When ETH broke through 3200 and the ETH/BTC exchange rate surpassed 0.026, no one expected that ETH could still change hands.

At the beginning of the year, ETH was like a runaway high-speed train, soaring high and then plummeting. From the end of 2024 to April 2025, the price of ETH fell from 4000 dollars to 1500 dollars, halving again and again, underperforming BTC, SOL, and even lagging behind a bunch of meme coins.

Just as retail investors were lamenting and KOLs were shorting, while institutions remained silent, a quieter and more covert script was unfolding behind the scenes: a classic washout.

The crash was not merely a "pricing adjustment" by the market for ETH, but rather a designed and purposeful exit washout.

The price dropped from 4000 to 1500, not to prove that ETH had no value, but to orderly wash out retail investors who had heavily invested at the high points during the bull market over the past two years.

When those who once waved the E flag began to stop-loss and flee, the ones taking over were not another batch of retail investors, but rather quieter and more disciplined funds: it was like a group of suited Wall Street players had entered.

They did not shout about going long on ETH on social media, nor did they make a big show of building positions, but instead quietly bought in through small-cap US stocks fundraising, market-making accounts, and structured arbitrage funds.

When everyone was asking, "Is the bottom in?", the real accumulation had already been completed.

Looking back in the rearview mirror, this crash from 4000 to 1500 was not a signal of recession, but more like a handover ceremony of discourse power. Ethereum no longer belonged to KOLs or speculators.

But this time, was it really Wall Street taking over?

Changing Hands: How Institutions Quietly Boosted ETH

The story of changing hands had already been widely circulated in the first half of the year. After the Hong Kong conference, rumors of "Ethereum underground garage changing hands" emerged.

At that time, most people's evaluation was: retail investors love to fantasize.

However, the on-chain data had long been a harbinger— from December 2024 to April 2025, it was a phase of free fall for Ethereum's price, but it was also the moment when the Herfindahl-Hirschman Index (HHI) quietly turned upward.

Image source: Glassnode

HHI is an indicator of asset concentration. On the Ethereum chain, it represents the trend of chip ownership. While the price plummeted, the HHI was rapidly rising, indicating that ETH was not being widely sold off by the market; instead, it was being concentrated from dispersed retail hands into the addresses of a few large holders or even institutions.

From December 2024 to now, the Herfindahl index of ETH has risen rapidly, returning to the 2018 high within 5 months, completing a chip concentration path that took 5 years to achieve. During the same period, the price of ETH fell from 4000 dollars to 1500 dollars, indicating that during the decline, large holders continued to collect chips, and the chips were not widely dispersed.

This concentration is conducive to controlling the market and amplifies ETH's recent volatility. Although the current concentration is still far below historical highs, once the main players start accumulating, they usually do not stop easily. They are more likely to be quietly accumulating rather than rushing to pump the price.

This is a standard chip turnover, or to put it more directly—this is a structural washout.

From an emotional perspective, it resembles a late-stage collapse; but from a structural perspective, it looks more like the main players are repositioning: quietly accumulating when there is the least hope, and remaining silent during the noisiest moments.

This method of operation, which we often see in A-shares, Hong Kong stocks, or small-cap US stocks, has now appeared in ETH.

Looking back, the process of falling to 1500 dollars was superficially a retail investor stampede, but in reality, it was a precisely controlled "retracement space." Changing hands does not necessarily have to be completed before the bull market starts; sometimes it is hidden in the deep waters of a bear market. Now we realize that those sell-offs justified by "ETF not approved," "narrative collapse," and "ecological weakness" were actually part of a deeper script—to let floating chips exit and return chips to the core.

By the time we truly realized the changing hands, ETH had already returned to above 3000 dollars. And when we review it again, you will understand that this position is not the end; it may be a new starting point—the turning point of ETH's washout has quietly completed at 1500 dollars.

So how did these institutions that seem to be Wall Street quietly boost ETH?

Image source: cryptotimes

In May 2025, SharpLink Gaming ($SBET) announced a PIPE financing of 425 million dollars to purchase 176,271 ETH, which at the time had a market value of over 460 million dollars.

On the day the news was announced, the stock price surged by 400%, igniting the US stock market with the dual themes of financing and crypto assets. This was seen as the first definitive positioning of "the ETH version benchmarked against MSTR," officially igniting Wall Street's speculation logic on ETH asset exposure.

The surge of SBET was initially viewed by the market as a game of hot potato in small-cap stocks. But just a month later, followers began to appear.

In June, BitMine Immersion Technologies ($BMNR) announced that it would raise 250 million dollars through PIPE financing to purchase ETH, clearly stating its intention to "transform into an ETH infrastructure asset manager." After the news was released, BMNR surged for several consecutive days, becoming another "ETH concept stock" after SBET.

Unlike SBET, BMNR was no longer just "buying and holding coins," but rather clearly targeting ETH staking yields, on-chain cash flow, and participation in the DeFi ecosystem. This was the first time a traditional mining company transformed to go long on ETH with a "quasi-ETF logic," indicating that the mindset of the main players had shifted from directional betting to structural capturing.

Almost simultaneously, BTCS ($BTCS) did not loudly announce how much ETH it bought at once, but emphasized the innovativeness of its financing structure: a hybrid financing model of "DeFi + TradFi." It was not just buying ETH, but acquiring a stablecoin liquidity anchor asset.

Bit Digital ($BTBT) also quietly disclosed its purchase of 20,000 ETH, planning to transform from a BTC mining company to an ETH staking node operator. In this round of changing hands, some players from the BTC camp have already begun to stand on the other side.

From SBET firing the first shot to BMNR, BTCS, BTBT, and other US stocks and mining companies taking turns, the entire process took less than a month, with a rapid, clear, and orderly rhythm.

Who is the mastermind behind this long-planned "changing hands"? Did Wall Street really pick up bloody chips?

The Mastermind Behind the "Changing Hands"

Setting aside the fantasy of Wall Street discovering the value of ETH, a careful reading of the fundraising statements released by these Ethereum strategic reserve companies may lead former ETH believers to sigh:

Because familiar names appear one after another: Pantera Capital, Galaxy Digital, Joseph Lubin, Peter Thiel…

It is these well-known institutions and figures in the crypto space that, through investment, technical support, and public opinion momentum, have packaged Ethereum into a "Wall Street-ized" new height.

Pantera Capital

Pantera Capital is a pioneer in cryptocurrency investment. In 2013, Pantera launched the first institutional investment fund in the US focused on Bitcoin, later expanding to Ethereum and other blockchain projects.

As an early angel investor in Ethereum's initial coin offering (ICO), Pantera bet on its potential as early as 2014 during Ethereum's crowdfunding, establishing a deep connection with Ethereum.

Pantera's investment portfolio also covers various projects in the DeFi sector within the Ethereum ecosystem, including foundational applications on Ethereum such as Uniswap, Aave, and Arbitrum.

In May 2025, Pantera reiterated Ethereum's core position in stablecoins and DeFi applications in its Blockchain Letter, calling it "the pillar of the blockchain economy."

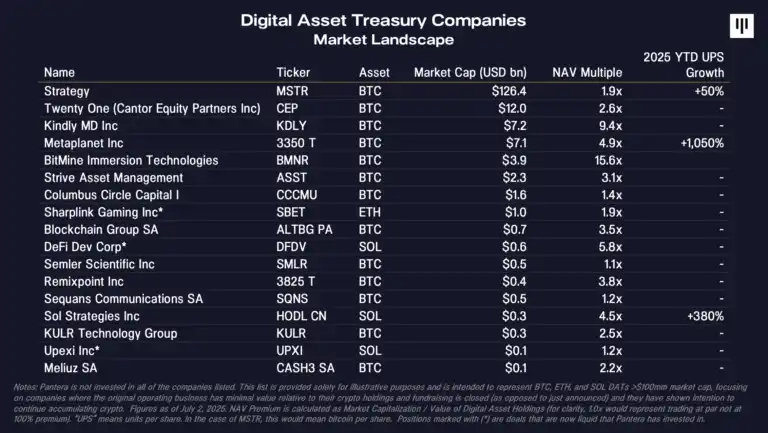

At the same time, it launched the DAT fund, specifically investing in companies that use digital assets as strategic reserves (Digital Asset Treasury Companies, DATs), describing this model as a new narrative for crypto asset exposure in the public market.

"Digital Asset Treasury Companies (DAT) will emulate MSTR, using publicly traded permanent capital vehicles to provide exposure to digital assets. After researching this strategy, we have built confidence in this investment thesis and concentrated our bets."

DAT companies invested by Pantera

Currently, the top two strategic reserve companies holding ETH—SharpLink and Bitmine—both have Pantera behind them.

In May 2025, Pantera participated in SharpLink's 425 million dollar private equity financing, jointly investing with crypto VCs such as ConsenSys, ParaFi Capital, and Galaxy Digital.

On June 30, 2025, Pantera again participated in BitMine's 250 million dollar private equity financing, with Galaxy Digital and ParaFi Capital also co-investing with Pantera.

Galaxy Digital manages the ETH ETF, while ParaFi Capital, like Pantera, has invested in numerous Ethereum DeFi applications, including Uniswap and Aave.

In addition, ParaFi has also invested in ConsenSys, which is one of the main backers of SharpLink and a long-term partner of Pantera for over a decade.

ConsenSys

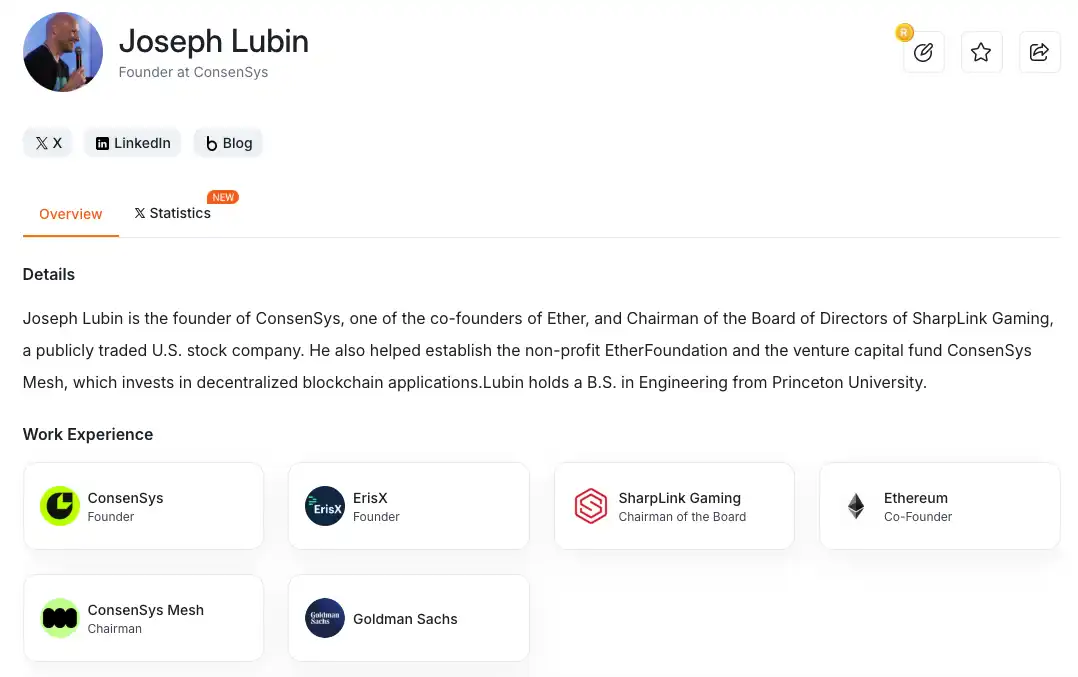

ConsenSys has developed important infrastructure applications for Ethereum such as Metamask, Infura, and Linea. Its founder, Joseph Lubin, is a co-founder of Ethereum whose influence is on par with Vitalik.

Joseph Lubin himself not only holds a large amount of Ethereum but also became the chairman of the board after investing in SharpLink, holding 9.9% of SBET shares, making him the largest individual shareholder publicly.

Before joining Ethereum, Joseph Lubin also worked at Goldman Sachs, making him a crossover figure between traditional finance and the crypto world.

In addition to ConsenSys and Pantera, which are Ethereum OGs from the ICO era, another crypto giant, Founders Fund, has also turned its attention to the Ethereum strategic reserve track.

Founders Fund

Founders Fund was founded by Silicon Valley and crypto legend Peter Thiel, and in 2023, it invested 200 million dollars in cryptocurrencies, with 100 million dollars used to purchase ETH at an average price of 1,700 dollars, acquiring 58,824 ETH.

Founders Fund is also an investor in several star projects based on Ethereum, such as Polymarket and Ondo Finance.

Founders Fund also participated in BitMine Immersion Technologies' 250 million dollar private equity financing, holding 9.1% of its shares (5,094,000 shares).

BitMine currently holds over 163,000 ETH, valued at approximately 500 million dollars, meaning Founders Fund's investment indirectly holds about 14,853 ETH through BitMine.

While completing the private financing for Ethereum strategic reserves, BitMine announced the appointment of Tom Lee as the new chairman of the board.

Tom Lee

Tom Lee was a well-known market strategist on Wall Street. From 1999 to 2014, he served as the chief equity strategist at J.P. Morgan Chase & Co., being named a top analyst by institutional investors every year since 1998.

In 2014, Lee left J.P. Morgan to co-found Fundstrat, providing stock research and consulting services to institutional investors, pension funds, family offices, and high-net-worth individuals.

At the same time, Lee is a frequent guest in financial media, often appearing on programs such as CNBC, Fox Business, and Bloomberg, frequently discussing the cryptocurrency and stock markets.

Since 2017, Lee has publicly been bullish on Bitcoin and predicted in 2024 that the price of Ethereum would reach 5,000 to 6,000 dollars.

Now, this crypto-friendly Wall Street figure seems to have become the "new spokesperson" for the Ethereum strategic reserve narrative, loudly promoting ETH on mainstream financial media like CNBC, claiming that Ethereum is the underlying architecture for stablecoins, and boldly predicting:

"When banks like Goldman Sachs and JPMorgan issue stablecoins on Ethereum, they will want to stake more Ethereum to ensure its security, and achieve this by establishing Ethereum strategic reserves."

Tom Lee's background in traditional finance and stock analysis, along with his good relationship with mainstream financial media, makes him very suitable for the role of promoting the Ethereum strategic reserve.

Dovey Wan, the chair of Primitive Ventures, also expressed positive views on the Ethereum strategic reserve model on X:

"The Ethereum strategic reserve is not just about companies buying ETH; it is an experiment in trust and financial architecture. SharpLink's model (stock premium → more ETH → greater flywheel effect) demonstrates how Ethereum can become a bridge for institutional investment through publicly listed companies."

It is worth noting that Primitive Ventures previously announced its bet on SharpLink.

Dovey Wan is also a member of the advisory board of CoinDesk, which was acquired by Bullish on November 20, 2023, and one of Bullish's investors is Founders Fund.

These highly recurring names make the Ethereum strategic reserve narrative quite different from MicroStrategy's initial spontaneous purchase of Bitcoin as an outsider company.

The Conspiracy of the Ethereum Core Circle

The rise of Ethereum strategic reserve companies has been meticulously planned by Ethereum OGs and whales at every step, from organization and initiation to dissemination.

These crypto institutions and core figures not only hold a large amount of Ethereum but also have intertwined relationships and are deeply involved in investing in Ethereum's infrastructure and DeFi-related projects.

It can be said that the core capital behind ETH has dominated this narrative of "changing hands" for Ethereum strategic reserves.

Whether these OG players were once the "old hands" of Ethereum is unknown, but these strategic reserve companies have indeed nearly become the "new hands" for ETH.

Ethereum Strategic Reserve Companies: The "New Hands" of ETH

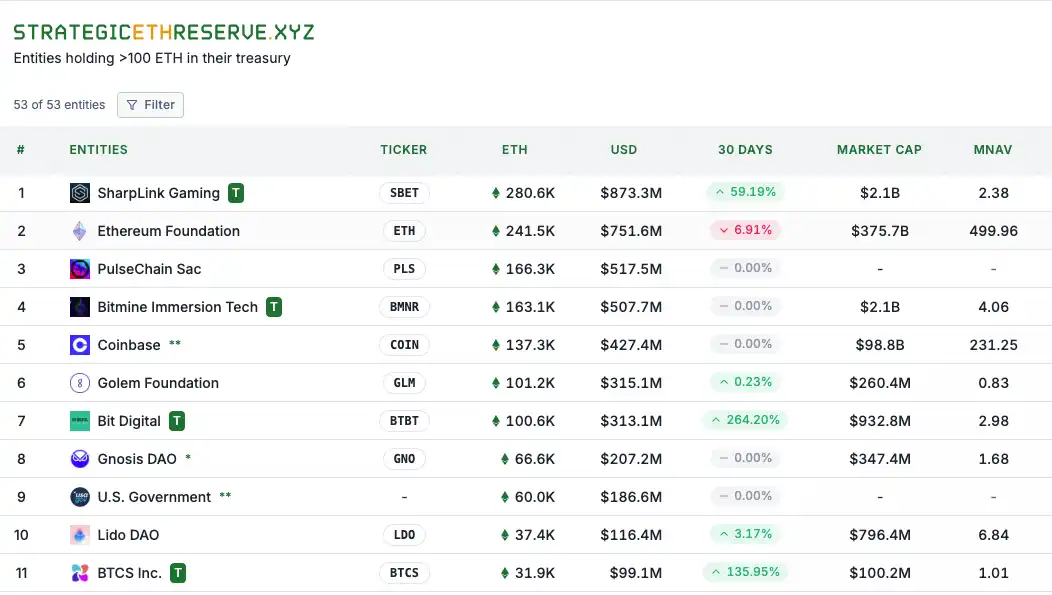

As of July 14, data shows that there are over 50 Ethereum strategic reserve companies in the market, holding a total value of ETH exceeding 4 billion dollars, accounting for more than 1% of the total circulating supply of ETH.

According to data from Strategic ETH Reserve, among the top 11 institutional holdings of Ethereum, 4 are already Ethereum strategic reserve companies.

The amount of Ethereum held by these companies accounts for over 40% of the holdings of the top 10 institutions, more than double that of the Ethereum Foundation and over nine times that of the U.S. government.

The 30-day increase of these strategic reserve companies has also far exceeded that of established crypto projects like Lido and exchange giants like Coinbase.

BTCS also announced last night that it has been included in the Russell Microcap Index.

Did the "Changing Hands" Change the Fundamentals of ETH?

Seemingly influenced by the Ethereum strategic reserve narrative, ETH's performance has been exceptionally strong in recent days.

But has the fundamental situation of Ethereum really changed?

This is the most controversial question during this round of changing hands. Supporters believe that ETH was merely mispriced due to emotions, with a clear technical route and stable economic model, moving towards the endpoint of a global settlement layer; while bears mock that it has lost vitality, users, and imagination, with a complete shutdown from DeFi to NFT to L2.

However, if we detach our perspective from emotions, we will find that the on-chain structure and economic foundation of ETH have not collapsed; what has truly changed is the way ETH is narrated—it is no longer an asset driven by narratives but a financial tool that can be structured for returns by Wall Street.

From an on-chain perspective, the supply and demand structure of ETH remains solid. EIP-1559 continues to be executed, leading to a mild deflation in ETH supply; the staking rate is steadily rising, with over a quarter of the circulating supply locked in the mainnet or LRT structure, providing a foundation for network security while also giving ETH the characteristics of a quasi "on-chain treasury bond."

The expansion route is clear, EIP-4844 has been launched, Rollup costs are continuously decreasing, and although the L2 developer ecosystem is not very hot, the infrastructure continues to improve.

Image source: The Block

But off-chain, the narrators of ETH are changing. In the past few years, the main subjects of Ethereum were KOLs, VCs, and DeFi protocols, those growth curves built on imagination and market dreams. However, since the LSD narrative cooled down in 2024, the NFT sector fell silent, and L2 expansion stagnated, the market has grown weary of ETH's "future story."

VCs cannot present new PPTs, retail investors are drawn away by memes, and Ethereum suddenly lost its reason for "price increase."

But just as retail investors grew tired of the Ponzi-like nature of memes and were doused with confidence by the exit of altcoins, Ethereum OGs have replaced the narrative with one that aligns with traditional financial logic.

The logic for ETH's rise has been transformed into: can it be packaged as structured notes, can it generate an annualized 6% on-chain stable yield, and can it become a quasi-treasury bond asset in a "TradFi investment portfolio"?

Among them, BTCS's approach is particularly typical: this established Web3 company in the U.S. announced in June 2025 that it would raise up to 100 million dollars through S-3 registration, with funds used to increase ETH holdings, expand node operations, and manage on-chain yields.

BTCS proposed a "DeFi + TradFi hybrid structure" flywheel model:

Using a certain leverage ratio, it finances through publicly listed companies via ATMs and convertible bonds to purchase ETH, then uses ETH as a staking base, combining on-chain lending, node staking yields, MEV extraction, and even future interactions with the Builder ecosystem to construct a stable cash flow model.

In their hands, ETH is not a speculative target but a financial tool that can be repeatedly discounted, a part of institutional financial models.

This switch in narrative essentially aligns with the logic that traditional financial institutions are willing to buy into.

In this sense, ETH has not changed; what has changed is its audience and the way it is narrated. The old consensus is withering, but a new financial pricing narrative is slowly emerging.

From Consensus to Conspiracy, the Script of ETH Feels Familiar

In the past, when we talked about ETH, we focused on technological iterations, narrative rotations, and the strength of consensus.

But today, what truly determines the next round of fate for ETH is no longer the "storytellers," but the "structure writers."

SBET, BMNR, BTCS, BTBT… behind this batch of quietly entering U.S. stock companies are the most OG investors and whales of Ethereum, as well as players most familiar with the "traditional financial game."

They know that once a digital asset can be standardized, structured, and included in traditional investment portfolios, its price will be redefined.

When Joseph Lubin and Tom Lee start accepting interviews from mainstream financial media like CNBC, deeply binding the potential of Ethereum with the stablecoin narrative; when Pantera and Peter Thiel begin to publicly disclose their Ethereum strategic reserve holdings:

Crypto giants and Ethereum whales are promoting Ethereum's "new story" to Wall Street and more traditional financial institutions.

Looking back, the process of Ethereum's "changing hands" is actually very typical: emotional panic, retail exit, and then the main players use PIPE financing, "on-chain staking yield models," and "U.S. secondary market speculation" to take over and build positions.

This is not a Web3 native story, but a complete reproduction of a familiar TradFi script: channeling assets, structuring narratives, and commodifying volatility.

And ETH is transitioning from a consensus asset to a conspiracy asset. Consensus is the self-identity of retail investors in the community; while conspiracy is the silent handover behind institutional structured trading.

All of this is a sign that the main players, after "changing positions," are beginning to "control the market."

Ultimately, we will find that the underlying structure of ETH has not changed, the chain is still running, the code is still being updated, and the largest holdings are still held by the same group of people. But who is narrating it, who is pairing it, and the narrative driving ETH's rise, as well as the audience it targets, have already changed.

The mask worn is the face of Wall Street, but the hands manipulating it are still those familiar old players.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。