The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of cryptocurrency enthusiasts. I welcome everyone's attention and likes, and I refuse any market smoke screens!

I just talked with you about being bearish in the coming week, and then there was a wave of growth. I believe everyone is very confused right now. Today, Lao Cui will once again interpret the entire trend for everyone. After this article, Lao Cui may choose to disappear for a while and will focus on the layout of users in hand. Please be patient and wait for Lao Cui for a while. Due to the continuous new highs in the US stock market, including the growth of gold and some bulk investment types, many users feel that we are currently in a period of strong economic growth. Especially for users who follow Lao Cui, the weak dollar and interest rate cuts provide unlimited imagination for the future. However, in Lao Cui's eyes, it is all bubble growth, and the actual problems have not been properly resolved. The financial crisis itself is a bubble problem. Understanding bubbles is about the reconstruction of assets. From the current data, it seems that we have already emerged from the crisis since 2019.

After six years, users without real estate feel a sigh of relief. Where is the actual problem that Lao Cui refers to? To put it bluntly, it is the employment rate and personal income. Whether it is the employment of college graduates or the employment issues of young people, or the basic security of ordinary workers, the current situation is actually quite weak, even less than half of the previous period. But why are the US stock market data so glamorous? Even the employment rate is currently above expectations? To answer the second question first, the employment data is questionable. The US non-farm data will only follow the pace of interest rate cuts, and the real data can only be seen before the interest rate cuts. The glamour of the stock market and gold is actually a hidden danger because ordinary people at this stage cannot achieve the idea of crossing classes through normal work, so they can only stimulate stock market growth while injecting vitality into technology. The US also wants to be great again. You can compare the domestic trends; why did the economy choose to develop real estate during its most prosperous period?

The lesson from real estate is Japan, which led to thirty years of regression after the bubble burst and has not yet eased. Yet we still have to walk this path, which is easy to understand because real estate is the most capable of driving economic circulation. The entire industrial chain can involve banks, developers, and workers, with a clear chain and many job positions. Plus, with the demographic dividend, there is no fear of houses not being sold. Especially after joining the WTO, the rapid development period was extremely swift, which is also a dividend of the era. Many friends interpret tariff issues from a political perspective, but Lao Cui interprets it only from a financial perspective. The intuitive feeling is that as one side rises, the other side declines. During the rapid growth explosion of the domestic economy, Japan and Europe are in a recession. The stronger you are, the weaker they become. At first, everyone thought the prices were cheap and worth buying, but as time goes on, they will find that the trade deficit is getting larger because the domestic industry is complete. For us, only the energy gap is worth purchasing; other industries are almost self-sufficient.

If we watch the trade deficit grow larger without intervening and let it develop, it will ultimately lead to a problem where your national assets will fall into the hands of others. If you are a ruler, you certainly do not want to see such a problem occur. This is also why the US can assertively tell everyone that increasing tariffs is reasonable. Because the tariffs they plan are to smooth out the trade deficit and strengthen national power. From this point, everyone can understand why Trump called on us to buy his energy. The intuitive feeling is that the only place we can still purchase from the US is energy, so the new rules of negotiation now include chips. If we do not continue to purchase these technological products, we may only watch the trade deficit grow, which is an unbearable existence for any country. Tariff issues will definitely be resolved properly; it is just about finding a balance point, which can be chips or other products we need.

Any industry related to finance cannot escape the essence of the market; cooperation can only be achieved when both buyers and sellers are satisfied. The decline of domestic real estate is also the same; this is a necessary stage of economic development. The problem with real estate is not just oversupply; more importantly, it is the decline of the financial environment. Without external circulation, there will be no internal circulation. Do not think that tariffs will only affect our development; looking back, the US is the same. The industrial structure issue is extremely critical for them; relying solely on finance and services without the support of manufacturing is the biggest problem regarding living costs. The opening of tariffs will only increase their living costs, so negotiations are also a necessary path. Now we can return to the most fundamental question: what stage are we and the US, or the whole world, currently in? Everyone knows that it is not just the financial level that is in a confrontational stage; it can be said that it is a comprehensive confrontation.

Speaking of confrontation, one side must show weakness for sustainable development, but currently, there is no compromise. For us and the US, there has been progress, such as the lifting of chip restrictions and rare earth exports, which we can see. However, what everyone desires, going back to before 2016, when the US unilaterally raised tariffs, is completely impossible. This also establishes that it is impossible for the financial market to return to its peak period. Looking at a larger scale, this is a confrontation between industry and finance. The bubbles in the financial industry are certainly more, while the industrial sector may be slightly alleviated. This is not blind promotion but a fact. Because if we set aside high technology, our only constraint is energy. The US's gap will be larger; the entire industrial chain, as well as the rare earths and even electric energy needed for high technology, will become stumbling blocks on their path to greatness.

So where is the prosperity of the US stock market? Everyone can take a look; the current pillar industries in the US are nothing but high-tech concept stocks. Analyzing calmly, do you think the market value of Nvidia and Tesla is inflated? Even if everyone has a graphics card or a Tesla car, compared to the current stock market value, there is still room for growth. However, the current confrontation can be said to be partly a capacity issue. And the only place to solve this capacity issue is industry. Therefore, the current market value is certainly inflated, but the US indeed has no solution; they can only let these companies grow larger to create jobs and stimulate economic circulation. Other industries are almost saturated. To maintain the prosperity of the stock market, companies are even buying back their own stocks, which is not increasing the bubble? It is not just a financial issue; the entire world is in a kind of pathological development, and the cause of the disease is also very clear. Since World War II, there has been no disruptive technological progress. Currently, we are still digesting previous technological achievements. Without new tracks emerging, we can only roll in the existing market, and the current existing market is already saturated, so the financial crisis follows.

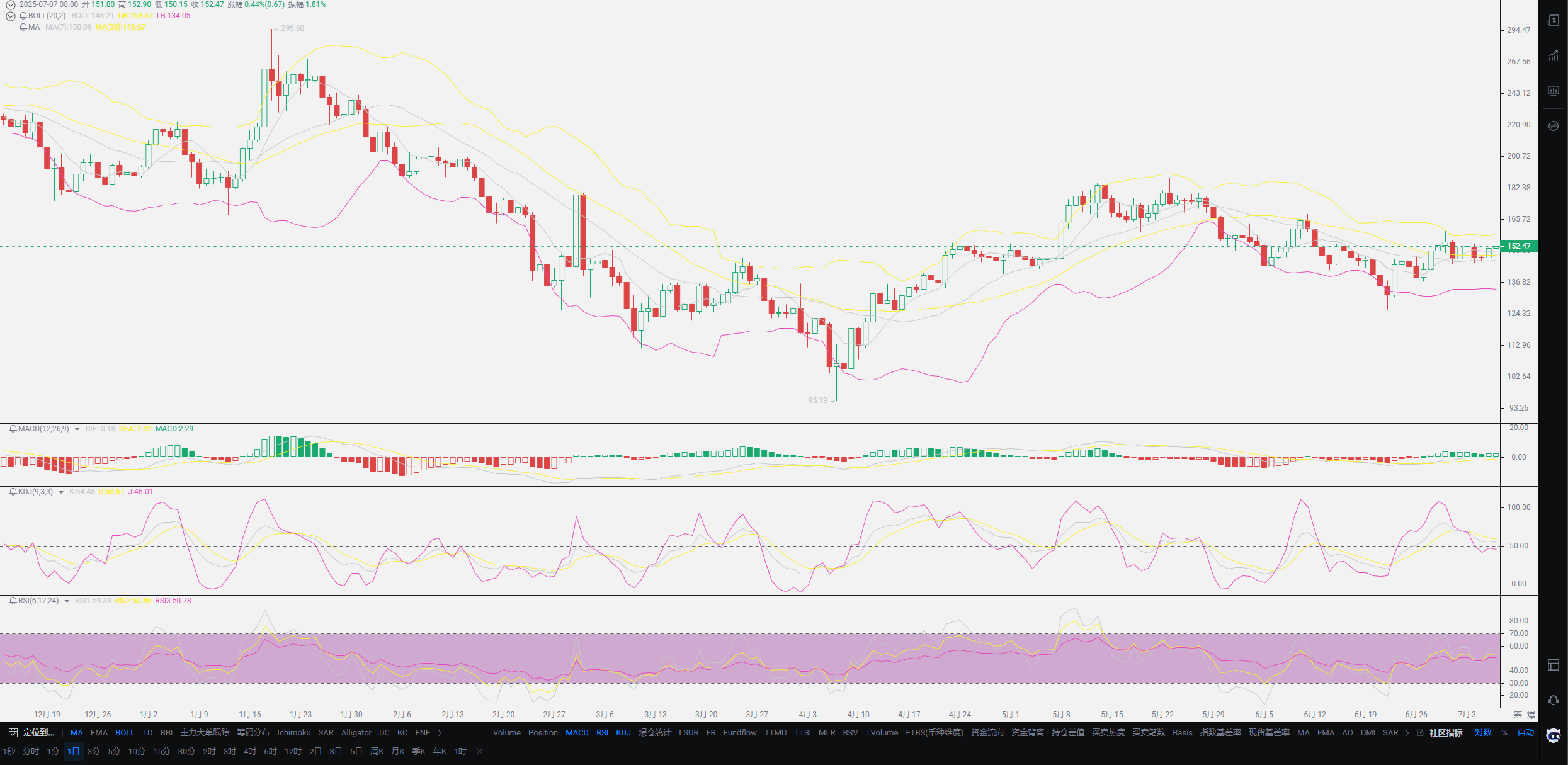

Lao Cui summarizes: In explaining the entire financial market, Lao Cui just wants to tell everyone what stage of development we are currently in. If you examine the cryptocurrency circle from this perspective, you will find the value generated under confrontation. At least the emergence of the cryptocurrency circle has solved part of the problem of currency circulation. The essence of the market is still the barter stage; innovating the attributes of currency is indeed a necessary path. Whether it is the US dollar or the euro, what is ultimately exchanged is still the resources of the country. What value can you provide, then you possess that attribute. If everyone truly understands what this article discusses, you will also understand the contradiction of the US's weak dollar and interest rate cuts. This step is a must for the US; it is also their trump card and more like a compromise. Returning to the cryptocurrency circle, perhaps the existence of the cryptocurrency circle is to solve the currency problem, and the current cryptocurrency circle is also in a state of confrontation. From the stablecoin bill to Bitcoin holdings, to the compliance of exchanges, all indicate the process of the cryptocurrency circle becoming formalized. The future of the cryptocurrency circle may be long, but other currencies may not be. As long as there is confrontation, the cryptocurrency circle will endure. Those who held the spot before will definitely receive the returns they deserve. In the medium term, Lao Cui still holds a bearish view, with the key points being the tariff issue and then the interest rate cuts. The glamour of the US stock market cannot cover up the fact of economic recession!

Original creation by WeChat public account: Lao Cui Talks About Currency. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation and plans for the big picture, not focusing on one piece or one territory, aiming for the ultimate victory. The novice, however, fights for every inch of land, frequently switching between long and short positions, only competing for short-term gains, resulting in frequent troubles.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。