Author: Luke, Mars Finance

An Unspoken "Risk Control Upgrade"

Recently, the atmosphere in the crypto community has become subtly tense. Many users have complained on social media about encountering unprecedentedly strict risk control measures while using the OKX exchange: seemingly routine actions, such as logging in with a VPN, managing multiple family members' accounts on the same device, or even having a slight connection to a "suspicious" entity, can trigger alarms, leading to temporary account freezes or the need to provide cumbersome proof materials.

In an instant, anxiety spread among users. Is this a "targeted strike" by the exchange against specific users, or a warning of a new round of regulatory storms?

Amidst the speculation, a series of announcements from OKX partially confirmed the market's sentiments. In these statements, OKX unusually disclosed many details of its risk control model, acknowledging the possibility of "false positives" in the system, and attempted to reassure the market with data indicating that "only about 1% of users will receive inquiries." However, this "technical" explanation seemed more like a "disclaimer" under immense pressure rather than a way to alleviate users' concerns. It clearly conveyed a message: risk control is tightening with unprecedented intensity, and this is not an active choice by the exchange, but a passive defense against significant external risks.

So, the question arises: what kind of risk could compel an industry giant like OKX to "collaterally damage" some real users while erecting high walls? The answer lies behind the collapse of a platform called "DGCX Xin Kang Jia," a shocking scam involving an amount as high as 13 billion RMB, affecting 2 million members.

Beneath the Iceberg: The Ghost of "Xin Kang Jia" and the Frenzy of the Lower-tier Market

As the exchange's risk control system sounded alarms, the real storm was brewing in China's vast third and fourth-tier cities. An investment platform named "DGCX Xin Kang Jia," founded in Guizhou in 2021, vanished into thin air at the end of June this year after completing its final harvest, leaving approximately 2 million investors and a massive black hole of 13 billion RMB.

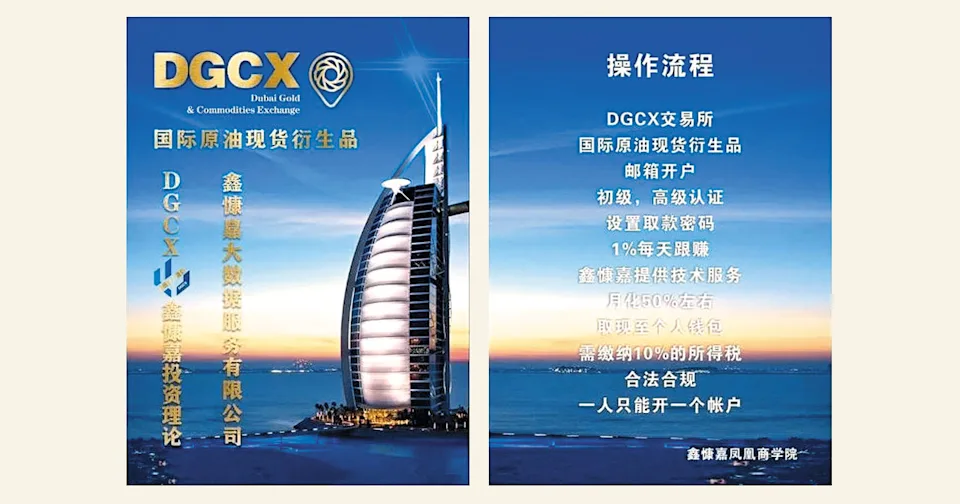

The operators of this scam precisely seized on the market's weak points. They appropriated the name "DGCX" — which stands for the Dubai Gold & Commodities Exchange, a label that sounds authoritative and internationally backed. They publicly touted themselves as the "DGCX China Branch," even falsely claiming to have reached a five-year strategic agreement with the state-owned enterprise PetroChina, when in reality, they had only purchased oil equipment from the company. By "colliding" with internationally renowned institutions and state-owned enterprises, "Xin Kang Jia" cloaked itself in a veneer of legitimacy and professionalism.

On this foundation, they wove an enticing story: using unique big data technology to conduct futures trading in gold, oil, and foreign exchange in the Middle East, promising high returns. How high were the returns? The answer was "0.2% daily interest," meaning an investment of 100,000 USD could yield 2,000 USD in interest daily. This promise, which defied financial common sense, precisely hit the knowledge blind spots and fantasies of wealth among the target demographic.

To grow this snowball, "Xin Kang Jia" established a "corps-style" nine-level structure similar to a pyramid scheme. A member could upgrade to "squad leader" by recruiting nine people, earning bonuses and a guaranteed monthly salary. Above that were "platoon leaders," "company commanders," up to the highest rank of "commander," with referral bonuses and monthly salaries reaching tens of thousands of USD. With the combination of a "high-end" concept, the lure of ultra-high returns, and a viral hierarchical system, "Xin Kang Jia" rapidly expanded, building a massive financial empire in a short time.

The "Trojan Horse" of USDT and the Founder's "Thank You Letter"

However, compared to previous scams, the most core "innovation" of "Xin Kang Jia" lay in its extreme use of the stablecoin USDT. It required all members to use USDT for "deposits" and "withdrawals," with all internal pricing also denominated in USDT. This design was the crowning touch of the entire scam, akin to a perfect "Trojan Horse."

First, it added a trendy "dollar investment" aura to the scam. Second, by requiring members to convert RMB into USDT before investing in the platform, the operators avoided handling large amounts of RMB themselves, significantly reducing the risk of regulatory detection during the fundraising phase. Most importantly, it paved the way for the eventual escape with funds. Given the free circulation of USDT internationally, transferring this huge sum out of the country was merely a matter of pressing a few keys on a crypto wallet.

And indeed, this was the case. Blockchain data shows that just before the platform's collapse at the end of June, a staggering 1.8 billion USDT (approximately 12.9 billion RMB) was swiftly transferred in 12 batches to three new crypto addresses. Subsequently, these funds could easily be "laundered" through the dark web or more complex mixing services, completely disappearing into the vast digital world.

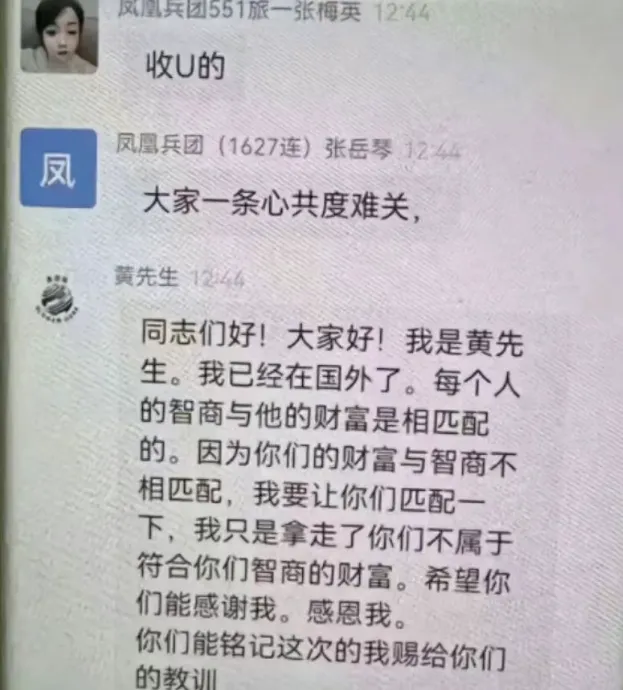

When 2 million members discovered that the platform could not process withdrawals and fell into despair, founder Huang Xin left a mocking and arrogant "farewell message" in the members' WeChat group:

"Hello comrades! I am Mr. Huang. I am already abroad. Each person's IQ matches their wealth. Because your wealth does not match your IQ, I want to help you match it. I simply took away the wealth that does not belong to your IQ level, and I hope you can thank me. Be grateful to me. Remember this lesson I have given you."

This statement starkly revealed the essence of the scam: it was not only a plunder of wealth but also a precise strike and ruthless mockery of human weaknesses and cognitive flaws.

The Silent War: On-chain "Tianyan" and the Cost of Risk Control

The "escape" of 13 billion RMB in ill-gotten gains from Xin Kang Jia staged a textbook case of digital financial crime. This forced the entire industry into an arms race of "the higher the law, the higher the magic." On one side are criminals, constantly iterating their money laundering techniques; on the other side are on-chain analysis firms like Chainalysis and the risk control teams of major exchanges. They act as the "Tianyan" on the chain, attempting to identify addresses and behavioral patterns related to criminal activities within vast amounts of transaction data.

The risk control rules mentioned by OKX in their announcements are a concrete manifestation of this war on the front lines. Every marked VPN address, every associated "blacklist" account, is an alarm sounded by the risk control system. However, wars always come with costs, and this time, part of the cost has unfortunately been borne by ordinary users.

To ensure they are not overwhelmed by massive amounts of dirty money, the risk control models of exchanges have been forced to become increasingly sensitive, resulting in a higher "false positive" rate. A privacy-conscious crypto enthusiast, a developer needing to conduct multi-account testing, or an ordinary person who inadvertently transacted with a suspicious address could all be swept up in this high-speed compliance machine. This is the significant dilemma currently faced by crypto users: on one hand, we enjoy the freedom and efficiency brought by decentralization; on the other hand, we must live under increasingly centralized and tightly monitored conditions reminiscent of traditional banks.

The tightening of risk control by OKX, which led to the "DGCX Xin Kang Jia" scandal involving billions, thus carries deeper symbolic significance. It is not merely a financial crime event but a turning point in the industry's development. It tells us that when the scale of crypto assets becomes large enough to trigger systemic risks, the once free-spirited "Wild West" era will inevitably come to an end. To exchange for safety, compliance, and acceptance by mainstream society, the entire ecosystem, including exchanges and every user within it, must adapt to new rules of the game. This silent war is far from over, and it is profoundly reshaping the digital new world we inhabit.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。