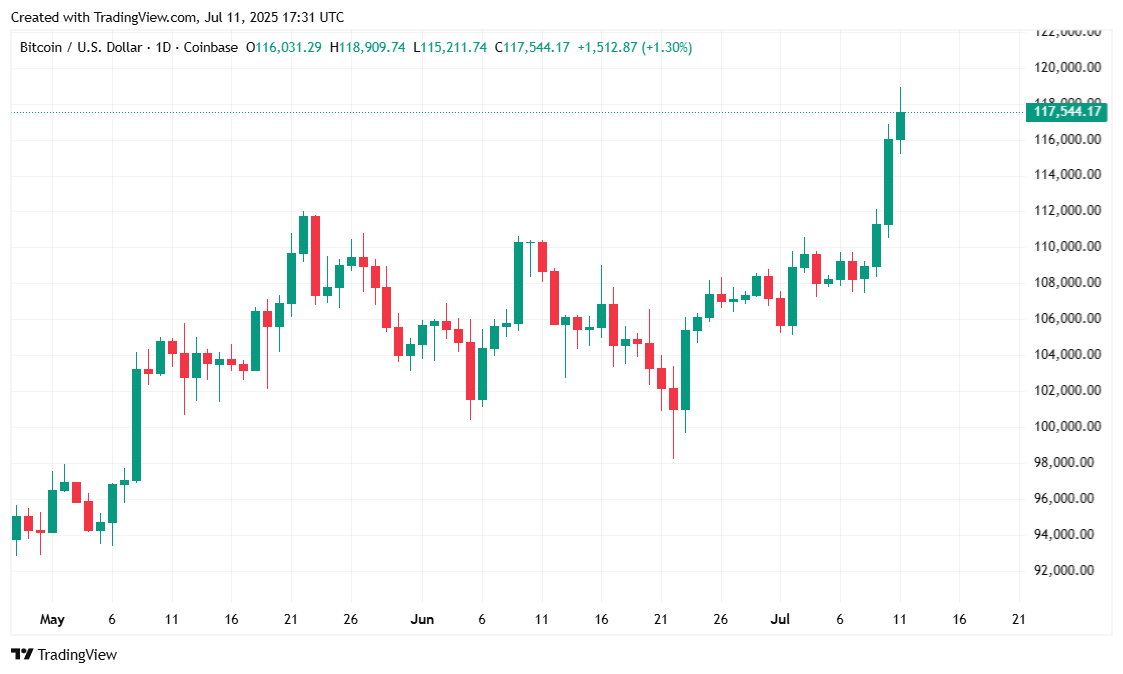

U.S. President Donald Trump upped the ante on Thursday evening, issuing a sternly worded tariff letter to Canada declaring a 35% tax on all Canadian goods entering the U.S. Stock markets retreated on the news Friday morning, with the S&P, Nasdaq, and Dow all down 0.33%, 0.08%, 0.76% at the time of writing. Equities stood in sharp contrast to bitcoin ( BTC) which soared into uncharted territory, peaking at $118,856.47 before simmering down to $117K later in the day.

Canadian Prime Minister Mark Carney, who won the country’s top job on a so-called “elbows up” campaign where he promised to “stand up to Donald Trump,” has made no progress on trade negotiations thus far. The phrase “elbows up” is an ice hockey reference used when players raise their elbows to indicate a willingness to defend themselves or physically engage their opponents. Hockey is Canada’s national sport.

But once Carney won the election, he went from elbows up to what CNN described as the “Trump Whisperer.” Carney fawned on the president, praising his leadership, all while Trump toyed with the idea of annexing Canada when the prime minister visited the White House. Naturally, when Trump suddenly slapped Carney with a 35% tax last night, on top of existing tariffs, Wall Street reacted, but bitcoin didn’t.

(Trump slapped Canada with a blanket 35% tariff on all goods entering the U.S. on top of existing trade taxes / CBC)

“Starting August 1, 2025, we will charge Canada a tariff of 35% on Canadian products sent to the United States, separate from all Sectoral Tariffs,” Trump wrote. “If for any reason you decide to raise your Tariffs, then, whatever the number you choose to raise them by, will be added onto the 35% that we charge.”

As of this writing, bitcoin has been trading as low as $113,077.17 and topped $118,856.47 over the past 24 hours. The digital asset’s price on Coinmarketcap was $117,481.31 at the time of reporting. The quoted price represents a 3.58% jump since yesterday and a much more significant 8.94% increase over the past week.

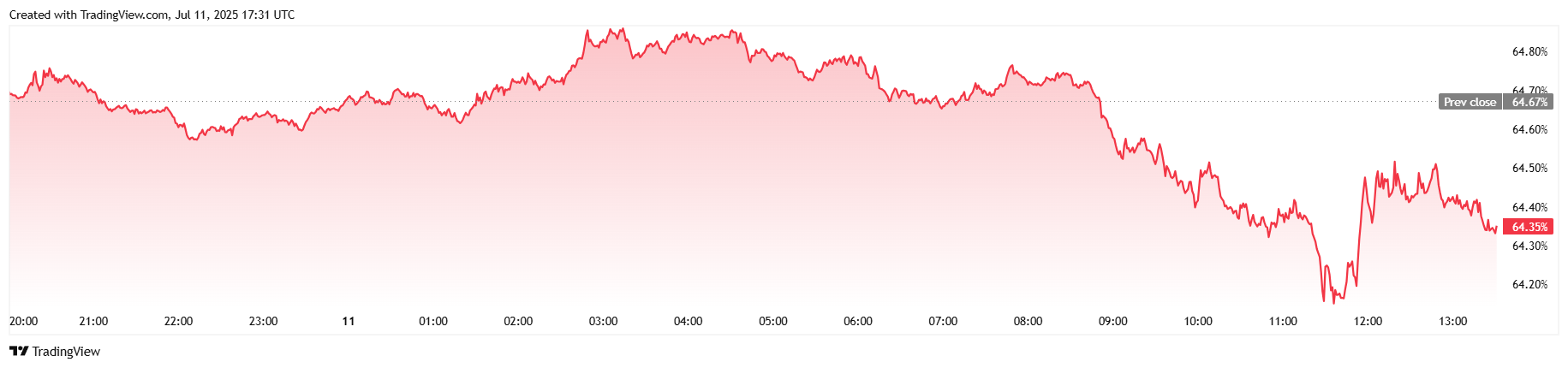

Trading volume since Thursday afternoon nearly doubled, jumping 86.52% to $124.87 billion on Friday. Bitcoin’s market capitalization rose 3.61% and was roughly $2.33 trillion at the time of reporting. Interestingly, BTC dominance tumbled 0.56% to 64.34%, an indication that several altcoins rose higher than bitcoin and ate into its share of the broader crypto market.

Total value of BTC futures contracts edged up 0.84% to $84.23 billion in the last 24 hours. Bitcoin liquidations have remained elevated since yesterday and Coinglass currently has them at $589.33 million. Today, much like Thursday, short sellers were responsible for almost all liquidations, with bears losing $554.84 million. Long positions had a much smaller but non-trivial $34.49 million liquidated.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。