Original Author: Lawrence Lee, Researcher at Mint Ventures

Recently, there have been many developments in the field of tokenized U.S. stocks:

The centralized exchange Kraken announced the launch of the tokenized stock trading platform xStocks.

The centralized exchange Coinbase announced it is seeking regulatory approval for its tokenized stock trading.

The public blockchain Solana submitted a framework for blockchain-based tokenized U.S. stock products.

Public blockchains and exchanges in the U.S. are accelerating the process of tokenizing U.S. stocks, and combined with the recent excitement following Circle's listing, one cannot help but feel optimistic about the prospects of tokenized U.S. stocks.

In fact, the value proposition of tokenized U.S. stocks is very clear:

Expands the trading market size: Provides a 24/7, borderless, permissionless trading venue for U.S. stock trading, which is currently not possible with Nasdaq or the New York Stock Exchange (although Nasdaq is applying for 24-hour trading, it is expected to be realized in the second half of 2026).

Superior composability: By integrating with other existing DeFi infrastructures, U.S. stock assets can be used as collateral, margin, and to build indices and fund products, leading to many currently unimaginable use cases.

The demands from both supply and demand sides are also very clear:

Supply side (U.S. listed companies): Reach potential investors from around the world through a borderless blockchain platform, gaining more potential buyers.

Demand side (investors): Many investors who previously could not trade U.S. stocks for various reasons can now directly allocate and speculate on U.S. stock assets through blockchain.

Quoted from “U.S. Stocks on the Chain and STO: An Unseen Narrative”

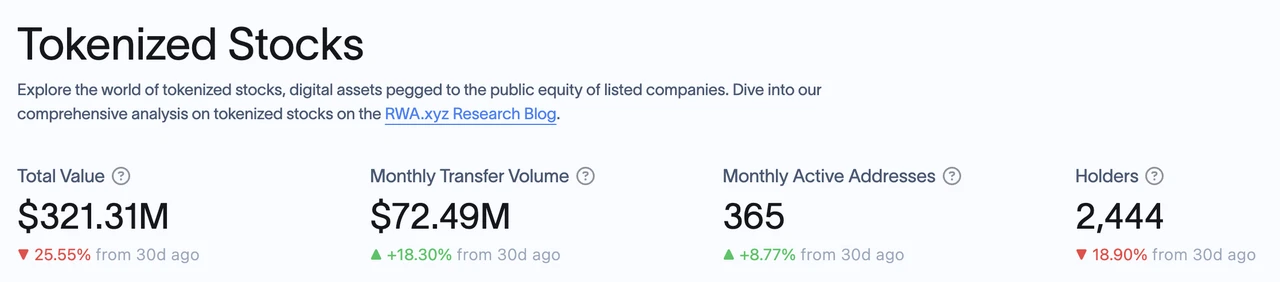

In this round of lenient crypto regulatory cycles, progress is highly likely. According to data from RWA.xyz, the current market capitalization of tokenized stocks is only $321 million, with 2,444 addresses holding tokenized stocks.

The huge market space and the currently limited asset scale form a stark contrast.

In this article, we will introduce and analyze the current players in the tokenized U.S. stock market and the product solutions of other players promoting tokenized U.S. stocks, as well as list potential investment targets under this concept.

This article represents the author's stage thoughts as of publication, which may change in the future, and the views expressed are highly subjective and may contain errors in facts, data, or reasoning logic. All views in this article are not investment advice, and criticism and further discussion from peers and readers are welcome.

According to data from RWA.xyz, the current tokenized stock market has the following projects based on issuance scale:

We will introduce the business models of Exodus, Backed Finance, and Dinari one by one (Montis Group focuses on European stocks, and SwarmX's business is similar to Backed Finance but on a smaller scale), as well as the progress of several other important players currently promoting tokenized U.S. stock business.

Exodus

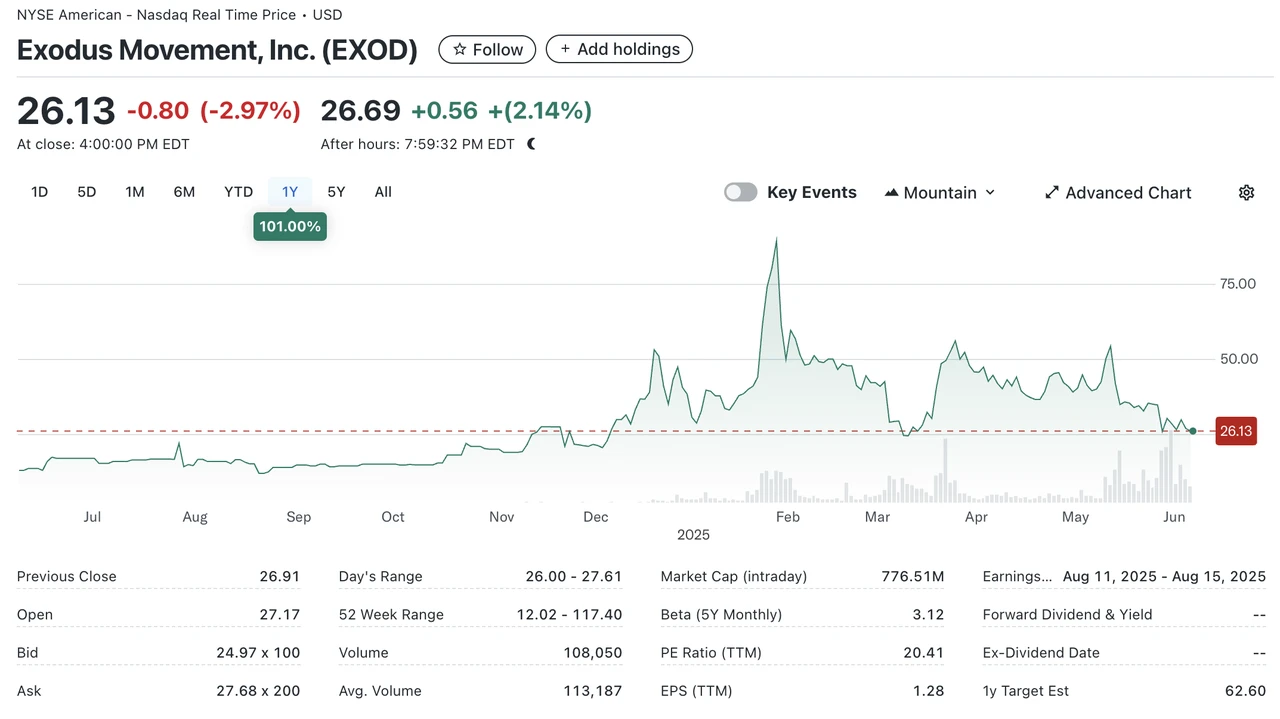

Exodus (NYSE.EXOD) is a U.S. company primarily engaged in the development of non-custodial crypto wallets, with its stock listed on the New York Stock Exchange (NYSE.EXOD). In addition to its own branded wallet, Exodus has also collaborated with the NFT market MagicEden to launch a wallet.

As early as 2021, Exodus allowed users to migrate their common stock to the Algorand chain through Securitize, but the tokens migrated to the chain cannot be traded or transferred on-chain and do not include governance rights or other economic rights (such as dividends). The Exodus token is more like a "digital twin" of real shares, with symbolic significance on the chain rather than practical significance.

Currently, EXOD has a market capitalization of $770 million, of which about $240 million is on-chain.

Exodus is the first stock to be approved by the SEC for tokenization (or more accurately, Exodus is the first tokenizable stock approved by the SEC to be listed on the NYSE). However, this process was not smooth; the listing of Exodus's stock was delayed from May 2024 until December before it officially went live on the NYSE.

However, the tokenization of Exodus's stock is only applicable to its own stock, and the tokenized stock cannot be traded, which is of little significance to us web3 investors.

Dinari

Dinari is a U.S.-registered company that has focused on stock tokenization within the U.S. compliance framework since its establishment in 2021. It completed a $10 million seed round in 2023 and a $12.7 million Series A round in 2024, with investors including Hack VC, Blockchange Ventures, Coinbase CTO Balaji Srinivasan, F Prime Capital, VanEck Ventures, and Blizzard (Avalanche Fund). Among them, F Prime is a fund under asset management giant Fidelity, and the investments from Fidelity and VanEck also demonstrate traditional asset management institutions' recognition of the tokenized U.S. stock market.

Dinari only supports non-U.S. users, and the process for trading U.S. stocks is as follows:

User completes KYC.

User selects the U.S. stocks they wish to purchase and pays with USD+ issued by Dinari (a stablecoin backed by short-term government bonds issued by Dinari, which can be exchanged for USDC).

Dinari submits the order to a partnered brokerage (Alpaca Securities or Interactive Brokers), and after the brokerage completes the order, the shares are held in a custodian bank, and Dinari mints corresponding dShares for the user.

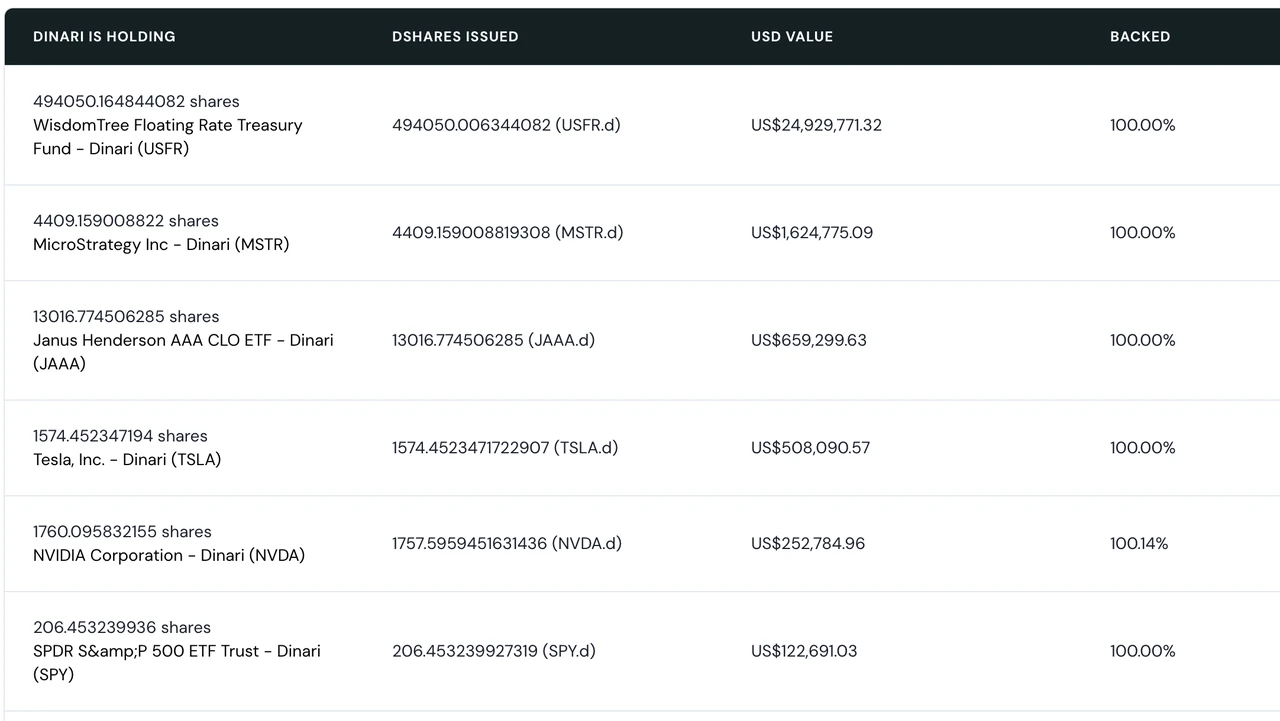

Currently, Dinari operates on Arbitrum, Base, and the Ethereum mainnet, with all dShares corresponding 1:1 to real-world equity. Users can view their dShares corresponding to equity on Dinari's official website, and Dinari can also distribute dividends or conduct stock splits for users holding its dShares.

However, dShares cannot be traded on-chain; to sell dShares, users can only trade through Dinari's official website, with the actual trading process being the reverse of the purchase process. dShares trading must also adhere to U.S. trading hours, and trading cannot occur outside of these hours. In terms of product form, in addition to direct stock trading, they also provide stock trading APIs that can collaborate with other trading frontends.

In fact, Dinari's business process, i.e., "KYC -> payment exchange -> compliant brokerage clearing and settlement," is consistent with the mainstream way for non-U.S. users to participate in U.S. stock trading. The main difference is that the asset categories users pay with are Hong Kong dollars, euros, etc., while Dinari accepts crypto assets, with the rest executed entirely according to the SEC's regulatory framework.

As a company primarily engaged in U.S. stock tokenization, Dinari's decision to register in the U.S. (most other projects are registered in Europe) shows confidence in its compliance capabilities. Their U.S. stock tokenization product officially launched in 2023, at which time the then SEC Chairman Gary Gensler, known for his strict stance on crypto regulation, could not find fault with their business model; after the new SEC Chairman Paul Atkins took office, the SEC specifically held a meeting with Dinari, requesting Dinari to demonstrate its system and answer related questions (source), all of which demonstrate the impeccable compliance of its product and the strong resources of the team in compliance.

However, since Dinari's tokenized U.S. stocks do not support on-chain trading, cryptocurrencies for Dinari are merely an entry and payment method. Functionally, Dinari's products are not much different from those of Futu, Robinhood, and others. For its target users, the product experience of Dinari does not have an advantage over competitors. For a user in Hong Kong, trading U.S. stocks on Dinari does not provide any experience improvement compared to trading on Futu, and it cannot use margin trading or other trading functions, and may even incur higher fees.

Perhaps due to this, Dinari's tokenized stock market size has remained small; currently, only MSTR has a market capitalization exceeding $1 million, and only five tokenized stocks exceed $100,000. Most of its TVL is from its floating-rate government bond products.

Current market capitalization of Dinari's tokenized stocks source

Overall, Dinari's tokenized stock business model has received regulatory certification, but strict compliance with regulations has led to its tokenized stocks being unable to trade or stake on-chain, losing composability, making the experience of holding its dShares less appealing than traditional brokerages, and the product is not very attractive to mainstream web3 users.

Among the current market players, a community project similar to Dinari is the meme coin Stonks' project mystonks.org. According to the project's own disclosed reserve report, their U.S. stock account currently has a market value exceeding $50 million, and user trading is more active than that of Dinari.

However, the compliance framework of mystonks.org still has flaws, such as the qualifications of its securities custody account not being clearly stated and users being unable to verify the reserve report.

Backed Finance

Backed Finance is a Swiss company established in 2021, with its product launched in early 2023. In 2024, it completed a $9.5 million financing round led by Gnosis, with participants including Cyber Fund, Blockchain Founders Fund, and Blue Bay Capital.

Like Dinari, Backed does not provide services for U.S. users. Its business process is as follows:

The issuer (professional investors) completes KYC certification and review on Backed Finance.

The issuer selects the U.S. stocks they wish to purchase and pays with stablecoins.

Backed Finance submits the order to a partnered brokerage to complete the stock purchase, then Backed Finance mints the corresponding bSTOCK token for the issuer.

Both bSTOCK and its wrapped version wbSTOCK can be freely traded on-chain (the wrapping is mainly for handling stock dividends, etc.), and retail investors can directly purchase bSTOCK or wbSTOCK on-chain.

It can be seen that, unlike Dinari where end users directly purchase U.S. stocks, Backed Finance currently has professional investors buy U.S. stocks and then transfer them to end users, significantly improving overall operational efficiency and enabling 24/7 trading. Another important difference is that the bSTOCK token issued by Backed is an unrestricted ERC-20 token, allowing users to create LPs on-chain for other users to purchase.

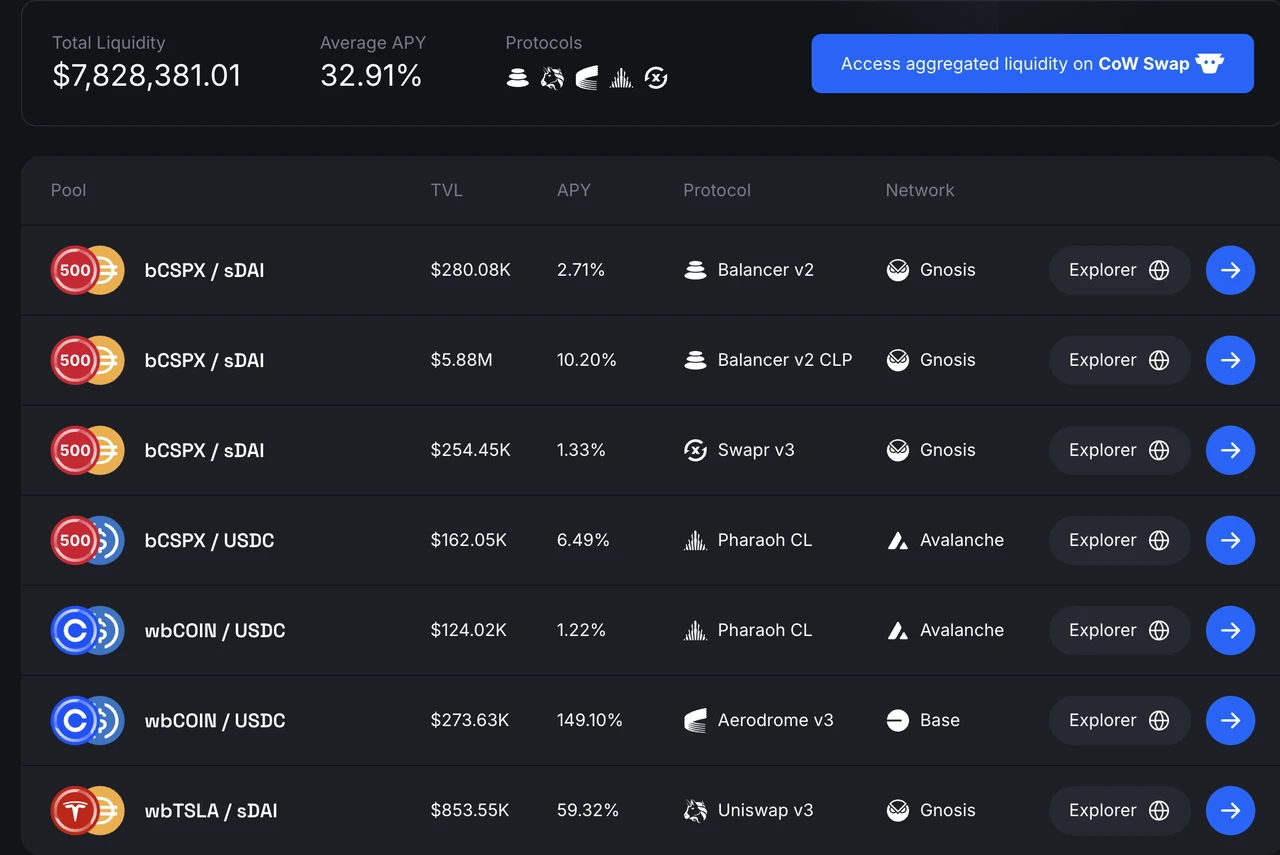

Liquidity of Backed tokenized stocks source

The on-chain liquidity of Backed Finance mainly comes from the SPX index, Coinbase, and Tesla, with users pairing bSTOCK tokens with stablecoins to enter AMM pools. Currently, the total TVL of the liquidity pool is close to $8 million, with an average APY of 32.91%. Liquidity is distributed across Gnosis's Balancer and Swapr, Base's Aerodrome, and Avalanche chain's Pharaoh, with the bCOIN-USDC pool's APY reaching 149%.

It should be noted that Backed Finance imposes no restrictions on the on-chain trading functionality of its bSTOCK tokens, providing users with a second path to hold their bSTOCK, namely:

- On-chain users (no KYC required) can directly purchase bSTOCK using stablecoins like USDC or sDAI.

This effectively breaks through the KYC restrictions, and the trading experience is no different from trading ordinary on-chain tokens, making it easier to promote among web3 users. An unrestricted ERC-20 token also opens the door to composability for tokenized stock holders, such as pairing with stablecoins to achieve an average APY of 33% in liquidity. This may also explain why Backed Finance's TVL is nearly ten times that of Dinari.

In terms of compliance, the entity behind Backed Finance is registered in Switzerland, and the aforementioned business model of "tokenized stocks corresponding to ERC-20 tokens can be freely transferred" has been recognized by European regulatory authorities (source). Backed Finance has also published reserve proof audited by The Network Firm.

However, the U.S. SEC has not yet commented on Backed Finance's business. Since the securities traded by Backed are all U.S. stocks, obtaining permission from Switzerland is certainly beneficial, but more importantly, how the U.S. regulatory authorities evaluate this business model.

Among other projects, SwarmX's business model is consistent with Backed Finance, but its business scale and compliance details are significantly behind Backed Finance.

Although Backed Finance's tokenized stock market capitalization is ten times that of Dinari, the asset scale of over $20 million and $8 million TVL is still not high, and on-chain trading is not very active. The reasons are:

There are not enough use cases for tokenized stocks on-chain; currently, they can only serve as LPs, and the advantages of composability have not been fully realized. This may be related to concerns about the legality of such models in associated lending, stablecoin, and other protocols.

More importantly, there is insufficient liquidity. Backed itself is not an exchange and does not have "natural" liquidity to support its tokenized stock trading. Under the current model, the liquidity of its tokenized stocks relies on the issuers, including how many tokenized stocks the issuers are willing to hold and how much liquidity they are willing to add to the LP. Currently, Backed's issuers do not seem willing to increase their investment in this area.

If the SEC can further clarify the regulatory framework and determine the feasibility of the Backed model, the above two points may improve.

xStocks

In May of this year, the U.S. exchange Kraken announced a collaboration with Backed Finance and Solana to launch xStocks.

On June 30, the xStocks product was officially launched. Its partners include not only Backed, Kraken, and Solana but also centralized exchanges Kraken and Bybit, decentralized exchanges on Solana such as Raydium and Jupiter, lending protocol Kamino, Bybit's incubated Dex Byreal, oracle Chainlink, payment protocol Alchemy Pay, and brokerage Alpaca.

Source: xStocks Official Website

The legal structure of the xStocks product is completely consistent with that of Backed Finance. It currently supports over 200 stock products, and Kraken's trading hours are 5*24. From the perspective of partnerships, Kraken, Bybit, Jupiter, Raydium, and Byreal are all exchanges supporting xStocks; Kamino can support xStocks as collateral, and Kamino Swap can also facilitate xStocks trading; Solana is the public chain on which xStocks operates; Chainlink is responsible for reserve reporting; and Alpaca is the partnered brokerage.

Currently, since the product has just launched, various data statistics are not yet complete, and trading volume is also low. However, compared to Backed Finance's own products, xStocks has more key partners:

In terms of centralized exchanges, there are Kraken and Bybit, which are more likely to leverage existing market makers and users to provide better liquidity for xStocks.

On-chain, there are various DEXs and Kamino, which for the first time provide other use cases for tokenized U.S. stocks beyond being LPs. Other protocols may also support xStocks in the future, further expanding its composability.

From this perspective, although xStocks has just launched, I believe it will quickly surpass existing players and become the largest issuer of tokenized U.S. stocks.

Robinhood

Robinhood, which has been actively expanding its crypto business, also submitted a report to the SEC in April 2025, hoping the SEC would establish a regulatory framework for RWAs that includes tokenized stocks. In May, Bloomberg reported that Robinhood would create a blockchain platform to allow European investors to invest in U.S. stocks, with Arbitrum or Solana as alternative public chains.

On June 30, Robinhood officially announced the launch of a tokenized U.S. stock trading product for European investors, which supports dividend distribution and has 5*24 access time.

Robinhood's tokenized stock product was initially issued on Arbitrum. In the future, its tokenized stock infrastructure will operate on Robinhood's own L2, which is also based on Arbitrum.

However, according to Robinhood's official documentation, their current tokenized stock product is not a true tokenized stock but rather a contract that tracks the corresponding U.S. stock prices, with the related assets securely held by a U.S. licensed institution in a Robinhood Europe account. Robinhood Europe issues the contracts and records them on the blockchain. Currently, their tokenized stocks can only be traded on Robinhood and cannot be transferred.

Other Players in the Market

In addition to the products mentioned above that have specific business operations launched, there are many other players laying out plans for tokenized U.S. stock businesses, including:

Solana

Solana places great importance on tokenized stocks. In addition to the previously mentioned xStocks, Solana has also established the Solana Policy Institute (SPI), which "aims to educate policymakers on why decentralized networks like Solana are the future infrastructure of the digital economy". Currently, two projects are being promoted: one is a project named Project Open, which "aims to achieve compliant blockchain-based securities issuance and trading, creating more efficient, transparent, and accessible capital markets while maintaining strong investor protection". Members of Project Open include SPI, the DEX Orca on the Solana chain, RWA service provider Superstate, and law firm Lowenstein Sandler LLP.

Project Open began submitting public written opinions to the SEC's crypto working group multiple times in April this year, and the SEC's crypto working group met with them on June 12 to discuss. After the meeting, Project Open members submitted further explanations of their business.

The tokenized U.S. stock issuance and trading process advocated by Project Open is as follows:

The process can be summarized as follows:

Issuers need to apply for SEC approval in advance; once approved, they can issue tokenized U.S. stocks.

Users wishing to purchase tokenized U.S. stocks must complete KYC in advance; after completion, they can use cryptocurrency to purchase the tokenized U.S. stocks issued by the issuer.

A registered transfer agent records the flow of shares on-chain.

Project Open also specifically requests that the SEC allow peer-to-peer trading of tokenized U.S. stocks through smart contract protocols, meaning that holders of tokenized U.S. stocks can trade within AMMs, thus opening the door to on-chain composability. However, according to the framework proposed in the document, all users holding tokenized U.S. stock shares must complete KYC. To achieve the above process, Project Open is applying for an 18-month exemption relief or confirmatory guidance for many operations (Exemptive Relief or Confirmatory Guidance, see references for details).

Overall, Project Open's proposal supplements the existing Backed Finance plan with KYC requirements. From my perspective, this proposal is almost certain to pass under the current SEC, which is relatively lenient towards DeFi; the only question is the timing of its approval.

Coinbase

As early as 2020, when Coinbase applied for a Nasdaq listing, its application documents included the idea of issuing tokenized COIN on-chain, but it was abandoned due to not meeting the SEC's requirements at the time. Recently, Coinbase is seeking a no-action letter or exemptive relief from the SEC to launch its tokenized stock business. However, there are currently no detailed documents available, and we can only confirm from press releases that:

Coinbase's tokenized stock trading plan is open to U.S. users.

This is a major distinction from other current players in the tokenized stock market, allowing Coinbase to compete directly with internet brokerages like Robinhood and traditional brokerages like Charles Schwab. Of course, this impact is far less significant for web3 investors than for Nasdaq:COIN.

Ondo

Ondo, which has already achieved results in the government bond RWA market (see Mint Ventures' previous article), has also long planned to engage in tokenized U.S. stock business. According to their documentation, their tokenized U.S. stock product has the following characteristics:

Open to non-U.S. users.

Trading hours are 24/7.

Tokens are minted and burned in real-time.

Allows the use of tokenized U.S. stock assets as collateral.

From the above characteristics, Ondo's product is quite similar to the new framework proposed by Solana. Ondo also announced at Solana's Accelerate conference that it plans to launch a tokenized U.S. stock product on the Solana network.

Ondo's tokenized U.S. stock product, Ondo Global Markets, is scheduled to launch later this year.

This summarizes the current state of the tokenized U.S. stock market and the situation of several other players laying out their plans.

From the fundamental motivation of demand, the main purpose for users to purchase tokenized stocks is to profit from stock price fluctuations, focusing on the liquidity of trading venues, payment capabilities, and whether KYC-free trading is possible. Whether a compliant institution is necessary for tokenization is not a concern for users, which is why there has always been a way to provide U.S. stock trading products to users through derivatives in the web3 market.

Providing U.S. Stock Trading through Derivatives

Currently, the main providers of U.S. stock derivatives services are Gains Network (on Arbitrum and Polygon) and Helix (on Injective). Their users do not actually trade U.S. stocks, so there is no need to tokenize U.S. stocks.

The core product logic is equivalent to applying perpetual contract logic to U.S. stocks, typically as follows:

Trading users do not need KYC, using stablecoins as collateral, allowing for leveraged trading.

Trading hours are the same as U.S. stock trading hours.

The underlying price is directly read from trusted data sources, such as using Chainlink.

Funding rates are used to balance the price difference between on-market prices and fair prices.

However, whether it is the current Gains and Helix or the previous Synthetix and Mirror, platforms that trade U.S. stocks in the form of synthetic assets have not generated significant trading volume. Currently, Helix's U.S. stock product has an average daily trading volume of no more than $10 million, while Gains' daily trading volume is less than $2 million. The reasons may include:

This form presents obvious regulatory risks, as although they do not actually provide U.S. stock trading, they effectively become the exchange for users to trade U.S. stocks. Regulatory authorities have clear requirements for any exchange, and KYC is the most basic part of regulation. Such platforms may escape regulatory scrutiny when their volume is low, but if their volume increases, they are likely to attract regulatory attention.

The aforementioned products do not have sufficient liquidity to support users' actual trading needs. The liquidity of these product forms needs to be resolved internally and cannot rely on any third party, and these products cannot provide users with real usable trading depth.

The trading volume of Helix's U.S. stock & forex products and the order book of COIN, which has the highest trading volume.

On the centralized exchange side, Bybit recently launched a U.S. stock trading platform based on MT5, which also adopts a similar perpetual contract product logic, not conducting actual trading of U.S. stocks but trading indices with stablecoins as collateral.

In addition, the yet-to-launch Shift project has introduced the concept of Asset-Referenced Tokens (ART), which reportedly allows for KYC-free U.S. stock trading. Its product process is as follows:

Shift purchases U.S. stocks and collateralizes them with compliant brokerages like Interactive Brokers, using Chainlink for reserve proof.

Shift issues reference asset tokens ART backed by the reserved U.S. stocks, with each ART corresponding to a U.S. stock asset, but ART is not a tokenized U.S. stock.

End users can purchase ART tokens without KYC.

Shift's solution maintains a 100% correspondence between ART and the underlying U.S. stocks, but ART is not a tokenized U.S. stock and does not confer ownership, dividend rights, or voting rights, thus making it exempt from various regulatory rules for securities, allowing for KYC-free characteristics (source).

Of course, from a regulatory perspective, ARTs cannot anchor securities-type assets. It is currently unclear how the Shift team plans to specifically implement "anchoring ARTs to U.S. stocks," and it is uncertain whether the specific product plan that will be launched can truly follow the aforementioned process. However, this scheme achieves KYC-free U.S. stock trading through certain loopholes in regulatory provisions, which is worth ongoing attention.

What Kind of Tokenized U.S. Stock Products Does the Market Need?

Regardless of the method of tokenizing U.S. stocks, the core processes can be summarized in two points:

Tokenization: This process is usually handled by compliant institutions, which regularly provide reserve proof. Essentially, it involves KYC-compliant users purchasing U.S. stocks before they are put on-chain. This step does not differ much across various schemes.

Trading: End users trade the tokenized stocks. The main differences between the various schemes lie here: some do not allow trading (Exodus), some only permit trading through traditional brokerage channels (Dinari and mystonks.org), while others support on-chain trading (Backed Finance, Solana, Ondo, Kraken). Notably, Backed Finance currently supports KYC-free users to directly purchase its tokenized U.S. stock products through AMMs under a Swiss compliance framework.

For end users, the main concerns during the tokenization process are compliance and asset security. Currently, most market players can adequately ensure these two points. The primary focus is on the trading process. For instance, if Dinari only allows trading through traditional brokerage channels and does not provide liquidity mining, lending, or other services for tokenized stocks, the significance of tokenization is largely diminished. Even with perfect compliance and a well-structured process, it is challenging to attract users.

In contrast, the solutions from xStocks, Backed Finance, and Solana represent more meaningful long-term tokenized U.S. stock solutions. After tokenization, U.S. stocks are traded not through traditional brokerage channels but on-chain, which allows for more effective utilization of the 24/7 availability and composability advantages brought by DeFi.

However, in the short term, on-chain liquidity will be difficult to match that of traditional channels. Low liquidity exchanges are essentially unusable; if the venues providing tokenized U.S. stocks cannot attract more liquidity, the influence of tokenized U.S. stocks will also be hard to expand. This is why I am optimistic that xStocks can quickly become a leader in tokenized U.S. stocks.

From this perspective, if the regulatory framework gradually becomes clearer and tokenized U.S. stock products truly gain popularity in web3, the exchanges that ultimately capture more market share will likely be those that currently have better liquidity and more trader users.

In fact, we can see from the few examples in the last cycle: Synthetix, Mirror, and Gains all launched products including U.S. stock trading in 2020, but the most influential U.S. stock trading product was FTX. The FTX solution is quite similar to the current Backed Finance scheme, but FTX's stock trading volume and AUM far exceed those of the later entrant, Backed Finance.

Potential Investment Targets

Although the market space for tokenized U.S. stocks is large, there are currently not many investment targets available for investors to choose from.

Among the existing players, neither Dinari nor Backed Finance has issued tokens, and Dinari has explicitly stated that it will not issue tokens. Only the Meme token stonks corresponding to mystonks.org can be considered a potential investment target.

Among the actively positioning players, the market capitalization of tokens from Coinbase, Solana, and Ondo is already relatively high, and their main businesses are not focused on tokenized U.S. stocks. The advancement of tokenized U.S. stocks will have some impact on their tokens, but the extent of that impact is difficult to predict.

xStocks' partners include leading Solana DEXs Raydium and Jupiter, as well as the lending protocol Kamino, but this collaboration is unlikely to significantly enhance the aforementioned protocols.

Among the members of SPI's Project Open, Phantom and Superstate have not yet issued tokens, while only Orca has issued a token.

In the derivatives projects, Helix has not issued a token, leaving only GNS as an optional target.

Due to the different business categories of the aforementioned projects, the forms of participation in tokenized U.S. stocks also vary, making it impossible to conduct valuation comparisons. Below is a list of the basic information of the relevant tokens:

References

https://x.com/xrxrisme69677/status/1925366818887409954

https://www.odaily.news/post/5204183

Relevant materials for Project Open:

Framework submitted in April: https://www.sec.gov/files/ctf-written-project-open-wireframe-04282025.pdf

On June 12, the SEC's crypto working group met with the Project Open team for discussion: https://www.sec.gov/files/ctf-memo-solana-policy-institute-et-al-061225.pdf

On June 17, SPI updated the proposal framework and submitted supplementary materials regarding the meeting content with Phantom, Superstate, and Orca.

Updated proposal framework by SPI: https://www.sec.gov/files/project-open-chain-equities-infrastructure-061725.pdf

SPI supplementary materials: https://www.sec.gov/files/project-open-061725.pdf

Phantom: https://www.sec.gov/files/phantom-technologies-061725.pdf

Superstate: https://www.sec.gov/files/ctf-superstate-letter-061725.pdf

Orca: https://www.sec.gov/files/orca-creative-061725.pdf

The Exemptive Relief or Confirmatory Guidance requested by Project Open includes:

Blockchain as a technological tool does not require or mandate any SEC registration.

Blockchain network fees are technical costs and do not fall under securities trading-related expenses.

Peer-to-peer transactions conducted through smart contract protocols are permitted and do not equate to the regulatory concept of trading on exchanges or alternative trading systems (ATS) (as they are bilateral transactions, such as those envisioned in Section 4(a)(1) of the 1933 Act).

Exemption for broker-dealer participation in Section 4(a)(1) transactions (serving a limited management role).

Non-custodial/self-custodial wallets (and their issuers) are not broker-dealers.

Holding tokenized shares in non-custodial/self-custodial wallets that have passed appropriate whitelisting and KYC is permitted.

Broker-dealers can create sub-wallets for clients to hold their tokenized shares, which constitutes appropriate "possession and control" of securities for the purposes of broker-dealer custody.

Transfer agents can use blockchain to fulfill their duties if they have KYC information for whitelisted wallet owners and modern qualified investor education information. a) Ability to enforce transfer restrictions. b) Ability to enforce restrictive legends (e.g., securities held by related parties).

Registration Statements can be used to register tokenized shares after obtaining appropriate exemptive relief. a) Proposed specific content and form requirements. b) Proposed methods for periodic reporting.

Purchasing shares directly from the issuer in the manner envisioned above will not make the purchaser an underwriter or broker-dealer; such purchases are not made in the capacity of a broker or dealer.

Appropriate exemptions from Reg NMS (e.g., order protection rules, best execution, access rules, etc.).

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。