Selected News

Trending Topics

Source: Overheard on CT (tg: @overheardonct), Kaito

PUMP: Today's discussions about PUMP focus on the upcoming token sale. The project is expected to launch sales on July 12, with a valuation of up to $4 billion, sparking widespread debate about whether the valuation is reasonable, especially compared to Bonk, which has recently surpassed PUMP in several metrics (such as token issuance and market share). Despite market skepticism regarding its valuation and potential impact on the liquidity of other tokens, overall enthusiasm and expectations remain high, with many predicting that this round of sales will sell out quickly.

MITOSIS: MITOSIS is gaining attention due to its collaboration with Yarm and Kaito, with market discussions centered on its potential in programmable liquidity and cross-chain DeFi solutions. The community is generally optimistic about its ability to drive innovation in DeFi through a flexible cross-chain liquidity mechanism. The upcoming TGE (Token Generation Event) and integration with Yarm (combining social interaction and liquidity) have also sparked heated discussions, with positive sentiment overall, anticipating innovative performance in liquidity management.

CYSIC: Cysic is in the spotlight today due to the launch of the "Yapper Ranking," a mechanism that encourages users to discuss its innovative concept: assetizing GPU, ASIC, and computing power into tradable revenue assets. The project has secured $18 million in investments from top firms like Polychain and Hashkey, focusing on the ZK (zero-knowledge) computing service sector, creating a computing-as-a-service platform with a built-in economic model. Its "dual-token mechanism" and focus on ZK computing hardware acceleration have attracted widespread attention from both the crypto and traditional tech communities.

HYPERLIQUID: HYPERLIQUID's rising popularity stems from a series of key developments, including Kinetiq's launch on the HyperEVM mainnet, Etherscan's introduction of the HyperEvmScan tool, and its record of $1.7 million in transaction fees within 24 hours, surpassing Solana, Ethereum, and Bitcoin. The community is excited about Kinetiq's launch of a liquid staking mechanism and Hyperliquid's integration with multiple protocols, believing these developments will drive further growth and ecosystem penetration.

LOUD: Today's discussions about LOUD focus on its connection with the emerging project Yarm. Yarm's popularity on social platforms is rising, with many users comparing it to early projects like Loudio and Yapyo. The involvement of KaitoAI and MitosisOrg has also drawn attention, with the community discussing whether it will introduce an AI-driven content quality assessment mechanism and a "Yap-to-Earn" model. While the market remains cautious, overall curiosity and expectations for Yarm's potential continue to heat up.

Selected Articles

As FTX's bankruptcy liquidation enters a critical stage, a highly controversial motion regarding the claims of "restricted country" users has caused an uproar among global creditors. FTX's liquidators stated that they would first seek legal advice to determine whether assets could be allocated to these jurisdictions; if the conclusion is that compensation is not possible, related claims may even be "legally confiscated" and transferred to the liquidation trust account. This means that Chinese creditors may not receive a single cent, and their assets could become "confiscated funds" of the trust fund. BlockBeats interviewed Will, who is not only one of FTX's major creditors but also a key initiator opposing this motion and raising objections. He detailed why he chose to stand up and lead this fight, the operational process of opposing the motion, the actual difficulties faced by the creditor community, and his deep observations on the motives behind the motion.

Twenty years later, Twitter founder Jack Dorsey returns with a new product, bitchat, in a minimalist style. The biggest highlight of bitchat is that it does not rely on any infrastructure—no servers, no Wi-Fi, or mobile signals. Each phone acts as both a "transmitter" and a "relay station," discovering each other using Bluetooth Low Energy (BLE). The reason it attracts the crypto industry is that all messages are end-to-end encrypted. Private chats use encryption technologies like X25519+AES-256-GCM, and group chats can also be password-protected, with only those who know the password able to see the content. Messages are only stored locally, disappearing automatically when exiting or shutting down, leaving no traces in the background. Compared to other encrypted communication products, bitchat completely abandons the "login" action, requiring no phone number, email, or long strings of keys. Each time it goes online, a random "user ID" is generated, which can also be modified at any time, eliminating concerns about identity tracking.

On-chain Data

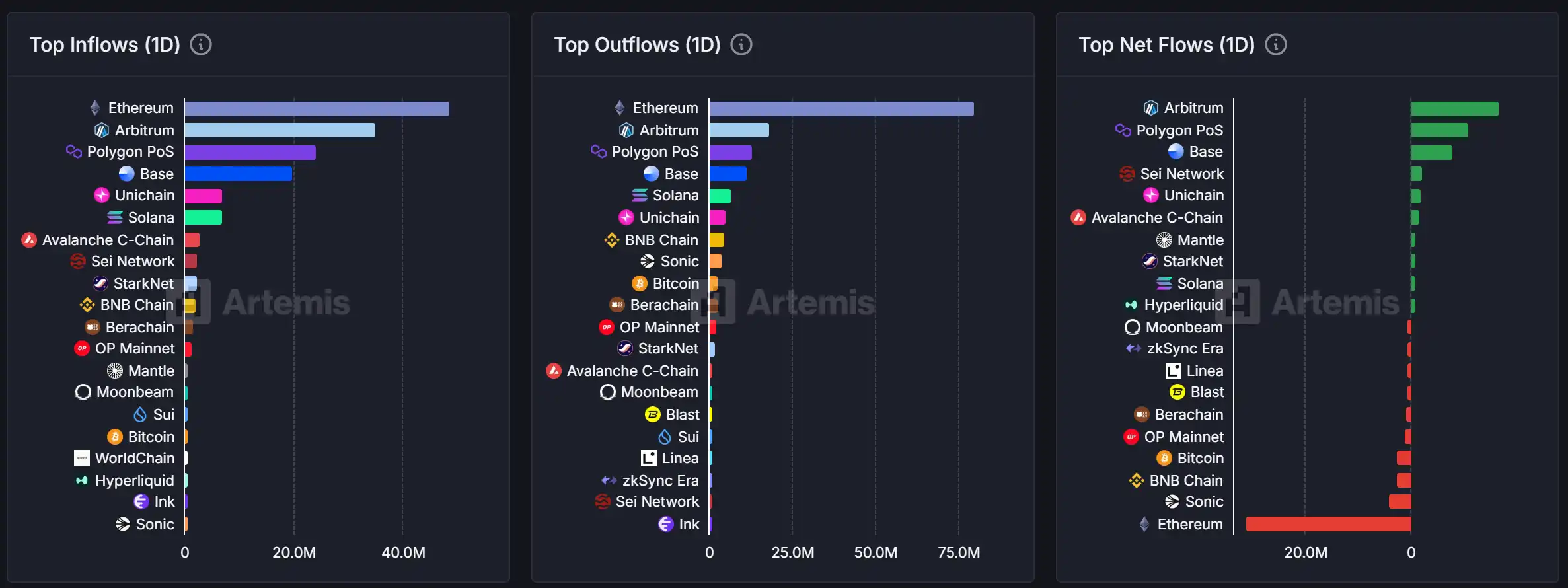

On-chain fund flow situation on July 8

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。