading Pair

- 4. Receive Funding Fees:

As long as the funding rate is positive, you will receive passive income every 8 hours.

- 5. Close Position + Repay + Take Profit:

When you're ready to end the strategy, close the position on BTC, repay the loan, and the remainder is your net profit after deducting interest and fees from the funding fees earned.

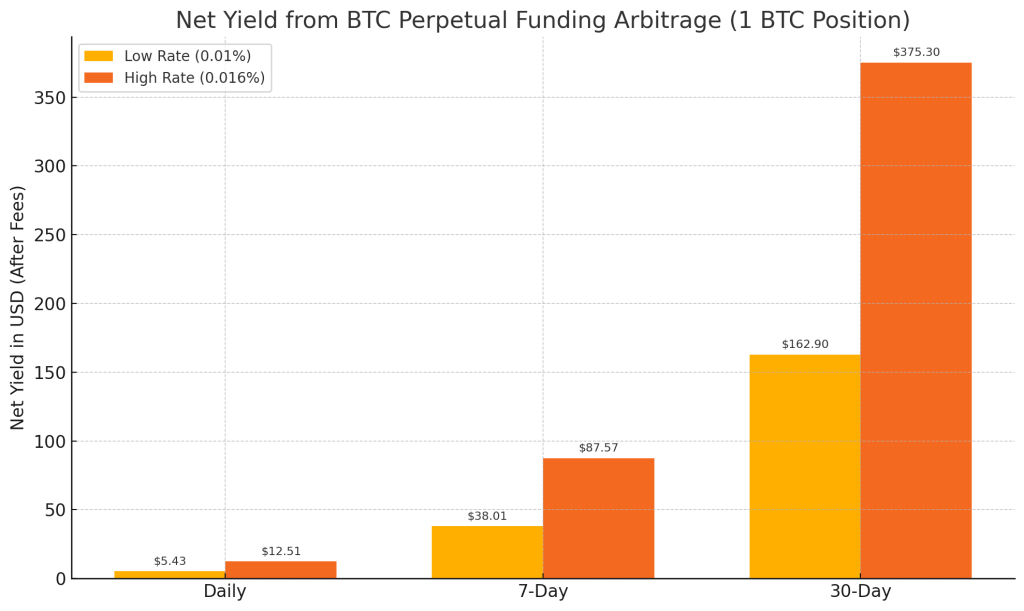

Practical Profit Example:

Calculation Explanation: Daily Net Profit = (F × P × Q) − (I × P × Q); Total Net Profit = [(F − I) × P × Q × T] − Fees

F = Daily funding rate (e.g., 0.01% = 0.0001)

P = Current BTC price (e.g., $118,000)

Q = Position size (e.g., 1 BTC)

I = Daily borrowing rate (APR ÷ 365, e.g., 1.55% ÷ 365 ≈ 0.0000425)

T = Borrowing days

Fee = Round-trip fees (e.g., ~$118)

Core Advantages of BTC Perpetual Arbitrage:

- Market Neutral Strategy:

No fear of market fluctuations; as long as the funding rate is positive, you can continue to earn.

- Passive Income Source:

As long as you maintain a short position daily, you can steadily accumulate coins without frequent trading.

- Extremely Low Costs:

XT's BTC borrowing rates are much lower than external platforms, making the strategy more cost-effective.

- Very Suitable for Altcoin Holders:

You don't have to sell your coins; you can earn arbitrage profits by staking to borrow BTC.

Strategy 3: Capture ETH Perpetual Contract Funding Rate Arbitrage Opportunities with XT Staking and Lending

This strategy is similar to the previously mentioned BTC arbitrage method, but the ETH Coin-Margined Perpetual Contract market usually experiences greater volatility, making timing and monitoring funding rates particularly important. With XT's low-interest ETH lending service, you can continuously earn daily income in a bullish market with a positive funding rate.

How Does ETH Arbitrage Work?

Similar to the BTC perpetual contract, when the ETH/USD coin-margined contract market is bullish, long users will periodically pay funding fees to short users. You only need to borrow ETH through XT and open a short position to earn this income daily.

The operation steps are very simple; just follow along:

- 1. Use altcoins or stablecoins as collateral:

Pledge mainstream altcoins like SOL, XRP, BTC, or stablecoins like USDT and USDC to obtain borrowing limits.

- 2. Borrow ETH through XT Staking and Lending:

Choose an appropriate borrowing term; XT currently offers a minimum annualized interest rate of 1.5% for ETH lending (available for 7 days or 30 days).

- 3. Open a short position:

Sell the borrowed ETH directly in XT's ETH Coin-Margined Perpetual Contract Market to establish a short position.

XT.com ETH/USD Coin-Margined Perpetual Contract Trading Pair

- 4. Receive funding fees:

As long as the market remains bullish, you can earn funding fee income daily from long users.

- 5. Close position, repay, and take profit:

When you decide to end the arbitrage, close your ETH position and repay the loan. After deducting trading fees and interest, the remainder is your net profit.

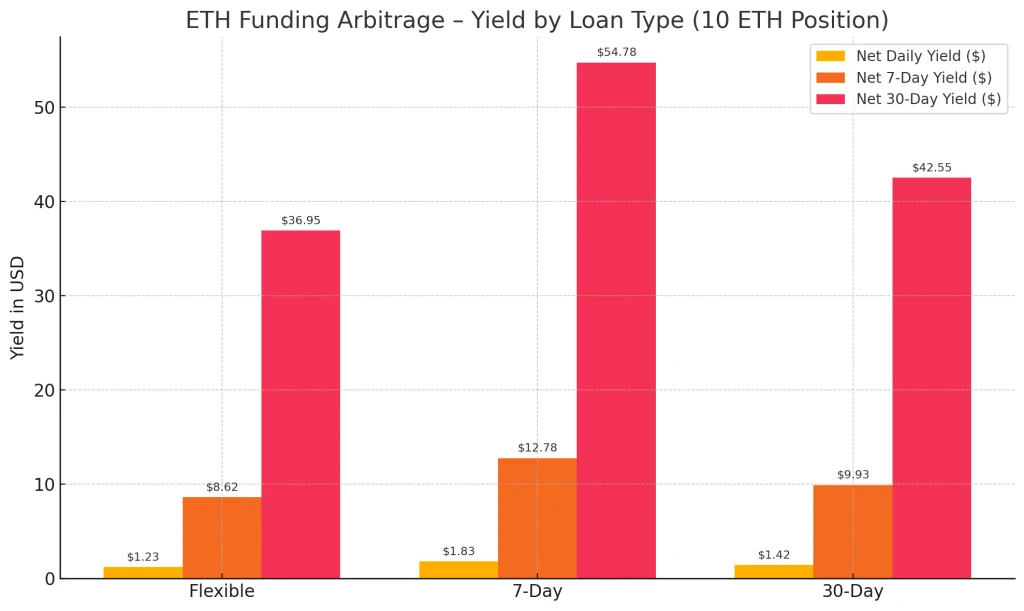

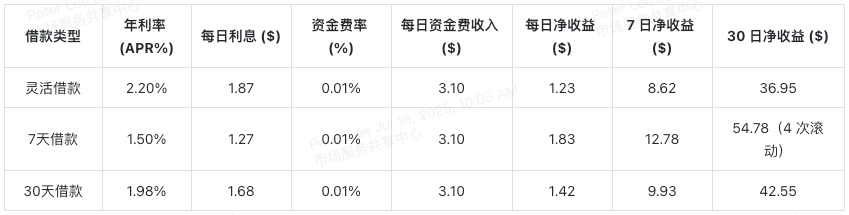

Daily Income Example:

Explanation 1: Assumptions

Position size: 10 ETH

Current ETH Price: $3,100

Daily funding rate: 0.01% (i.e., 0.0001)

Trading fees not included

7-day borrowing means repaying and re-borrowing after 7 days, rolling 4 times to simulate a 30-day period

Explanation 2: Calculation Formula

Daily net income = (F × P × Q) − (I × P × Q)

Total net income = [(F − I) × P × Q × T] − Fees

Where:

F = Daily funding rate (e.g., 0.01% = 0.0001)

P = Current ETH price (e.g., $3,100)

Q = Position size (e.g., 10 ETH)

I = Daily borrowing rate (APR ÷ 365, e.g., 1.5% ÷ 365 ≈ 0.0000411)

T = Borrowing days (e.g., 7 or 30)

Fee = Total fees (e.g., approximately $120 for bilateral fees on 10 ETH)

Advantages of ETH Perpetual Arbitrage Strategy:

- Daily income can be reused:

As long as the market is bullish, you can earn income every day.

- Low operational costs:

The borrowing rate for ETH is extremely low, increasing the arbitrage potential.

- Suitable for intermediate users:

Ideal for traders who are sensitive to market fluctuations and can regularly monitor funding fees.

Advanced Tips: How to Maximize Your Arbitrage Income

Want to truly make the most of the arbitrage strategies mentioned earlier? Here are some tips you must master! They can help you reduce costs, increase profits, and control risks effectively.

Choosing Borrowing Terms

– If you plan to complete the arbitrage in a short time, prioritize using 7-day borrowing to minimize interest expenses.

– If you expect to hold the arbitrage position for a longer term, a 30-day borrowing term is more suitable, allowing you to lock in a lower fixed rate.

Collateral Asset Recommendations

Choose assets with higher collateral rates, like ETH and SOL, to increase your borrowing limits.

Diversify your collateral portfolio to reduce risks from the volatility of a single asset.

Funding Fee Monitoring

The funding fee updates every 8 hours, so it's advisable to check regularly to seize positive income opportunities.

Set funding fee alerts to respond promptly to market fluctuations.

Key Points for Risk Control

Maintain a healthy collateral ratio, keeping it within a safe range to avoid approaching the liquidation line.

Set stop-loss orders for your contract positions to prevent significant losses from sudden market movements.

Repayment Strategy

- After the arbitrage ends, it is advisable to repay the loan as soon as possible to effectively reduce interest costs and increase net income.

What’s Next?

XT's Staking and Lending feature allows traders of varying experience levels to easily start earning stable and secure passive income. Whether you are a beginner or have some experience, these beginner-friendly, low-risk arbitrage strategies can maximize your capital efficiency without transferring assets or operating on multiple platforms.

Currently, the annualized rate for BTC is as low as 1.23%, and ETH is only 1.5%. XT.com offers very competitive financing solutions in the industry. Combined with the operational techniques introduced in this article, you can now leverage the price and funding rate differentials within the platform to start your arbitrage income journey.

Go to the XT Staking and Lending page now, choose the currency and term you want to borrow, and put these strategies into practice to get your assets moving!

Frequently Asked Questions: About XT Staking and Lending and Arbitrage

Q: Can beginners use XT Staking and Lending for arbitrage?

A: Absolutely. XT's Staking and Lending feature is easy to operate, has low rates, and flexible repayment options, making it very suitable for newcomers to try low-risk arbitrage. It is recommended to start with a small amount, familiarize yourself with the process, and then gradually expand your operation scale.

Q: What are the potential risks of using cryptocurrency lending for arbitrage?

A: There are two main risks: first, the price fluctuations of the collateral may lead to positions approaching the liquidation line; second, the funding rate of the perpetual contract may change unfavorably. It is advisable to maintain a healthy collateral ratio and keep an eye on market fluctuations to adjust positions in a timely manner to control risks.

Q: Can I repay XT's Staking and Lending early?

A: Yes, but it depends on the type of loan. On-demand loans support borrowing and repayment at any time without penalties; however, early repayment of fixed-term loans (such as 7 days or 30 days) may incur penalties, so it is advisable to choose the appropriate term based on your needs.

Q: Do I need high trading skills to implement these arbitrage strategies?

A: No, the arbitrage methods introduced in the article are very clear and easy to understand; just follow the steps. Additionally, the XT platform itself is very user-friendly, making it suitable for beginners. However, it is recommended to continuously monitor market dynamics, as having a certain level of foundational knowledge will lead to more stable returns.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。