MicroStrategy Bitcoin Holdings Q2 2025: What the $MSTR Numbers Reveal?

Think about this: You buy Bitcoin, never sell it, and still end up with $14 billion in profit. That is not a wish—it is the reality for Microstrategy Bitcoin holdings Q2 2025.

With the currency reaching $107K, they have reported one of the largest unrealized gains (MSTR BTC profit) in corporate history. Even more impressive, the firm increased its total digital asset value by $21 billion in just one quarter.

So what exactly happened? And why are analysts saying $MSTR could explode past $440? Let’s break down the whole scenario

MSTR News Today: MicroStrategy Bitcoin Holdings Q2 2025 Breakdown

In Microstrategy Form 8-K July 2025 filing, the firm revealed a staggering $14.05 billion unrealized gain on its asset position. The update was also posted on the company's official X account, reaffirming the power of long-term accumulation.

Source: Strategy Official X Account

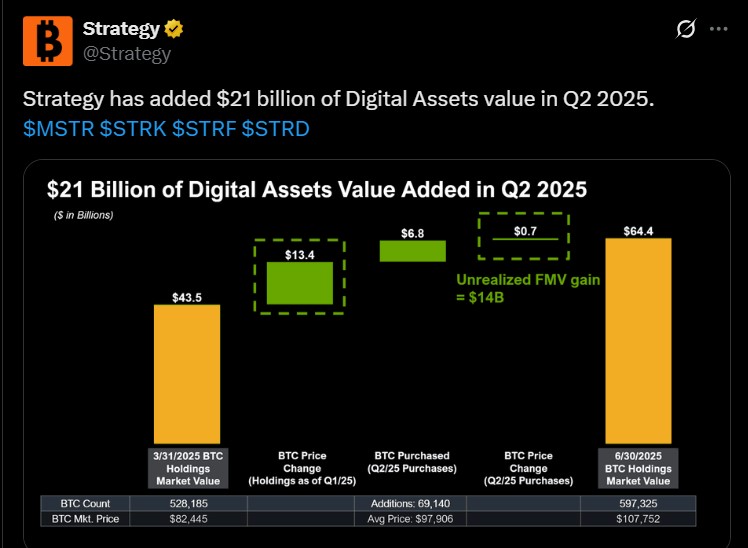

Key Stats – Q2 2025 Performance:

| MicroStrategy Bitcoin Holdings – April-June Period 2025 | |

|---|---|

| Start of Quater2 (March 31, 2025) | Crypto Held: 528,185 Total Value: $43.5B ($82,445) |

| BTC Price Growth on Existing Holdings | Unrealized Gain: $13.4B |

| New coins Acquired in April-June Period | Amount: 69,140 Avg Buy Price: $97,906 Cost: $6.77B Unrealized Gain: $0.7B |

| End of Q2 (June 30, 2025) | asset Held: 597,325 Total Value: $64.4B ($107,752) |

$21 Billion in Total Digital Asset Value Added

It’s performance wasn't just about profits—it also showcased strategic growth. With a total value increase of $21 billion, the firm is now firmly positioned as its biggest corporate whale.

MicroStrategy Bitcoin Holdings Q2 2025 perfectly sums up how a bold strategy and price rally created historic gains.

Highlights from Form 8-K Filing (July 2025)

-

Total coins Held: 597,325 tokens

-

Asset Bought: 69,140 BTC

-

Microstrategy Bitcoin Average Price: $70,982

-

Total Carrying Value: $64.36B

-

Unrealized Profit: $14.05B

-

Deferred Tax Expense: $4.04B

-

Funding Method: Equity + Preferred Stock Offerings

This reflects financial discipline and effectively used fair value accounting to report actual digital asset gains.

What If BTC Falls? MicroStrategy Stays Realistic

Even with this historic $14 billion gain, the firm issued a word of caution to investors: Bitcoin price volatility could reverse these gains in future quarters, and impact the company’s financial performance.

Source: TradingView

At the time of writing, the token trades near $108,186, showing a 0.07% dip over the last 24 hours (source: TradingView). Being a crypto analyst, my observation says, these subtle fluctuations highlight how quickly fortunes in the crypto market can shift.

So while Q2 2025 was a massive win, the road ahead still depends heavily on how it performs in the coming months.

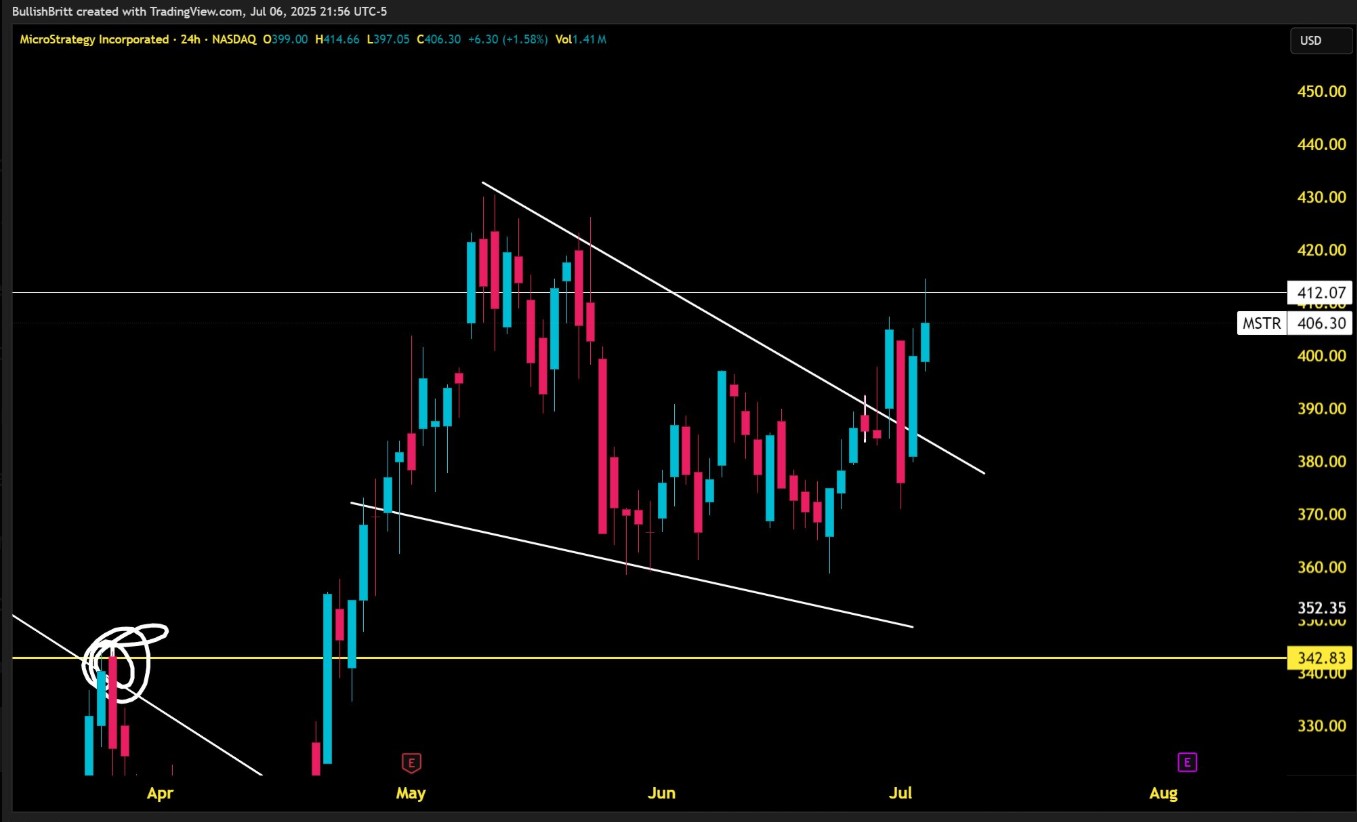

$ MSTR Bull Run Forming ? Stock Headed to $440+

In the latest MSTR news, crypto analyst BRITT recently shared a technical chart on X indicating a “Bull Flag Breakout” pattern for this stock. If this plays out, the MSTR stock forecast for 2025 could easily cross $440 or higher.

Source: BRITT X Account

Given the company’s rock-solid fundamentals and growing position, investors are paying close attention as the company’s strategy continues to align with bullish price action.

Final Thoughts: A Winning Period for MicroStrategy

Microstrategy Holdings Q2 2025 will go down as a landmark time. The firm’s conviction-driven strategy delivered:

-

A $14B MSTR Bitcoin profit

-

Over 69K coins added

-

No BTC sold

-

$21B boost in digital asset value

Whether the token goes higher or not, Q2 2025 will be remembered as a breakout quarter in the books of MicroStrategy—and a lesson in long-term belief in crypto.

Also read: ARI Wallet Daily Quiz Answer 08 July 2025: Earn 10 Coin免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。