Ethereum's ether (ETH), the second largest crypto asset, is seeing renewed investor interest, with spot exchange-traded funds (ETFs) in the U.S. recording one of their strongest streak of momentum of their one-year history.

On Thursday, BlackRock’s iShares Ethereum Trust (ETHA) booked its largest daily inflow to date, with over $300 million, pushing its total assets under management to $5.6 billion, data compiled by Farside Investors show.

That’s part of a broader resurgence in ether-backed investment products.

The nine U.S.-listed ETH ETFs attracted a combined $703 million in net inflows this week, according to crypto data provider SoSoValue. Although Friday’s data is still pending, it has already marked the third-strongest weekly haul since the products launched last July.

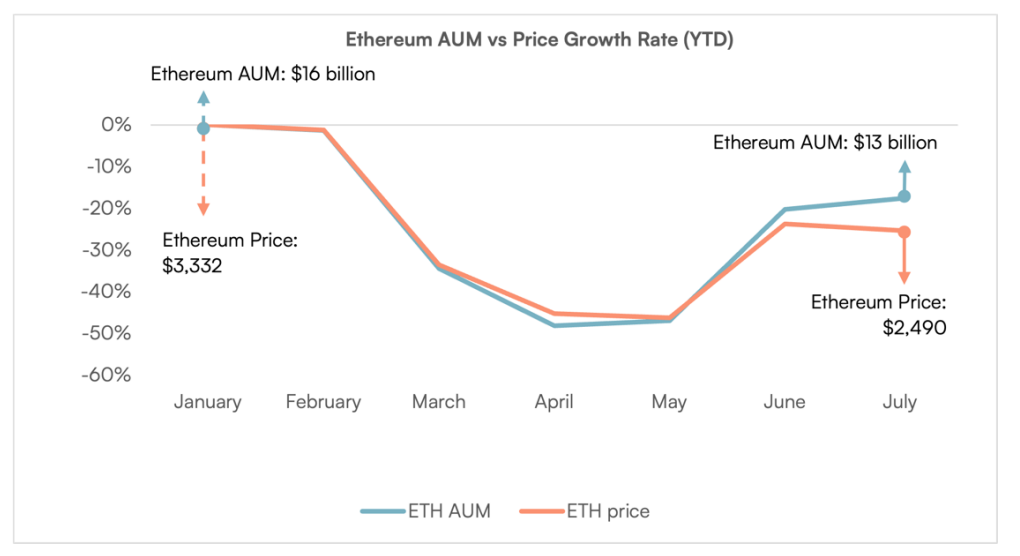

Investor demand has picked up lately even as ether’s price has lagged behind bitcoin this year, a new report from asset manager Fineqia noted.

The AUM of ETH-backed exchange-traded products (ETPs) grew 61% faster in the first half of 2025 than the market capitalization of the underlying asset, a sign of steady inflows into the products, the report said.

The report notes that ETP demand began to rebound by late April and continued into June, outpacing ETH's price gain.

The capital flood helped fuel ETH's rebound to $3,000, its highest price in more than four months.

Read more: Ethereum Foundation Sells 10,000 ETH to SharpLink in First-Such OTC Deal

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。