In the world, everyone is bustling for profit; in the world, everyone is striving for benefits! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. I welcome everyone's attention and likes, and I refuse any market smoke screens!

Once again, I declare that Lao Cui does not participate in group chats. If anyone has any group chat needs, please do not come to Lao Cui! Recently, the market fluctuations have not been large, so there is not much to discuss regarding trends. Today, I will continue the previous approach to answering questions. With the depreciation of the dollar in the past two days, I have also expressed my views, including that short-term growth is within expectations. Therefore, I need to emphasize one point: depreciation requires a long-term process similar to interest rate cuts. It can only indicate the general trend at a macro level and is not applicable to contract users. Everyone should not rely on such news to make trades. This includes the recent positive news regarding tariffs, especially the lifting of restrictions on chips by foreign giant companies, which can be considered short-term positive news. The trend will not deviate from the bull market level. My emphasis on a bearish outlook in the medium term is based on the situation before the bull market, so please do not misunderstand.

The depth of the pullback in July and August has always existed in the medium term, and the approach can continue to operate. With the implementation of the stablecoin bill, many friends in the Hong Kong stock market have been consulting me. Since the Americans are driving growth, is it worth investing in stablecoins here in Hong Kong? In comparison, if everyone calculates based on returns, the American returns are definitely higher than all markets. If only considering Hong Kong stocks, there will certainly be some returns, but the two cannot be compared. It is important to understand that Hong Kong's stablecoins are only pegged to the Hong Kong dollar, while the Americans are pegged to U.S. Treasury bonds and the dollar. This shows that in terms of currency comparison, whoever has more advantages will have a larger market and more returns. The emergence of Hong Kong is not to seize the stablecoin market and the cryptocurrency market share; please do not get the direction wrong. This question is difficult to answer directly; it is only necessary to be clear that currently, over 90% of stablecoins in the cryptocurrency market are pegged to the U.S., and the pricing power is currently in their hands. The emergence of Hong Kong only provides another option.

With the release of employment data from the U.S. yesterday, it has also driven varying degrees of increases in the financial sector. Many friends are once again confused as to why the probability of interest rate cuts has increased, yet the financial market is still rising. I have answered this question before; the core reason is not about interest rate cuts. Rather, the data from the U.S. shows that the liquidity in the American market is good, and there are not many problems, with a large amount of capital available for investment. Powell and major European institutions have directly stated that interest rate cuts will not occur in the near future, and instead, will guide the market towards a bearish range; these two cannot be compared. Interest rate cuts are aimed at the future market, while employment data refers to the present. If the current market performs well, there will be no interest rate cuts. This is why after the announcement yesterday, over 200 million flowed into the cryptocurrency market. The core goal of interest rate cuts is to inject liquidity, allowing more people to dare to borrow and invest, thus driving economic circulation.

Many friends feel that this rebound seems somewhat unexpected, benefiting from the depreciation of the dollar and the results of tariffs. From the current tariff perspective, many key industries may return to the state before tariffs. The core issues are chips and rare earths, with both sides making concessions. Do not overlook the importance of chips; I also dabble in mining and understand how crucial graphics cards and computing power are. Once these restrictions are lifted, technology and national strength may experience explosive growth. It is widely recognized that computing power equals national strength, and with the natural resource capabilities in the country, especially in terms of electricity, once lifted, the title of supercomputers may again be led by us. The impact on the financial sector is also significant; today, I can remind everyone to pay attention to Nvidia's stock price regarding tariff exemptions, as companies related to computing power will also see a wave of growth. Especially with the massive liquidity injection and the depreciation of the dollar, even without a bull market, it will not lead to losses for everyone. I specifically refer to U.S. stocks, followed by Hong Kong stocks.

Many friends come to ask me after the market has moved, including inquiries about stablecoin concept stocks, only after seeing profits do they become interested. The industries I mentioned are certainly of interest to potential users, and they can purchase directly. If you do not have overseas accounts, do not worry too much about other markets; the focus should still be on the cryptocurrency market, which still has opportunities for you to transcend classes. Returning to the main point, the lifting of chip restrictions is definitely good news for miners in the cryptocurrency market, as mining cards will become cheaper. This will lead to a decrease in costs for miners, combined with the optimization of packaging programs for various cryptocurrencies, the underlying operational logic costs will also decrease. This will allow more energy and financial resources to be focused on optimizing cryptocurrencies. The most benefited will be SOL and Ethereum; the founding team of Ethereum is expected to undergo a reform by the end of this year, and it is highly likely to be realized.

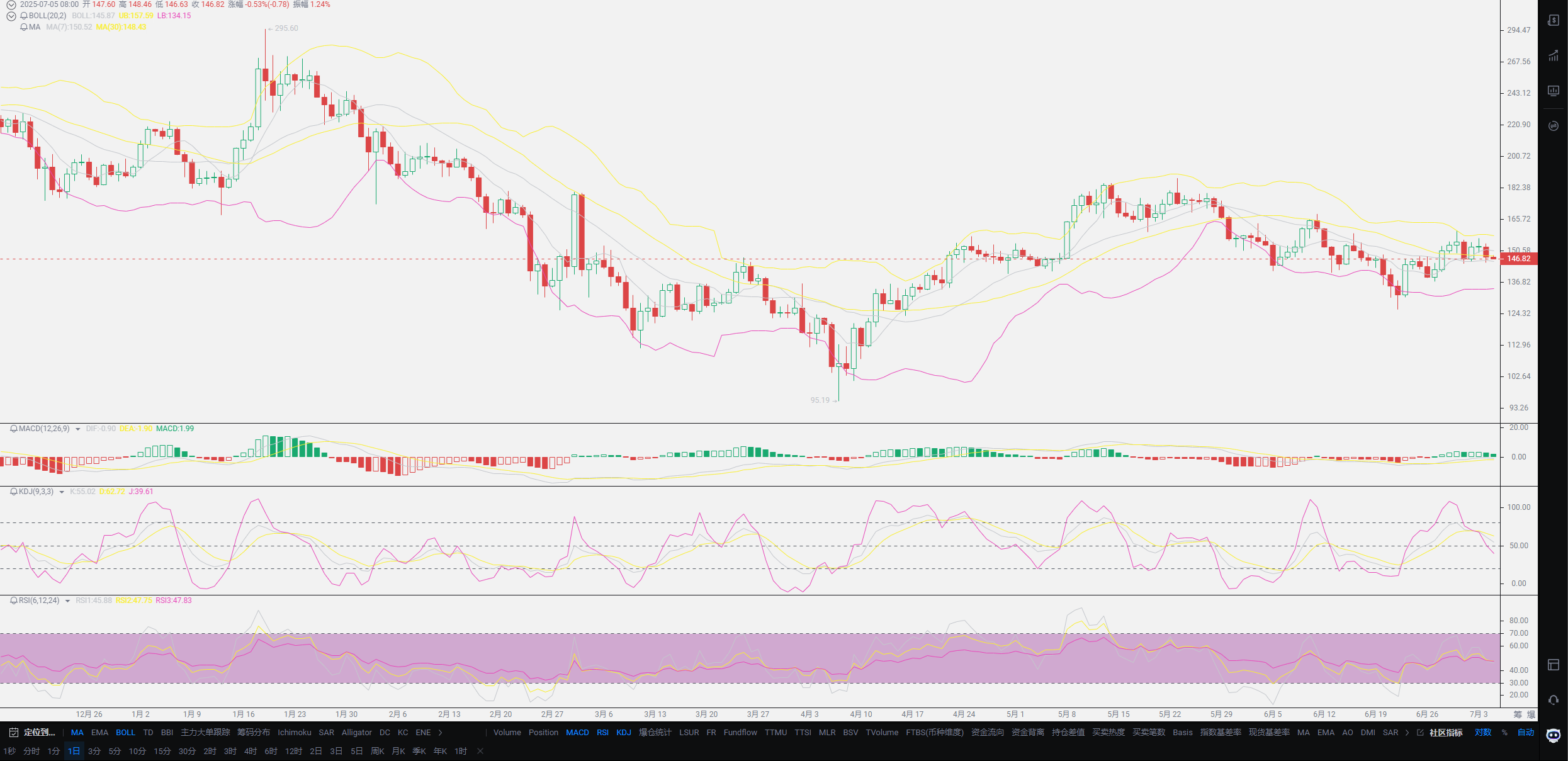

Regarding the bearish outlook, I will not change my previous thoughts in the medium term, especially with a certain whale account suddenly releasing nearly 2 billion in assets. This asset has been stored for many years without activation, and this sudden outflow requires everyone to pay close attention. It is likely that this wave of selling in July is about to come, and users who are long should be cautious. It is not just this asset's circulation; if you pay attention to Binance's wallet, you will also find that the amount of Bitcoin flowing into Binance is increasing, mostly in the hundreds of millions. For these individuals, a sell-off may just be a matter of time. The current values cannot be assessed yet, as most are still in an accumulation state. Once activated, this year's lowest point may be reached between July and August, which is the depth of this wave of selling. From the current market perspective, the accumulated funds in the cryptocurrency market are not sufficient to allow Bitcoin to have sustained breakthrough capabilities; the 110,000 mark may already be the peak.

In summary, looking at all resource properties, we are likely facing a decision by the market makers; especially in terms of short-term capital accumulation, the countdown to a sell-off has already begun. Therefore, for contract users, it is advisable to short to respond to the current trend. Once the downward range opens, it will not stop at the 105,000 position; it is highly likely to form a sudden short-term drop of about 10,000 to 20,000 points. Ethereum will also struggle to hold the 2,500 position and may likely drop to 2,000 or even below. Everyone can consider laying out short positions. For spot users, if you are currently in a profitable state, you can take some profits; if you are still in a loss state, try to average down at lower prices. The opening of the bearish market will not happen all at once, and the increasingly prominent tariff issues will only deepen the cryptocurrency market in the short term. The arrival of the bearish period will not exceed next week’s timeline; there will definitely be a wave of bearish pressure in the 6-15 range, so everyone should layout early! For issues regarding points or positions, you can consult me directly!

Original content created by WeChat Official Account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even more than ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation and strategizes for the big picture, not focusing on individual pieces or positions, aiming for the ultimate victory. The novice, however, fights for every inch, frequently switching between long and short positions, only competing for short-term gains, resulting in frequent entrapment.

This material is for learning reference only and does not constitute trading advice. Trading based on this information is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。