In the midst of strategizing, we can win from thousands of miles away. Hello everyone, I am Lin Chao, a global financial market observer, focusing on cryptocurrency market analysis, bringing you the most in-depth trading information analysis and technical teaching.

Yesterday, Lin Chao received a private message from a fan who said he had lost over several million playing altcoins. He had previously been cut by air coins like FIL, leaving him in ruins. Yesterday, holding onto a last glimmer of hope, he invested in another altcoin, hoping to recover his losses, but it went to zero again. He felt lost and didn't know what to do. This fan told me that he started getting involved in the crypto space in 2021, playing with altcoins like FIL and BZZ, investing a lot of money in total. In fact, if he had converted that into BTC or ETH, he might have achieved financial freedom by now. Lin Chao expressed deep regret but felt helpless.

It's not just him; many people who enter the crypto space start by buying altcoins recommended by friends. With limited capital, they can't afford BTC, and the amount they can buy of ETH is also small, making them feel the returns are not significant. They are afraid to play contracts, having heard too many stories of liquidation, feeling the risks are high. After much deliberation, they find that a friend is bullish on an altcoin, which is very cheap, and after some boasting, they feel the next hundredfold coin is about to arrive, thinking that buying in will bring hope for overnight wealth. They don't need to operate; just holding it is better than playing contracts. At least no matter how much it drops, they still have the spot in hand every day, and as long as they don't sell, they won't lose. Lin Chao describes the mindset of holding altcoins very accurately, doesn't he?

Because this is the path many have taken. When I first entered the space, I also fell for altcoins. At that time, it was also a friend's recommendation, and this friend was even the issuer of the coin, clearly stating how much would be issued, when the pump would happen, and which funds would come in. But so what? I was still cut clearly. If you haven't been cut, you can't even say you're in the crypto space; that's standard. As long as you think about getting rich overnight, you will be manipulated. Fortunately, I admit my mistakes, take the hits, and learn from them.

However, those without financial logic are the ones who suffer. They repeatedly switch from one altcoin to another, getting cut each time. Then, when the price drops sharply, they come to ask Lin Chao, "Teacher, can you help me see if this coin can go back up? Is there a possibility it will go to zero?" I have repeatedly emphasized in my writings and private chats that everyone should avoid altcoins, but unfortunately, people just don't learn from others. I understand human greed well; it has nothing to do with the amount of wealth accumulated. As long as there is a lack of understanding, they will be manipulated.

Everyone needs to understand the underlying logic of why a coin rises. It is driven by capital. Taking Bitcoin as an example, its birth formed a consensus among people, making them realize that blockchain transactions can indeed create a trading reservoir and can flow globally. Once this consensus is reached, naturally, more people will participate, regardless of their motives. The more participants there are, the higher the price will go. Then there are underlying structures, blockchain public chains, and blockchain applications, such as later ETH, SOL, etc., which build public chains and public areas, supporting more people to join this space, thus raising the tide for all.

But what about air coins? They have no value logic, cannot trace any public chain information, and rely solely on boasting and selling expectations. So who will buy them? Retail investors, especially marginal retail investors, those who are friends recommending friends. Everyone should think calmly: if it’s all retail investors driving the price, can it really go up? It can in the short term, but what if there aren't enough buyers? It will inevitably go to zero, and in the long run, it will definitely go to zero. The reason is simple: without institutional entry, there will be insufficient momentum. This is why Lin Chao has always told everyone that the ultimate goal is to convert all the various coins in hand into Bitcoin after making a profit. It’s still that simple logic: consensus. Now, whether it’s institutions or governments, they all hold Bitcoin, so it won’t go to zero. Because as more people participate, there will be competition; when someone sells, someone else will buy, creating price fluctuations, thus forming the chaotic market of crypto.

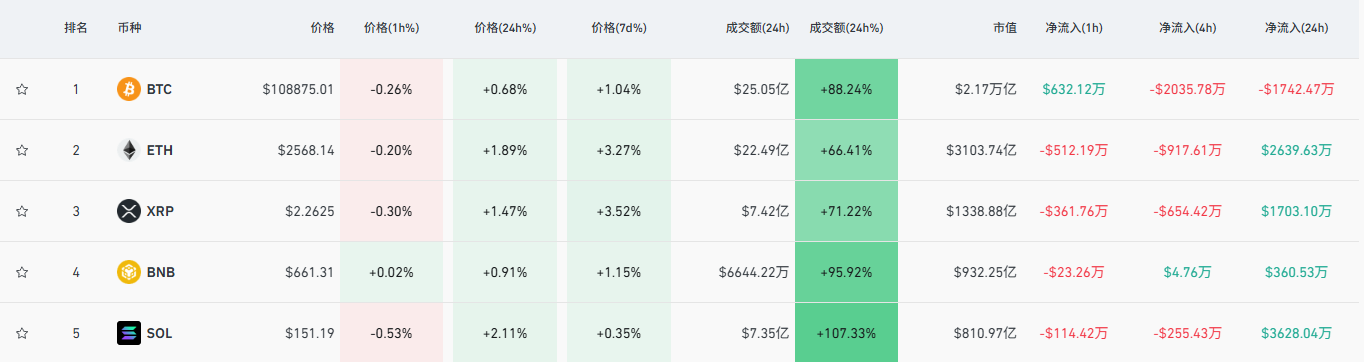

Currently, Lin Chao only holds 3+1 coins, which are the top 3 coins by market cap plus one coin from the top 10, and uses spot trading combined with contracts to adjust the overall holding cost. So please stop sending private messages asking Lin Chao which coin will rise a hundredfold. If I really knew, would anyone still work hard to trade for profit? Many users think they can just buy in and hold indefinitely, as they won’t need to put in effort to operate. But the price volatility in the crypto space and the long trading hours are unmatched by any financial market. In such a flexible market, one must adapt to the ever-changing conditions. Don’t think about a one-time effort leading to lasting success, and don’t think you can hold onto a certain altcoin for several hundred times the return. This logic has long been invalid in today’s crypto market. We can see from the top 5 cryptocurrencies by market cap that Bitcoin had a net outflow that day, while other coins had net inflows. What does this represent? It indicates that there is currently no more liquid capital in the market to push all coins forward together. The only movement is from higher-priced coins to lower-priced coins, creating price fluctuations, the so-called "when a whale falls, all things thrive." Many coins in today’s market can no longer follow Bitcoin's price trend, and Lin Chao predicts that as time goes on, this phenomenon will become more pronounced.

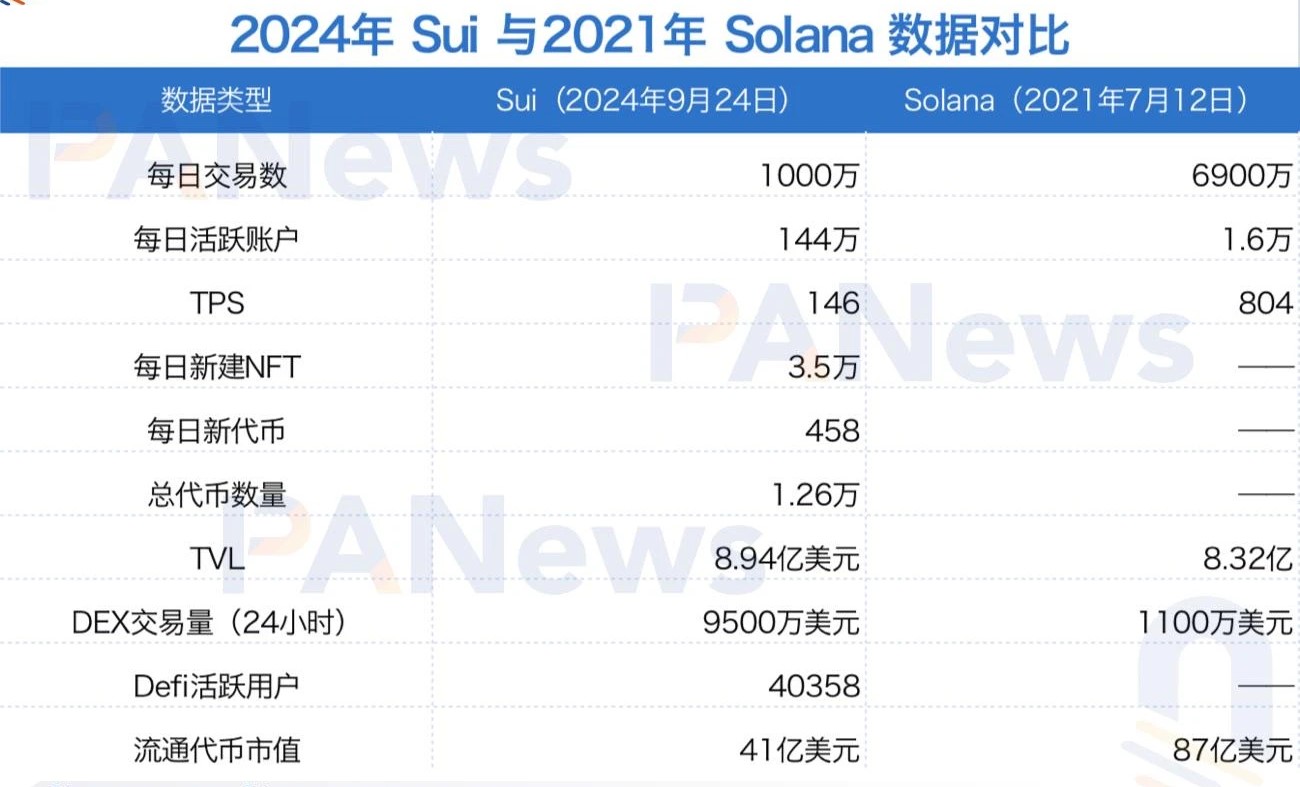

Many fans have left messages hoping Lin Chao can talk about the SUI coin. In fact, they just want to verify how long this coin can last or whether it can experience a big explosion and multiply several times. First, Lin Chao wants to express that SUI is not considered an air coin in my eyes; at least it has backers. From on-chain data, we can see that SUI's current path is indeed similar to SOL's in 2021. They have similar driving institutions, including a16z, Coinbase, Bixin, Binance, and SUI's trust fund also comes from Grayscale, which is the same as SOL. At the same time, they also have similar social media narratives and performance advantages, and currently, they have a wide popularity among KOLs in the crypto space.

Although they share so many commonalities, it does not mean SUI will become the next SOL. In fact, just like people, no two coins are exactly the same. We can see from the hacker attack on May 22, 2025, that its security is questionable to Lin Chao. Moreover, after the hacker attack, the SUI team announced that they would freeze the stolen SUI tokens. What does this represent? It indicates that this token is not decentralized, which contradicts the very nature of blockchain. Additionally, SUI's holders are relatively concentrated, in stark contrast to the dispersed holders of SOL, meaning that the manipulators can easily pump or dump the price, making it very easy to control the coin price. Especially in the current market, without more institutional funds to concentrate on pushing the coin price up, retail investors' funds will be concentrated and harvested by manipulators, supplying team expenses or even directly turning into profits.

From a technical analysis perspective, SUI's price is clearly in a process of high-level retracement and will oscillate repeatedly along the resistance level for a long time. The lowest support level is quite far from the mid-line support level. Once significant negative news appears and breaks through the mid-line support, it is very likely to revert to its original state, approaching the price support near 0.7. I will not hold a large amount of SUI at the current price level. On the contrary, if users who held it at a lower cost earlier, I think this is more like a good time to exit. At least before SOL's ETF is officially approved, SUI cannot be considered a good target to attract institutional investors' attention. Therefore, when encountering price plateau areas and facing directional choices, in the short term, SUI is likely to maintain a downward oscillating trend.

The success of investment depends not only on choosing good targets but also on when to buy and sell. Preserving capital and making good asset allocation is essential for steady progress in the ocean of investment. Life is like a long river flowing into the sea; what determines victory or defeat is never the gains and losses of a single pass or a momentary profit or loss, but the confluence of many rivers!

The global market is ever-changing, and the world is a whole. Follow Lin Chao to gain a top-tier global financial perspective.

For real-time consultation, feel free to follow the public account: Lin Chao on Cryptocurrency.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。