Key Points

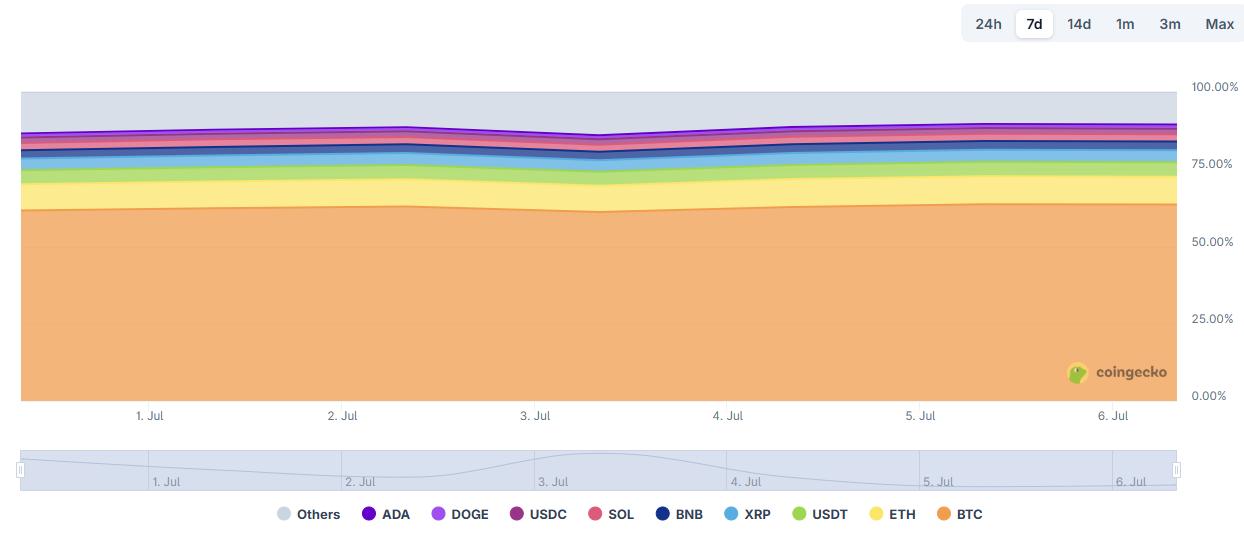

● The total market capitalization of cryptocurrencies is $3.45 trillion, down from $3.51 trillion last week, representing a decline of 1.7% this week. As of the time of writing, the cumulative net inflow of Bitcoin spot ETFs in the U.S. is approximately $49.64 billion, with a net inflow of $770 million this week; the cumulative net inflow of Ethereum spot ETFs in the U.S. is approximately $4.4 billion, with a net inflow of $219 million this week.

● The total market capitalization of stablecoins is $265 billion, with USDT having a market cap of $158.7 billion, accounting for 59.89% of the total stablecoin market cap; followed by USDC with a market cap of $62.2 billion, accounting for 23.47% of the total stablecoin market cap; and DAI with a market cap of $5.36 billion, accounting for 2% of the total stablecoin market cap.

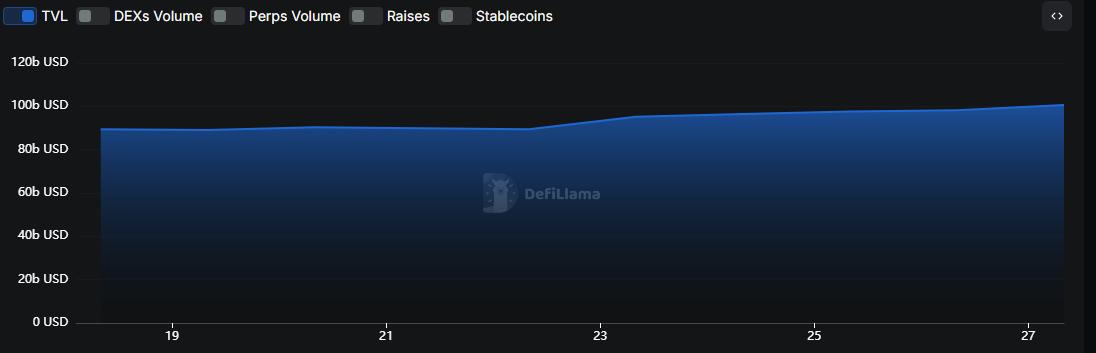

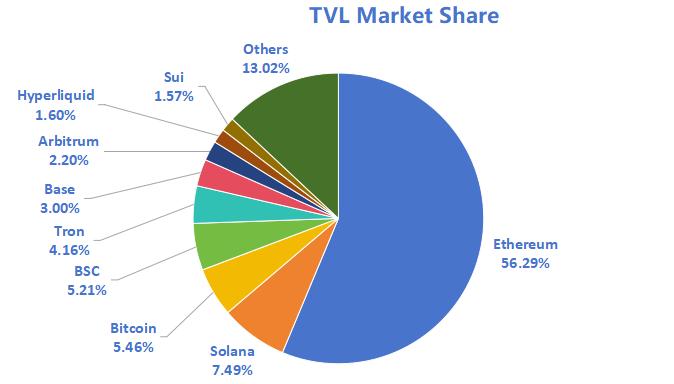

● According to DeFiLlama, the total TVL (Total Value Locked) in DeFi this week is $116.4 billion, up from $113.4 billion last week, representing an increase of 2.65% this week. When categorized by public chains, the top three public chains by TVL are Ethereum with a share of 56.29%; Solana with a share of 7.49%; and Bitcoin with a share of 5.46%.

● From on-chain data, the transaction volume of Layer 1 public chains this week, except for Solana, has decreased. BNBChain saw the most significant decline, down 32.9% from last week. Meanwhile, Solana increased by 16% compared to last week; in terms of transaction fees, Ethereum and Solana saw the most significant changes, with Ethereum down 50% and Solana down 75% from last week. In terms of daily active addresses, all public chains, except for Ethereum, Toncoin, and Aptos, have seen overall growth, with Sui showing the most significant increase of 71.87% compared to last week. Additionally, Solana increased by 41.88% compared to last week.

● Innovative projects of interest: Keyring Network is dedicated to providing permissioned tools for on-chain compliant trading for financial service institutions. Its solution emphasizes institutional-level privacy protection capabilities, bridging the gap between compliance and blockchain interaction; Strata is a perpetual yield tiering protocol designed specifically for Ethena's Delta neutral synthetic stablecoin USDe, aimed at providing structured yield exposure; Derolas is a decentralized market-making system built by Olas Agents, aimed at addressing the common liquidity coordination challenges in the DeFi ecosystem.

Table of Contents

1. Total Market Capitalization of Cryptocurrencies / Bitcoin Market Cap Proportion

3. ETF Inflow and Outflow Data

4. ETH/BTC and ETH/USD Exchange Ratios

5. Decentralized Finance (DeFi)

7. Stablecoin Market Capitalization and Issuance Situation

II. This Week's Hot Money Trends

1. Top Five VC Coins and Meme Coins by Growth This Week

1. Major Industry Events This Week

2. Major Events Coming Next Week

3. Important Investments and Financing from Last Week

I. Market Overview

1. Total Cryptocurrency Market Capitalization / Bitcoin Market Share

The total market capitalization of cryptocurrencies is $3.45 trillion, down from $3.51 trillion last week, representing a decrease of 1.7% this week.

Figure 1 Data Source: cryptorank

As of the time of publication, Bitcoin's market capitalization is $2.17 trillion, accounting for 62.96% of the total cryptocurrency market capitalization. Meanwhile, the market capitalization of stablecoins is $265 billion, representing 7.68% of the total cryptocurrency market capitalization.

Data Source: coingeck

2. Fear Index

The cryptocurrency fear index is at 74, indicating greed.

Figure 3 Data Source: coinglass

3. ETF Inflow and Outflow Data

As of the time of publication, the total net inflow of the U.S. Bitcoin spot ETF is approximately $49.64 billion, with a net inflow of $770 million this week; the total net inflow of the U.S. Ethereum spot ETF is approximately $4.4 billion, with a net inflow of $219 million this week.

Data Source: sosovalue

4. ETH/BTC and ETH/USD Exchange Rates

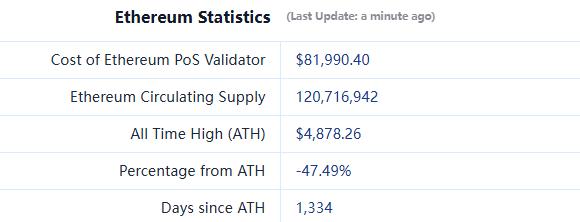

ETHUSD: Current price is $2,562, with a historical high of $4,878, down approximately 47.49% from the peak.

ETHBTC: Currently at 0.023530, with a historical high of 0.1238.

Data Source: ratiogang

5. Decentralized Finance (DeFi)

According to DeFiLlama, the total TVL of DeFi this week is $116.4 billion, up from $113.4 billion last week, representing an increase of 2.65%.

Data Source: defillama

By public chain classification, the top three public chains by TVL are Ethereum at 56.29%; Solana at 7.49%; and Bitcoin at 5.46%.

Data Source: CoinW Research Institute, defillama Data as of July 6, 2025

6. On-Chain Data

Layer 1 Related Data

Mainly analyzing the current data of major Layer 1 chains including ETH, SOL, BNB, TON, SUI, and APT based on daily trading volume, daily active addresses, and transaction fees.

Data Source: CoinW Research Institute, defillama, Nansen Data as of July 6, 2025

● Daily Trading Volume and Transaction Fees: Daily trading volume and transaction fees are core indicators of public chain activity and user experience. This week, daily trading volume decreased for all public chains except Solana, with BNBChain experiencing the most significant drop of 32.9% compared to last week. Meanwhile, Solana saw a 16% increase; in terms of transaction fees, Ethereum and Solana showed the most significant changes, with Ethereum down 50% and Solana down 75% compared to last week.

● Daily Active Addresses and TVL: Daily active addresses reflect the ecological participation and user stickiness of public chains, while TVL reflects user trust in the platform. In terms of daily active addresses, all public chains showed overall growth except for Ethereum, Toncoin, and Aptos, with Sui experiencing the most significant increase of 71.87% compared to last week. At the same time, Solana saw an increase of 41.88%.

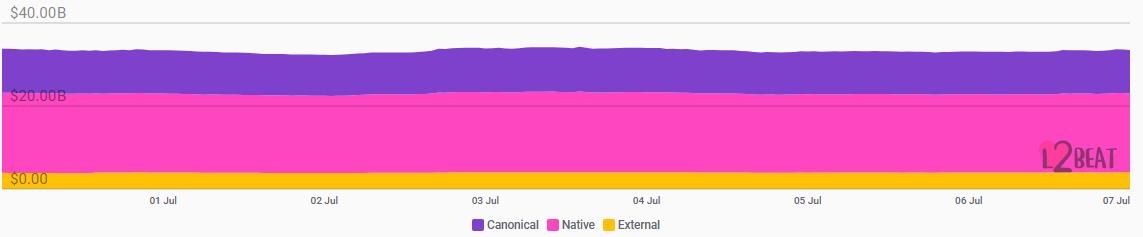

Layer 2 Related Data

● According to L2Beat, the total TVL of Ethereum Layer 2 is $33.5 billion, up from $32.49 billion last week, representing an overall increase of 3.1%.

Data Source: L2Beat Data as of July 6, 2025

Base and Arbitrum hold the top positions with market shares of 36.09% and 34.19%, respectively, with Base still ranking first in TVL among Ethereum Layer 2 this week.

Data Source: footprint Data as of July 6, 2025

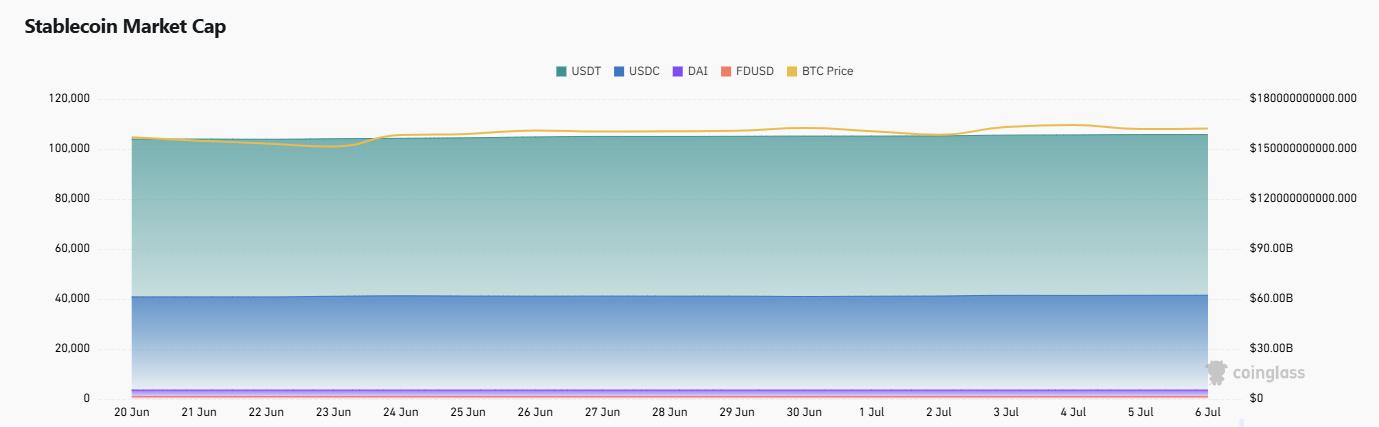

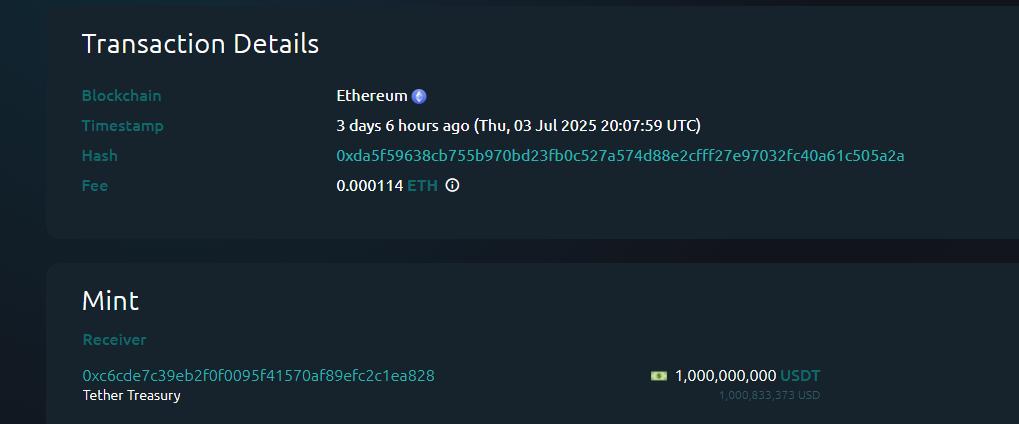

7. Stablecoin Market Capitalization and Issuance

According to Coinglass, the total market capitalization of stablecoins is $265 billion. Among them, USDT has a market capitalization of $158.7 billion, accounting for 59.89% of the total stablecoin market capitalization; followed by USDC with a market capitalization of $62.2 billion, accounting for 23.47%; and DAI with a market capitalization of $5.36 billion, accounting for 2%.

Data Source: CoinW Research Institute, Coinglass Data as of July 6, 2025

According to Whale Alert, this week, USDC Treasury issued a total of 980 million USDC, and Tether Treasury issued a total of 1.06 billion USDT, with a total issuance of stablecoins this week amounting to 2.04 billion, compared to last week's total issuance of 485 million, representing an increase of approximately 320.62% in stablecoin issuance this week.

Data Source: Whale Alert Data as of July 6, 2025

II. Hot Money Trends This Week

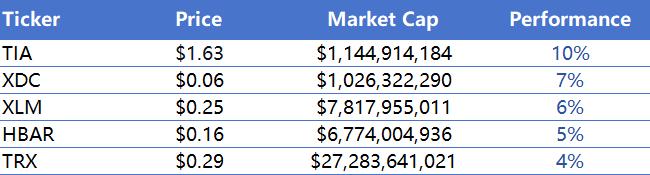

1. Top Five VC Coins and Meme Coins by Increase This Week

The top five VC coins by increase over the past week

Data Source: CoinW Research Institute, coinmarketcap Data as of July 6, 2025

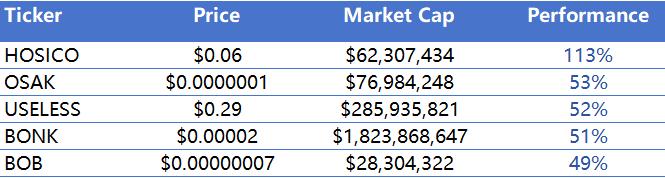

The top five Meme coins by increase over the past week

Data Source: CoinW Research Institute, coinmarketcap Data as of July 6, 2025

2. New Project Insights

● Keyring Network: A technology company based in London, UK, dedicated to providing compliant on-chain trading tools for financial service institutions. Since its establishment in 2022, Keyring has utilized zero-knowledge (ZK) privacy technology to help financial institutions achieve controllable connections with compliant trading counterparts while ensuring data privacy and security. Its solutions emphasize institutional-level privacy protection capabilities, bridging the gap between compliance and blockchain interactions.

● Strata: A perpetual yield tiering protocol designed specifically for Ethena's neutral synthetic stablecoin USDe, aimed at providing structured yield exposure. The protocol allows users to flexibly allocate based on their risk preferences by dividing into senior and junior risk tier portfolios, sharing the potential returns from Ethena's arbitrage strategies.

● Derolas: A decentralized market-making system built by Olas Agents, aimed at solving the common liquidity coordination challenges in the DeFi ecosystem. This system is committed to achieving automated and collaborative market-making strategy deployment through a modular smart agent architecture, enhancing liquidity efficiency and capital utilization across different DeFi protocols.

III. Industry News Updates

1. Major Industry Events This Week

● The on-chain asset management platform Lorenzo has launched its first OTF testnet product, USD1+ OTF, which is also its first U-based yield product settled in USD1 stablecoin, currently deployed on the BNB Chain testnet. This product is supported by the financial abstraction layer developed by Lorenzo, which will integrate RWA yields, quantitative strategies, and DeFi yields, with all yields settled uniformly in USD1. Lorenzo thus becomes one of the earliest projects to build real yield products around USD1, promoting the practical use of USD1 in the on-chain financial ecosystem. Users can participate in product testing by staking USDT, USDC, or USD1 to obtain sUSD1 and tokens representing yield rights, experiencing a stable, diverse, and real yield structure.

● The Ethereum SVM L2 network has launched an ES token airdrop check portal. ASC NFT holders will directly receive the ES airdrop on the day of the Eclipse TGE, with no snapshot and no claim required. The Eclipse ecosystem's technology and research team, Eclipse Labs, has stated that Eclipse Labs employees have signed documents prohibiting them from claiming any ES airdrop and have provided all addresses to exclude the possibility of participating in the airdrop. All allocations for employees and investors will be locked for one year after the token goes public and will gradually unlock over three years.

● Protocol Guild stated that it has allocated nearly $30 million to individuals engaged in Ethereum L1 development since 2022. At the current funding level, Protocol Guild expects to redistribute an additional $37 million over the next four years. Protocol Guild mentioned that there is still a long way to go in balancing core development incentives and invited interested parties to participate.

● Nexus, a company dedicated to achieving verifiable computation through cryptography and zero-knowledge proofs, announced that it has sent 10,000 reward points to contributors from the first week of Testnet III, which users can claim on the Nexus OS dashboard.

2. Major Events Coming Next Week

● Aethir Edge tokenomics 2.0 will launch on July 13, introducing a staking-driven reward mechanism. Users will need to stake ATH to participate in rewards, which are divided into Bronze, Silver, and Gold tiers, with a maximum reward of 240 ATH per day.

● Resolv announced that the total token allocation for the second quarter has been set at 5.75% of the total supply, with at least 4% allocated for the second quarter points program. The second quarter began on May 9 and will continue until September 9, during which more integrations, opportunities, and product improvements will be launched.

● The modular RollApp network Dymension announced the launch of Season 2, with the first wave of registrations now open to long-term stakers. S2 registration will be conducted in phases, with different registration waves having varying participation conditions and time limits. Successfully registered users will receive DYMONDs, which can be earned through on-chain activities and invitations, and can choose to redeem them for DYM tokens during specific time windows or continue participating for higher rewards.

3. Important Financing Events Last Week

● Distinct Possibility Studios raised $30.5 million, with investors including Bitkraft Ventures, BH Digital, Hashed, Shima Capital, and North Island Ventures. Distinct Possibility Studios is an independent game studio focused on the Web3 space, dedicated to developing immersive large-scale MMO and FPS gaming experiences. Its first project, "Reaper Actual," integrates blockchain technology with gaming mechanics, innovating in digital assets, player economies, and on-chain interactions, and has gained widespread attention in the market. (July 4, 2025)

● TWL Miner completed a Series B financing round, raising $95 million, with the investing institution undisclosed. TWL Miner is a platform company focused on cloud mining services, dedicated to providing users with convenient and efficient cryptocurrency mining solutions. Users can participate in mining without purchasing expensive equipment, leveraging the platform's cloud computing capabilities to obtain stable passive income. (July 1, 2025)

● Caleb & Brown announced its acquisition on July 1, 2025, for $65.8 million, with investors including the Australian trading platform Swyftx. Caleb & Brown is a cryptocurrency brokerage and custody service provider aimed at individual and institutional clients, focusing on providing a secure and efficient digital asset trading experience. (July 1, 2025)

Reference Links:

Keyring Network

https://x.com/KeyringNetworkStrata

https://x.com/strata_moneyDerolas

https://x.com/derolas_xyzDistinct Possibility Studios

https://x.com/DPS_StudiosTWL Miner

https://x.com/twl_minerCaleb & Brown

https://x.com/calebandbrown

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。