Source: Forex Spy +

Original: FX007

The spy previously shared his experience of being required to pay back taxes after trading US stocks. For details, see the previous article “Overseas Investments Start Paying Taxes!”. Before June 30, I had already completed the back taxes, paying the “capital gains tax” for the years 2022, 2023, and 2024, which means that if you made a profit for the entire year, you have to pay 20% tax, and losses cannot be deducted from the next year's profits.

Today, I saw a case shared by a netizen and realized that even trading USDT can be detected, and they also had to pay back 20% tax. This means everyone needs to be more cautious when using overseas bank cards and investment accounts.

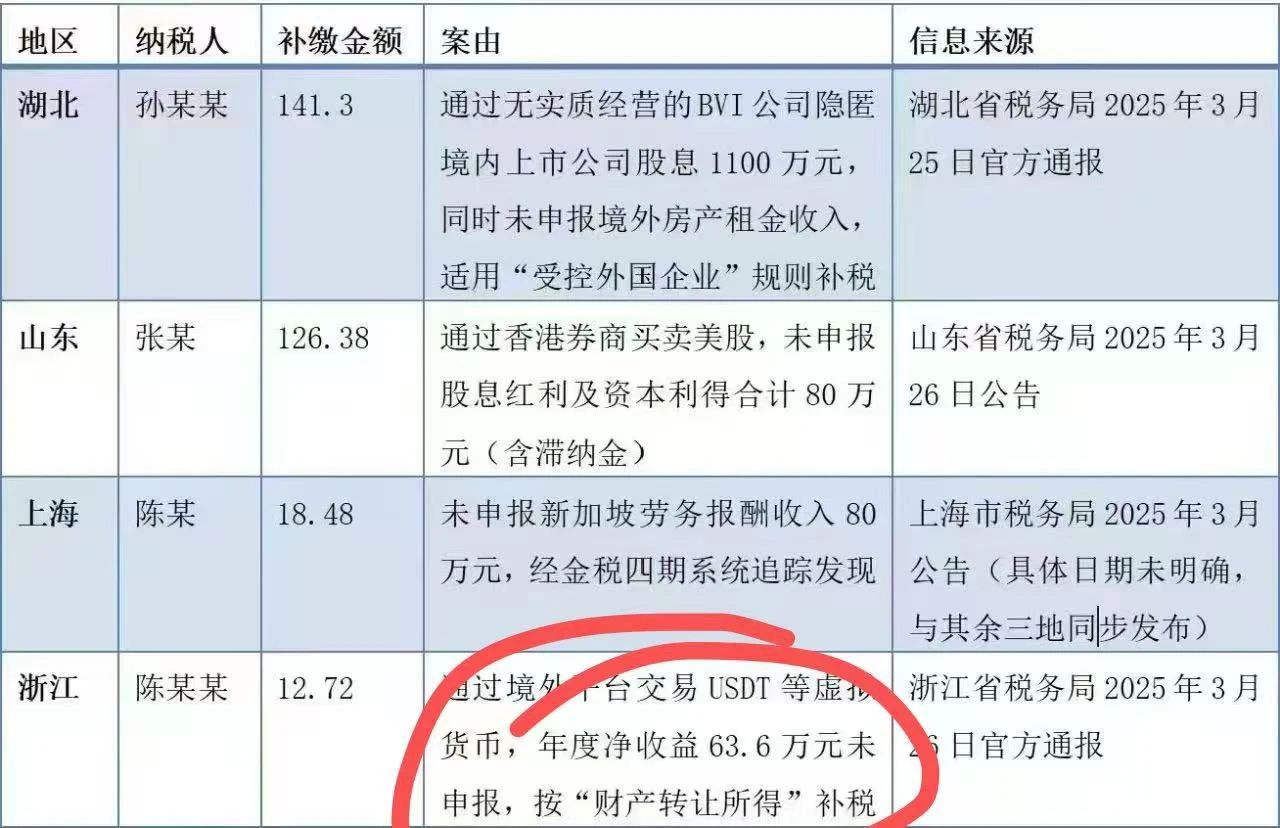

A certain Mr. Chen from Zhejiang was found to have traded USDT and other virtual currencies through an overseas platform, with an annual net income of 636,000 yuan that was not reported, resulting in a back tax payment of 127,200 yuan for “capital gains”. This regulatory storm triggered by CRS information exchange and the fourth phase of the Golden Tax system is spreading from high-net-worth individuals to middle-class investors — your US stock accounts, Hong Kong insurance policies, overseas properties, and overseas investment income may all be on the tax radar.

This year, tax inspections have broken the traditional model of "only checking billionaires," with middle-class investors holding assets of 100,000 to 1 million yuan becoming the main focus. A certain Mr. Zhang from Shandong traded US stocks through a Hong Kong brokerage, with unreported dividends and capital gains totaling 800,000 yuan, ultimately paying a total of 1,263,800 yuan including late fees (Source: Official report from Shandong Provincial Taxation Bureau, March 26, 2025).

Typical High-Risk Scenarios:

1. Overseas Securities Trading: Including US stocks, Hong Kong stocks, and high-frequency trading of virtual currencies.

A citizen from Wuhan, Liu Mo, traded US stocks worth 15 million dollars through Tiger Brokers from 2021 to 2024. Despite the account ultimately having only a few thousand dollars left, he was still required to conduct a self-check.

A certain Mr. Chen from Zhejiang traded USDT and other virtual currencies through an overseas platform, with an annual net income of 636,000 yuan that was not reported, resulting in a back tax payment of 127,200 yuan.

2. Offshore Company Dividends: A certain Mr. Wang held Luckin Coffee stocks with annual dividends of 100,000 yuan, resulting in a back tax payment of 20,000 yuan under the 'Controlled Foreign Corporation' rules.

3. Cross-Border Labor Compensation: A consulting advisor from Shanghai failed to report labor compensation of 800,000 yuan from Singapore, and after being tracked by the fourth phase of the Golden Tax system, was required to pay approximately 256,000 yuan in individual income tax (including late fees).

It is particularly important to note that if you have overseas income that you have not actively reported, there will be late fees each year. This fee is quite high, calculated daily, at 0.05% of the unpaid tax amount (equivalent to an annualized rate of 18.25%).

For example, if you have 10,000 yuan of overseas individual income tax that you did not pay this year, after a year, the late fee would be 1,825 yuan. So everyone should actively conduct self-checks.

Under the regulatory network woven by CRS and the fourth phase of the Golden Tax system, the era of unreported overseas income has ended. Actively embracing transparent rules is the ultimate "firewall" against tax risks.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。